China's CPI Inflation Hit A 21-Month High In November

| 0.7% YoY | China's November CPI inflation |

| As expected |

CPI inflation accelerated for the third consecutive month

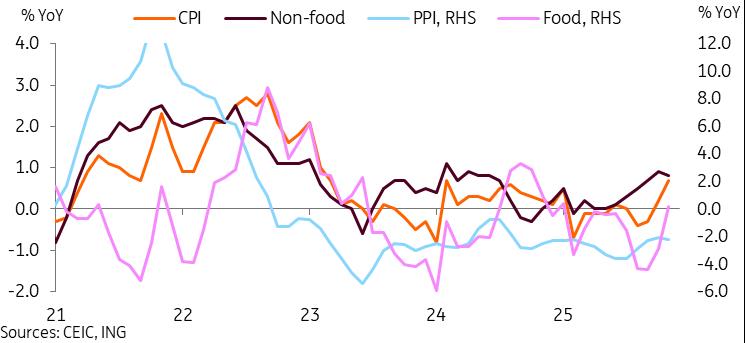

China's consumer price index inflation rose to 0.7% year on year in November, up from 0.2% in October. This was broadly in line with consensus forecasts. It marks a 21-month high, and it's tied for the highest level in the past 33 months.

The big driver was a larger-than-expected boost to food prices, which rose 0.5% month-on-month to 0.2% YoY. Year-to-date, this has been a significant drag on CPI inflation -- food inflation is at -1.7% YoY. The biggest contributor was a spike in fresh vegetable prices, which surged 7.2% MoM to reach 14.5% YoY. The lift from food prices could continue in the coming months, where we expect China's pork price cycle to turn again. Currently, pork prices (-15.0%) continue to weigh on food inflation, and this effect is likely to reverse next year.

Core inflation stabilised at 1.2% YoY in November, halting a 6-month streak of consecutive acceleration. Non-food prices actually dipped to 0.8% YoY, down slightly from October's 0.9% read, primarily thanks to a steeper decline of transport & communication prices, which fell to -2.3% YoY. Other categories were generally more or less stable on the month.

Producer price index inflation edged down slightly to -2.2% YoY, remaining in negative territory for a 38th consecutive month. Most subcategories are seeing negative YoY, but non-ferrous metal-related industries have bucked the trend with some positive YoY levels.

While deflationary pressures have been discussed extensively this year. The recent positive momentum on the CPI could actually eke out a tiny positive read for 2025 as a whole. We don't think inflation is likely to constrain the People's Bank of China's policy easing next year. This is especially the case if core inflation stabilises near current levels and the bulk of the upswing is driven by a food price recovery.

As we discuss in our 10 questions for China in 2026 piece, we expect China's CPI inflation will move back to positive territory for 2026. This will be positive for those who fear China will be stuck in deflation. But it will also mean a less supportive GDP deflator. Recent attention has been on getting 2026, the first year of the next Five-Year Plan period, off to a good start. This will likely require another wave of policy support in the early months of next year. As such, we are pencilling in 20bp of rate cuts in 2026.

Surge in fresh vegetable prices boosted food inflation back to positive levels

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment