Iron Ore Heads Towards A Softer Year

Iron ore prices have held at elevated levels for most of 2025, but next year's fundamentals point to a more bearish environment. This is set to be shaped by shifting sentiment around China's growth trajectory and the pace at which new supply, especially from Simandou, materialises.

China steel consumption slowsChina remains the single most important swing factor for iron ore demand, but the nature of its demand is changing. While the property market shows little sign of a meaningful recovery, which has eroded a key pillar of steel consumption, Beijing has a renewed focus on infrastructure investment, particularly in transport, energy and advanced manufacturing.

This shift, however, is less steel-intensive than previous investment booms and does not fully offset the drag from traditional demand drivers. It does, however, help to stabilise overall consumption and has underpinned import resilience even as domestic steel margins have compressed.

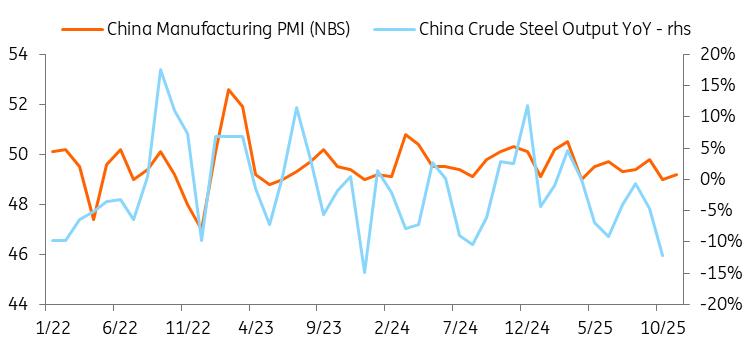

China manufacturing PMI remains in contraction

Source: NBS, China Federation of Logistics and Purchasing, ING Research

China's manufacturing activity (NBS PMI) edged higher in November but remained stuck in contraction for the eighth consecutive month, underscoring persistent softness in external demand and ongoing domestic headwinds. Broader macro indicators point to continued weakness as policymakers appear to be delaying further policy support. Looking ahead, without stronger policy support or a clearer rebound in demand, China's industrial cycle will struggle to regain momentum.

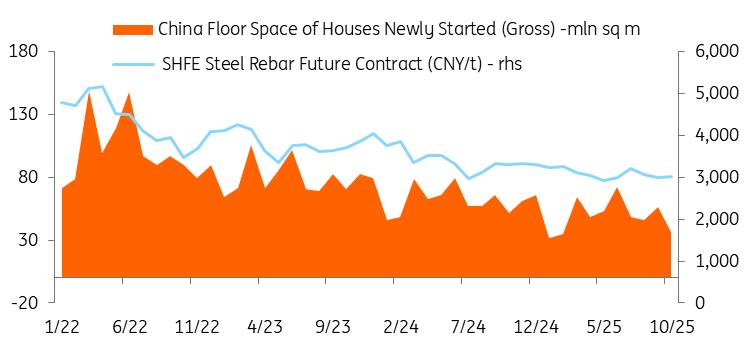

Property slump drags on

Source: SHFE, NBS, ING Research China steel output continues to drop

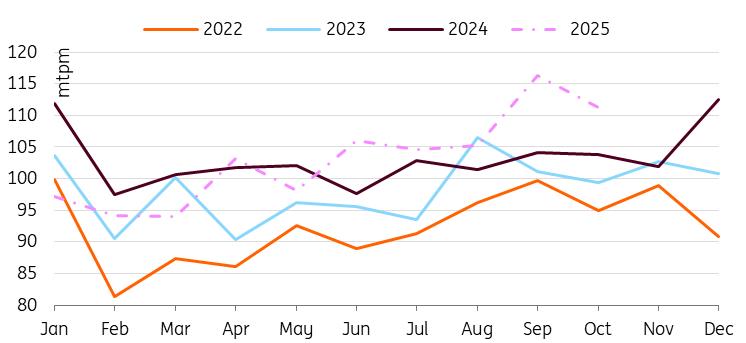

China's steel production continued to slide in October as a result of weakening domestic demand and output cuts at mills amid China's crackdown on overcapacity in domestic industries. Crude industrial steel production dropped 12% in October from a year earlier to 72 million tonnes – the lowest since December 2023. The year-to-date figure is 4% behind last year's pace. China's crude steel output has now dropped for five months in a row.

With manufacturing momentum softening, property activity still under pressure, and policy support unlikely to fully offset these headwinds, China's steel output is set to remain under pressure. This should keep iron ore demand on a weaker footing.

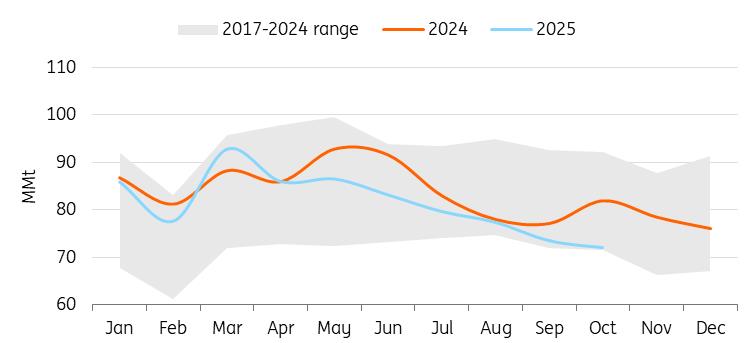

China crude steel output falls to lowest since 2023

Source: NBS, ING Research China steel inventories remain elevated

Source: China Iron and Steel Association, ING Research

High finished steel export volumes have remained a central theme in 2025, extending the trend from 2024. In the January-October period, China exported more than 97 million tonnes, 6.6% higher year-on-year, and is on course to surpass last year's total of 111 million tonnes.

With domestic steel prices under pressure and domestic consumption remaining soft, China is expected to keep export volumes high again in 2026, with volumes increasing into Southeast Asia, the Middle East and Africa, despite a rising number of trade barriers.

China exports more steel

Source: China Customs, ING Research

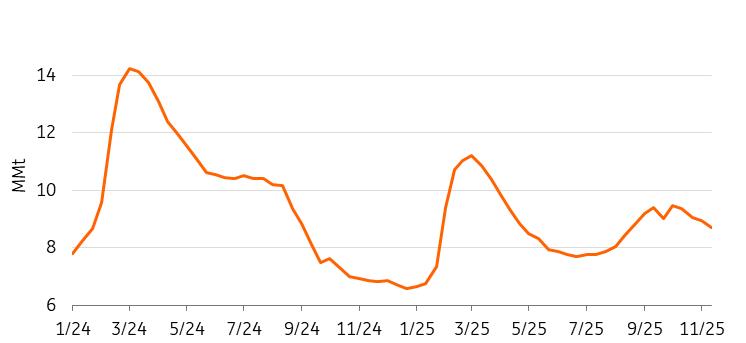

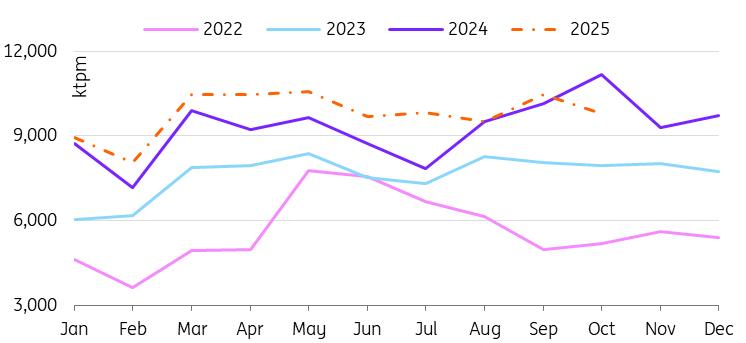

Although steel output has been disappointing, China's iron ore imports have been strong this year, hitting 113.3 million tonnes in October. That's around 7% more than a year earlier, and above 100 million tonnes for the fifth month straight.

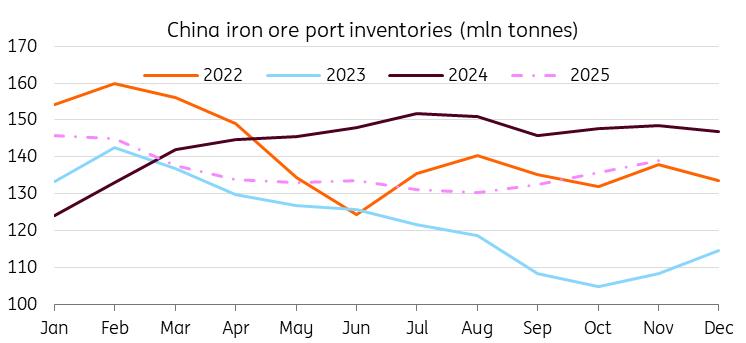

At the same time, iron ore port inventories have built, reflecting a combination of decreasing domestic iron ore production and restocking amid optimism following a positive meeting between US President Donald Trump and China's President Xi Jinping in late October. Iron ore prices have hovered in a relatively tight range, which has also supported incremental importing this year. These inventories may act as a buffer, limiting the extent of any near-term price rallies unless steel output surprises to the upside. But if steel demand continues to struggle, imports could face downward pressure again.

China iron ore imports have remained strong this year

Source: China Customs, ING Research China iron ore port inventories have built

Source: Steelhome, ING Research Seaborne iron ore supply is rising

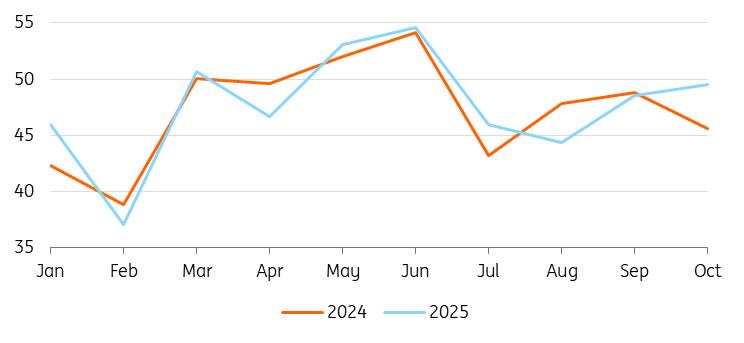

On the supply side, global seaborne iron ore supply is expected to continue growing, with Australia and Brazil set to increase shipments.

Iron ore shipments from Australia's Port Hedland, a major Australian export terminal, rose to a record high in October at 49.5 million tonnes, up almost 8% from October 2024. Another major exporter, Brazil, shipped an average of 1.85 million tonnes per day in October. The country has hit record export volumes this year.

Iron ore shipments from Australia's Port Hedland hit October record

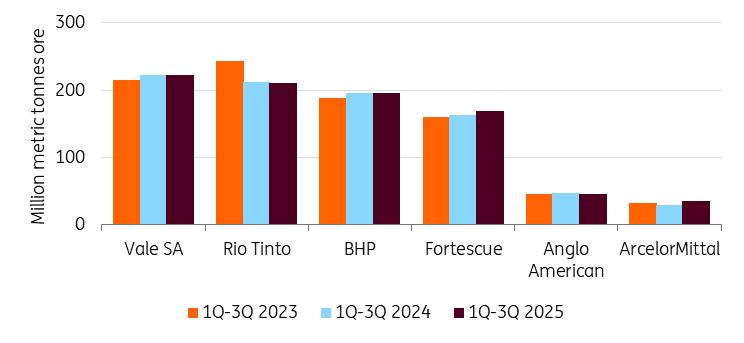

Source: Pilbara Ports, ING Research Iron ore output from majors is up this year

Source: BNEF, Vale SA, Rio Tinto, BHP, Fortescue, Anglo American, ArcelorMittal, ING Research

One of the potential game-changers in iron ore supply is Guinea's Simandou project – one of the largest sources of potential new high-grade supply in decades. Even partial volumes entering the market would contribute to a more comfortably supplied balance. As additional tonnes come through, higher-cost producers, particularly low-grade Chinese domestic mines, may face renewed profitability pressure, reinforcing the dominance of large, low-cost exporters.

The giant Simandou iron ore mine made its first shipment in November, marking a major milestone after nearly three decades of development, and is expected to arrive in China between January and February 2026. The mine is expected to send around 20 million tonnes of iron ore in 2026, with full capacity of 120 million tonnes per year expected by 2030.

Simandou's ramp-up could shift the global market's power dynamics, reducing China's reliance on major miners and strengthening its leverage in the iron ore market, as well as providing it with greater ability to influence global prices.

BHP-China dispute adds to uncertaintyThe ongoing pricing standoff, which began two months ago between BHP and China's state-backed CMRG (China Minerals Resources Group), has added to uncertainty in the iron ore market. The standoff is part of China's strategic push to exert greater influence over iron ore pricing and to increase the use of the yuan in contract settlements, reducing reliance on the US dollar.

CMRG was created by Beijing three years ago to shift leverage from major iron ore producers toward China, the world's largest iron ore buyer.

Beijing has recently expanded its embargo on some BHP cargoes, ordering steel mills and traders to stop buying“jingbao fines”, a low-grade of iron ore that represents a small part of the miner's exports to China. The ban follows an earlier halt on BHP's“jimblebar fines”, a Pilbara iron ore grade and one of BHP's most popular export types.

While the dispute is likely a negotiating tactic rather than a structural break, it heightens near-term volatility by disrupting trade flows and undermining confidence in China's procurement approach. If unresolved, the impasse could drive a rerouting of some trade flows and force BHP to discount cargoes into alternative markets. For now, BHP has kept its full-year 2026 production guidance unchanged at 258-269 million tonnes.

More weakness aheadIron ore prices are likely to drift lower over the next year. Rising seaborne supply, persistent Chinese property sector weakness, and elevated inventories all point toward a weakness in prices in 2026. Inventory risk, especially port stocks in China, could act as a cap on the upside. We see prices averaging $95/t in 2026.

The key things to watch will be China's steel production policy, the pace of infrastructure spending, and the timing of new supply additions.

If Chinese stimulus gathers momentum or if major supply projects experience delays, prices could stabilise at higher levels.

A sharper-than-anticipated deterioration in China's construction sector or a faster ramp-up of new mines would increase downside risks.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment