403

Sorry!!

Error! We're sorry, but the page you were

looking for doesn't exist.

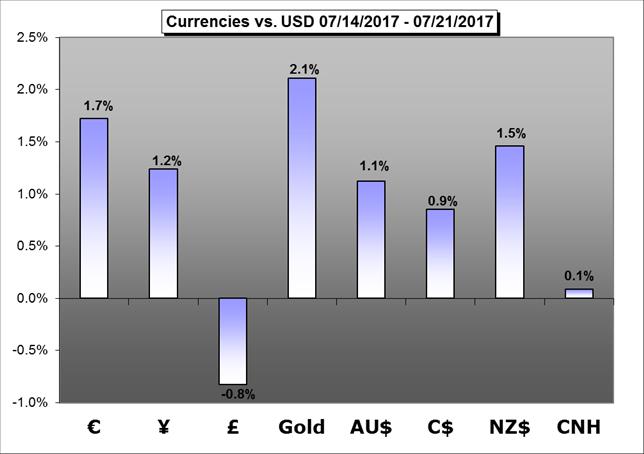

Weekly Trading Forecast: Are Markets Underestimating Fed Resolve?

(MENAFN- DailyFX) financial markets have been defined by fading Fed rate hike bets in recent weeks. An rate decision and second-quarter US GDP data now threaten that narrative.

Euro Forecast:

The Euro faces a telltale period ahead as the bulls' defiance of a dovish ECB is tested with the passage of top-tier economic data and official commentary.British Pound Forecast:

The British Pound came into this week with legitimate prospects for bullish continuation. But with inflation printing below expectations, that bullish move may be on pause for the foreseeable future.Japanese Yen Forecast:

The Japanese Yen may continue to appreciate against its U.S. counterpart next week should the Federal Open Market Committee (FOMC) soften its hawkish outlook for monetary policy.Australian Dollar Forecast:

The Australian Dollar market can look forward to a US monetary policy call and official local consumer price data, but the RBA may now be a more obvious focus than either.New Zealand Dollar Forecast:

broke to upside this week and returned to levels last seen in September 2016 on Fin Min commentsCanadian Dollar Forecast:

The Canadian Dollar has been strengthening against its US cousin since early May and that trend will most likely continue as long as further interest rate hikes remain probable.Chinese Yuan Forecast:

Looking forward, Chinese regulators' guidance, July FOMC decision, as well as U.S. data prints are more likely to add mixed moves into the pair; both retracement and breakout are possible for the pair next week.Gold Forecast:

Prices posted the largest weekly rally since May with the advance now eyeing slope resistance. Here are the updated targets & invalidation levels that matter next week.Global Equities Forecast:

This coming week market eyes will be on the FOMC; the DAX looking to follow-through on post-ECB downdraft, while the Nikkei searches for direction.Crude Oil Forecast:

Crude Oil is pushing away from price resistance as the market anticipates the OPEC review in St. Petersburg will not lead to further supply cuts.See what live coverage is scheduled to cover key event risk for the FX and capital markets on the .

See how retail traders are positioning in the majors using the .

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Manuka Honey Market Report 2024, Industry Growth, Size, Share, Top Compan...

- Modular Kitchen Market 2024, Industry Growth, Share, Size, Key Players An...

- Acrylamide Production Cost Analysis Report: A Comprehensive Assessment Of...

- Fish Sauce Market 2024, Industry Trends, Growth, Demand And Analysis Repo...

- Australia Foreign Exchange Market Size, Growth, Industry Demand And Forec...

- Cold Pressed Oil Market Trends 2024, Leading Companies Share, Size And Fo...

- Pasta Sauce Market 2024, Industry Growth, Share, Size, Key Players Analys...

Comments

No comment