(MENAFN- EIN Presswire) Military and Defense Sensor

The market for military and defense sensors is rapidly growing as a result of militaries all over the world making more purchases of defensive systems.

PORTLAND, OR, UNITED STATES, May 3, 2023 /einpresswire.com / -- The market for military and defense sensors is rapidly growing as a result of militaries all over the world making more purchases of defensive systems. The military and defense sensors of a weapon, aircraft, or electronic gadget are subsystems that notice changes in its environment or scans it to obtain information. Once processed and analyzed, the data is sent to another electrical system, usually a computer processor. Military and defense sensors are employed in missiles, warfare, aircraft, and radars among other systems for navigation, weapon control, active guidance, target tracking, and environmental awareness. Electro-optical sensors can also be used to detect dust, smoke, and fog.

Request Sample PDF at:

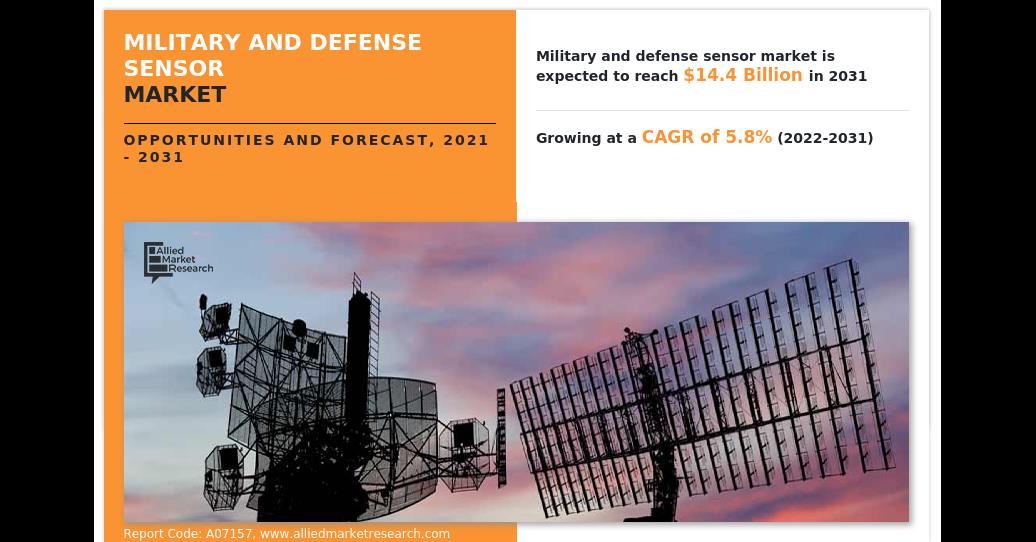

According to a new report published by Allied Market Research, titled,“military and defense sensor market " was valued at $8.3 billion in 2021, and is estimated to reach $14.4 billion by 2031, growing at a CAGR of 5.8% from 2022 to 2031.

Covid-19 Scenario:

The outbreak of the COVID-19 pandemic hurt the growth of the global military and defense sensor market , owing to the implementation of global lockdown which resulted to hamper the industry.

Curfew practices globally affected the domestic as well as international production of military and defense sensors, which, in turn, hampered the growth of the overall market.

Supply chain was disrupted due to import & export restrictions. Manufacturers faced a shortage of labor and unavailability of raw materials.

The military and defense sensor market has a high scope of growth opportunities in the future due to factors such as high demand for army vehicles equipped with safety features, and greater adoption of automatic driver assistance systems.

Interested to Procure the Research Report? Inquire Before Buying -

By platform, the market is categorized into land, naval, and airborne. The land segment gained the highest market share in 2021 and is projected to lead the market within the forecast timeframe due to the rapid adoption of military and defense sensors in developing countries. In addition, the increasing innovations, and developments by market players which in turn drive the demand for military and defense sensors in the forecast timeframe. Ground based systems integrate and communicate with the airborne and naval systems, which helps in tactical advancements. Hence, the companies are largely focusing on communications part of efficient communication programs, particularly for land applications. It is projected to enable the communication for land-based operations and maintain the interoperability during wartime.

By component, the military and defense sensor market is categorized as software and hardware. Among these segments, the hardware segment captured a significant market share as compared to the software segment, owing to the higher use of this technology for better fuel efficiency. For instance, in April 2019, Thales acquired the Gemalto which engaged in digital identity and security. This acquisition increased Thales's revenue as well as the company's expansion throughout the world. Moreover, the installation of military sensors in aircraft provides a broad range of communications capabilities for a variety of aircraft, unmanned aerial vehicles (UAVs), and other mobile platforms, fueling the segment's expansion over the anticipated timeframe.

By application, the military and defense sensor industry is categorized as combat operations, target recognition, electronic warfare, communication and navigation, command and control, surveillance and monitoring, and intelligence and reconnaissance. The target recognition segment dominated in the global military and defense sensor market segment due to the rising number of threat activities and border conflicts between countries which increases the demand for target recognition sensors. The market players are expanding the capabilities of the development which improves the production capacity and supports the market expansion globally during the forecast period. For instance, in September 2022, Pico Technology launched the TA497 PicoBNC+ optical sensor is part of the new PQ316 PicoBNC+ Optical Sensor Kit. With all the user-friendliness advantages offered by Pico Technology's PicoBNC+ smart interface technology, the optical sensor kit gives users a practical way to capture rotational speed reference signals for Noise, Vibration, and Harshness (NVH) balancing applications. Thus, such developments are anticipated to drive the segment's growth during the forecast period.

KEY FINDINGS OF THE STUDY

By platform, the land segment leads the market during the forecast period.

By component, the hardware segment leads the market during the forecast period.

By application, the communication and navigation segment are expected to grow at a lucrative growth rate during the forecast period (2022-2031).

Europe is anticipated to exhibit the highest CAGR during the forecast period.

The key market players in the military and defense sensor market are Thales Group, BAE Systems plc., Raytheon Company, Curtiss-Wright Corporation, Honeywell International Inc., Esterline Technologies Corporation, Kongsberg Gruppen ASA, TE Connectivity Ltd., Lockheed Martin Corporation, and Rockwest Solutions, and others.

Procure Research Report at

Allied Market Research

Allied Market Research

+1 800-792-5285

email us here

Visit us on social media:

facebook

twitter

linkedin

Comments

No comment