Bitcoin's New All-Time High: Are We At The Peak Or Just Beginning?

In light of this remarkable price action, CryptoQuant analyst Gaah has conducted a recent analysis of Bitcoin 's current market cycle position and is questioning if the cryptocurrency might be approaching a peak .

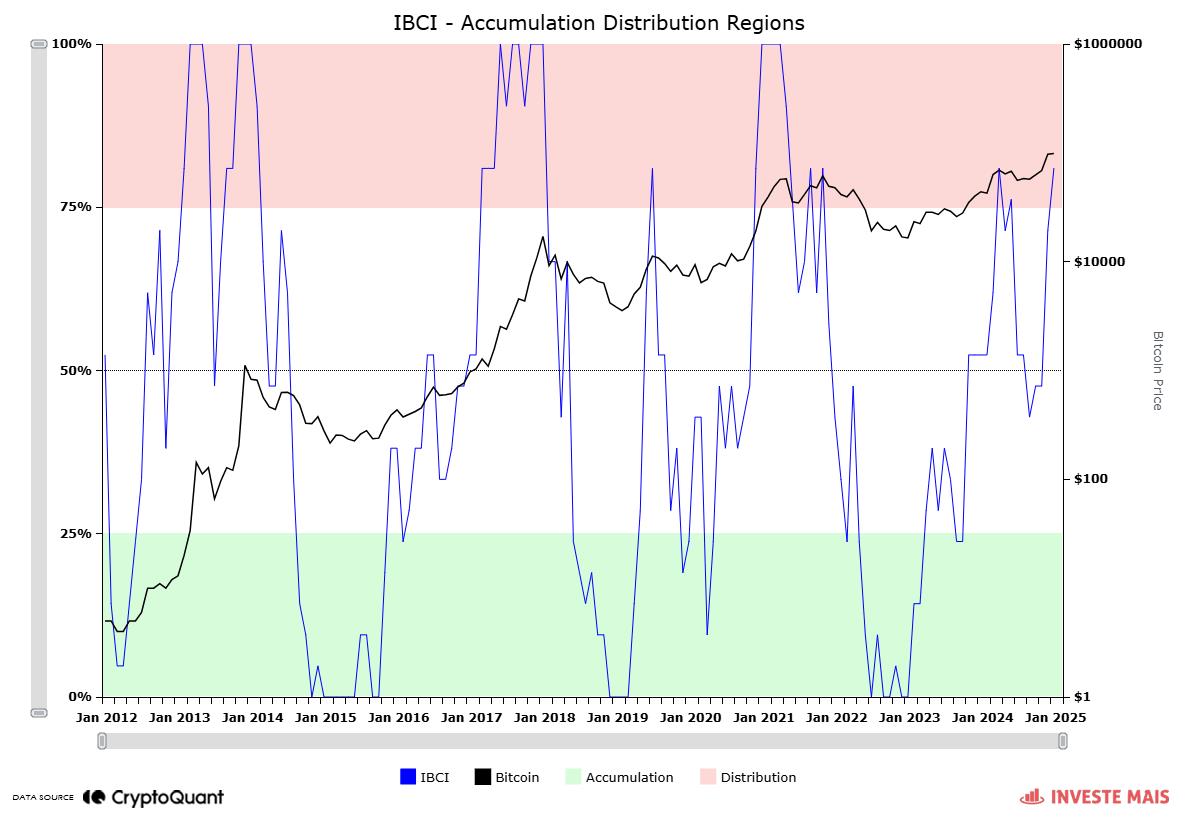

Bitcoin: Is a Peak on the Horizon?In Gaah's findings, the Bitcoin Cycle Indicators Index (IBCI)-a composite metric that aggregates various on-chain data sets including the Puell Multiple, MVRV, NUPL, and SOPR-has for the first time in eight months entered the“distribution region.”

Although this does not definitively indicate a market top, it acts as a warning sign that Bitcoin may be entering the concluding stages of the ongoing bull cycle. For IBCI to conclusively reach a peak, all its components must hit their historical maxima , as noted by the analyst.

Nonetheless, as long as the IBCI remains above the 50% threshold, the overall market trend continues to be optimistic, suggesting an ongoing demand and opportunities for further price growth.

