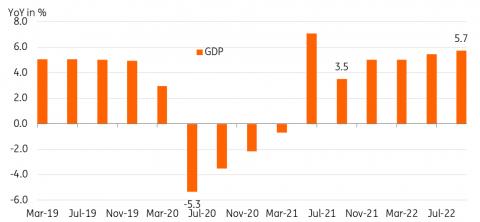

Philippines: Filipino Consumer Unleashed, 3Q GDP Rises To 7.6%

Philippine 3Q GDP blew past market expectations to hit 7.6% YoY (consensus 6.1%) driven by

robust household spending and construction activity.

Household consumption did not skip a beat, up 8% YoY despite surging inflation (6.5% YoY average for the quarter).

Filipinos are likely extending so-called“revenge spending” activities after almost two

full years under lockdown.

Household spending delivered 5.9 percentage points of the 7.6% growth boosted by activities related to the economic reopening.

Spending on recreation & culture (46.0%), restaurants & hotels (38.2%) and transport (20.5%) offset slowing spending on basic food items (3.9%).

One additional driver of

growth was construction activity, which expanded 11.8% despite the sharp uptick in borrowing costs.

The strong performance of this sector can also be tied to the economic reopening as firms and households push through with projects after two

years of delays.

It appears that firms and households are willing to bear the increased borrowing costs just to restart projects now that the economy is open.

Badan Pusat Statistik

Government support fades and greater economy appears on the mend

Fiscal spending had been a key support for growth during the lockdowns experienced during the pandemic.

With the economy now open, government expenditures and public construction has faded somewhat.

Government spending slowed to 0.8% from 11.1% in the previous quarter.

Elevated debt levels may be one factor limiting the ability of the government to provide support.

However, with private consumption and investment activity proving resilient, there may be less pressure for fiscal authorities to do so while shifting the focus to debt consolidation.

The main surprise from

today's report was the resilient household spending performance. In the past, elevated inflation took a bite out of

consumption but the reopening story appears to be the more compelling force for now.

With inflation set to hit 8% in November and borrowing costs on track to rise at least 300bp for the year, how are households sustaining this pace of spending?

One explanation would be overseas Filipino remittances which may be supercharged by a more favourable exchange rate.

However, we believe that consumers are also digging deeper into savings, which unfortunately have yet to return to pre-Covid levels.

For now, it appears that households can fund extended revenge spending activities by drawing down savings for a little longer, however, this could increase their vulnerability to potential shocks to income down the road.

Today's third-quarter

GDP report suggests that the Philippines will easily attain its growth target for the year.

With the holidays fast approaching, we can expect growth momentum to remain intact with household spending likely supporting overall economic activity for the first holiday without

mobility restrictions.

Meanwhile, the department of education allowed students to return to classrooms for this school year, which may generate more spending activity as well.

We expect growth to settle close to the upper end of the national government target for 2022 although 2023 growth could be challenged should current headwinds persist.

Meanwhile, the much lower savings rate reported by households suggests that although spending may remain robust in the near term, a sustained drawdown on savings could expose households to shocks at a time when

borrowing costs have risen significantly.

With growth resilient, we expect the Bangko Sentral ng Pilipinas

to remain hawkish, with the central bank likely pushing the policy rate to 5.5% by year-end.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment