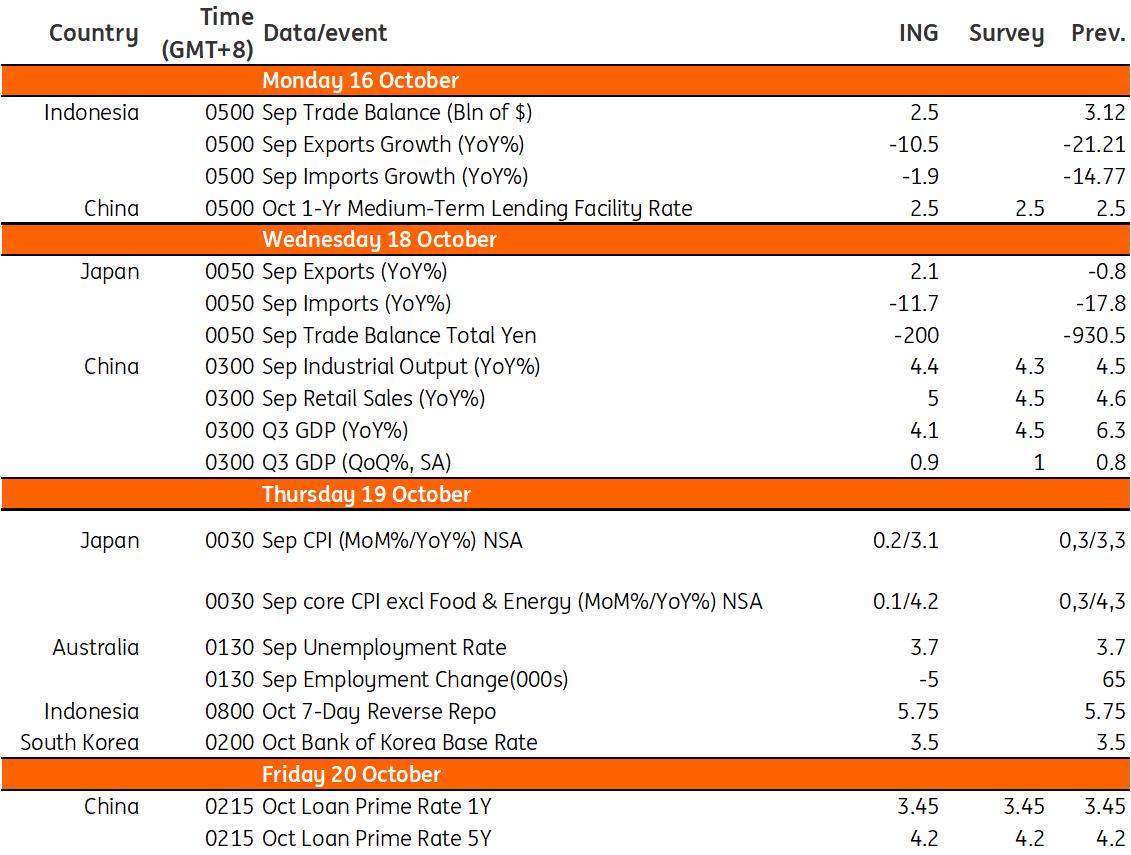

(MENAFN- ING) We'll be keeping an eye on an incoming flood of data from China next week, along with inflation figures for Japan and Australia's jobs report. Central bank decisions from the Bank of Korea and Bank Indonesia will also be in focus

In this article China GDP, retail sales and industrial production out next week Australia unemployment to hold steady Bank of Korea meet to decide key rate Japan inflation report and trade data BI expected to extend pause as Governor Warjiyo preaches patience

Shutterstock China GDP, retail sales and industrial production out next week

China will release its third quarter GDP next week amidst its usual monthly data deluge, and we are forecasting growth of about 4.1% year-on-year. China's macro data for the third quarter has been very soft right up until September when there was a sign of slight stabilisation. 4.1% YoY growth would keep the seasonally adjusted quarter-on-quarter rate at approximately the same pace as in the second quarter of the year on our calculations, and so is a relatively generous forecast given the backdrop (although it is down slightly from the median 4.5% estimation).

It is unlikely that the People's Bank of China (PBoC) will cut the 1-year MLF rate now that there are some signs that the economy is stabilising, especially while the CNY remains under weakening pressure. For retail sales, we should see slightly higher growth, partly due to favourable base effects and holiday spending. We expect the retail sales growth to be at 5.0% YoY. Industrial production growth may also edge slightly higher in line with recent PMI figures.

Australia unemployment to hold steady

Australia will release its employment data next week. Last month's data showed 65k newly added jobs, with the bulk of these being part-time. We are expecting some of the part-time will convert to full-time, turning part-time employment negative. In turn, it'll likely exceed the full-time total to deliver a negative total employment change. We expect the unemployment rate to remain at 3.7%.

Bank of Korea meet to decide key rate

Next week's highlight for Korea should be the Bank of Korea (BoK) meeting. No action is widely expected, but it will still be worth watching how the BoK addresses the recent pick-up in inflation with rising geopolitical tensions and its view on the inflation outlook.

Alongside rising market rates and increasing financial stress for households, household debt – including mortgages – has continuously increased for more than a couple of months. We will therefore be monitoring how the BoK responds to these challenges.

Japan inflation report and trade data

Base effects will likely lead to a slowdown for both headline (3.0% YoY) and core inflation, excluding food and energy (4.1%) in September. We believe the monthly price gain will continue, given high fuel and service prices.

The Bank of Japan (BoJ) is expected to revise up its inflation quarterly outlook, and this may improve the chances of a policy adjustment – changes to the yield curve control (YCC) or in forward guidance – at its October meeting. Meanwhile, trade is expected to rebound 2.1% YoY in October after having fallen for the previous two months. The trade balance, however, will likely remain in the deficit zone.

BI expected to extend pause as Governor Warjiyo preaches patience

Bank Indonesia (BI) will meet next week to discuss policy. We expect it to hold rates steady at 5.75% following recent comments from Governor Perry Warjiyo. BI would likely be on hold for some time largely to lend support to the currency, which has been under pressure as of late. We will see BI tracking any moves by the Federal Reserve, extending their pause should the Fed opt to refrain from hiking rates further.

Key events in Asia next week

Refinitiv, ING

MENAFN12102023000222011065ID1107233280

Author:

Robert Carnell, Min Joo Kang , Nicholas Mapa

*Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/about/disclaimer/

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.