Poland: Strong industry and labour market in early 2022

The data confirms strong manufacturing activity, as suggested by a significant rise in new orders (e.g. in PMI). Manufacturing output grew by 15.6% YoY. We consider this to be a result of improving conditions in global production, including some easing in supply chain disruptions, due to the loosening of restrictions during the Delta variant. At the same time, the impact of the Omicron variant on Europe and Asia proved significantly less severe compared to the previous wave. This is reflected in the strong output of computers and electronics (27.5% YoY), which were previously affected by shortages of electronic components.

High natural gas prices continued to support local energy production as well, as this prompted a switch to more attractively priced coal-based electricity production. As a result, production of energy rose by over 50% in January, while mining expanded by over 30% YoY.

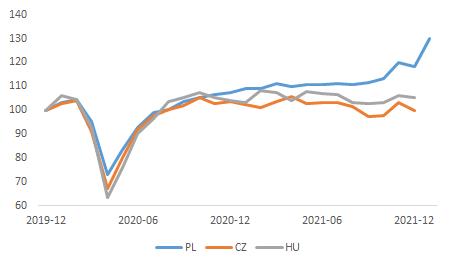

Industrial output (Dec2019=100)

Average wages and salaries in the enterprise sector went up by 9.5% YoY in January – in line with our forecast and slightly below the market consensus of 10.1% YoY. Average paid employment increased by 2.3% YoY vs. our forecast of 2.7% YoY and market expectations at 1.7% YoY.

In monthly terms, employment jumped up by 98K. The bulk of this was associated with the annual update of the statistical sample by the StatOffice (enterprises employing nine or more workers). Employment was also supported by jobs creation and the return of workers from sick leave.

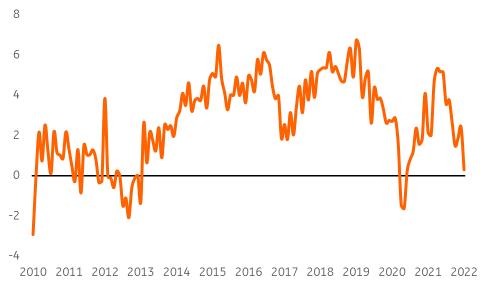

Wages continue to expand at around a double-digit pace. Continued upward wage pressure is resulting from low unemployment (strong bargaining power of employees) and rapid price growth (the main rationale behind higher wage demands). But importantly, soaring inflation hampered real wage growth, which came in at just 0.3% YoY. In our view, this will boost wage demands and increase the risk of a wage-price spiral.

Real wage growth in enterprises, %YoY

Bottom line: after a strong 4Q21 economic expansion continued in 1Q22.

- Omicron did not hit demand and so far, consumption remains buoyant despite inflation.

- There are signs of a wage-price spiral in the labour market.

- Fiscal policy is boosting demand (CPI+) rather than supply (CPI-). The fact that CPI inflation did not exceed 10% YoY is no reason for complacency as economic developments and fiscal policy will fuel inflation and high core inflation over the medium term, while CPI will be somewhat compressed by some protective inflation measures (indirect tax cuts) in the short term.

- This is why the National Bank of Poland's governor made a hawkish pivot recently. He is calling for a stronger zloty in order to combat inflation and stated that rate hikes will not increase unemployment but rather ease wage pressure. The NBP is prepared for further decisive policy moves.

- We feel comfortable with our 2022 GDP growth forecast above the market consensus (ING 4.5%).

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment