Should You Want To Invest In a Hedge Fund That Doesn't Want A Performance Fee?

This begs the question: should investors really want a manager ? After two years of negative performance hedging for a market crash that never came, Ainslie is ditching the fund's 17.5% performance fee for existing investors putting new money into the $10 billion fund. And he's not the first to make such an offer.

Get The Full Ray Dalio Series in PDF Get the entire 10-part series on Ray Dalio in PDF. Save it to your desktop, read it on your tablet, or email to your colleagues

Andrew Warford offering to ditch a performance fee allows them to ramp up more management fee revenue until they clear the high-water mark again

There is a strategy among certain allocation professionals to invest into certain hedge funds after a significant drawdown. For the systematic funds, much of this can be done based on beta market cycles or volatility-adjusted returns. When trend following changes from a market environment of price persistence to one of flattened volatility, for instance, for the strategy exist. For a fund manager behind the eight ball of no performance fees until clearing the previous high water mark, the answer might raise more assets that pay a management fee.

There is a larger concept of investing on a drawdown that raises deep issues on both sides of the argument -- including the logistical practicality of engaging in such behavior, as many funds have lockups and are not easy to enter / exit on a moment's notice.

When Glenview Capital's Larry Robbins indigestion over this healthcare stocks – sucked into the middle of a manipulation scandal that threatened to draw regulatory ire over drug prices and upset the apple cart – the hedge fund took significant losses.

To mend fences with investors, he offered the ability to invest fee-free. The logic was that Larry and his team could not have possibly foreseen the allegations of dirty dealing taking place in the "" hedge fund hotel stock that was Valeant Pharmaceuticals. The supporting logic was they have a good hedge fund strategy with solid people who hit an inevitable speed bump. This thinking was rewarded, with the hedge fund up near 20% as of August 2017, stoutly beating the S & P 500.

The questions with Ainslieare a little different.

Maverick Capital's Andrew Warford has a negative market outlook

The long / short fund, which has been bearish through its market analysis and , has in essence engaged in costly hedging. Will this strategy continue? Based on a July 30 letter to investors authored by Andrew Warford and reviewed by ValueWalk, he doesn't appear to be backing down:

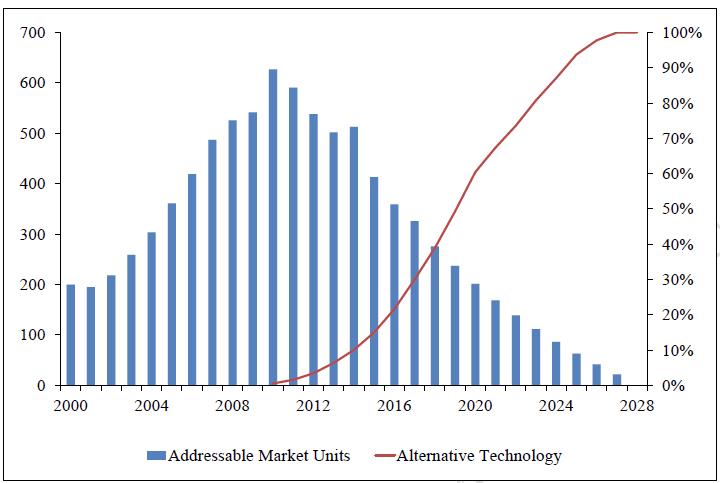

Andrew Warford has a death watch of sorts that is driving stock picks. He sees the death of linear TV, which he says hit a tipping point in July 2017. He also thinks digital disintermediation is going to negatively impact numerous models while technology obsolescence is going to impact bottom lines.

Specifically, Andrew Warford outlines the following as "five of the most important investment themes expressed in our short portfolio"

- Death of Linear TV

Omnichannel Evolution

Healthcare Waste

Digital Disintermediation

Technology Obsolescence

Andrew Warford ends off the letter stating:

We have been here many times before on the short side in the technology space. Correctly identifying the secular drivers of fundamentals and the sustainability of such drivers has served us well over the last twenty-three years. We are confident this time will be no different.

Andrew Warford also doesn't like the retail sector, a point he made in his fourth quarter 2016 letter to investors.

'The short retail debate has clearly been won by the bears. Investors are keenly aware of the traffic challenges and cost burdens facing bricks and mortar retailers and have started to appreciate the fact that there is virtually no terminal value in many of these businesses. A short retail pitch in a quarterly letter is perhaps the most obvious, prolific, and non-variant theme we can identify in global investing over the last decade. So why are we writing about it as our largest short theme in 2017? Simple – valuations today do not appropriately discount our view of the rate and/or inevitability of decline in fundamentals and our conviction in the endgame is unwavering.'

Since we wrote this in our Q4 2016 letter, there has been significant pain across much of the retail landscape, notably in names levered to mall traffic or those perceived to be in the cross hairs of Amazon. While the consensus 'short retail theme' has worked across a host of names, we are continuing to find a fruitful opportunity set across multiple categories and geographies.

Oh, and that 'healthcare waste' is not sustainable and heading for a tipping point.

There is a lot Andrew Warford is bearish about. The question for investors is: ?

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment