403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

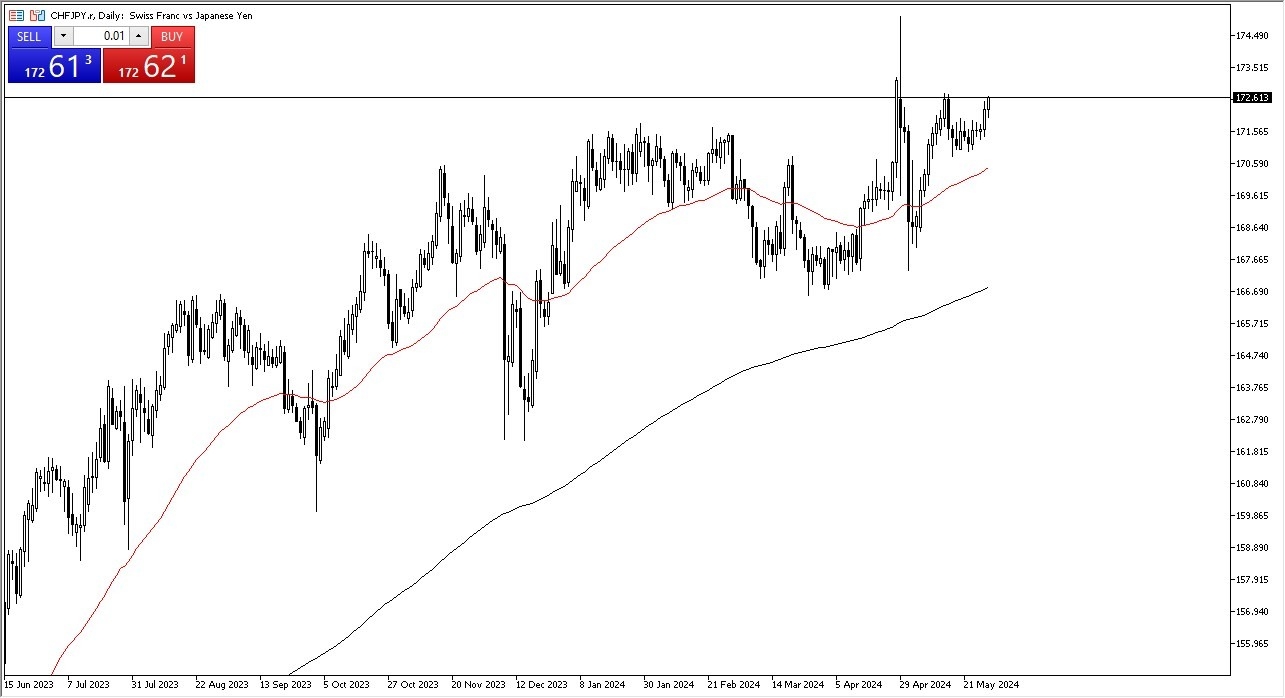

CHF/JPY Forecast Today - 30/05: CHF/JPY Ascends (Chart)

(MENAFN- Daily Forex)

- The Swiss franc initially pulled back just a bit during the trading session on Wednesday, but then turned around to show signs of life. The ¥172.75 level is an area that we have seen interest at previously, in the form of resistance. Keep in mind that we are close to the top of the candlestick where the Bank of Japan intervened, and therefore it does make a certain amount of sense that we continue to go higher.

- 1 Get Started 74% of retail CFD accounts lose money

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment