(MENAFN- Iraq Business News)

By Ahmed Tabaqchali, Chief Strategist of AFC Iraq Fund .

Any opinions expressed are those of the author, and do not necessarily reflect the views of iraq business news .

Iraq Market Report: Dinar Revalued Upwards, Market Shrugs

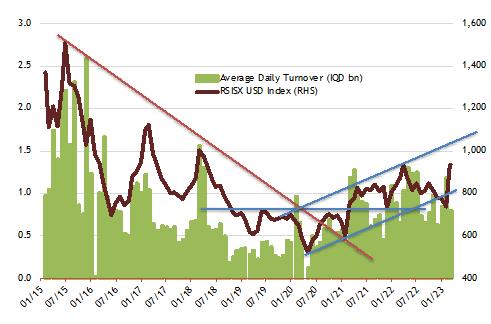

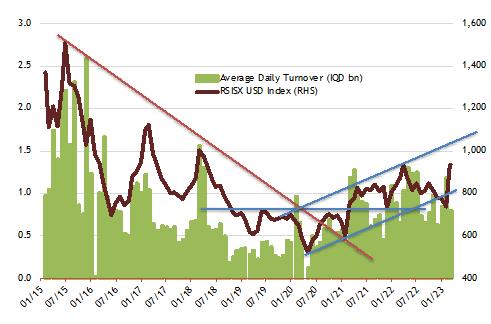

The market, as measured by the Rabee Securities RSISX USD Index, was up 24.9% in February, and up 18.8% for the year. However, this strong performance was positively affected by two crucial decisions taken by the Central Bank of Iraq (CBI).

The first was a revaluation, in early February, of the official exchange rate of the Iraqi Dinar (IQD) versus the US Dollar (USD) by 10.3% or from USD 1 = IQD 1,450 to USD 1 = IQD 1,300. The second was the implementation of its recent measures to widen access to the official rate and to remove bureaucratic barriers for the transfer of funds to/from Iraq, as discussed here a few months ago. The combination effectively means that most transfers to/from Iraq will be affected at the effective official rate of USD 1 = IQD 1,290/1,320 instead of the parallel market rate of USD 1 = IQD 1,552/1,562 at month end, and as such the official exchange rate would be the rate to be used for the valuation of the index going forward - both of which explains the strong monthly performance.

Adjusted for the CBI's measures, in other words, if the currency had been flat at February's close, then the RSISX USD Index's would have declined 2.1% for the month - this underling decline, coupled with the 36.0% month-on-month decline in the average daily traded volume on the Iraq Stock Exchange (ISX), suggests that the market has largely shrugged off the effects of the IQD's 10% revaluation against the USD and that it has continued with its looking through and discounting the currency's volatility as discussed last month .

The RSISX USD Index's performance is mirrored in those of its constituents, especially considering the strong performance of a number of constituents last month which this month had minor declines. In local currency terms, only the Bank of Baghdad (BBOB) was up 2.1%, Asiacell (TASC) almost flat at -0.1%, and the rest were down. The decliners were led by Al-Mansour Hotels down 8.1%, Kharkh Tour Amusement City (SKTA) down 5.5%, Al Mansour Bank (BMNS) down 4.5%, Baghdad Soft Drinks (IBSD) down 4.2%, the National Bank of Iraq (BNOI) down 3.8%, the Commercial Bank of Iraq (BCOI) down 1.9%, Iraqi for Seed Production (AISP) down 1.8%, and Al-Mansour Pharmaceutical Industries (IMAP) down 1.4%.

The revaluation of the IQD versus the USD and the valuation of the index at the official exchange rate going forward, has not fundamentally altered the technical picture of the market, as it is now halfway through its 34-month up-trending channel reversing most of the negative effects of the currency's declines since mid-November 2022 (chart below) - which still supports the market's positive technical picture as discussed here in the past few months. The macroeconomic fundamentals discussed here last year support our view that this uptrend will likely remain in force; however, its upward slope might moderate or even go sideways - as the effects of the CBI's measures would not affect the coming months' market action. The 2023 budget proposal was not submitted in January 2023 as expected , nor in February 2023 as hoped for, but hopefully will be submitted this month or the following month - which means a delayed catalyst for the market's next move - especially as all indications suggest that it would be a much more expansionary budget that was discussed here a few months ago.

RSISX USD Index versus Average Daily Turnover

(Source: Iraq Stock Exchange, Rabee Securities, AFC Research, data as of March 9th)

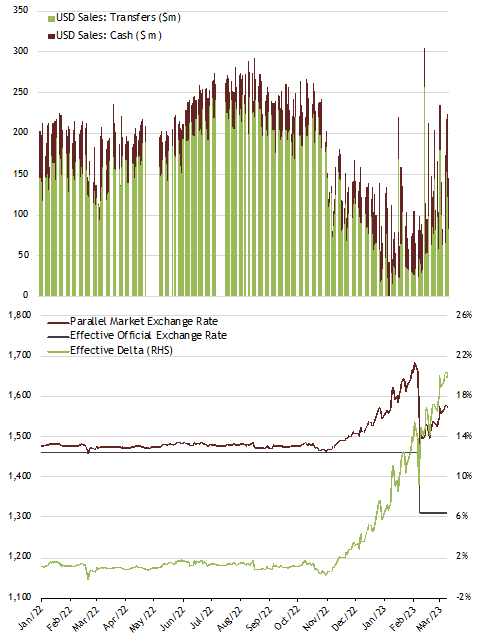

Revaluation of the Iraqi Dinar versus the US Dollar

Background : As written here last month , the Central Bank of Iraq (CBI), as part of an ongoing process of encouraging the move towards the adoption of banking and away from the informality that dominates economic activity, implemented in mid-November 2022 new procedural requirements to those for its provisioning of USD for importers. These procedural requirements would bring the country's cross-border fund transfers in-line with global standards which require a high level of transparency. However, they represent a seismic shift to the country's cash-dominated economy, in which large informal sectors drive the bulk of economic activity. As such, the introduction of the new procedural requirements immediately affected the volumes of the CBI's daily USD-IQD transactions for cross-border fund transfers, which led to a supply-demand mismatch and consequently to a depreciation in the market price of the IQD versus the USD.

The government and the CBI subsequently introduced a sequence of measures to create demand for the IQD and for furthering the adoption of banking - crucial measures to de-dollarize the economy, and to accelerate its evolution away from the dominance of cash. As crucial as these measures are, their full effectiveness will take place over several years, and as such, the IQD's market prices versus the USD continued to decline. Given public pressures, spurred by populist rhetoric, for immediate measures, the CBI, with the government's blessing , implemented a 10 per cent revaluation of the IQD exchange rate against the USD - from 1,450 to 1,300 IQDs per USD - in the hope that the market price of the IQD would reverse its depreciation versus the USD.

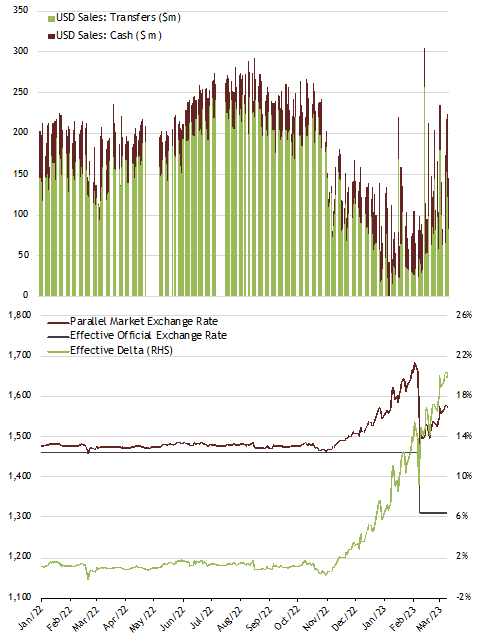

Fundamentally, the revaluation in nominally lowering the official exchange rate does not alter the relationship between the official exchange rate and the market rate that existed pre-revaluation - a relationship that reasserted itself with the premium of the market rate over the official rate staying at the same elevated levels as those pre-revaluation (green line in lower half of chart below).

Volumes in CBI's USD-IQD Transactions versus the USD/IQD Exchange Rates

(Source: Central Bank of Iraq until February 7th, Baghdad FX exchange houses from February8th, AFC Research, daily data as of March 9th)

While the revaluation was nominal, yet the combination with the CBI's measures - that eased onerous bureaucratic processes for cross border-fund transfers at the official USD-IQD exchange rate, and the creation of incentives for the adoption of banking away from the prevalence of cash in economic transactions and payments - has accelerated the move away from informality that dominates the bulk of economic activities. The 22% premium of the market exchange rate over the official exchange rate (lower half of chart above) created a huge competitive advantage for companies operating formally versus those operating informally - consequently providing the economic incentive for informal companies to transfer to formality and to access the banking sector for the first time. These developments, and the high transparency levels demanded by the CBI's procedural requirements introduced in mid-November 2022, have benefited the higher-quality banks whose infrastructure is able to deal with the inflow of new clients and the subsequent increased volumes of cross-border transactions. Moreover, they have accelerated the adoption of banking away from the dominance of cash as both a store of value and a means of economic exchange - a process that is positive for the investment thesis for the banking sector in Iraq as discussed here in 'banks & the iraq investment thesis ' in February 2022.

Consequently, the volumes of the CBI's USD-IQD transactions have begun to recover from the lows at the end of the prior year and began a gradual upward trend, helped by the market's on-going adjustment to the increased levels of transparency demanded in cross-border fund transfers (first half of above chart). However, the still high degrees of informality, the dollarization in economic activities and the time needed for the market to fully adjust to the increased levels of transparency demanded in cross-border fund transfers, mean that volumes will likely remain lower than the pre-November 2022 levels - when the CBI's new measure for cross-border fund transfers was first introduced. Consequently, the pressures on the market price of the exchange rate of the IQD versus the USD will likely continue, however, these will ease in time and the premium over the official rate will likely stabilize in a range that is lower than the current high levels.

Please click here to download ahmed tabaqchali's full report in pdf format .

Mr Tabaqchali (@amtabaqchali ) is the Chief Strategist of the AFC Iraq Fund, and is an experienced capital markets professional with over 25 years' experience in US and MENA markets. He is a Visiting Fellow at the LSE Middle East Centre, Senior Fellow at the Institute of Regional and International Studies (IRIS), and a Senior Non-resident Fellow at the Atlantic Council. He is also a board member of Capital Investments, the investment banking arm of Capital Bank in Jordan.

His comments, opinions and analyses are personal views and are intended to be for informational purposes and general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any fund or security or to adopt any investment strategy. It does not constitute legal or tax or investment advice. The information provided in this material is compiled from sources that are believed to be reliable, but no guarantee is made of its correctness, is rendered as at publication date and may change without notice and it is not intended as a complete analysis of every material fact regarding Iraq, the region, market or investment.

Comments

No comment