(MENAFN- News Direct) Perth, Australia | April 28, 2023 06:57 AM Eastern Daylight Time

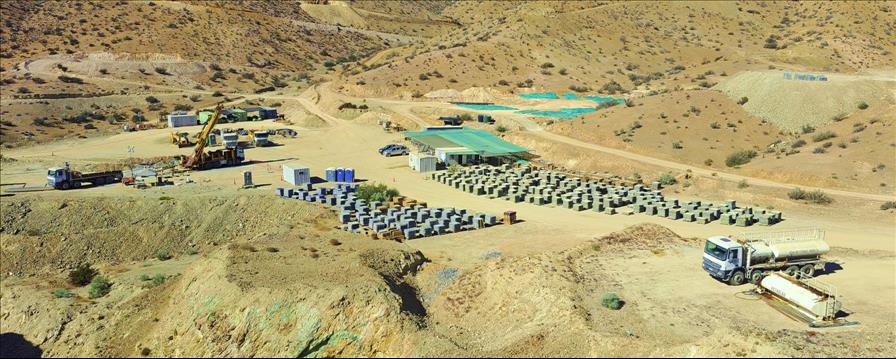

Drilling operations adjacent to the Cortadera core yard, Costa Fuego copper project, Chile, February 2023

Next Phase of Copper-Gold Growth Begins . New assay results confirm a fourth porphyry at Cortadera, returning a wide diamond drill intersection of copper (Cu) and gold (Au) from shallow depth:

o 120m grading 0.5% CuEq* (0.4% Cu, 0.2g/t Au) from 22m depth down-hole to end of hole (LCD001)including 38m grading 1.0% CuEq* (0.8% Cu, 0.4g/t Au) from 22m depth;

. Wide intercept of mineralised porphyry intersected below Cortadera's Cuerpo 1 porphyry confirming significant resource expansion potential:

o 270m grading 0.5% CuEq* (0.4% Copper (Cu), 0.1g/t Gold (Au)) from surface (CRP0202D) including 114m grading 0.7% CuEq* (0.6% Cu, 0.1g/t Au) from 70m depth,

o 84m grading 0.4% CuEq* (0.4% Cu) from 336m depth downhole (CORMET001) including 26m grading 0.6% CuEq* (0.6% Cu, 0.1g/t Au) from 374m depth.

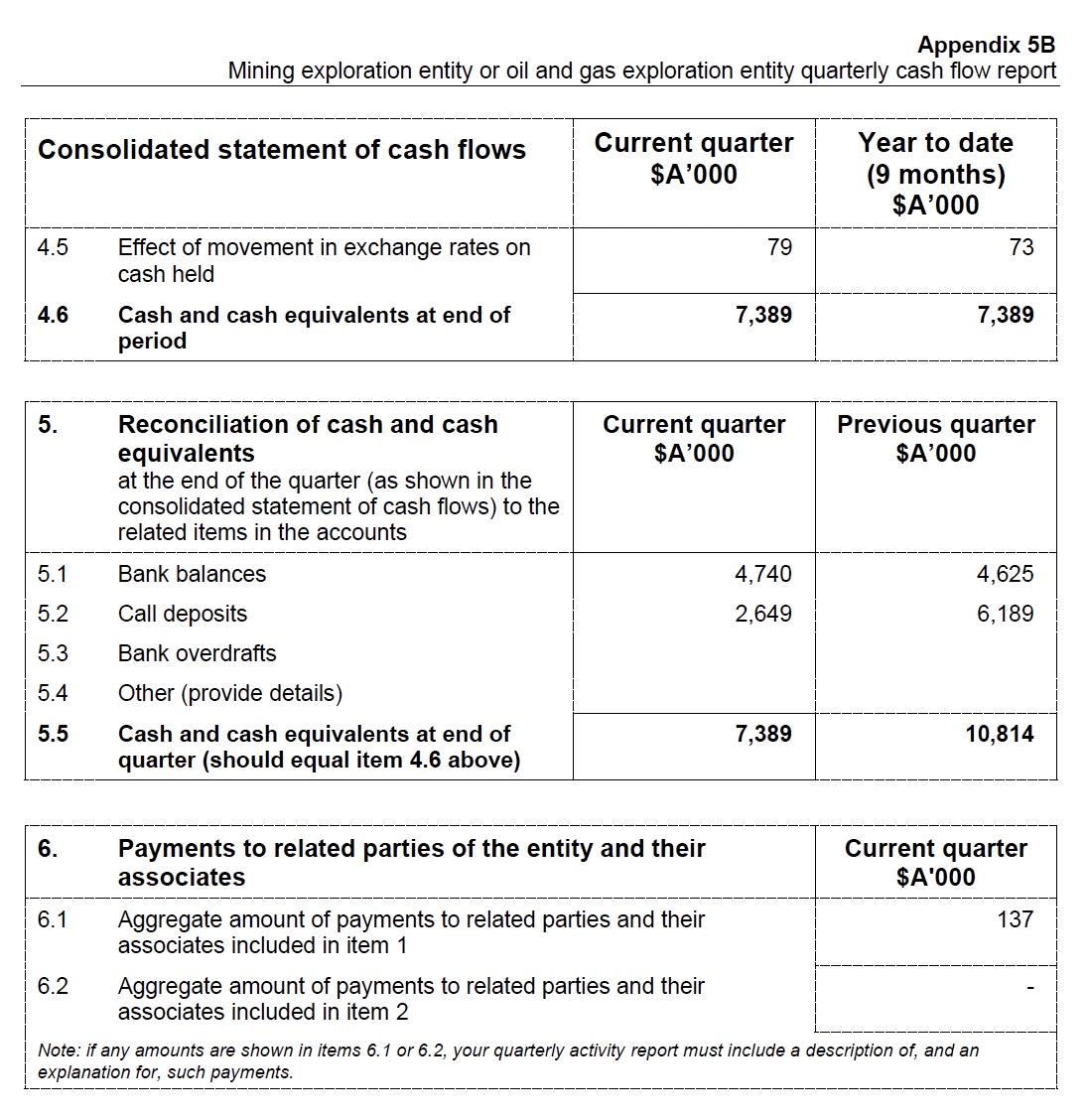

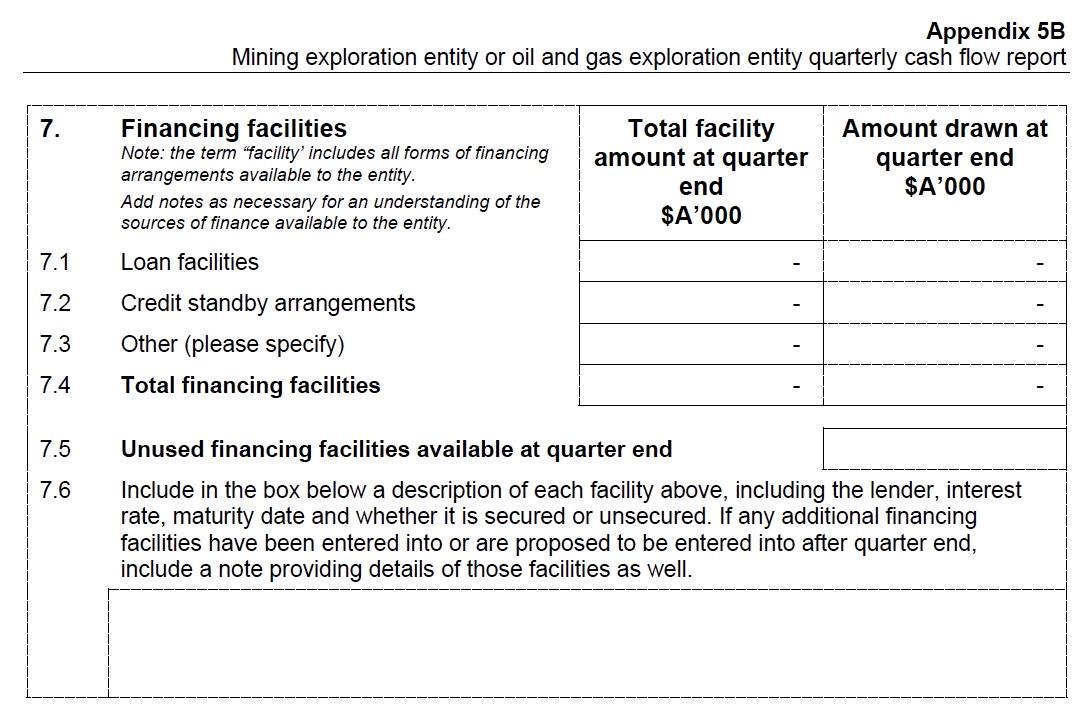

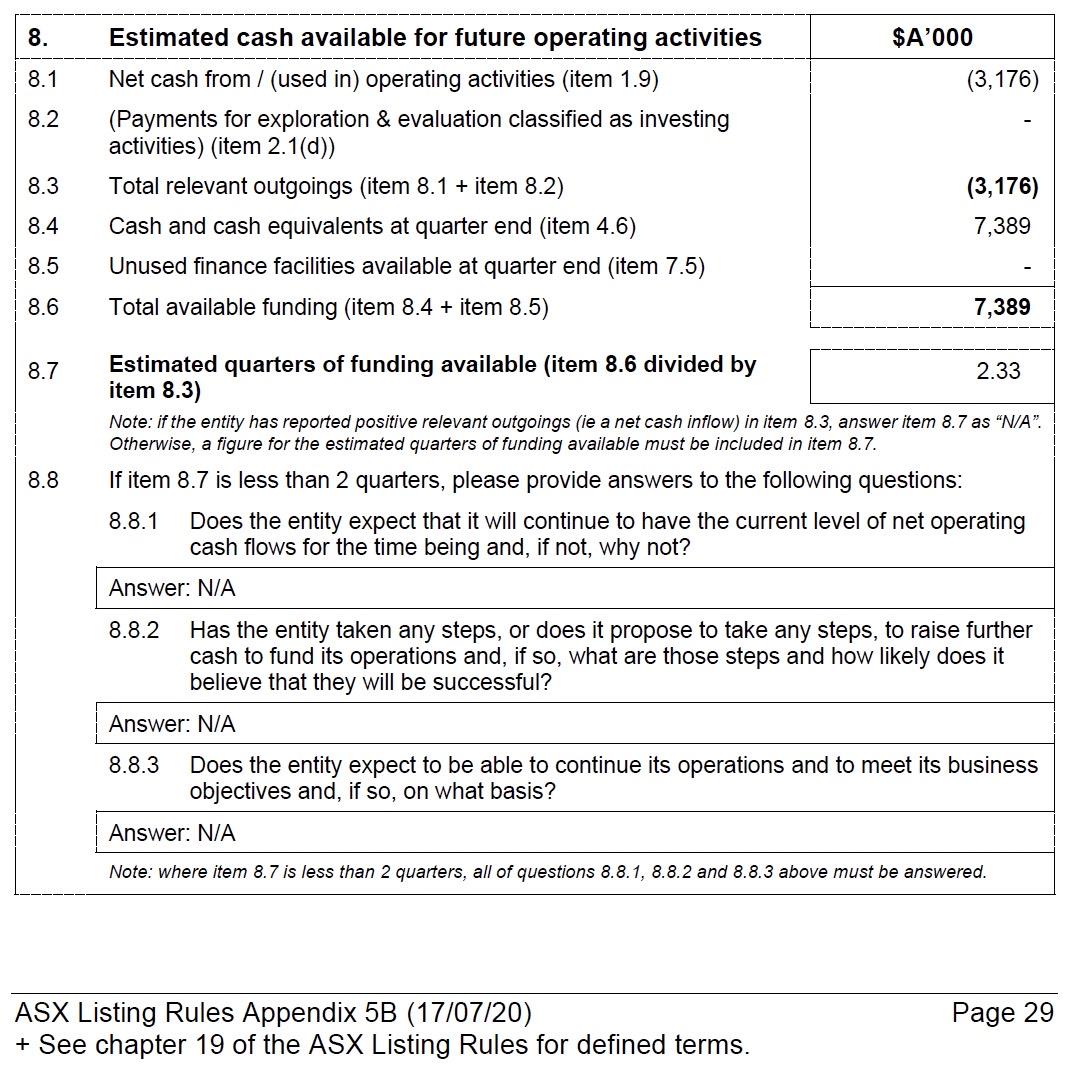

Costa Fuego Preliminary Economics Assessment (PEA) On-Track for Q2 2023 Unmarketable Parcel Share Sale Facility Opened Strong Cash Balance of $7.4 million * Copper Equivalent (CuEq) reported for the drillhole intersections were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery) + (Mo ppm × Mo price per g/t ×Mo_recovery) + (Au ppm × Au price per g/t × Au_recovery) + (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne × Cu_recovery). The Metal Prices applied in the calculation were:Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. The entirety of the intersection is assumed as fresh. The recovery and copper equivalent formula for Cortadera – Recoveries of 83% Cu, 56% Au, 83% Mo and 37% Ag. CuEq (%) = Cu(%) + 0.56 x Au(g/t) + 0.00046 x Mo(ppm) + 0.0043 x Ag(g/t)

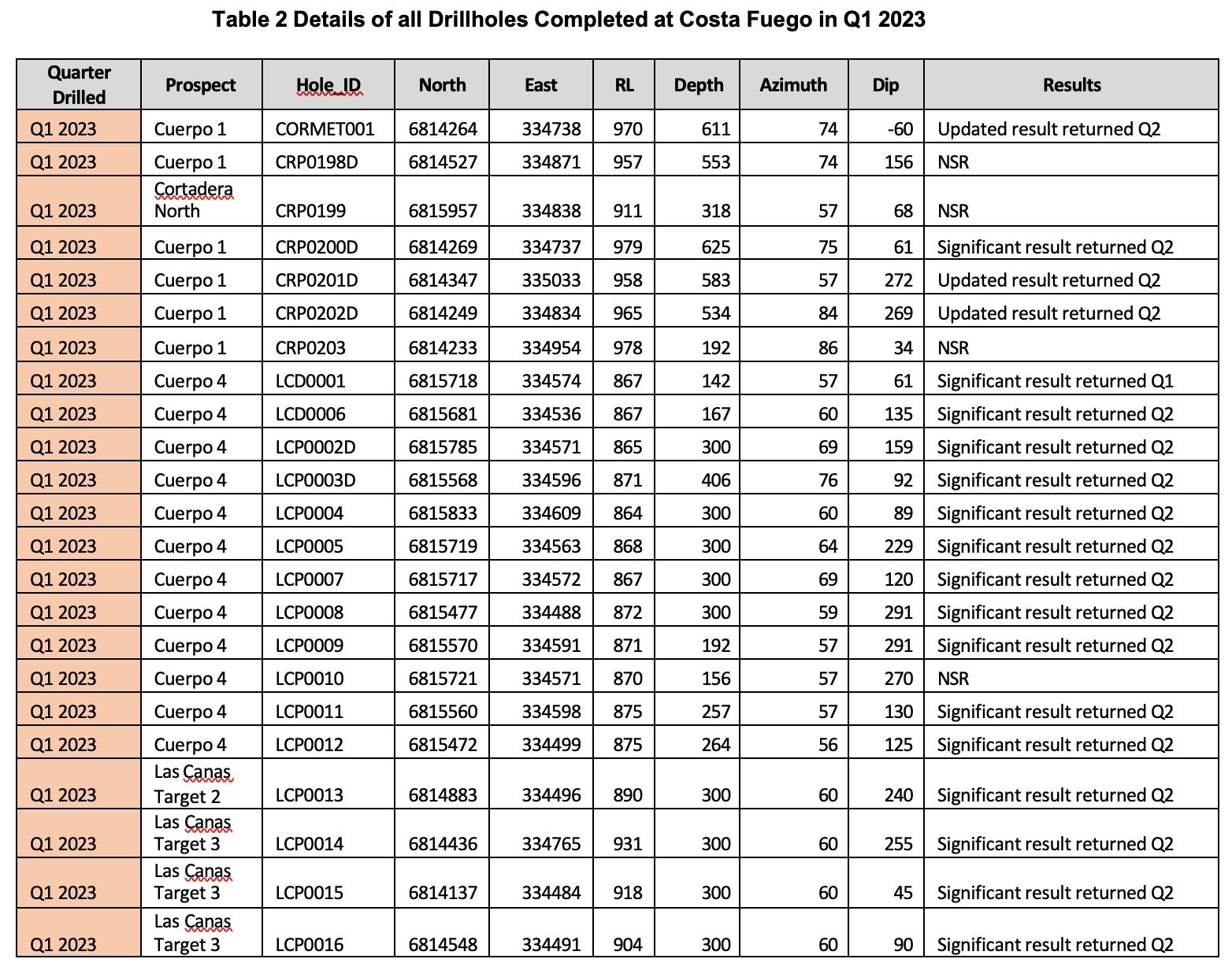

SUMMARY OF OPERATIONAL ACTIVITIES Next Phase of Copper-Gold Growth Begins In early January 2023, the Company commenced drilling across several extensional targets to the Cortadera copper-gold Mineral Resource, the centrepiece of the Company's coastal range, low-altitude, Costa Fuego senior copper development in Chile.

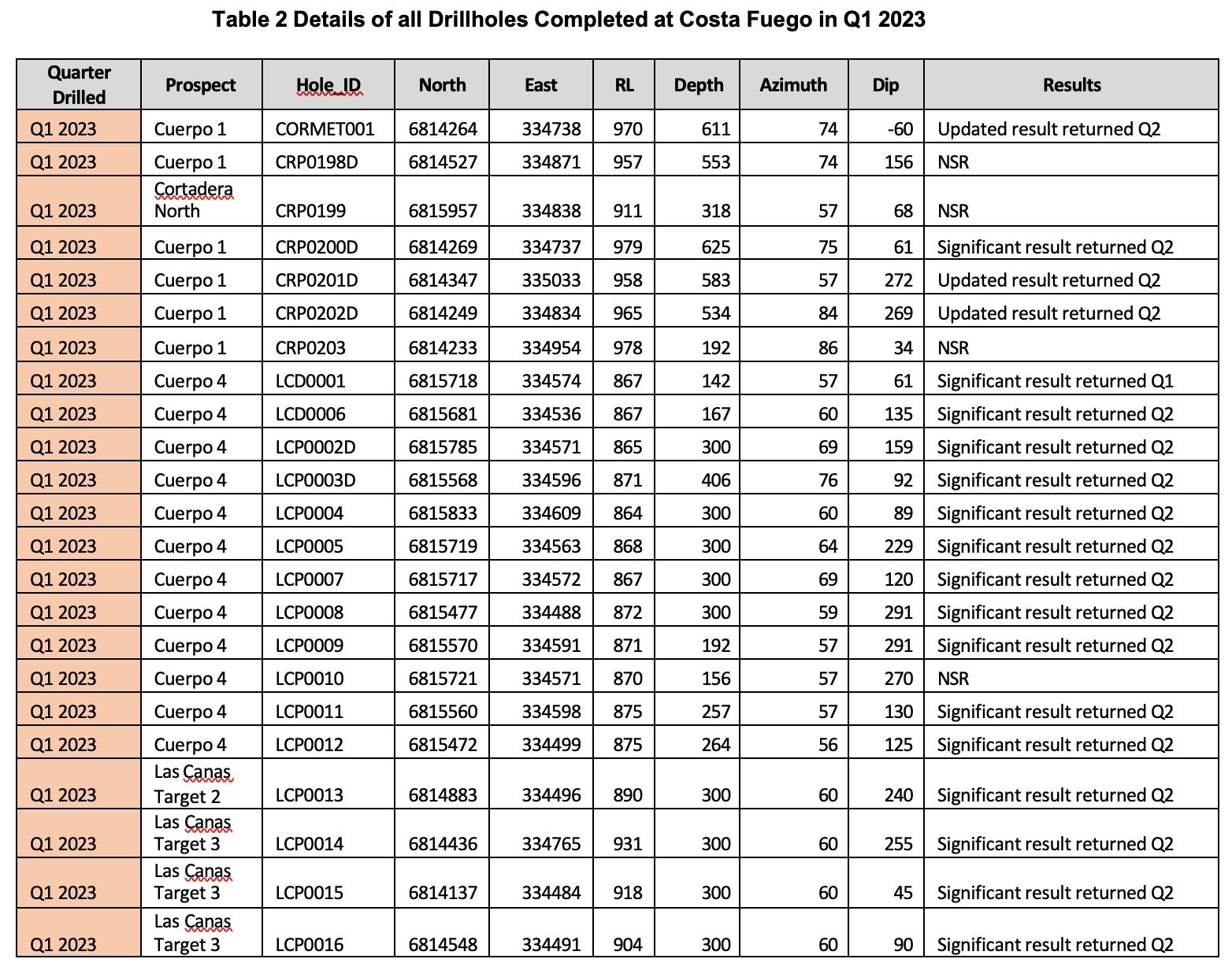

First-pass drilling, which comprised 23 drill holes for 7,700m, was completed in late March and planning is underway for a second phase of exploration drilling to commence in June.

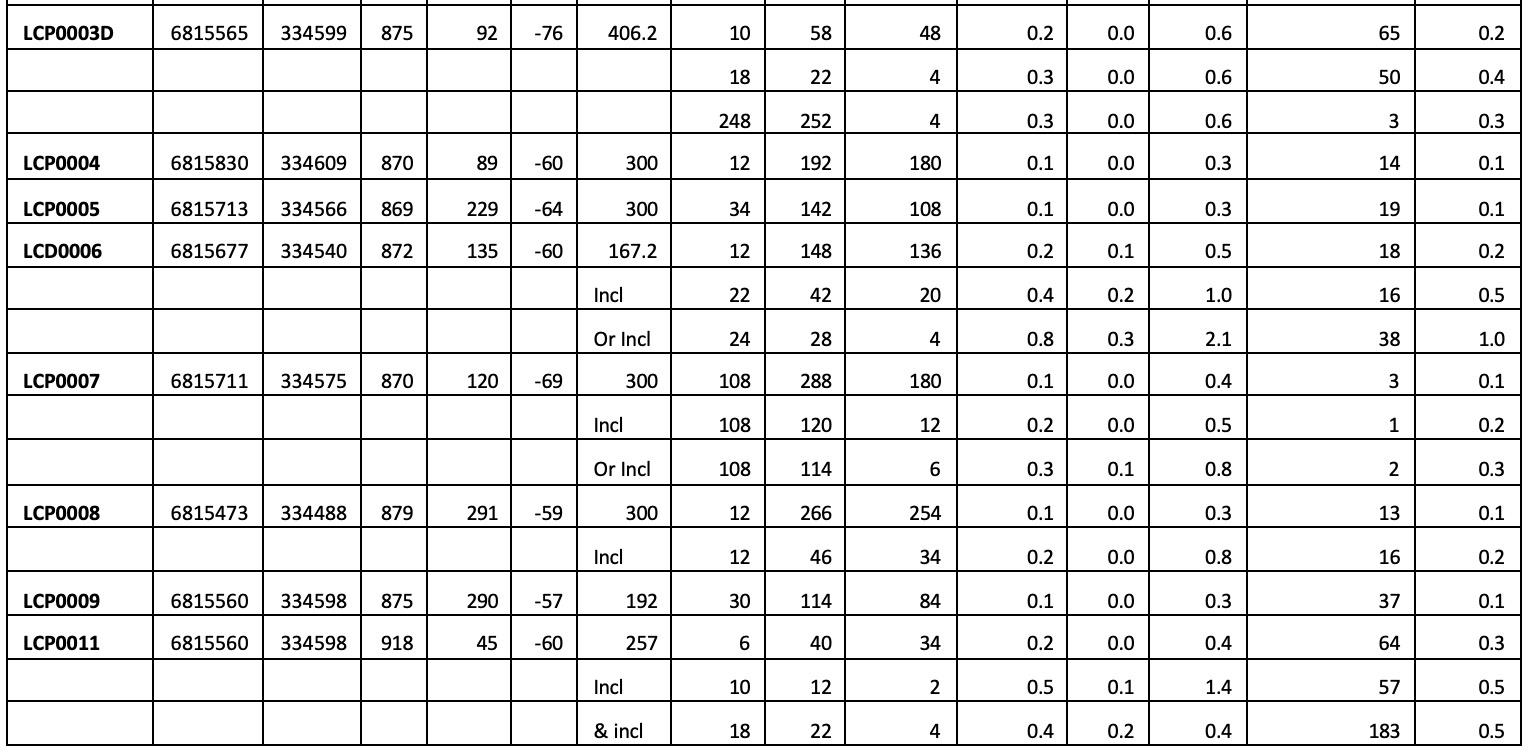

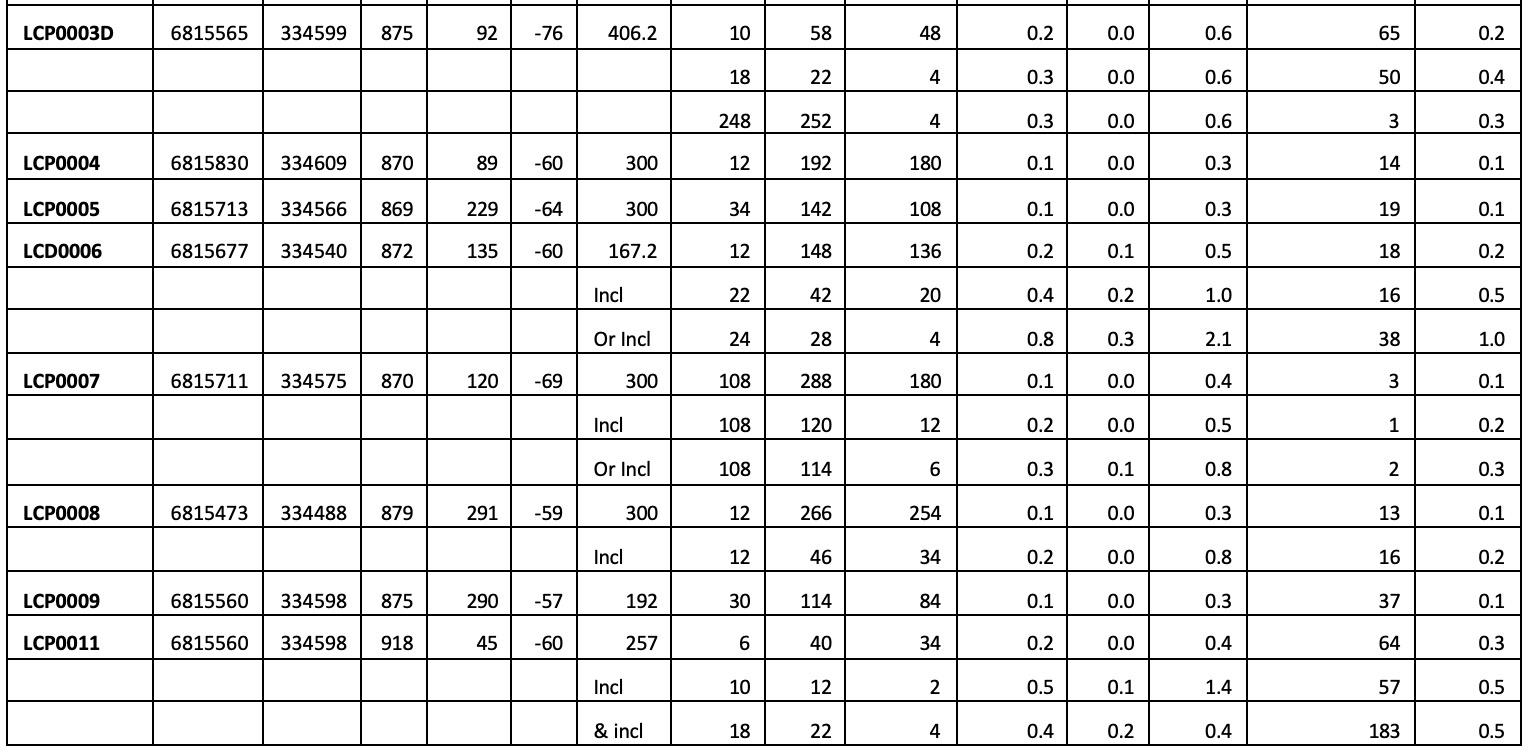

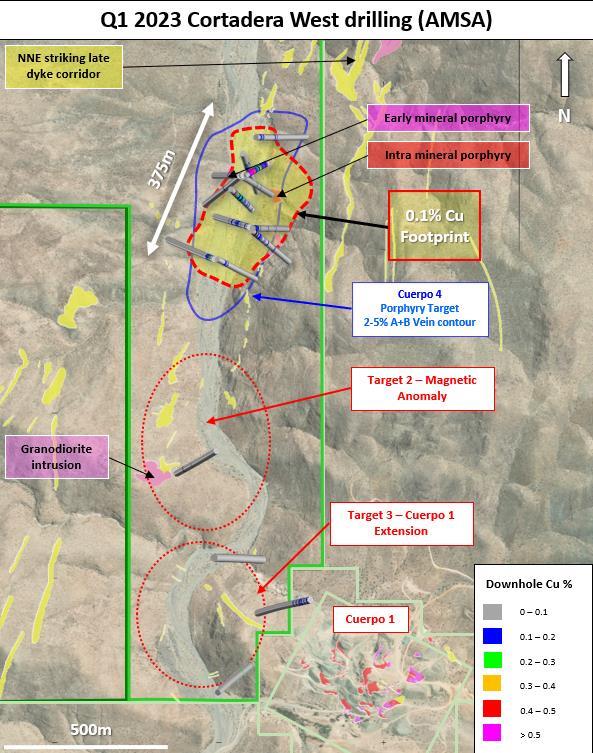

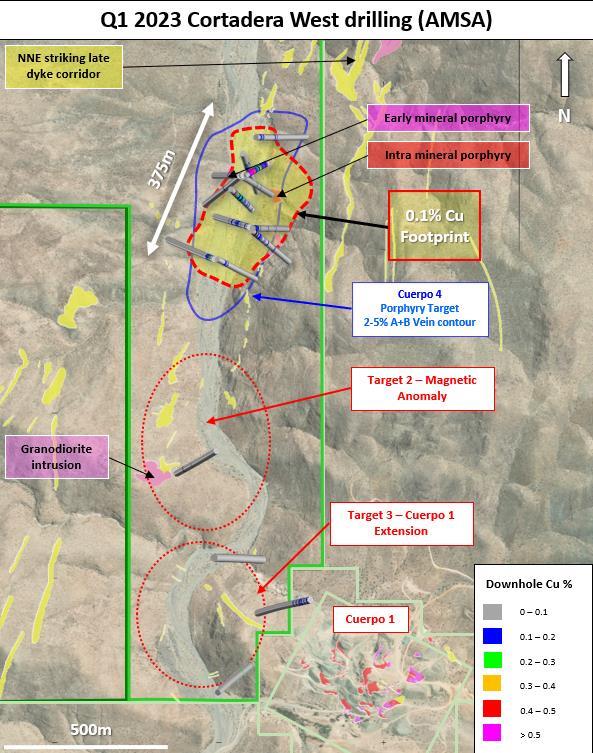

Fourth Porphyry Confirmed at Cortadera During the quarter, Hot Chili completed its first 3,000m drill commitment on the properties held under a two- year option agreement (the "Option") with Antofagasta Minerals ("AMSA") over the potential western extension of the Cortadera resource (see announcement dated 28th November 2022).

New assay results have recorded a significant drill intersection of shallow copper-gold porphyry mineralisation, confirming the presence of a fourth porphyry (Cuerpo 4) at Cortadera.

Diamond drill hole LD0001 was drilled as a confirmatory twin hole to historical AMSA drill hole COR-03 that intersected 128m grading 0.5% CuEq* (0.4% Cu & 0.1g/t Au) from 28m downhole depth, including 16m grading 1.3% CuEq* (1% Cu & 0.5g/t Au) from 28m depth (as announced on 28th November 2022).

LCD0001 has successfully returned a similar result to AMSA's hole, intersecting 120m grading 0.5% CuEq* (0.4% Cu, 0.2g/t Au from 22m depth down-hole to end of hole. Importantly, the wide intersection also included38m grading 1.0% CuEq* (0.8% Cu, 0.4g/t Au) from 22m depth, or 18m grading 1.3% CuEq* (1.0% Cu, 0.5g/t Au) from 32m depth.

Figure 1. LCD0001 (56m depth) grading 1.0% Cu, 0.7g/t Au, 4.6g/t Ag. Tonalitic porphyry with sericite-chlorite alteration and 2% A-B porphyry vein abundance. Confirmation drill hole across new fourth porphyry at Cortadera

Sulphide mineralisation (chalcopyrite-pyrite) is primarily hosted within an early and intra-mineral stage tonalitic porphyry with sericite-chlorite-biotite alteration and 2 to 7% A-B porphyry vein abundance (typical of higher-grade sulphide porphyry mineralisation at the Cortadera resource).

Final results from shallow Reverse Circulation (RC) and Diamond (DD) drilling across Cuerpo 4 have added further definition, confirming a zone of near-surface, low-grade mineralisation measuring approximately 350m in strike extent.

Mineralisation across Cuerpo 4 is shallow and open along strike toward Cortadera North and to the SSW. Sulphide mineralisation (chalcopyrite-pyrite) occurs both in the tonalitic porphyry and proximal skarn units, with local zones of copper enrichment associated with logged chalcopyrite, chalcocite and minor covellite.

The Company plans to review the results of its first phase of drilling with AMSA prior to the design of the remaining 3,000m drill commitment required to exercise the Option to acquire the mining leases. Advanced 3D modelling is also being completed to assist in the design of the deeper holes to test below Cuerpo 4.

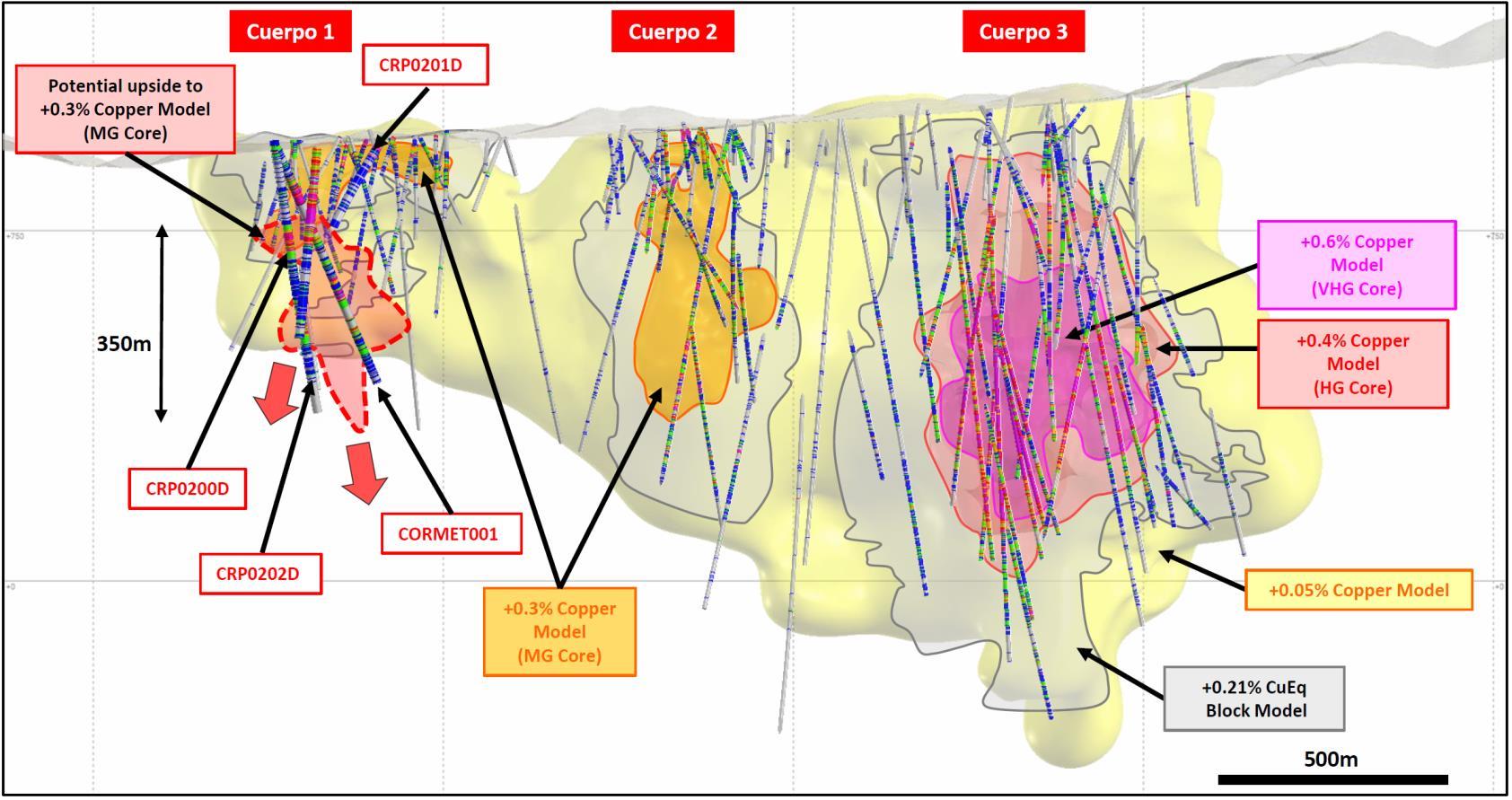

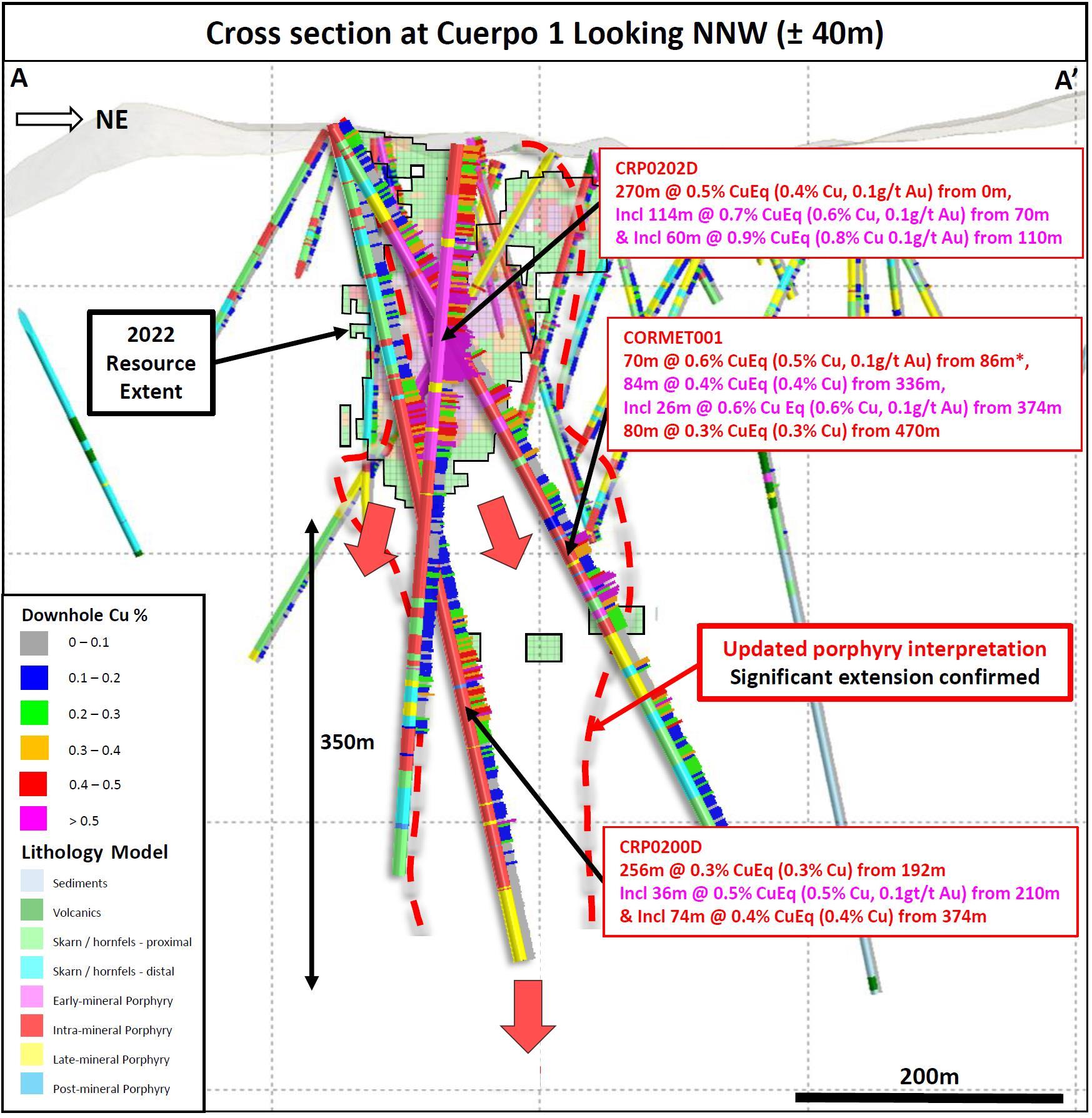

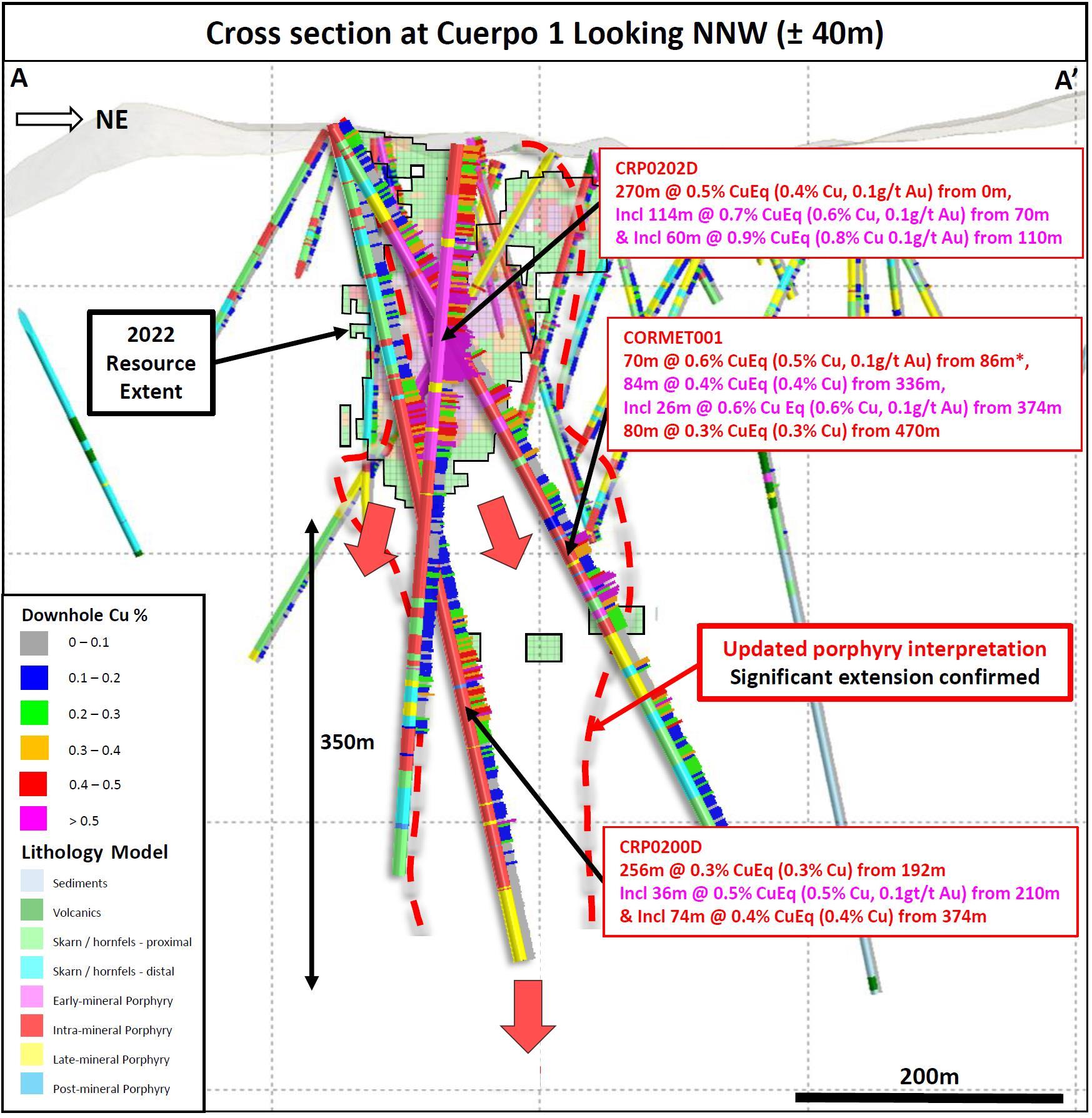

Cuerpo 1 Resource Growth Potential Expanding During the quarter, the Company also confirmed potential for a significant depth extension to the current Mineral Resource below Cuerpo 1 at Cortadera.

Diamond drill hole CORMET001 was completed to a depth of 350m in April 2022 and confirmed significant mineralisation below the defined limits of the Cuerpo 1 Mineral Resource, with the hole ending in 6m grading 0.6% Cu in mineralised porphyry (as announced 29th April 2022).

The Company has also extended diamond drill hole CORMET001, and completed a further five drill holes below Cuerpo 1. Assay results received during quarter from this drilling confirm a significant extension to mineralisation below the current Mineral Resource, intersecting mineralised porphyry (early- and intra- mineral) up to 300m below the Indicated Mineral Resource for Cuerpo 1.

Significant intersections recorded to date include:

. 270m grading 0.5% CuEq* (0.4% Cu, 0.1g/t Au) from surface (CRP0202D) including 114m grading 0.7% CuEq* (0.6% Cu, 0.1g/t Au) from 70m depth, orincluding 60m grading 0.9% CuEq* (0.8% Cu, 0.1g/t Au) from 110m depth

. 54m grading 0.5% CuEq* (0.4% Cu, 0.1g/t Au, 55ppm Mo) from surface (CRP0201D)

. 84m grading 0.4% CuEq* (0.4% Cu) from 336m (CORMET0011)

including 26m grading 0.6% CuEq* (0.6% Cu, 0.1g/t Au) from 374m depth.

. 256m grading 0.3% CuEq* (0.3% Cu) from 192m depth (CRP0200D) including36m grading 0.5% CuEq* (0.5% Cu, 0.1g/t Au) from 210m depth, and including 74m grading 0.4% CuEq* (0.4% Cu) from 374m depth

1 Note that this intersection includes an interval from 336m to 350m previously reported in April 2022.

Next Drill Phase Planned to Commence in June 2023

The Company is advanced with preparations for the commencement of a second phase of exploration drilling across its Costa Fuego landholding in June this year.

Access and drill platform clearing is complete across the Company's Cortadera North target and planning is underway to commence clearing across the Corroteo target, located 5km southeast of Cortadera and viewed as a potential Productora“look-alike” target.

The next drill phase will comprise approximately 6,000m to 8,000m of drilling.

Costa Fuego PEA On-Track for Q2 2023 The Costa Fuego PEA is in the final stages of completion and is expected to be released in June 2023.

The Company's study team has added a low-grade sulphide leach option and fully optimised mine scheduling and cost estimation ahead of financial modelling, final independent review, and sign-off by leading independent consultant Wood.

The Company anticipates positive economics for Costa Fuego as a combined open pit and underground mining hub with centralised processing for a conventional 20Mtpa throughput sulphide concentrator and SX/EW plant, producing both copper-gold concentrate and copper cathode. The PEA study scale is targeting potential annual metal production up to 100kt of copper and up to 50koz of gold, with additional molybdenum and silver credits.

The operation would take advantage of proximity to existing infrastructure including power, roads, ports and already permitted sea water supply to deliver significantly reduce development timelines. The operation also looks set to maintain a low carbon intensity by avoiding power intensive desalination plants and accessing abundant renewable energy in the Chilean power market.

Hot Chili plans to release a Pre-feasibility Study (PFS) for Costa Fuego in 2024 following completion of its current Mineral Resource growth drilling. This will assess the potential for expanding metal production.

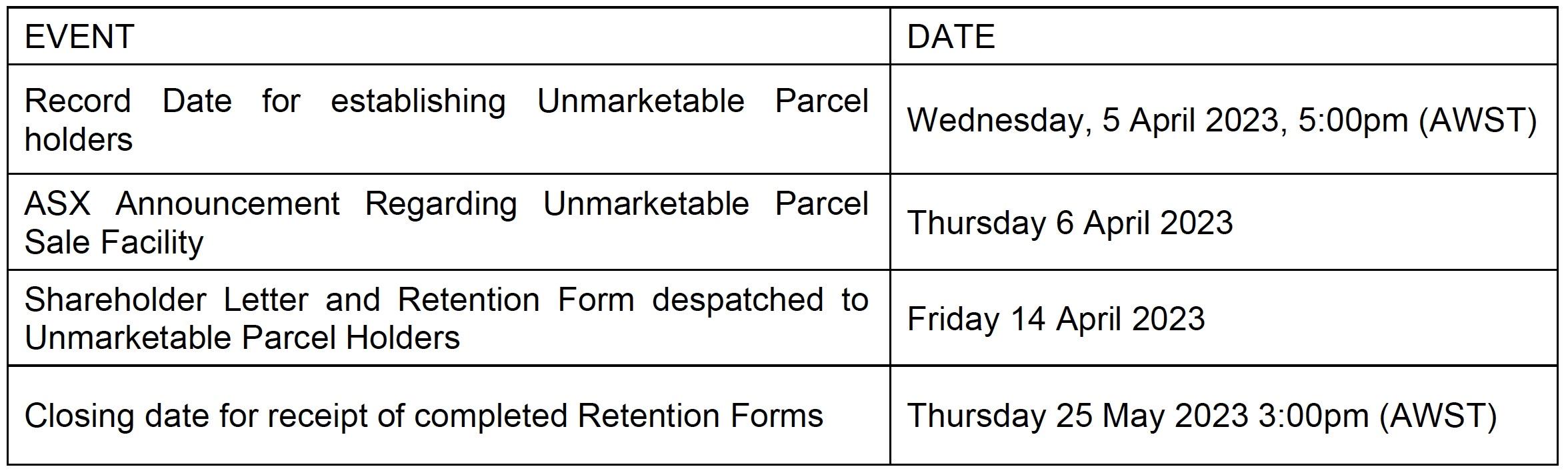

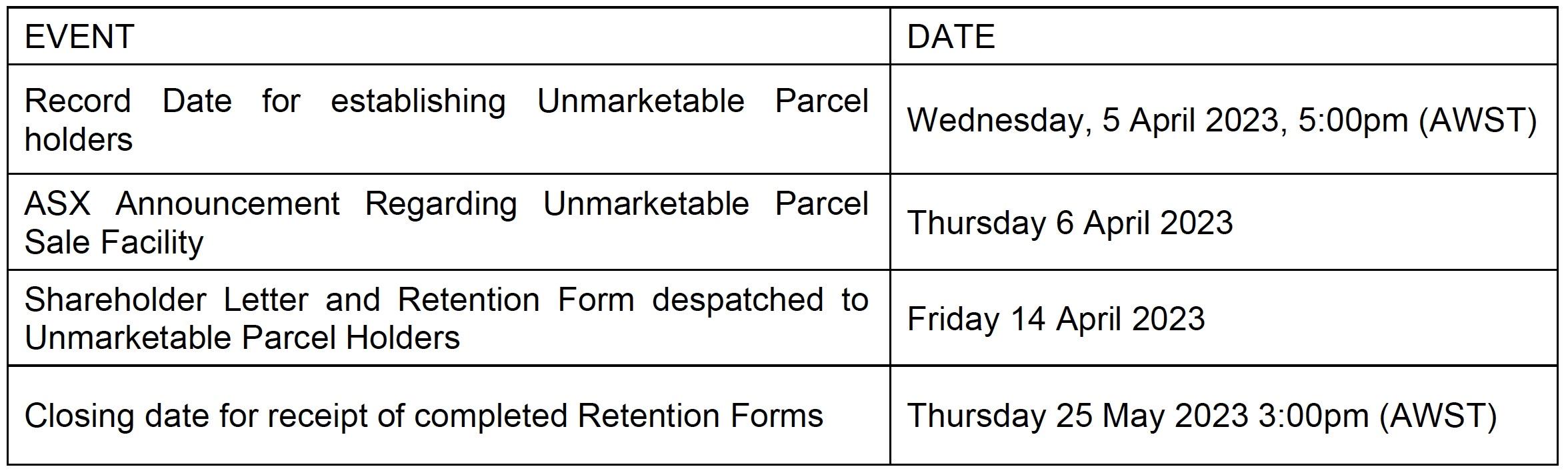

SUMMARY OF CORPORATE ACTIVITIES Unmarketable Parcel Share Sale Facility The Company established a share sale facility (Facility) for shareholders who hold fully paid ordinary shares on the Australian register of the Company (Shares) valued at less than A$500. Unmarketable Parcels can be difficult or expensive to sell, so the Company is offering the Facility to enable eligible shareholders at recorddate who hold less than A$500 worth of shares at the closing date to sell their shares without having to act through a broker or pay brokerage or handling fees. The Company will pay all costs associated with the saleand transfer of shares through the Facility (excluding any tax consequences of the sales, which will be the responsibility of the relevant shareholder)

The Facility, while benefitting small shareholders, will also benefit the Company as it is expected to reduce the administration costs associated with maintaining a large number of shareholdings on the Company's share register.

The key dates in relation to the facility are set out below:

-figcaption

< />

Figure 2 Location of Productora, Cortadera and San Antonio deposits in relation to the coastal range infrastructure of Hot Chili's combined Costa Fuego copper project, located 600km north of Santiago in Chile

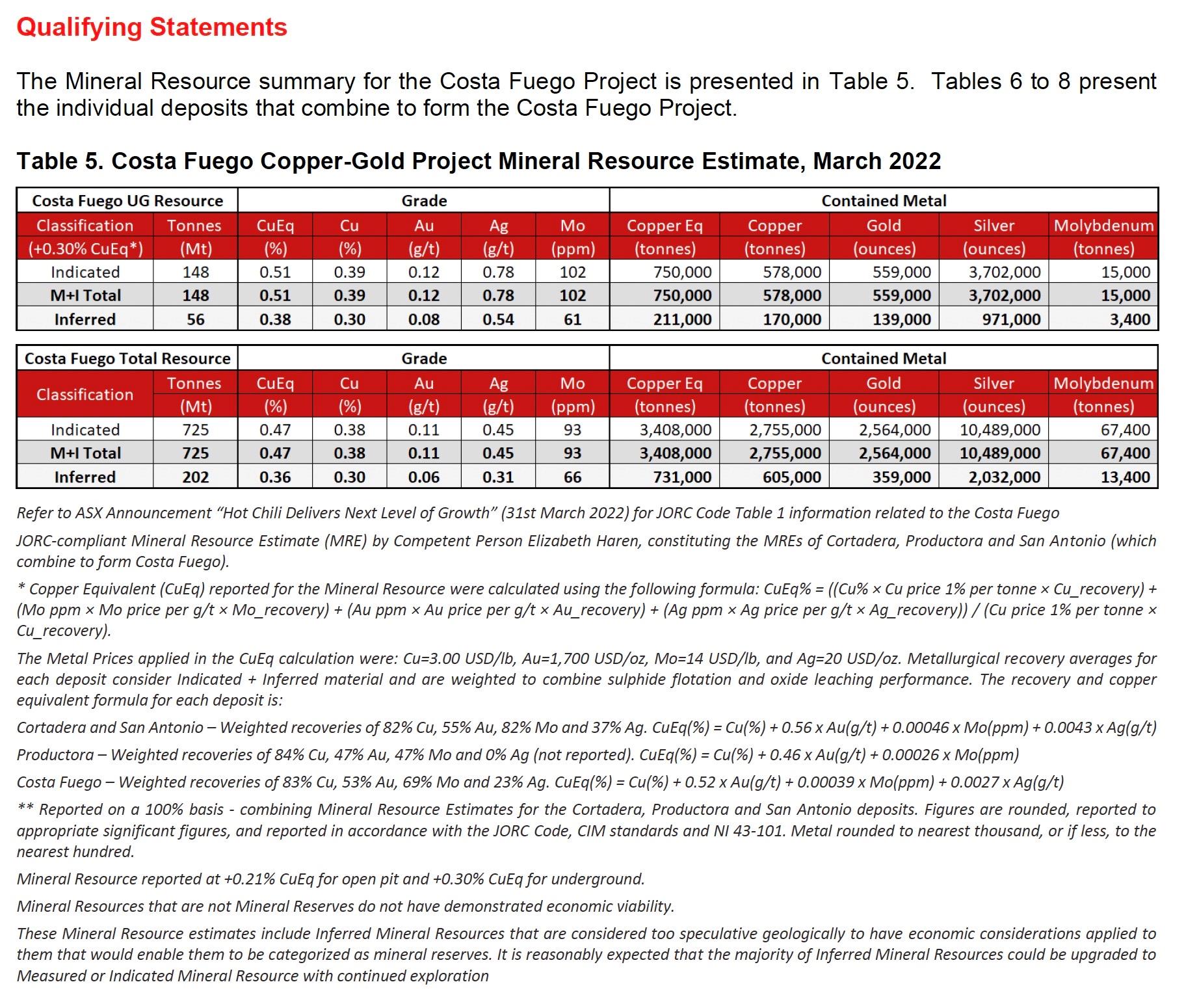

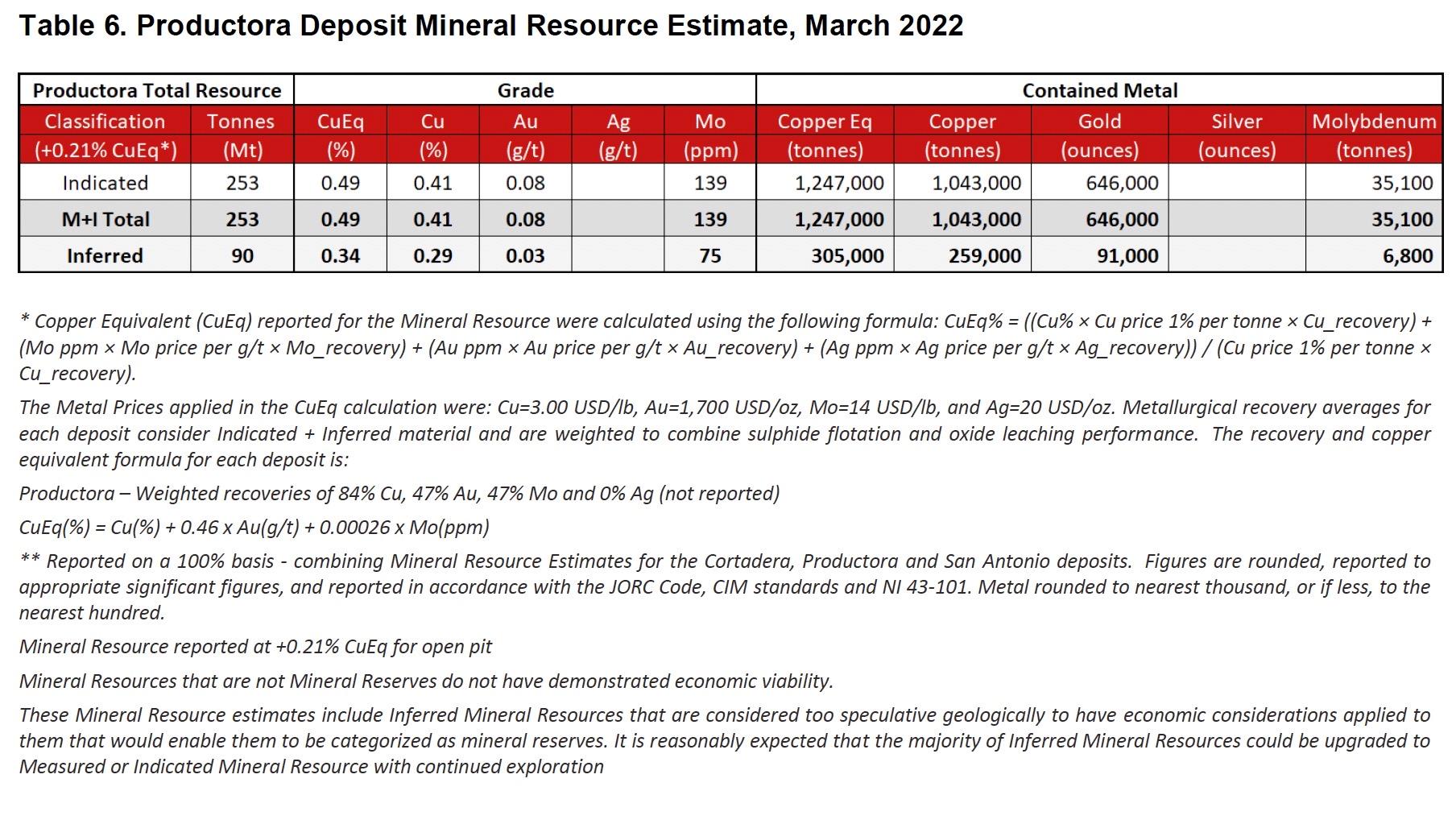

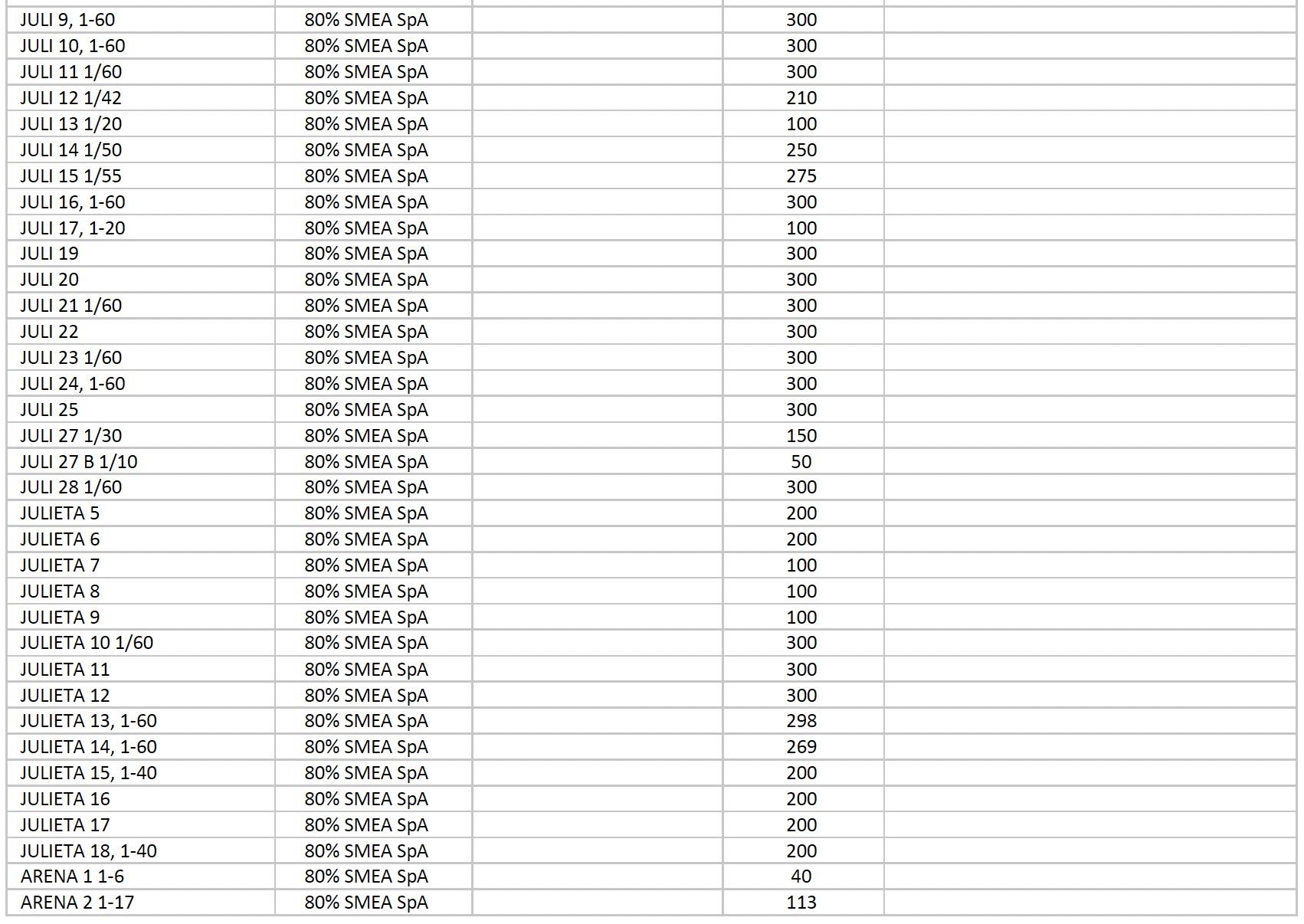

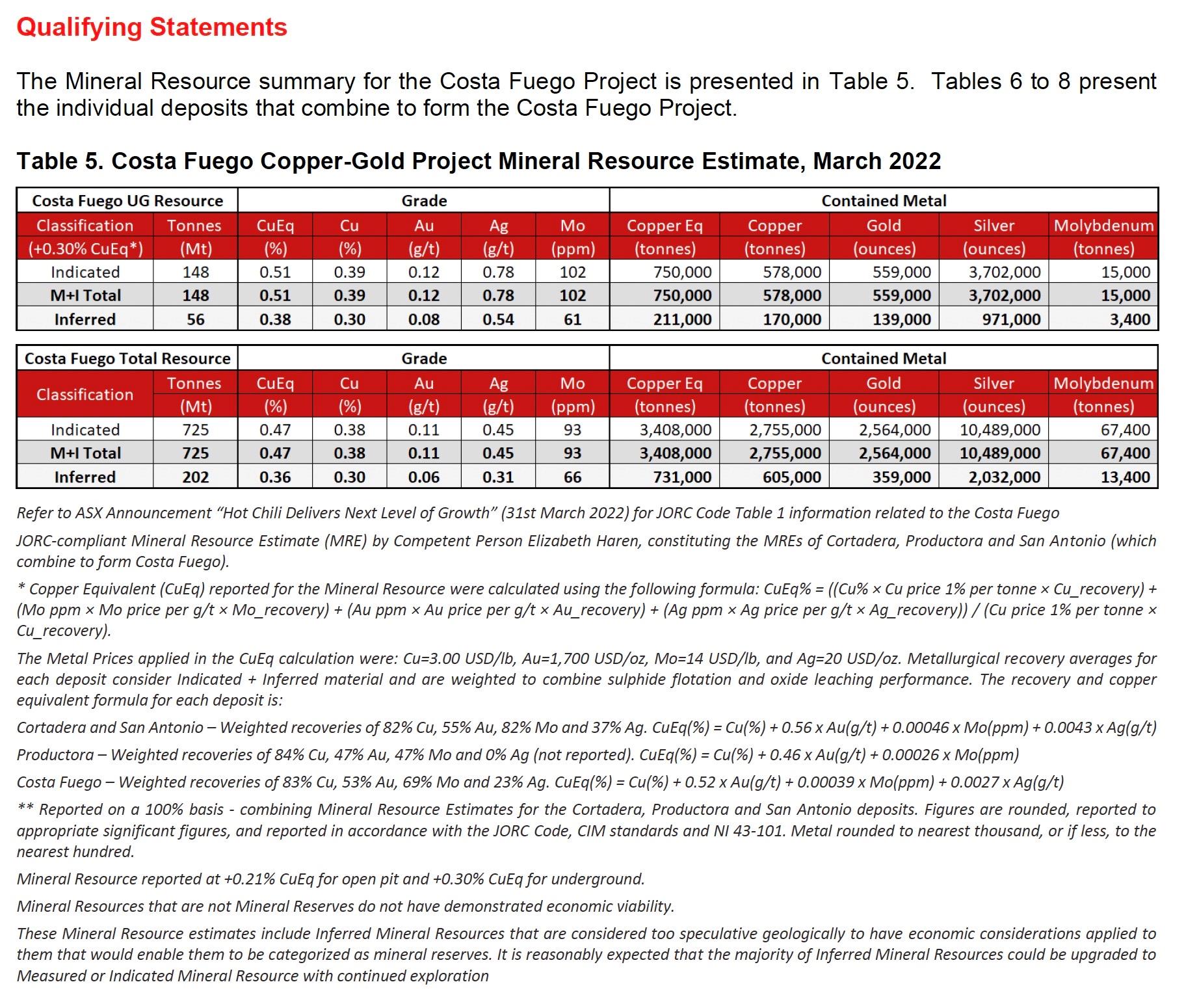

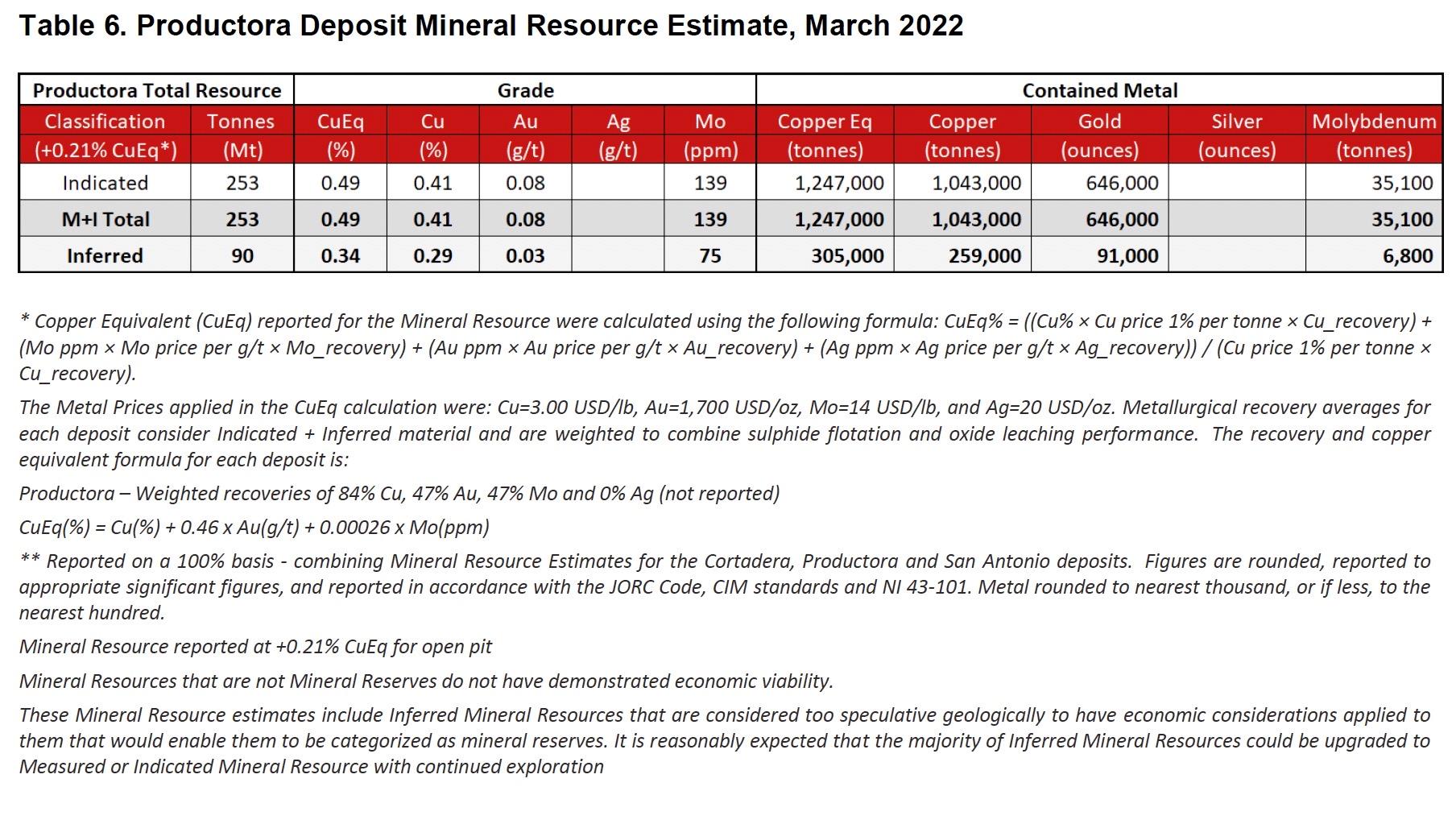

Refer to ASX Announcement“Hot Chili Delivers Next Level of Growth” (31st March 2022) for JORC Code Table 1 information related to the Costa Fuego

JORC-compliant Mineral Resource Estimate (MRE) by Competent Person Elizabeth Haren, constituting the MREs of Cortadera, Productora and San Antonio(which combine to form Costa Fuego).

* Copper Equivalent (CuEq) reported for the Mineral Resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne ×Cu_recovery) + (Mo ppm × Mo price per g/t × Mo_recovery) + (Au ppm × Au price per g/t × Au_recovery) + (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cuprice 1% per tonne × Cu_recovery).

The Metal Prices applied in the CuEq calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. Metallurgical recovery averagesfor each deposit consider Indicated + Inferred material and are weighted to combine sulphide flotation and oxide leaching performance. The recovery and copper equivalent formula for each deposit is:

Cortadera and San Antonio – Weighted recoveries of 82% Cu, 55% Au, 82% Mo and 37% Ag. CuEq(%) = Cu(%) + 0.56 x Au(g/t) + 0.00046 x Mo(ppm) + 0.0043 xAg(g/t)

Productora – Weighted recoveries of 84% Cu, 47% Au, 47% Mo and 0% Ag (not reported). CuEq(%) = Cu(%) + 0.46 x Au(g/t) + 0.00026 x Mo(ppm)

Costa Fuego – Weighted recoveries of 83% Cu, 53% Au, 69% Mo and 23% Ag. CuEq(%) = Cu(%) + 0.52 x Au(g/t) + 0.00039 x Mo(ppm) + 0.0027 x Ag(g/t)

** Reported on a 100% Basis - combining Mineral Resource Estimates for the Cortadera, Productora and San Antonio deposits. Figures are rounded, reported to appropriate significant figures, and reported in accordance with the JORC Code, CIM and NI 43-101. Metal rounded to nearest thousand, or if less, to the nearesthundred.

Total Mineral Resource reported at +0.21% CuEq for open pit and +0.30% CuEq for underground.Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

For disclosure of the Mineral Resources by category and individual metal, please see Table 5 below.

-figcaption

< />

-figcaption

< />

-figcaption

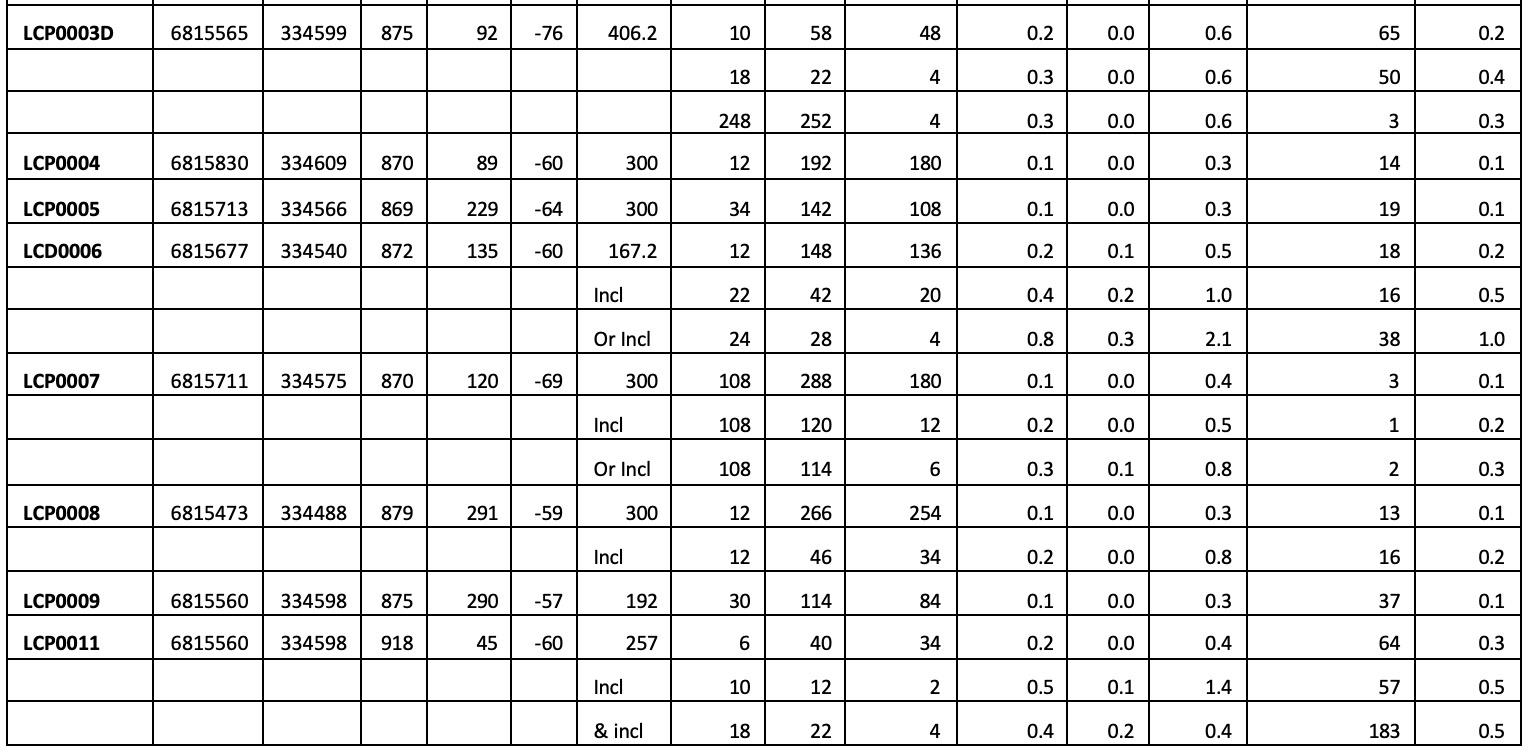

Significant intercepts are calculated above a nominal cut-off grade of 0.1% Cu. Where appropriate, significant intersections may contain up to 30m down-hole distance of internal dilution (less than 0.1% Cu).Significant intersections are separated where internal dilution is greater than 30m down-hole distance. The selection of 0.1% Cu for intersection cut- off grade above is selected on the basis of exploration significance and is not meant to represent potential marginal economic cut-off grade for bulk tonnage polymetallic copper deposits of similar grade in Chile and elsewhere in the world.

Down-hole significant intercept widths are estimated to be at or around true-widths of mineralisation

* Copper Equivalent (CuEq) reported for the drillhole intersections were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery) + (Mo ppm × Mo price per g/t × Mo_recovery) + (Au ppm × Au price per g/t × Au_recovery) + (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne × Cu_recovery). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. The entirety of the intersection is assumed as fresh. The recovery and copper equivalent formula for each deposit is:

Cortadera – Recoveries of 83% Cu, 56% Au, 83% Mo and 37% Ag. CuEq(%) = Cu(%) + 0.56 x Au(g/t) + 0.00046 x Mo(ppm) + 0.0043 x Ag(g/t) Productora – Recoveries of 84% Cu, 47% Au, 47% Mo and 0% Ag (not reported). CuEq(%) = Cu(%) + 0.48 x Au(g/t) + 0.00026 x Mo(ppm)

San Antonio and Valentina – Recoveries of 88% Cu, 72% Au, 88% Mo and 69% Ag. CuEq(%) = Cu(%) + 0.68 x Au(g/t) + 0.00047 x Mo(ppm) + 0.0076 x Ag(g/t)

1 Drillhole previously reported up to 350m (see 'Cortadera Delivers Another Strong Result' dated 29th April 2022). Subsequent entire drillhole analysis then completed. For disclosure of the detailed analytical and testing procedures, please refer to“Sampling, Analysis and Data Verification” later in this report.

Note 1: NSR – no significant intersection recorded.

Figure 3. Plan view across the Cortadera West tenements (AMSA) displaying surface mapping and the collar locations of drilling returned during the quarter.

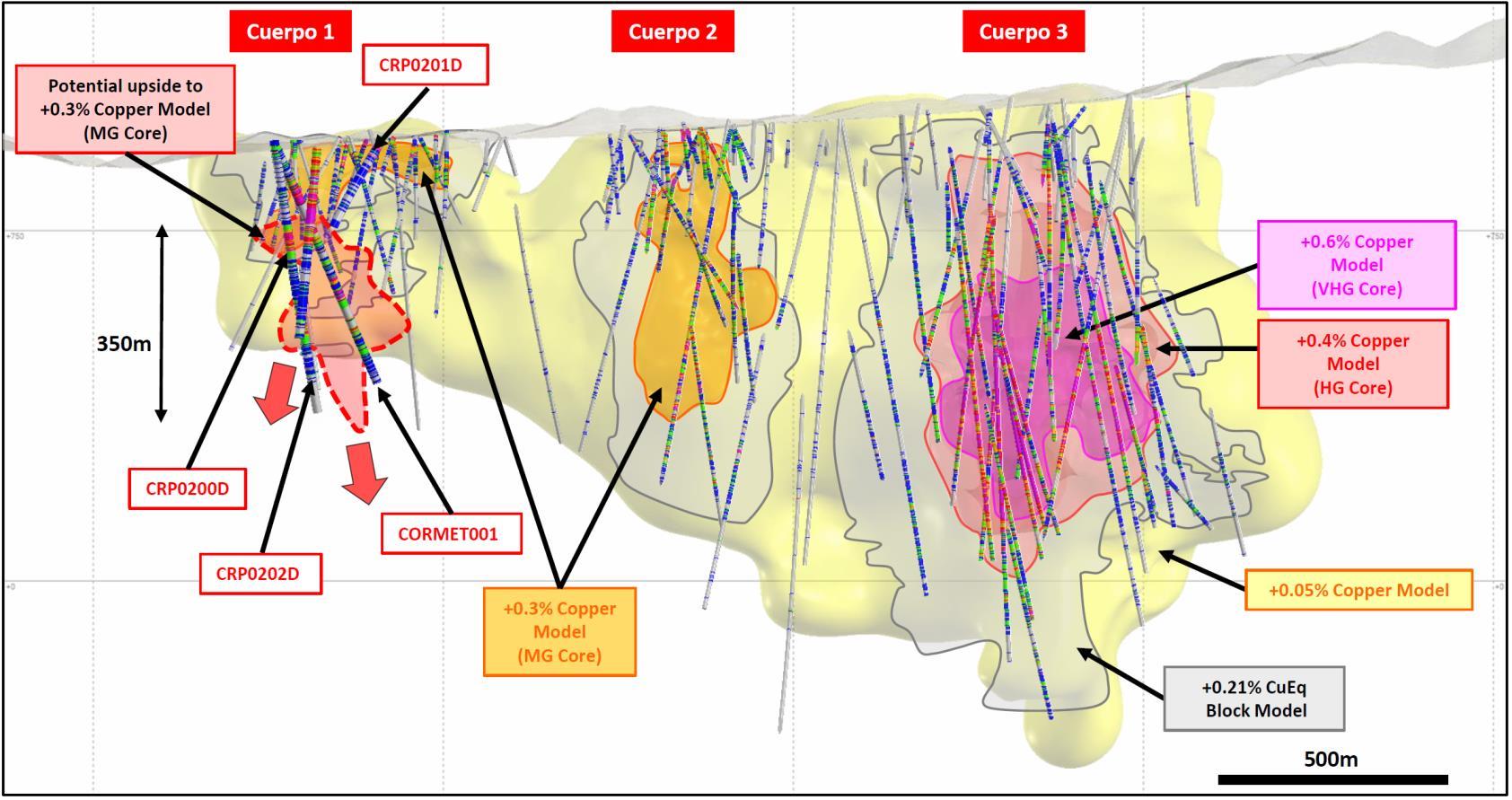

Figure 4. Long section view showing location of Cortadera Resource Extension drillholes into Cuerpo 1 and the potential growth of the +0.3% copper model (MG Core).

Figure 5. Cross-section looking NNW displaying new drillholes at Cuerpo 1 with an updated porphyry interpretation relative to the 2022 Resource model (+0.21% CuEq blocks outlined). Lithology shown on the trace, Cu% assays shown as histograms downhole.

Figure 6. Location of future growth pipeline exploration targets at Costa Fuego, relative to existing resources. Note: For disclosure of the Mineral Resources by category and grade of each metal used to establish the copper equivalent grades, please see Qualifying Statements below.

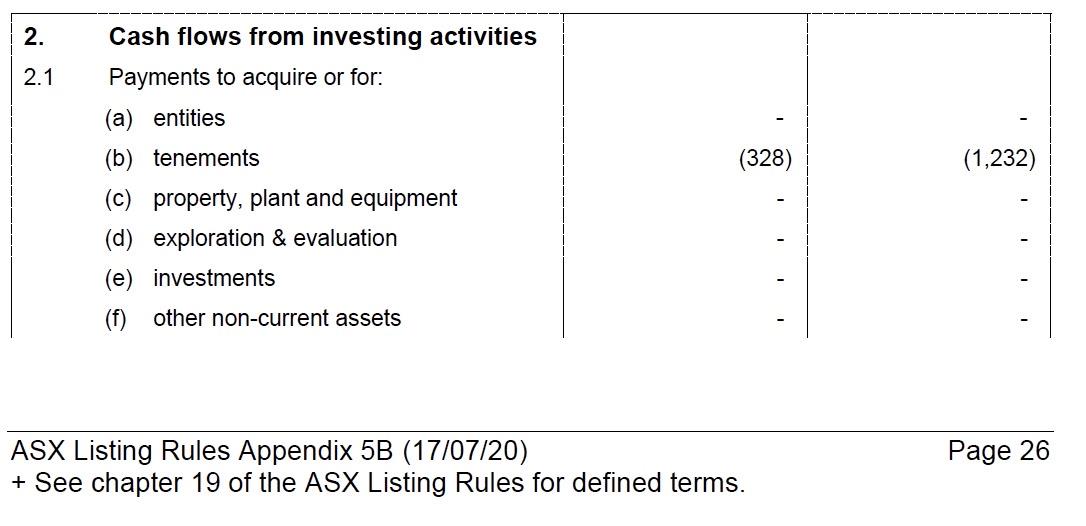

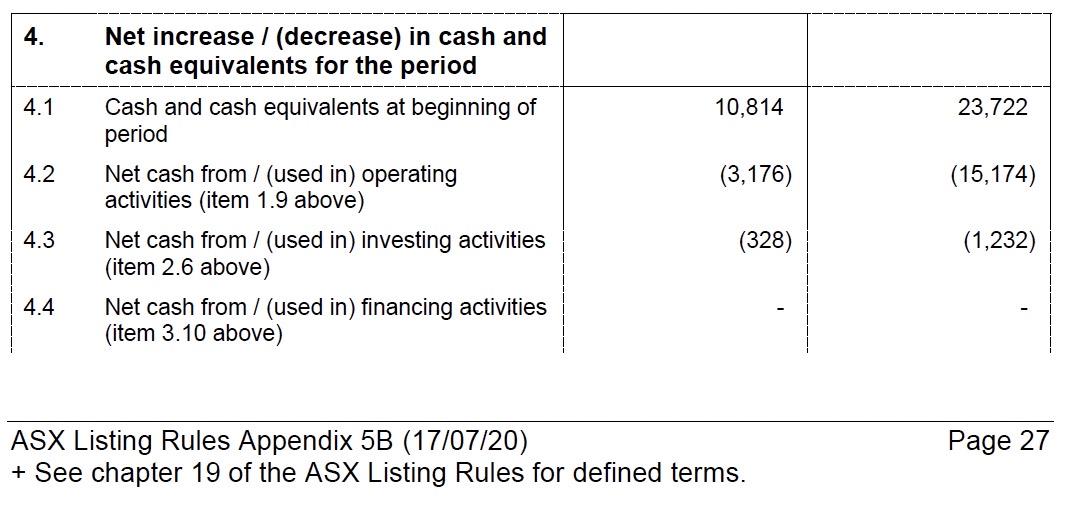

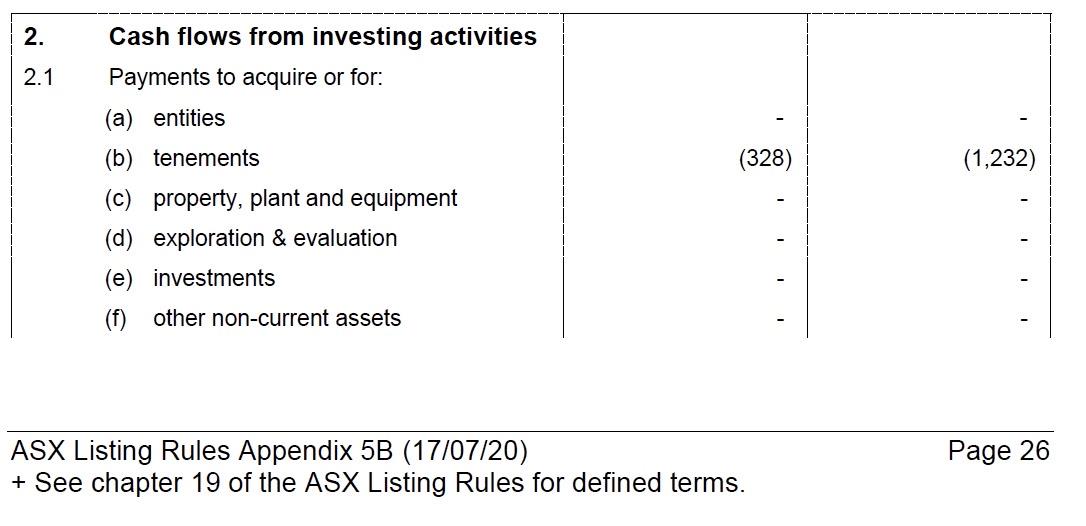

Additional ASX Disclosure Information ASX Listing Rule 5.3.2 : There was no substantive mining production and development activities during the quarter.

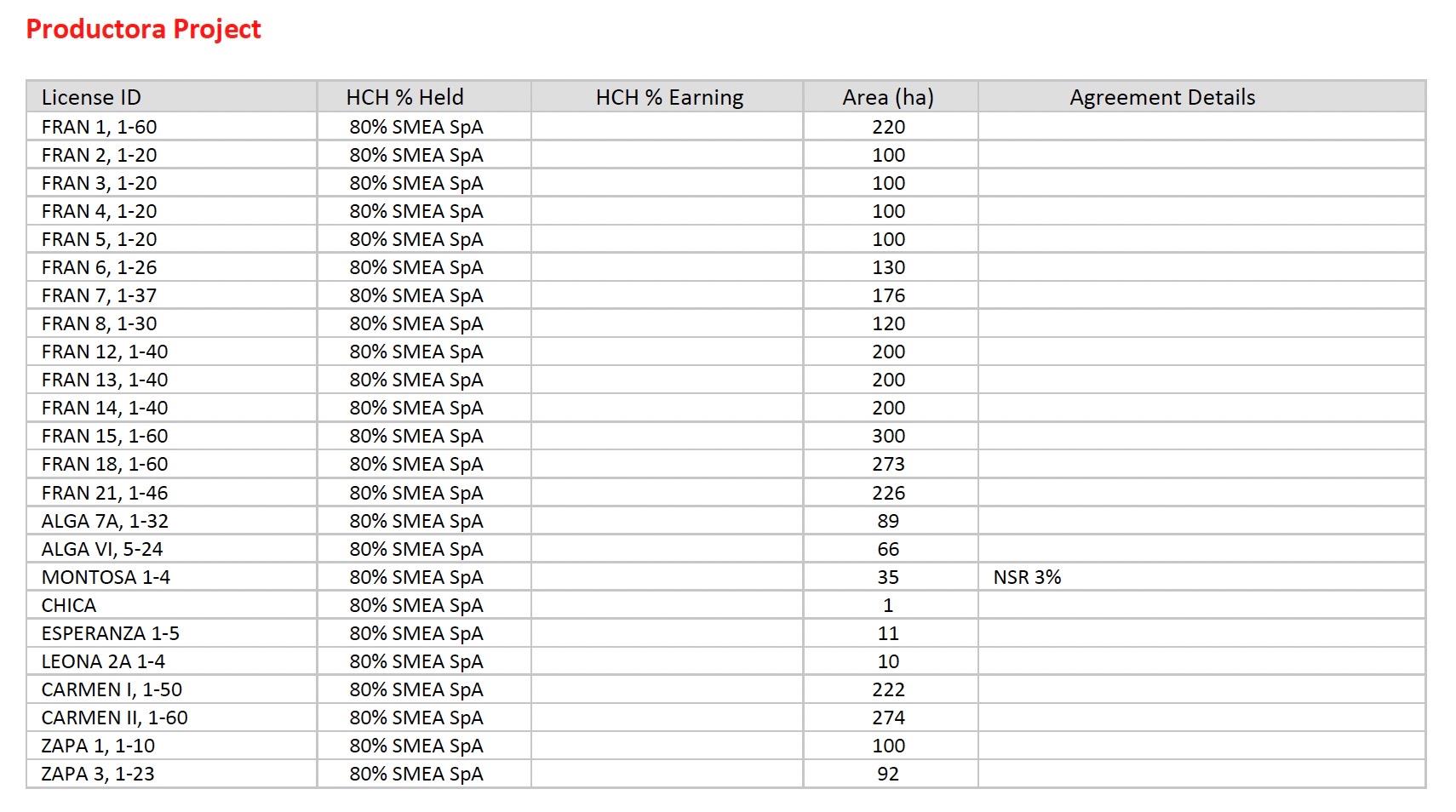

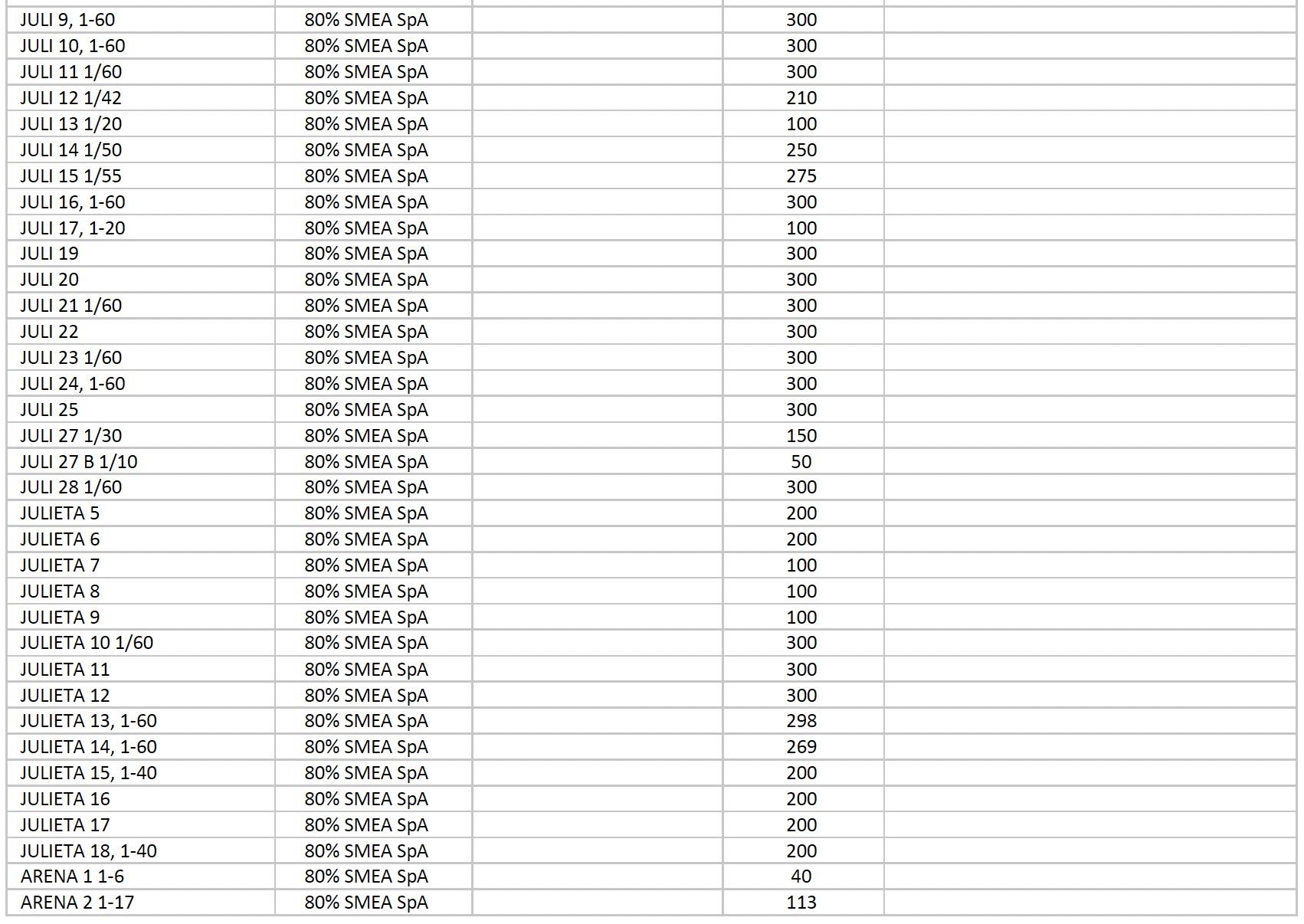

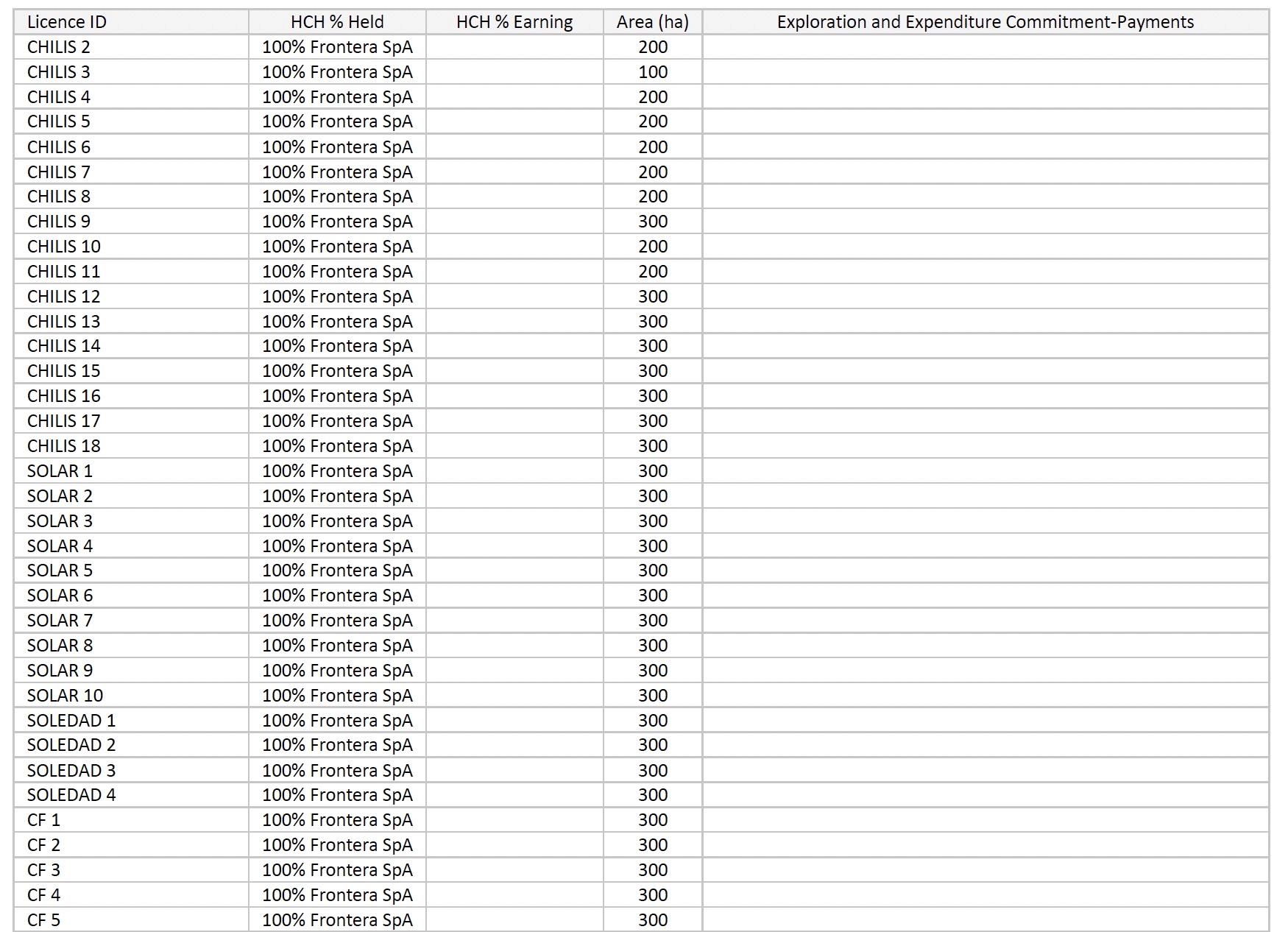

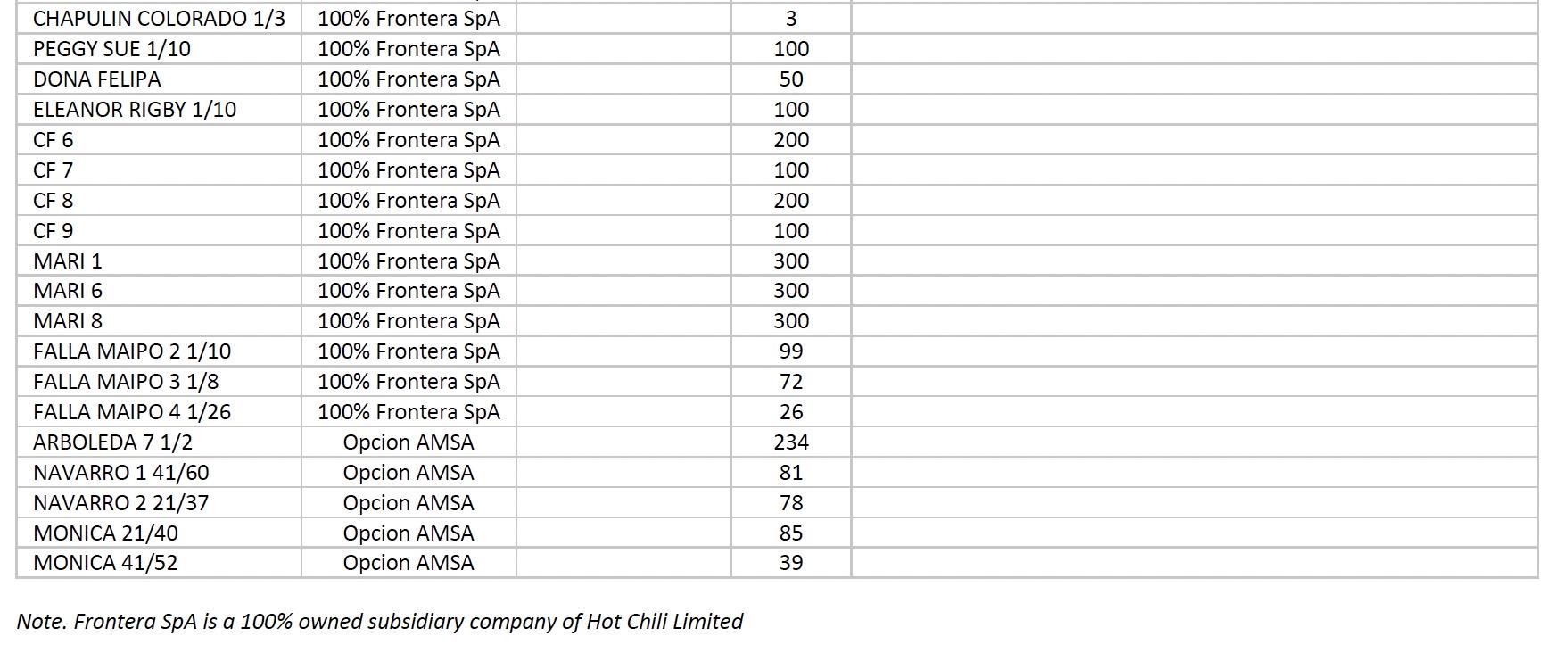

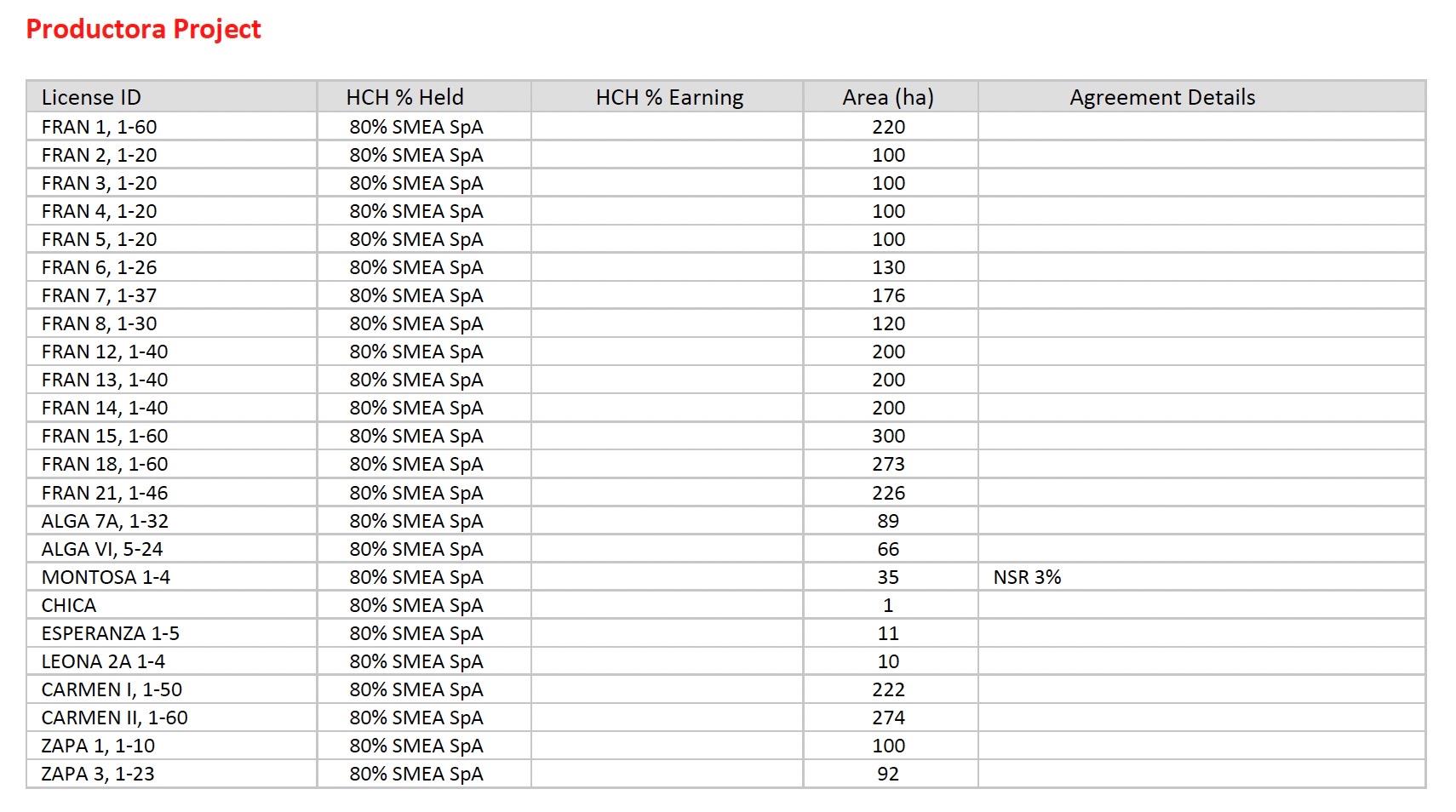

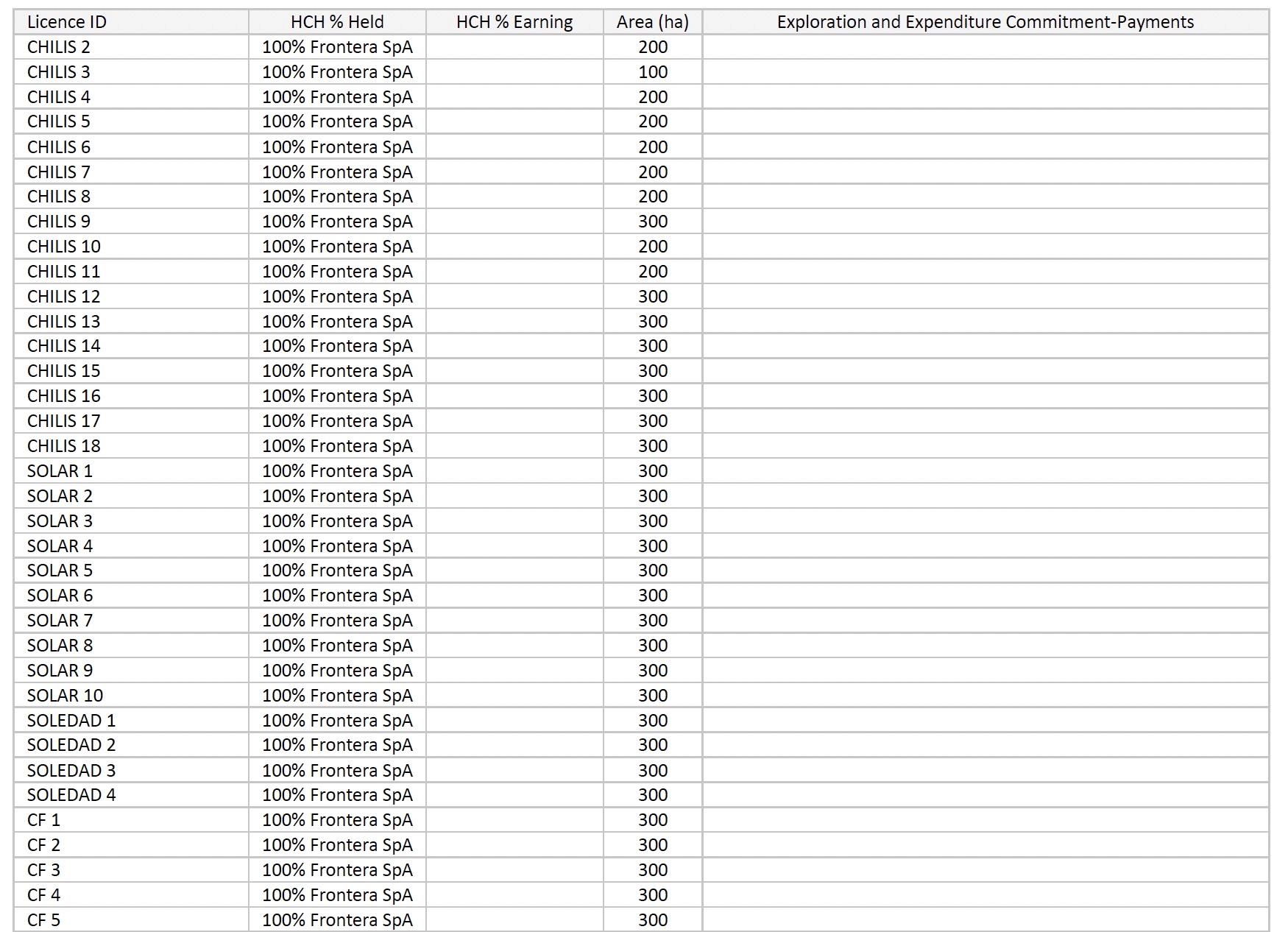

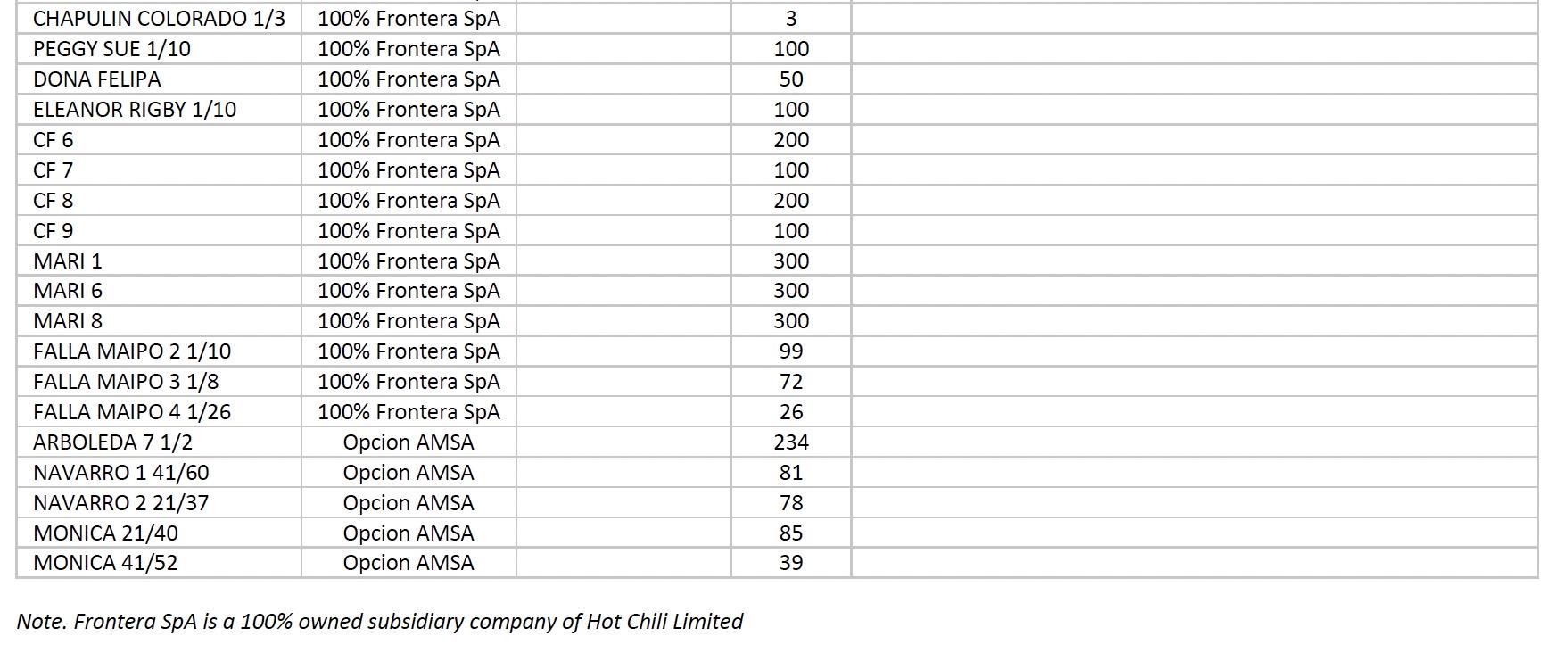

ASX Listing Rule 5.3.3 - Schedule of Mineral Tenements as at 31 March 2023

The schedule of Mineral Tenements and changes in interests is appended at the end of this activities report.

ASX Listing Rule 5.3.4 : Reporting under a use of funds statement in a Prospectus does not apply to the Company currently.

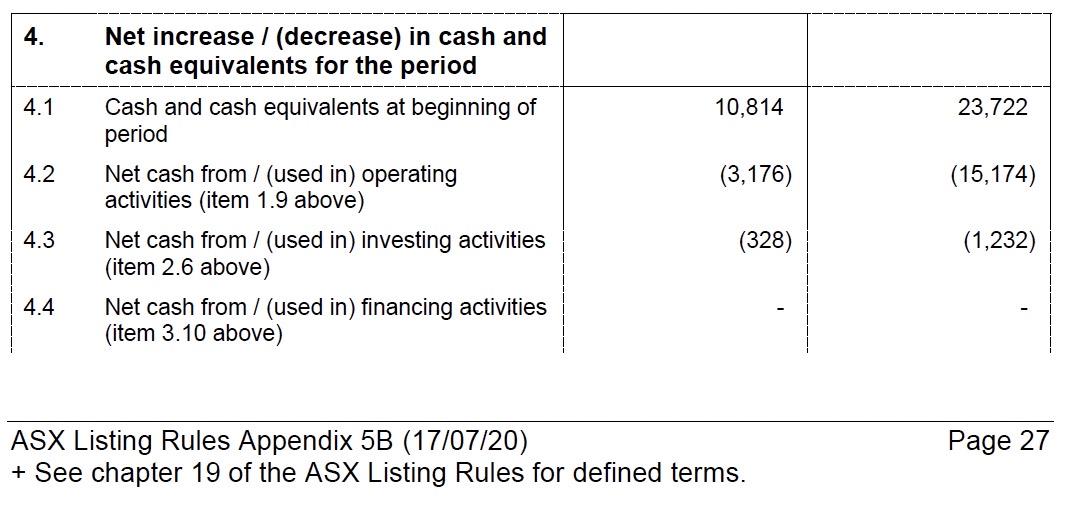

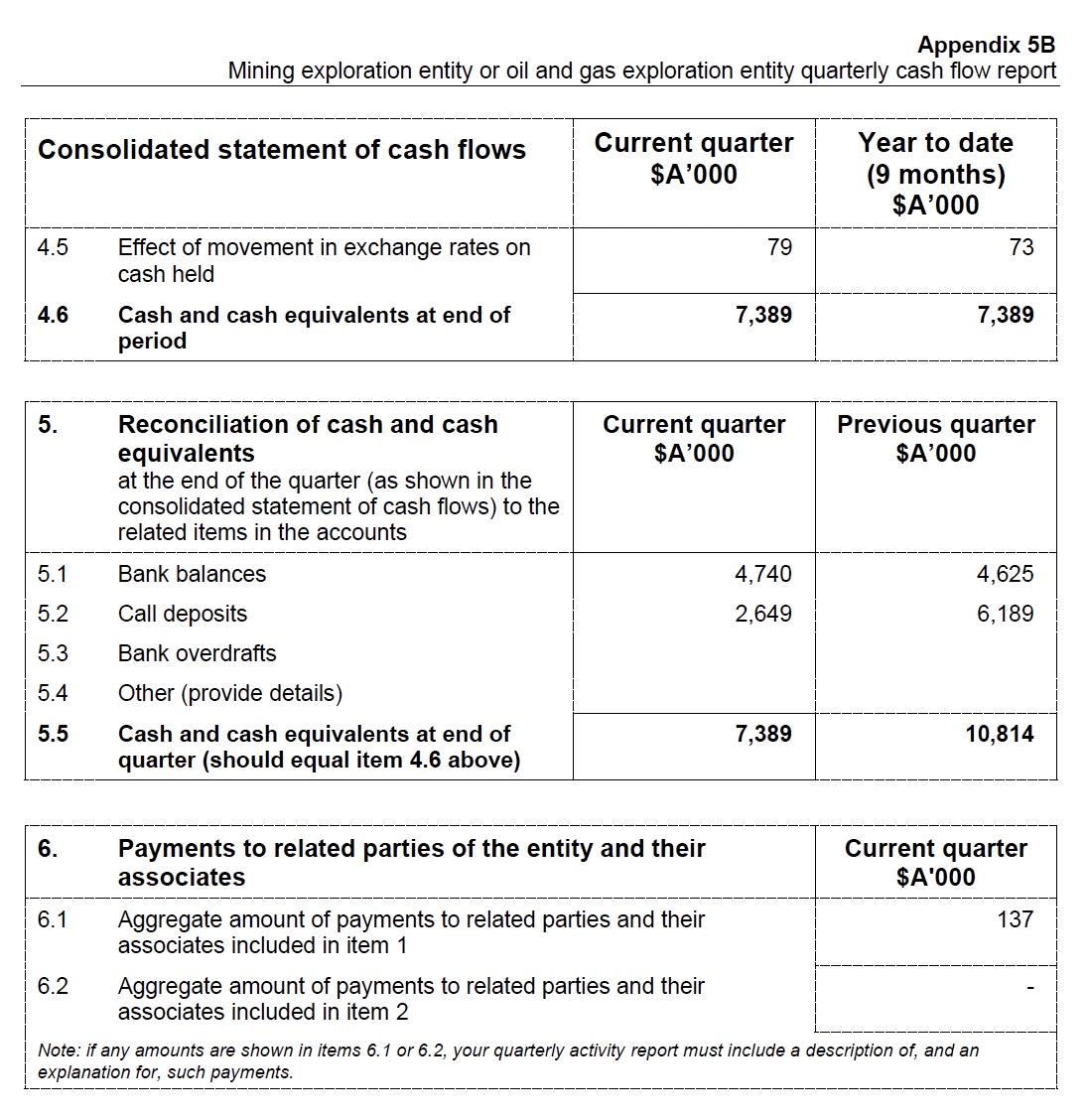

ASX Listing Rule 5.3.5: Payments to related parties of the Company and their associates during the quarter per Section 6.1 of the Appendix 5B totaled $136,832. This is comprised of directors' salaries and superannuation.

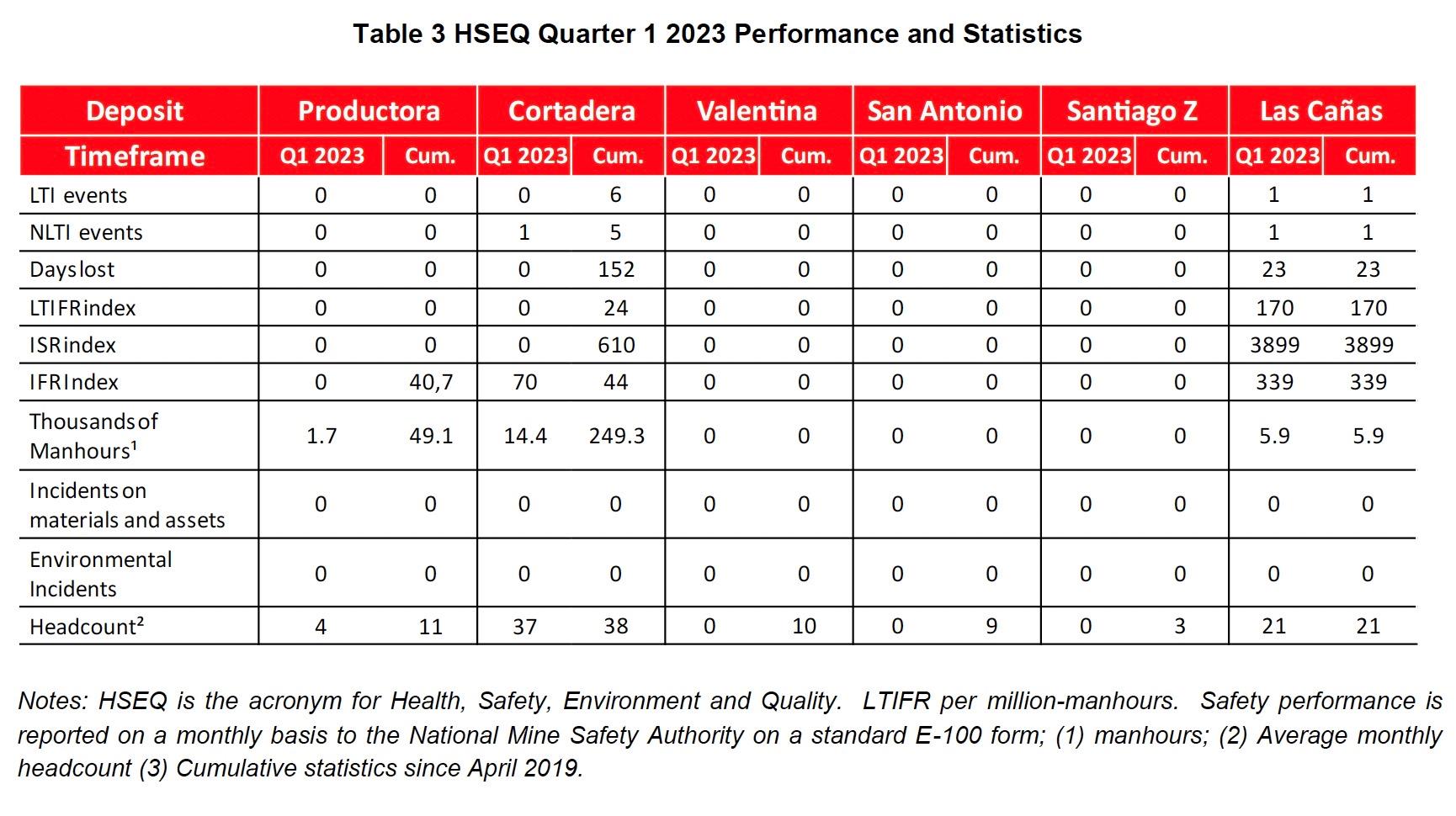

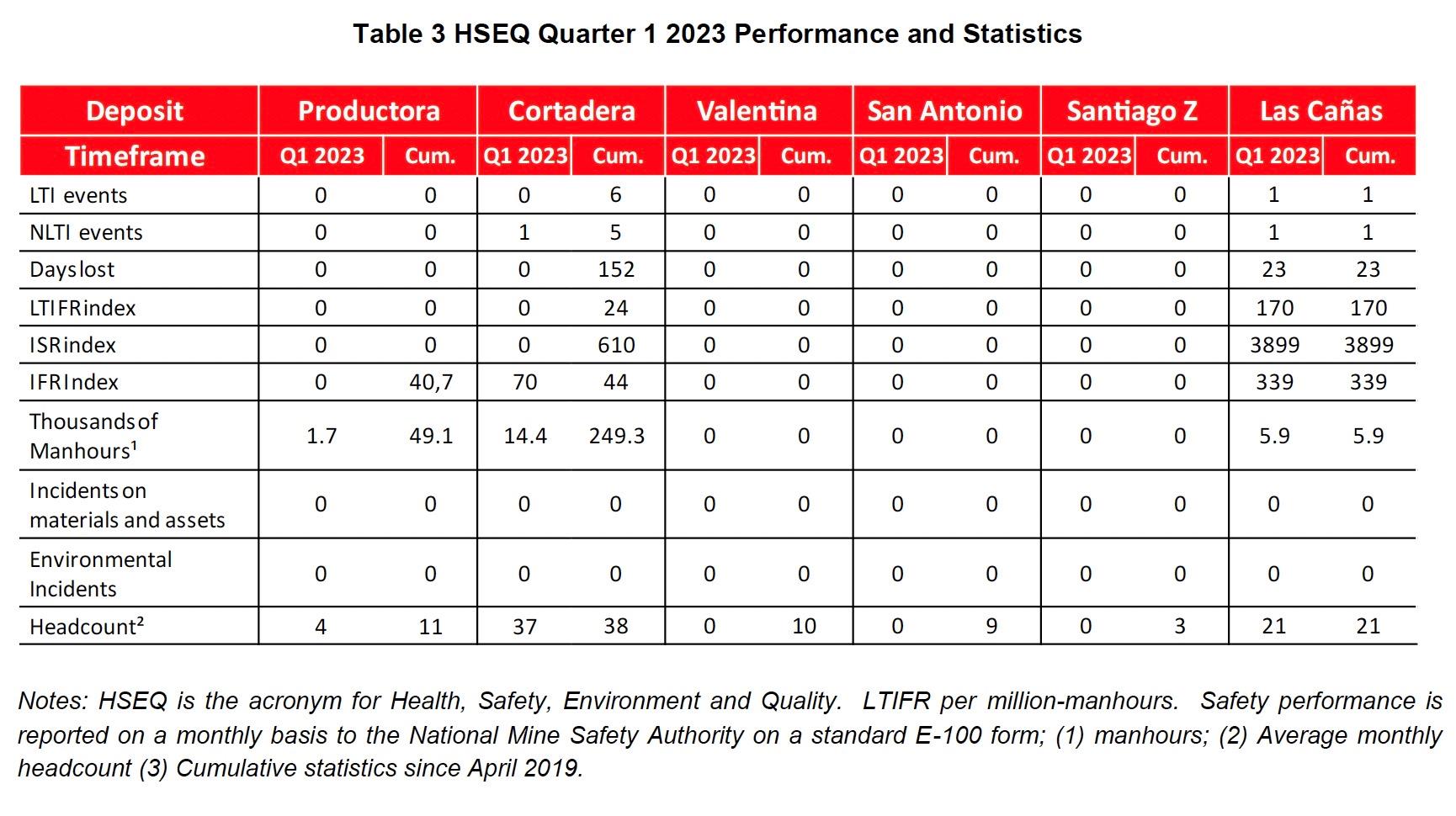

Health, Safety, Environment and Quality Field operations during the period including geological reconnaissance activities, RC and diamond drilling, core-testing and logging, field mapping, and sampling exercises across the Cortadera, El Fuego and Productora landholdings. El Fuego field activities are run from the Cortadera operations centre and safety statistics are combined for reporting.

One safety incident was recorded during the quarter. A drilling contractor fractures his right thumb due to incorrect tool handling.

Hot Chili's sustainability framework ensures an emphasis on business processes that target long-term economic, environmental and social value. The Company is dedicated to continual monitoring and improvement of health, safety and the environmental systems.

Importantly, the Company has implemented COVID safety measures and procedures to ensure the safety of its staff, consultants and contractors during these challenging times. This has been critical in allowing for continuation of drilling and other field activities during the quarter.

The Company has refined these protocols and ensured adequate manning of each operational shift to maintain strong productivity at its operations. There is no greater importance than ensuring the safety of our people and their families.

The Company's HSEQ quarterly performance is summarised below:

-figcaption

Tenement Changes During the Quarter During the Quarter, the Company has requested the conversion of the mining exploration concessions Porfiada A 1/40, Porfiada E 1/20, Porfiada F 1/60, Porfiada VII 1/60, Porfiada VIII 1/60, Porfiada IX 1/60 and Chili 10 (7 in total) into exploitation rights, so as to retain preference over third parties.

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

Competent Person's Statement- Exploration Results

Exploration information in this Announcement is based upon work compiled by Mr Christian Easterday, the Managing Director and a full-time employee of Hot Chili Limited whom is a Member of the Australasian Institute of Geoscientists (AIG). Mr Easterday has sufficient experiencethat is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a'Competent Person' as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves' (JORC Code). Mr Easterday consents to the inclusion in the report of the matters based on their information in the form and context in which it appears.

Competent Person's Statement- Costa Fuego Mineral Resources

The information in this report that relates to Mineral Resources for Cortadera, Productora and San Antonio which constitute the combinedCosta Fuego Project is based on information compiled by Ms Elizabeth Haren, a Competent Person who is a Member and Chartered Professional of The Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Ms Haren is afull-time employee of Haren Consulting Pty Ltd and an independent consultant to Hot Chili. Ms Haren has sufficient experience, which isrelevant to the style of mineralisation and types of deposits under consideration and to the activities undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code of Reporting of Exploration Results, Mineral Resources and Ore Reserves' and is a qualified person for the purposes of National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Ms Haren consents to the inclusion in the report of the matters based on her information in the form and context in which it appears. For further information on theCosta Fuego Project, refer to the technical report titled "NI 43-101 Resource Report for the Costa Fuego Copper Project Located in Atacama,Chile", dated May 13, 2022 with an effective date of March 31, 2022, which is available for review on SEDAR ) under Hot Chili's issuer profile.

Scientific and Technical Information

The scientific and technical information contained in this document was reviewed and approved by Ms Kirsty Sheerin, a Member of the Australian Institute of Geoscientists, Hot Chili's Resource Development Manager and a qualified person for the purposes of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Ms Sheerin has undertaken extensive data verification and is satisfied with the exploration, sampling, security, and QA/QC procedures employed by Hot Chili for Costa Fuego and that their results are sufficient to produce data suitable for the purposes described in the technical report titled "NI 43-101 Resource Report for the Costa Fuego Copper Project Located in Atacama, Chile", dated May 13, 2022 with an effective date of March 31, 2022, as well as for public reporting purposes subsequent to the technical report.

Sampling, Analysis and Data Verification

A fixed cone splitter was used to create two nominal 12.5% samples (Sample "A" and "B"), along with the large bulk reject sample. The "A" sample is always taken from the same sampling chute, and comprises the primary sample submitted to the laboratory. The "B" samples wereretained for use as the field duplicate sample. The coarse residues were collected into large plastic bags and were retained on the ground near the drillhole collar, generally in rows of 50 bags.

All RC drillhole sampling was executed at two metre intervals for Costa Fuego. Within logged mineralisation zones, the 2-metre sample ("A" sample) was submitted. Outside the main mineralised zones (as determined by the logging geologist), 4-metre composites were created fromscoops of 2-metre sample residues over this interval. The composited 4-metre samples were analysed first and, if required, the individual and original 2-metre "A" samples comprising this 4-metre interval were sent for analysis. This ensured that no mineralisation was missed while minimising analytical costs. The same procedure was applied to RC drilling undertaken across Productora, however, drillhole sampling was executed at 1-metre intervals.

At Costa Fuego, the majority of diamond core has had systematic half-core sampled at 2-metre intervals. Half-core was chosen as thepreferred sampling method to ensure a representative sample was submitted for analysis, while also retaining half-core for review of lithology and mineralisation, and for further test work as required.

Prior to the cutting and sample process, two additional samples are also taken for Costa Fuego being Density and Geotechnical samples.

. Density samples are selected every 30 metres if the geological conditions allow it and are provided to the laboratory for testwork.

. Geotechnical samples are taken for tests including triaxial (one sample per 250 m) and uniaxial tests (one sample per 50 m).

Once assigned a sample number, individual samples to be sent to ALS laboratories were sealed using a staple gun and accompanied by threeidentical sample tickets (one stapled to plastic bag to identify any tampering/breakage of seal prior to opening at the laboratory in preparationand another placed in the bag). Any broken staple seals on samples were to be notified by ALS to Hot Chili. No sealed bags were reported as being opened or broken by ALS.

For both RC and diamond samples, sample bags were placed inside larger plastic bags and delivered by a dedicated truck to the ALS analytical laboratory in Coquimbo (Chile) for sample preparation and routine analysis.

Following analysis at ALS, the RC and diamond drilling coarse rejects were returned to site and stored in sequence in plastic bags

under shade cloth at Hot Chili's nearby Productora core farm. The laboratory pulps were returned and stored at the Productora core farm where they are stored in organised, dry and safe storage containers.

Hot Chili has strict chain of custody security procedures for all samples sent to and from the analytical laboratories.

The ALS analytical laboratory in Coquimbo (Chile) completed all sample preparation and specific gravity test work, while ALS Santiago (Chile)completed all gold analysis, and ALS Lima (Peru) completed all other multielement analysis for the Cortadera assays used in the resource estimate. Hot Chili has implemented rigorous sample preparation and analytical procedures for both RC and diamond core samples, following consultation with ALS in Chile, to ensure that mineralised assays were reported with a high degree of confidence and a wide range of appropriate commodities were assessed.

Samples have been analysed by certified laboratories in Chile and Lima, Peru by standard analytical techniques including:

. Copper, silver and molybdenum were analysed by 4-acid digestion (Hydrochloric-Nitric- Perchloric-Hydrofluoric) followed by evaluation using Inductively Coupled Plasma - Optical Emission Spectrometry ("ICP-OES") or Atomic Absorption Spectrometry ("AAS");

. Copper results 10,000 ppm were analysed by "ore grade" method Cu-AA62 (upper limit 40% Cu);

. Samples within the oxide and transitional weathering domains (as determined by geologists' logging) were analysed for "soluble copper" (upper limit 10% Cu) to detect the leachability of copper oxide minerals within these domains; and

. Gold was analysed by 30 or 50 g lead-collection Fire Assay, followed by ICP-OES or AAS.

The verification of input data included the use of company QA/QC blanks and reference material, field and laboratory duplicates, umpire laboratory checks and independent sample and assay verification.

The Qualified Person has assessed the drillhole database validation work and QAQC undertaken by Hot Chili and was satisfied the input data could be relied upon for the estimation of Indicated and Inferred Classified Mineral Resources.

All laboratories used are independent of Hot Chili and the work is performed under a commercial arrangement.

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

ASX Listing Rules Appendix 5B (17/07/20) + See chapter 19 of the ASX Listing Rules for defined terms.

About Hot Chili

Hot Chili Ltd (ASX/TSXV: HCH, OTCQX: HHLKF) aims to build shareholder value through the acquisition, exploration and development of high-quality copper assets in a low elevation and accessible region of northern Chile. With substantial mineral resources already defined, the Company's Costa Fuego Copper Hub is well positioned to benefit from the looming structural shortfall in copper production due to its size, quality and low economic hurdle location with an indicated resource of 2.8Mt Cu, 2.6Moz Au and 67kt of Mo (in 725Mt) and inferred resource of 0.6 Mt Cu, 1.2 Moz Au and 13kt Mo (in 202Mt). Costa Fuego is rated by S&P Global Market Intelligence one of the top 10“low risk” undeveloped copper projects globally. Hot Chili has materially de-risked the potential future development of Costa Fuego, securing seawater extraction rights, surface rights for mining activities, easement corridors for water and power pipelines, and electrical connection to the national power grid as well as entering into a LOI with the nearby port of Las Losas. Costa Fuego has exceptional ESG credentials due to the abundance of existing infrastructure, amenability of ore processing using seawater, potential to operate Costa Fuego on a 100% renewable power mix, minimal community impact and ability to drive growth in an economically deprived area. Hot Chili's growth trajectory continues with the recent announcement of further consolidation contiguous with the bulk of its resources. This new, low-cost, acquisition contains near surface copper-gold porphyry mineralization intersected in historic drilling that has yet to be followed up. The Company commenced an initial 10,000m drill program in January 2023 to test highly prospective copper-gold porphyry targets along strike of the existing porphyry cluster.

Certain statements contained in this news release, including information as to the future financial or operating performance of Hot Chili and its projects may include statements that are "forward‐looking statements" which may include, amongst other things, statements regarding targets, estimates and assumptions in respect of mineral reserves and mineral resources and anticipated grades and recovery rates, production and prices, recovery costs and results, and capital expenditures and are or may be based on assumptions and estimates related to future technical, economic, market, political, social and other conditions.These forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by Hot Chili, are inherently subject to significant technical, business, economic, competitive, political and social uncertainties and contingencies and involve known and unknown risks and uncertainties that could cause actual events or results to differ materially from estimated or anticipated events or results reflected in such forward‐looking statements.

Hot Chili disclaims any intent or obligation to update publicly or release any revisions to any forward‐looking statements, whether as a result of new information, future events, circumstances or results or otherwise after the date of this news release or to reflect the occurrence of unanticipated events, other than as may be required by law. The words "believe", "expect", "anticipate", "indicate", "contemplate", "target", "plan", "intends", "continue", "budget", "estimate", "may", "will", "schedule" and similar expressions identify forward‐looking statements.

All forward‐looking statements made in this news release are qualified by the foregoing cautionary statements. Investors are cautioned that forward‐looking statements are not a guarantee of future performance and accordingly investors are cautioned not to put undue reliance on forward‐looking statements due to the inherent uncertainty therein.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Comments

No comment