Asia Week Ahead: Rate Decisions In Japan, Indonesia, Taiwan And Key Data On China

The Bank of Japan is expected to deliver a 25 bp hike on 19 December. Upcoming data should bolster the BoJ's belief that the economy is on a recovery path. With the reduction in tariff uncertainties, we expect a more pronounced bounceback in manufacturing. This should be reflected in Tankan and purchasing managers data. Also, November exports are projected to grow robustly, with a 7% gain driven by cars and semiconductors. We expect inflation to stay around 3% in November amid growing pressures from services prices. This will keep the BoJ in rate hike mode.

China: IP and retail sales expected to rise slightly while FAI continues to contractChina publishes its key economic data for November on Monday. We expect industrial production and retail sales to edge up slightly from October's growth levels to 5.1% and 2.9% year-on-year, respectively. Yet, fixed asset investment will extend its contraction to -2.8% you, year-to-date. Absent any stimulus, the 70-city property prices are expected to extend recent declines. Property investment is likely to decelerate further. The rollout of stimulus has been limited in recent months as the 2025 growth target looks fairly secure. But we could get more support measures announced in the coming months with 2026 seen as an important year - the start of the new Five-Year period.

Taiwan: CBC expected to hold the interest rateWith little of note on the data front, the Central Bank of China's quarterly monetary policy meeting is the key focus. Despite the Federal Reserve's multiple cuts in recent months, we believe the CBC will keep the benchmark interest rate unchanged at 2.0% on Thursday. There's little reason to cut rates given the upside surprise to growth so far this year and recent sensitivity to the stability of the TWD. This opinion is shared by markets, with a unanimous call for a hold from economists. Of particular importance: any hawkish or dovish tilt to its forward guidance.

Indonesia: BI expected to cut rates by 25bpsBank Indonesia is likely to cut rates by 25 bps on Wednesday to boost growth. This comes amid a slightly softer inflation print in November and pressure on IDR from narrower rate differentials easing after the recent Fed cut.

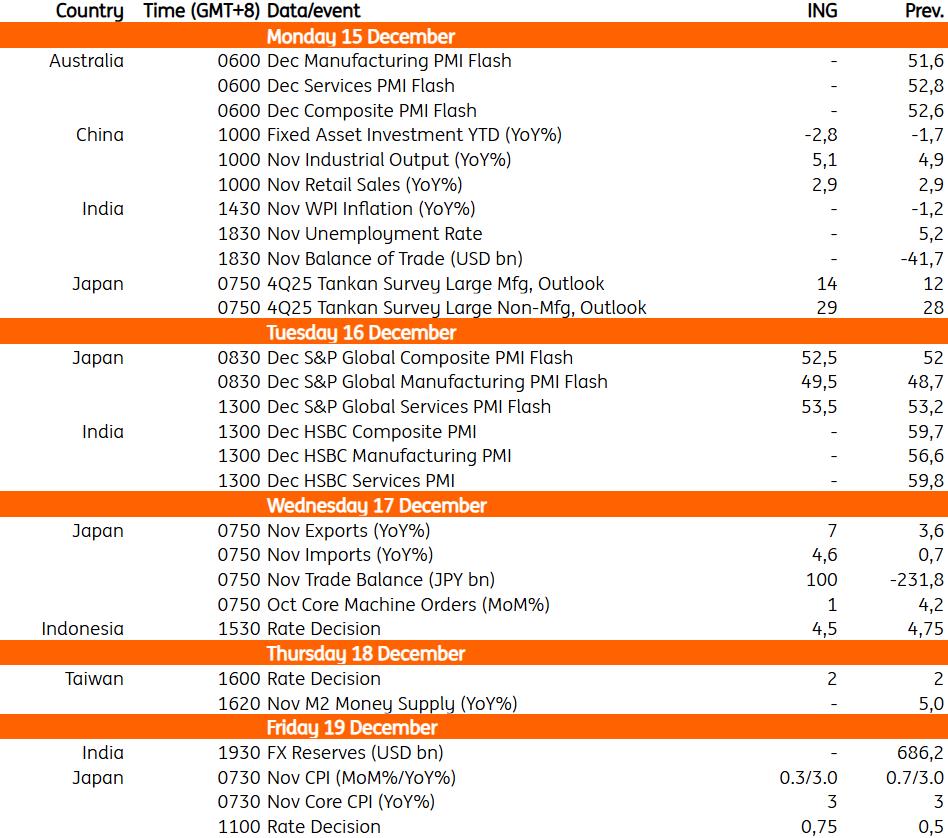

Key events in Asia next week

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment