Latest stories

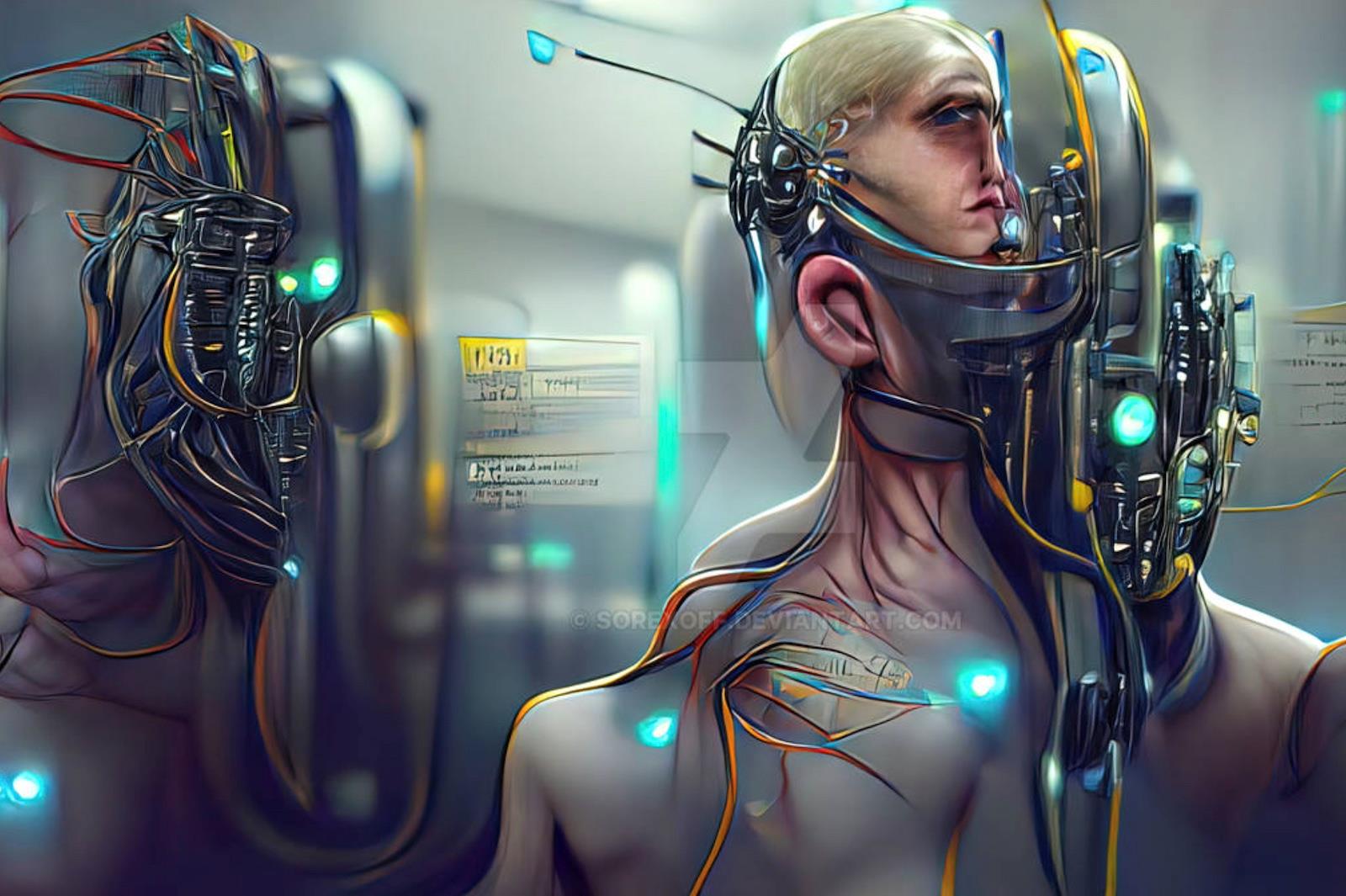

AI won't save us but cybernetics could ![Biden's waffling war stances miffing allies, losing votes]() Biden's waffling war stances miffing allies, losing votes

Biden's waffling war stances miffing allies, losing votes

India needs to assert its superpower arrival Similarly, in Greece , the State Grid made substantial inroads by acquiring a 24% stake in the national electricity transmission network operator from the Greek government in 2016.

While Portugal, Italy, and Greece were primary targets, Chinese investors have also acquired grids in Luxembourg . Last but not least, let's not forget China's green-tech industry has flooded Europe with cheap solar panels and electric vehicles (EVs).

US making inroadsThe stakes are all the higher because China is not the only country with ambitions in the EU: The United States is also seeking to benefit from the bloc's poorly thought-out energy strategy.

Russia's war against Ukraine has not weakened the United States' energy dominance in the world, and more specifically in the EU. Indeed, while Russian gas was expected to act as a bridge fuel in the energy transition, particularly for Germany, the EU was quick to adopt sanctions against its long-term trade partner that minimized its dependence.

Partly filling the vacant space left by Moscow, the United States has become the leading producer and exporter of LNG to Europe . This development favors US trade while domestic energy costs are kept low, further widening the price gap, with Europe experiencing energy inflation and undermining its relative competitiveness and attractiveness to energy-intensive industry.

Beyond these energy supply issues, EU member states are struggling to carve out a common vision, highlighting the challenges of sovereignty and strategic autonomy.

European companies, particularly in France, have endeavored to develop fourth-generation small modular nuclear reactors (SMR), with an attempt to create a European nuclear alliance made in November 2023.

But at the same moment, countries such as Italy, Belgium and Romania have partnered with the American Westinghouse Electric Company to develop lead-cooled fast reactors .

Here again, the coordination gap plays to the advantage of American influence in Europe, as confirmed by John Kerry in September 2023 . As part of the“Clean Fuel from SMR” international consortium led by American companies, the Czech Republic, Slovakia and Poland were selected to participate and will receive support for coal-to-SMR feasibility studies.

These EU countries are turning to the Americans to build new nuclear power plants , mainly because of their funding and technical expertise, while the EU continues to block all support for nuclear projects developed on its soil.

Cracks in net-zeroThe scale of these foreign investments in renewable energies, new nuclear facilities and grid development could come to bear heavily onto the bloc's strategic independence at a time when it's looking to decarbonize.

These investments raise concerns over continental energy security, given the still fragmented nature of Europe's energy landscape:

In the short run, supply issues due to the energy crisis urgently push the EU to turn to other foreign partners (other than Russia) and only shift our energy dependence problem. In the longer term, faced with Chinese dumping and US protectionism , Europe will have to protect domestic energy manufacturers or grid operators after having long neglected them.

The main challenge for Europe is ending one dependency without falling into another. To replace imports of fossil fuels (coal, gas, and oil) that are harmful to the climate, the EU member states must accelerate and coordinate the development of their“green” technologies.

Toward green sovereigntyThese risks demand that the bloc not only pay more attention to non-EU operators but also take greater responsibility for its own energy system. How can it do this, all while pursuing the vision of the“green, secure and affordable energy supply” set out in its Green Deal?

For starters, we recommend EU member states work harder on building truly European energy grids. As we move toward decarbonization, we can expect that increasingly an array of renewable energies will power our electricity system. These arrangements will require extensive and interconnected networks on a European scale, which must be consolidated and developed by the EU member states themselves.

A second emergency is green energy financing. In November, the European Climate Neutrality Observatory warned that a lack of EU-level public investment in green energy and other advances could cause the bloc to fail to meet its net-zero goals .

Sign up for one of our free newsletters The Daily ReportStart your day right with Asia Times' top stories AT Weekly ReportA weekly roundup of Asia Times' most-read stories

Rather than take heed of the warning, member states axed the fund earmarked for renewables and clean tech – the Strategic Technologies for Europe Platform (STEP) – to 1.5 billion euros in February.

Our book calls for a radical change of strategy, through the creation of a“European transition savings account” to attract private savings, on the one hand, and a“European sovereign fund” that receives proceeds from carbon-pricing revenues on the other.

Whether these actually come into being will depend on the upcoming European elections. Results leaning toward a higher European ambition could help us see in clean, affordable and secure solutions.

At the other end of the spectrum, further veering to the nationalistic right could carry harmful effects for the bloc's economic clout and, paradoxically, sovereignty.

Michel Derdevet, president of the organization Confrontations Europe , coauthored this article. Carine Sebi is associate professor and chair of Energy for Society, Grenoble École de Management (GEM) , and Patrick Criqui is a director and energy economist at Université Grenoble Alpes (UGA)

This article is republished from The Conversation under a Creative Commons license. Read the original article .

Already have an account?Sign in Sign up here to comment on Asia Times stories OR Thank you for registering!

An account was already registered with this email. Please check your inbox for an authentication link.