In addition to the IBCI, Gaah points out that other on-chain indicators present a nuanced perspective. The NUPL metric is currently close to its upper range, hinting at a potential conclusion to the bull market, while the Puell Multiple is nearer to its lower zone, suggesting there could be potential for additional growth .

The interaction of these signals implies that the market may not have reached a clear peak just yet. Historically, a fully realized IBCI peak generally precedes corrections and longer-term bearish trends. However, the present situation provides a cautious sense of hope, assuming that demand continues to remain robust and other indicators align positively.

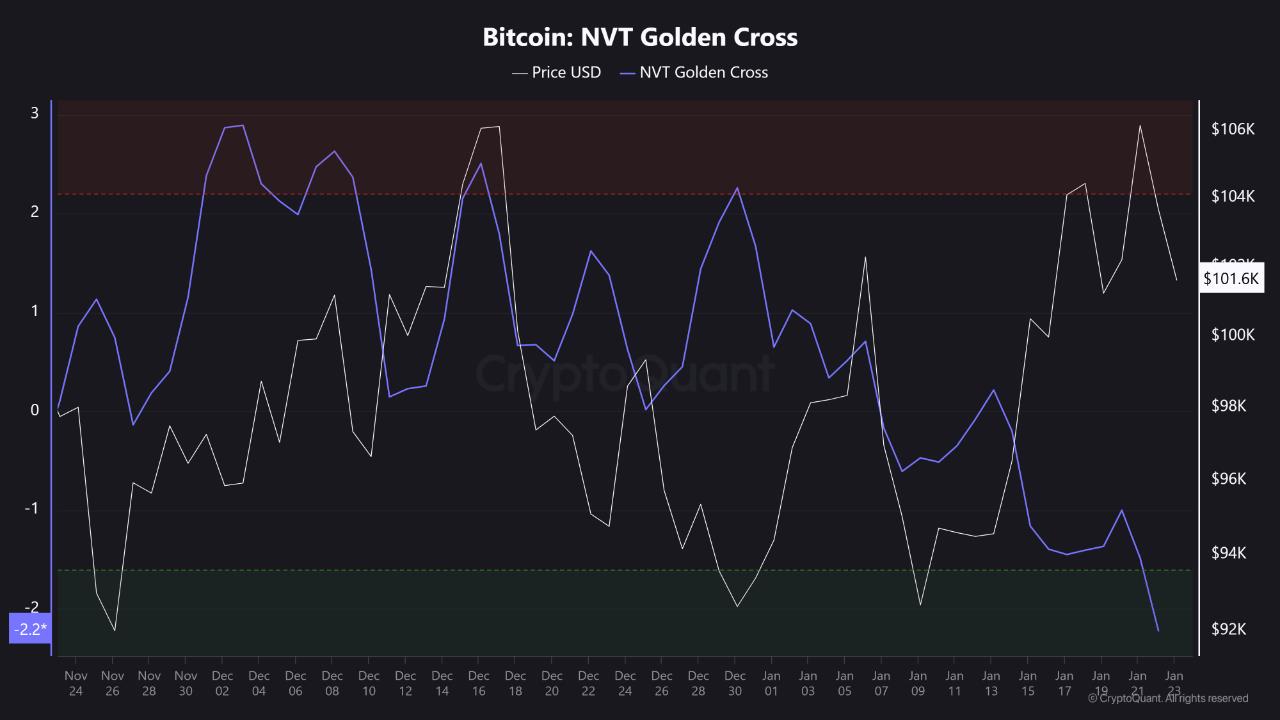

Divergent InsightsOffering a contrasting viewpoint, another CryptoQuant analyst, Burak Kesmeci, presents a different perspective through the lens of the Bitcoin NVT Golden Cross. This metric, created to detect local tops and bottoms, has recently reached its lowest level in 60 days, indicating a potential“local bottom.”

Kesmeci states that historically, when the NVT Golden Cross drops below -1.6, it often signifies that the cryptocurrency is operating in a lower price range. Following a recent decline of approximately 7.5% after reaching its all-time high, the current metric value may be indicative of potential upward movement . Kesmeci elaborated:

Featured image created with DALL-E, Chart from TradingView

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk.

Don't invest unless you're prepared to lose all the money you invest.

This is a high-risk investment, and you should not expect to be protected if something goes wrong.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment