Producer Prices Rose Modestly In Korea While Market Waits For 2Q24 GDP On Thursday

| 2.5% | Producer prices |

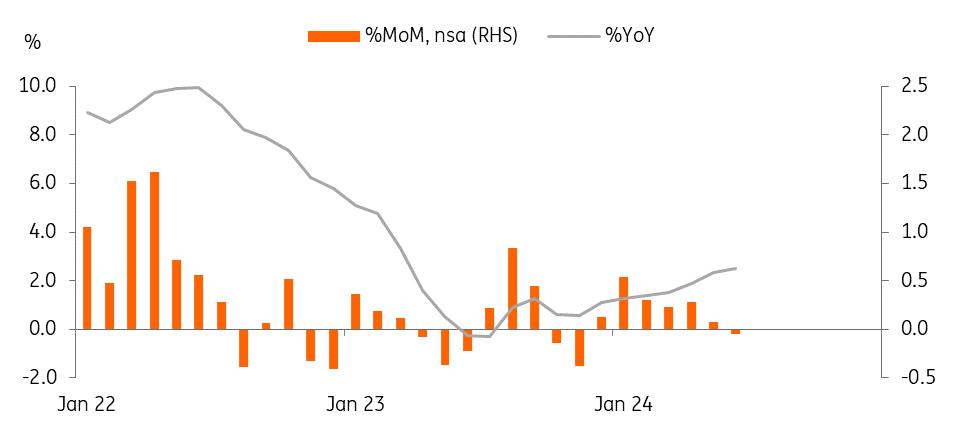

The gain in June was mainly due to a high base related to the government's energy subsidy programme last year. Petroleum prices jumped 13.4% in June (vs 8.7% in May), although the monthly rate declined -0.1% month-on-month nsa. Fresh food prices moderated further to 10% year-on-year in June (15.3% in May). However, we have already seen a sharp rise in retail prices for fresh food in July due to the recent bad weather conditions. Therefore, despite the slowdown in producer prices, we expect fresh food prices to pick up again in July.

Producer prices are on the rise

Source: CEIC Inflation is expected to cool from August despite recent pick-up in fresh food prices

The Bank of Korea's main concern remains inflation for now, as fresh food and other public service prices are expected to rise for a few months. But we expect that base effects will pull down headline inflation to below the 2% level from August, and the BoK's focus should soon shift to domestic growth and financial stability.

GDP preview and BoK watchIn this vein, Korea's 2Q GDP will be closely watched on Thursday. We expect a 0.1% quarter-on-quarter sa growth (vs 1.3% in 1Q24, 0.1% market consensus), while some market participants expect a small contraction. Exports have been stronger than expected during the quarter, thus we believe that it will offset the contraction of domestic growth. However, if second quarter GDP tumbles to contraction territory, then the BoK's rate cut possibility in October will rise, as we have long expected.

In addition to the GDP figures, housing prices and household debt should be monitored closely. The government's recent easing of the housing market and mortgages has led to a reacceleration of household debt and housing prices in the Seoul area, which will potentially become a major delay factor for the BoK to pivot its policy stance. If the property market doesn't calm down and household debt continues to rise, then the BoK may delay its first rate cut beyond October.

Household debt growth reaccelerated since MarchSource: CEIC

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment