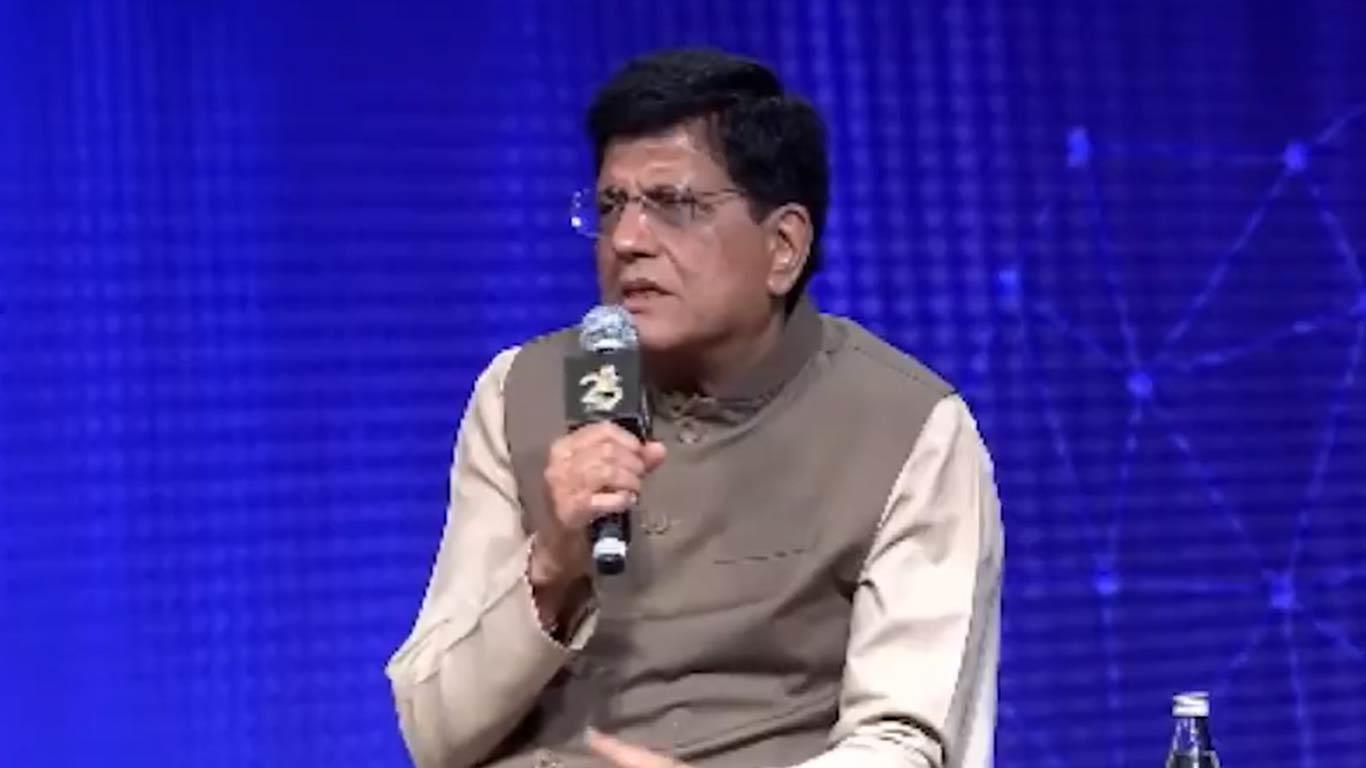

Piyush Goyal Urges RBI To Cut Interest Rates

Speaking at a CNBC TV18 event, the former Chartered Accountant challenged the central bank's approach to monetary policy, particularly its consideration of food inflation in rate-setting decisions.

"I certainly believe they should cut interest rates, growth needs a further impetus," Goyal stated, emphasising India's position as the world's fastest-growing economy.

The minister characterised the use of food inflation as a metric for rate-setting decisions as 'flawed theory,' a stance he claims to have maintained for two decades, including during his time in opposition.

RBI Governor Shaktikanta Das, who attended the same event, declined to comment on Goyal's suggestions, indicating that the six-member monetary policy committee would address such considerations at their upcoming December meeting.

The minister's position gained support from finance industry veteran Deepak Parekh, who advocated for reductions in both the repo rate and cash reserve ratio (CRR).

The debate over inflation metrics has gained prominence as India's headline inflation reached 6.2 percent in October, exceeding the RBI's mandated 2-6 percent range.

Goyal projected that inflation rates would decrease in December and January due to base effect adjustments, noting that the past decade has witnessed the lowest inflation rates in India's history under the current administration.

Addressing broader economic indicators, Goyal highlighted substantial growth in private capital expenditure and encouraged businesses to focus on volume-based strategies to serve India's vast consumer market.

He cited a notable example of foreign investment success, referencing an unnamed South Korean automaker's significant returns on their initial investment in India.

(KNN Bureau)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment