Indonesia: Headline Inflation Ticks Higher In November

Sudirman Central Business District in Jakarta, Indonesia

| 2.9% | YoY November inflation |

| Higher than expected |

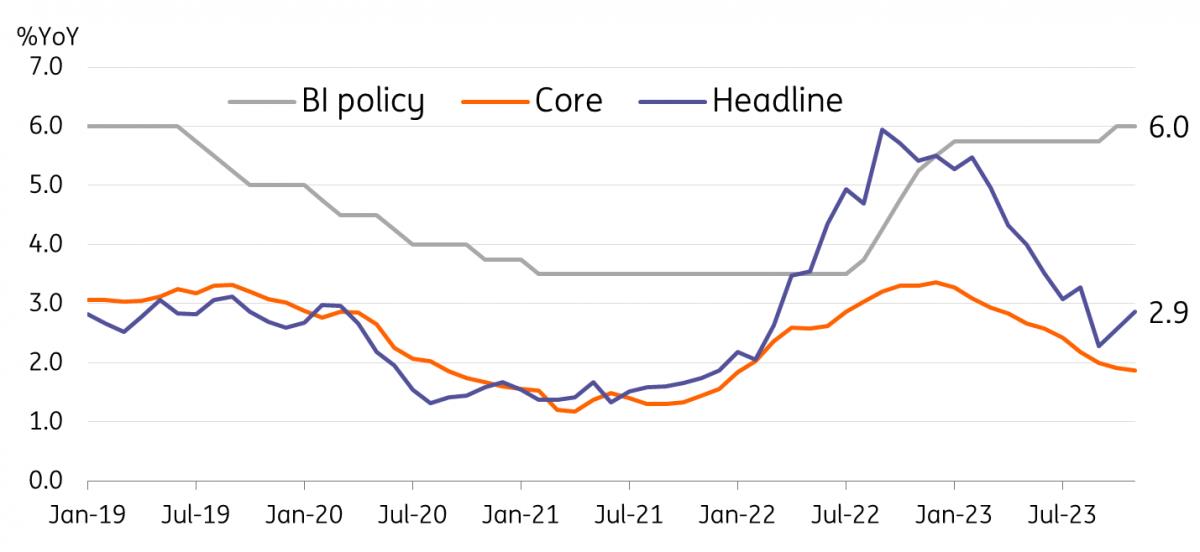

Indonesia's headline inflation rose to 2.9% YoY, slightly faster than expected and up from the previous month at 2.6% YoY. From the previous month, prices rose 0.4%, also faster than market expectations.

The main reason for the pickup in headline inflation was the 6.7% YoY acceleration in basic food prices and a slight increase in transport costs (1.3% YoY). Most other subcategories posted slightly slower inflation readings compared to the previous month.

Imported inflation remains a constant threat for Indonesia, with the IDR coming under substantial pressure of late after the trade surplus narrowed in 2023.

Inflation rises due food prices

Badan Pusat Statistik and Bank Indonesia Bank Indonesia signals hawkish bias

Despite expectations for the Bank Indonesia (BI) to consider cutting rates to support growth, we believe the central bank will need to hold their current stance for some time. Recent comments form BI Governor Warjiyo suggest his preference to retain rates at current levels, precisely because of an expected uptick for inflation in the coming months.

Global food prices are likely to remain vulnerable to spikes in early next year with the El Nino weather phenomenon to persist until April 2024. Thus we expect BI to retain policy rates for some time to help support the IDR and limit price pressures emanating from imported inflation.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment