Team Collaboration Software Market Set To Reach USD 62.4 Billion By 2032 | Enhanced Workflow Efficiency And Growing Remote Workforce Fuel Market Growth | Research By S&S Insider

| Report Attributes | Details |

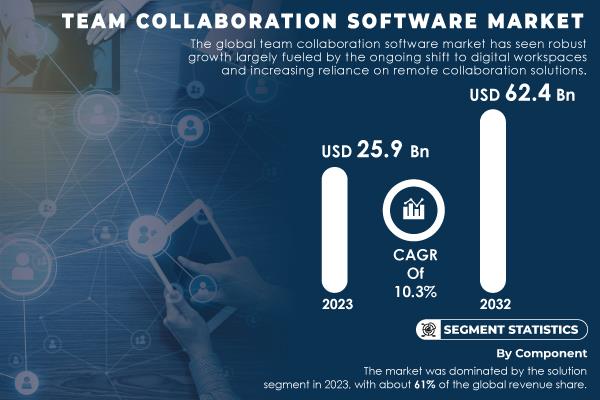

| Market Size in 2023 | US$ 25.9 Bn |

| Market Size by 2032 | US$ 62.4 Bn |

| CAGR | CAGR of 10.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | . The global shift toward remote and hybrid work models has accelerated demand for team collaboration tools that facilitate seamless communication and information sharing. . Cloud-based collaboration software is increasingly popular due to its scalability, lower costs, and easy accessibility, which are ideal for diverse work settings. . Real-time messaging, video conferencing, and file-sharing capabilities are in high demand as businesses aim to streamline communication. |

Do you have any specific queries or need any customization research on Team Collaboration Software Market , Make an Enquiry Now@

Trends Driving the Team Collaboration Software Market

- Rise of Remote and Hybrid Work

The increasing preference for flexible work models is a primary driver of the team collaboration software market. Many companies have shifted to hybrid or fully remote work policies, leading to a surge in demand for tools that enable seamless communication, task management, and document sharing. As organizations aim to reduce overhead costs and attract top talent, investment in these platforms is expected to rise.

- Integration of AI and Machine Learning

AI-powered features in team collaboration software enable enhanced automation, smart task prioritization, and predictive analytics, which allow teams to optimize their work processes. Machine learning algorithms also enable personalization of user experiences, suggesting relevant documents, automating scheduling, and identifying workflow inefficiencies. This integration of AI-driven insights facilitates smoother collaboration and helps businesses make data-backed decisions.

- Security and Compliance Enhancements

With increasing concerns over data privacy and cyber threats, organizations are prioritizing security in team collaboration tools. Many platforms now incorporate end-to-end encryption, advanced user authentication, and compliance with global data protection standards, such as GDPR in Europe and CCPA in California. Enhanced security protocols ensure that sensitive company data remains protected, fostering greater confidence among enterprise users.

Segmentation of the Team Collaboration Software Market

By Component

In 2023, the solutions segment held approximately 61% of the total revenue share. This segment includes applications for video conferencing, messaging, document sharing, and project management, which are widely adopted by organizations of all sizes. Video conferencing tools like Zoom, Microsoft Teams, and Slack have seen rapid growth, driven by the need for real-time communication.

Services Segment: Professional services, including implementation, and training, make up the services segment. As companies seek to maximize the potential of their collaboration software, demand for tailored implementation services is rising. These services ensure that software solutions align with organizational goals and integrate seamlessly with existing systems.

By Enterprise Size

Large enterprises dominated the market in 2023, holding 68% of the revenue share. These organizations prioritize collaboration platforms to manage complex workflows, cross-functional teams, and global operations. Advanced software solutions help them streamline communications across departments and regions.

Small and Medium Enterprises (SMEs) are increasingly adopting team collaboration software as cloud-based options become more affordable and scalable. By adopting these tools, SMEs can compete more effectively with larger organizations by enhancing operational efficiency and reducing miscommunication. The flexibility and cost-effectiveness of team collaboration software make it an ideal choice for SMEs with limited budgets.

Team Collaboration Software Market Segmentation:

By Component

- Solution

- Web Conferencing Communications Task Management File Sharing and Synchronization Enterprise Social Network Others

- Professional Integration and Implementation Training and Education Support and Maintenance Managed

By Enterprise Size

- Small & Medium-sized Enterprises (SMEs) Large Enterprises

By Deployment

- Cloud On-premise

By Software Type

- Conferencing Software Communication & Coordination Software

By End-User

- Banking, Financial Services and Insurance (BFSI) IT and Telecommunications Manufacturing Retail and Consumer Goods Healthcare Transportation and Logistics Education Others

Regional Analysis

North America held the highest market share in 2023, accounting for approximately 35% of the global revenue. The region's dominance is attributed to a high level of digital literacy, advanced technological infrastructure, and the presence of major market players. Companies like Microsoft, Google, and Slack Technologies have established strong bases in the U.S., driving innovation and adoption of team collaboration software. Additionally, federal government initiatives in the U.S. supporting digital transformation in the workplace, alongside high investment in secure communication tools, contribute to market growth. Government bodies are also encouraging the adoption of collaboration platforms to improve efficiency across public sector organizations.

The Asia-Pacific region is experiencing rapid growth in the team collaboration software market, primarily due to the expansion of small and medium enterprises and the region's increasing adoption of digital technologies. Countries like China, Japan, and India are witnessing significant investments in cloud infrastructure and digital transformation initiatives, supporting the adoption of team collaboration tools. The region's large young workforce and high smartphone penetration further boost market demand.

Buy an Enterprise-User PDF of Team Collaboration Software Market Analysis & Outlook 2024-2032@

Key Opportunities in the Team Collaboration Software Market

The growth of cloud-based collaboration software and the increasing trend towards remote work presents ample opportunities for software providers. With ongoing advancements in AI and machine learning, the market is expected to see the development of intelligent collaboration tools that can provide insights into team productivity, facilitate knowledge sharing, and automate administrative tasks. The potential for enhanced integration with other enterprise software, such as customer relationship management (CRM) and enterprise resource planning (ERP), offers an additional avenue for growth.

Recent Developments

- Microsoft Teams' New AI-Powered Features (2023): Microsoft introduced AI-powered features in its Teams platform, including meeting summaries, automatic action points, and real-time language translation, making collaboration more efficient and accessible across languages. Zoom Acquires Workvivo (2023): Zoom expanded its capabilities by acquiring Workvivo, an employee engagement platform, to enhance its product offerings in team collaboration and workforce connectivity.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Team Collaboration Software Market Segmentation, By Component

8. Team Collaboration Software Market Segmentation, By Enterprise size

9. Team Collaboration Software Market Segmentation, By Deployment

10. Team Collaboration Software Market Segmentation, By Software Type

11. Team Collaboration Software Market Segmentation, By End-user

12. Regional Analysis

13. Company Profiles

14. Use Cases and Best Practices

15. Conclusion

Access Complete Report Details of Team Collaboration Software Market Analysis Report 2024-2032@

[For more information or need any customization research mail us at ...]

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Akash Anand – Head of Business Development & Strategy ... Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment