Falconbridge's Doha Office To Bridge Institutional Capital With Qatar's Non-Hydrocarbon Economy

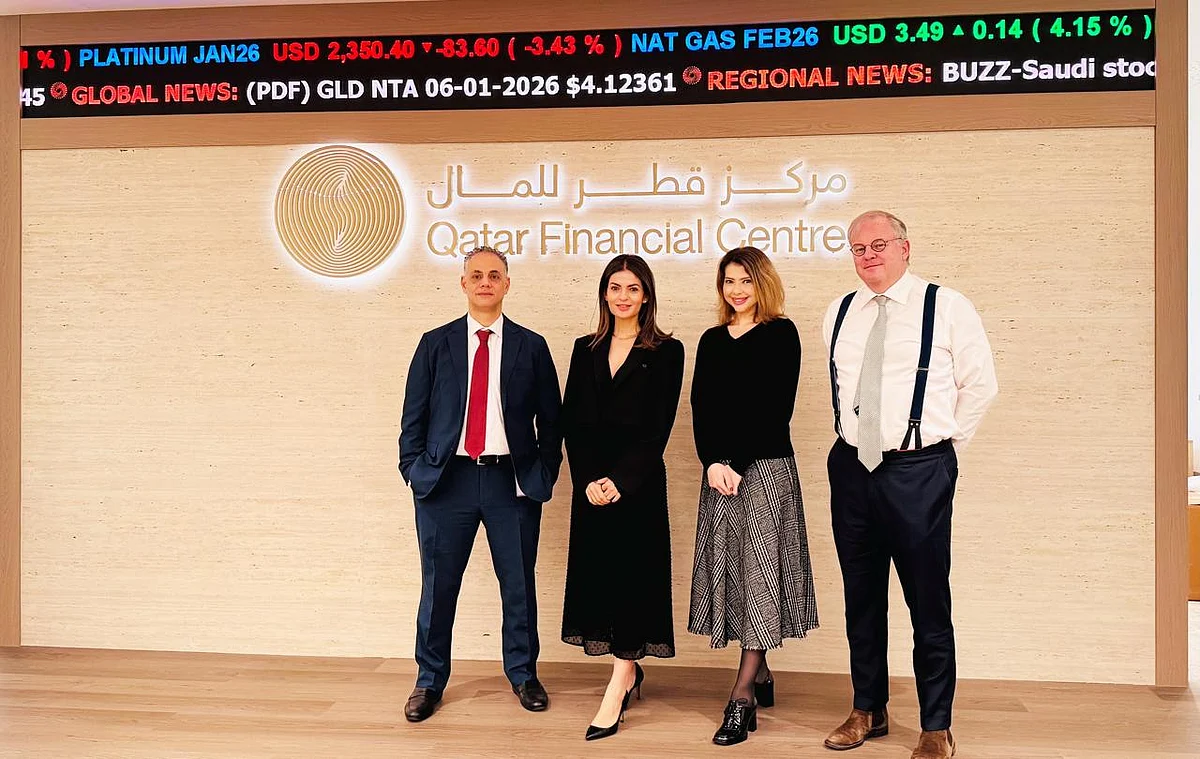

Falconbridge Advisors, the Dubai-headquartered boutique advisory firm, has announced the strategic expansion of its operations with the opening of its Doha office. The move formalizes and strengthens the commercial bridge between the UAE and Qatar, responding to a growing volume of institutional capital flowing between the two Gulf economies.

The expansion comes at a pivotal moment in UAE–Qatar economic relations. Bilateral trade between the two nations reached QAR 28 billion (USD 7.7 billion) in the past year, representing a 50% year-on-year increase, as both countries accelerate diversification under their respective national development strategies.

Recommended For You Iran will treat any attack as 'all-out war against us,' says senior Iran official Fashion Friday to free prediction contest: How Dubai Racing Carnival draws new crowds Emirates International School Jumeirah celebrates Winter Wonderland“Our expansion into Doha is a direct response to strong demand from our Dubai-based and international clients who increasingly view the UAE and Qatar as a single, high-growth strategic corridor,” said Saleha Osmani, Founder and Managing Director of Falconbridge Advisors.

“We are seeing a significant influx of interest from global blue chip names, particularly U.S.-based investment funds, technology companies, and institutional players looking to establish a presence in the region and build long-term partnerships. Our focus is on creating clear, credible pathways for these firms to anchor themselves in Qatar while leveraging the wider Gulf ecosystem.”

By anchoring its operations in both Dubai and Doha, Falconbridge Advisors is uniquely positioned to guide clients through the distinct yet complementary regulatory, commercial, and cultural landscapes of the two markets.

Falconbridge's Doha office will focus on facilitating market entry for global private equity firms, venture capital funds, technology companies, and institutional investors into Qatar's $200B+ non-hydrocarbon economy. Core service pillars include:

. Cross-Border Market Entry: Providing UAE-based and international firms with structured roadmaps for licensing through the Qatar Financial Centre (QFC) and Qatar Free Zones (QFZ).

. Institutional Intelligence: Delivering on-the-ground insight into sectors prioritized under Qatar's Third National Development Strategy (2024–2030), including fintech, logistics, advanced manufacturing, and digital infrastructure.

. Strategic Connectivity: Leveraging deep regional relationships to connect global capital with sovereign entities, family offices, and private sector leaders.

. Leadership Deployment: Supporting the placement of senior executives and C-suite talent capable of operating effectively across Dubai and Doha.

“Qatar has firmly established itself as a destination for long-term institutional capital seeking stability, policy clarity, and structural growth,” Osmani added.

“Our role is to ensure that capital moving between Dubai and Doha does so through transparent regulatory pathways and delivers high-impact commercial outcomes in both markets and the overall region.”

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment