403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Pakistan rupee likely to start weakening again

(MENAFN- Gulf Times) Don't be fooled the Pakistani rupee's biggest jump in a decade on Monday was probably a flash in the pan.

The South Asian nation's finances remain dire and the rupee is likely to start weakening again soon, according to Edwin Gutierrez, the London-based head of emerging-market sovereign debt at Aberdeen Standard Investments.

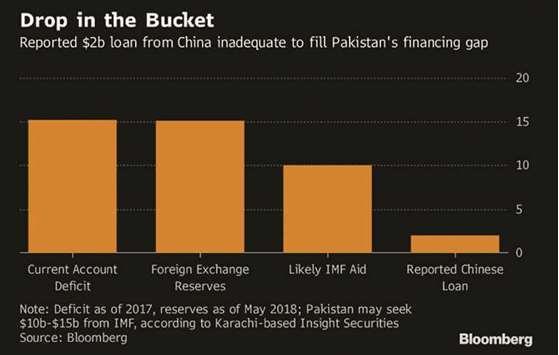

The currency climbed 0.7% to 124.188 per dollar at the close in Karachi, according to the central bank. The rupee advanced more than 2% Monday on press reports of a $2bn loan from China.

Yet longer term, the incoming government of Imran Khan may have to seek a bailout from the International Monetary Fund to stave off an economic crisis, and those funds may come at the cost of a weaker rupee.

'The currency needs to adjust given the current-account deficit and the fact that they are bleeding FX reserves, Gutierrez said. 'Indeed, an IMF deal might look like the one that they recently struck with Argentina which strongly encouraged letting the currency go.

The Argentine peso slumped to a new low in June, even after the country reached a record $50bn agreement with the IMF just weeks earlier.

By contrast, Karachi-based brokerage Insight Securities predicts Pakistan is likely to seek $10bn to $15bn from the multi-lateral lender, a sum that may not be enough to restore market confidence. Pakistan's foreign reserves fell to $15.1bn in May from a peak of $24bn in 2016 following a current-account deficit of $15.2bn last year.

As the central bank attempts to stem the flow, policymakers have devalued the currency four times since December.

All of that comes against a global backdrop of higher oil prices, trade war tensions and an emerging-market sell-off. Even before the rally, Eaton Vance Corp had expected the rupee to weaken by another 10% to 15% before it would be 'more fairly valued, said Eric Stein, a Boston-based co-director of global income at the firm.

The South Asian nation's finances remain dire and the rupee is likely to start weakening again soon, according to Edwin Gutierrez, the London-based head of emerging-market sovereign debt at Aberdeen Standard Investments.

The currency climbed 0.7% to 124.188 per dollar at the close in Karachi, according to the central bank. The rupee advanced more than 2% Monday on press reports of a $2bn loan from China.

Yet longer term, the incoming government of Imran Khan may have to seek a bailout from the International Monetary Fund to stave off an economic crisis, and those funds may come at the cost of a weaker rupee.

'The currency needs to adjust given the current-account deficit and the fact that they are bleeding FX reserves, Gutierrez said. 'Indeed, an IMF deal might look like the one that they recently struck with Argentina which strongly encouraged letting the currency go.

The Argentine peso slumped to a new low in June, even after the country reached a record $50bn agreement with the IMF just weeks earlier.

By contrast, Karachi-based brokerage Insight Securities predicts Pakistan is likely to seek $10bn to $15bn from the multi-lateral lender, a sum that may not be enough to restore market confidence. Pakistan's foreign reserves fell to $15.1bn in May from a peak of $24bn in 2016 following a current-account deficit of $15.2bn last year.

As the central bank attempts to stem the flow, policymakers have devalued the currency four times since December.

All of that comes against a global backdrop of higher oil prices, trade war tensions and an emerging-market sell-off. Even before the rally, Eaton Vance Corp had expected the rupee to weaken by another 10% to 15% before it would be 'more fairly valued, said Eric Stein, a Boston-based co-director of global income at the firm.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment