Nickel Still Capped By Surplus

Global nickel supply is expected to outpace demand again in 2026. Indonesia accounts for around 60% of global nickel output and is the primary driver of global mine supply growth, particularly through low-cost nickel pig iron (NPI) and expanding high-pressure acid leach (HPAL) capacity.

Margins for Indonesian producers remain resilient, even at lower price levels, due to integrated operations and low production costs. In contrast, ex-Indonesia supply is increasingly challenged, with nickel producers closing mines, scrapping development projects and selling assets as nickel prices decline. However, that is unlikely to offset the magnitude of Indonesian expansions.

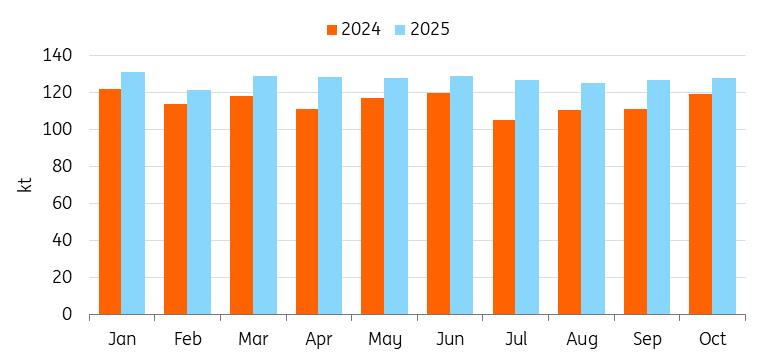

Indonesian NPI production is up YoY

Source: SMM, ING Research

However, Indonesia has recently intensified efforts to take stricter control of its mining sector, providing cautious optimism for the nickel market.

Stricter permit enforcement to better manage supply and stabilise prices signals tighter political control over nickel output, as well as increasing production uncertainty.

The government's crackdown on environmental and safety issues has resulted in the seizure of part of the Weda Bay in September, which is the largest nickel mine in the world, and the suspension of 190 mining permits nationwide. The government is also shifting to annual RKAB quotas (down from three years).

Indonesia's nickel industry is also facing greater local scrutiny. Much of this scrutiny comes from Indonesia's expanding HPAL operations, where the combination of intensive acid use, high waste volumes and complex tailings storage has raised environmental concerns. This could influence future project approvals and add more uncertainty to Indonesia's supply trajectory. The HPAL method is an important part of Indonesia's nickel strategy because it allows it to convert its large reserves of low-grade laterite ore into battery-grade nickel, which is essential for electric vehicle (EV) supply chains.

Most recently, Indonesia has halted new permits for nickel refining facilities producing only intermediate products, like NPI, ferronickel, matte and MHP. New processing or refining facilities can still be developed, but only if the companies commit to producing higher-value downstream products rather than stopping at intermediate nickel products.

This latest move accelerates Indonesia's push for higher-value processing, reducing intermediate oversupply and boosting investment in refined and battery-grade nickel. Indonesia banned raw nickel ore export in 2020 to spur investment in processing. The measure offers little immediate relief for nickel's structural glut, as approved projects will keep adding capacity. However, strict enforcement could tighten supply in the medium to longer term.

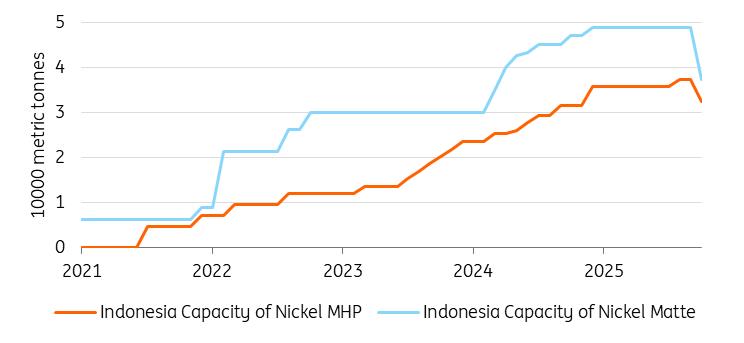

Indonesia ramps up efforts to ease supply glut in intermediate products

Source: SMM, ING Research

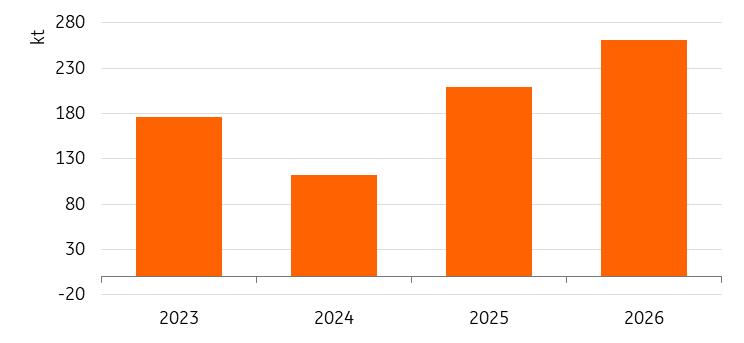

Supply risks do exist for nickel, but they are not yet large enough to materially challenge the surplus outlook. The global market is forecast to be in a surplus of 261kt in 2026, following a surplus of 209kt in 2025.

Global nickel market heading for another surplus in 2026

Source: INSG, ING Research LME stockpiles keep rising

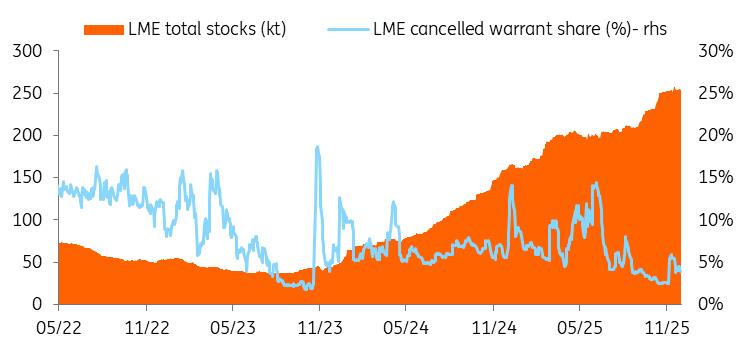

The surplus in the Class 1 market is reflected in the rising exchange stocks, with stockpiles in LME-tracked warehouses now building for two years. They now stand at the highest level in more than four years. Only Class 1 nickel, which accounts for around a quarter of global primary supply, can be delivered onto the LME.

Excess nickel feedstock is being refined into Class 1 metal and absorbed by the LME, where the fast-track listing of new brands continues to attract more supply.

China and Indonesia have increased their exports of nickel cathode this year, with most of these exports going to LME warehouses. China's refined nickel exports are up 55% year-on-year in the first 10 months of 2025. Meanwhile, exports of nickel cathode from Indonesia rose nearly 80% in the first three quarters of the year from the same period in 2024.

Class 1 surplus reflected in rising exchange stocks

Source: LME, ING Research

In October, the Chinese cathode share of available tonnage rose to 70% from around 50% at the start of the year, as shown in LME country of origin data. Including Indonesian-origin metal, this share went up to 75% compared to 55% in January.

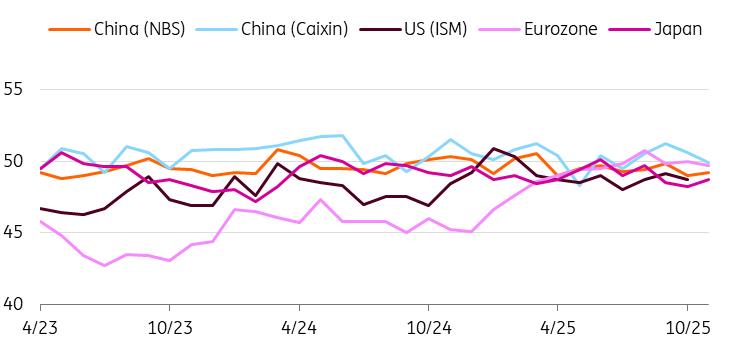

Stainless stable, batteries lagStainless steel continues to account for the majority of global nickel demand, making up more than 60% of total consumption, and its growth is set to remain sluggish in 2026. Declining manufacturing activity in key global economies has weighed on nickel prices; the manufacturing sector is a primary consumer of nickel.

Manufacturing weakness persists across leading economies

Source: Refinitiv, ING Research

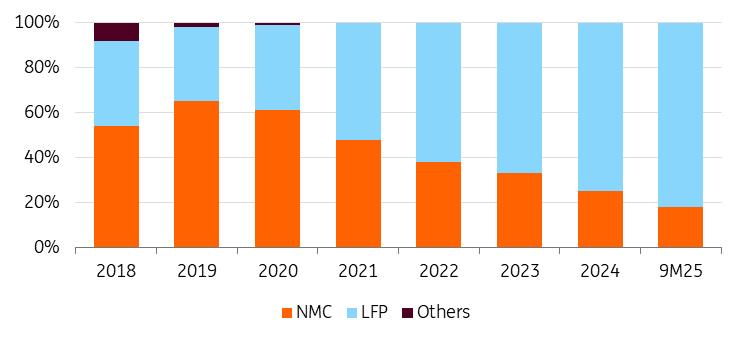

Meanwhile, the battery sector is expanding, albeit at a slower pace than previously expected, reflecting the rising share of non-nickel chemistries – particularly lithium iron phosphate (LFP). This is especially the case in China, the world's largest producer of EV batteries. In China, nickel-manganese-cobalt's (NMC) market share fell to 18% in the first nine months of 2025 from 25% in 2024.

LFP batteries are generally cheaper, safer, and have a much longer cycle life. LFP battery cells cost about 25% less than NCM cells in China, according to ICCSino data.

The trend of switching to LFP batteries is set to continue. This, combined with stronger demand for plug-in hybrid EVs at the expense of battery EVs, will continue to cap demand for nickel-intensive NMC chemistries.

Batteries remain the largest cost component for EVs, and LFPs are also gaining popularity globally, extending beyond their dominant market in China, driven by their lower cost and role in making EVs more affordable.

China's EV battery mix is dominated by LFPs

Source: China Industry Technology Innovation Strategic for Electric Vehicle, Bloomberg Intelligence, ING Research

In the US, September saw the removal of subsidies for EVs as part of the budget legislation – the 'One Big Beautiful Bill Act' – passed in July. The end of the federal tax credit means buyers can no longer claim a credit of up to $7,500 for new EVs and $3,000 for used EVs, effectively raising the purchase price. This will likely lead to a drop in sales, already seen in the initial data showing a sharp decline in October sales, and potentially a surplus of unsold inventory. It could also slow the overall pace of EV adoption in the US.

Risks skewed to the downsideThe nickel market will likely remain under pressure in 2026 due to continued surplus.

Indonesian policy is a key upside risk – any introduction of export controls, production quotas, or tighter environmental regulations could restrict supply.

The technology trajectory in the battery sector also remains key. Faster-than-expected substitution away from nickel-rich chemistries would deepen the global surplus, while any reversal of this trend would offer support to prices.

Slower global growth would weigh on stainless-steel demand, adding pressure to prices.

Nickel prices are likely to remain range-bound, constrained by elevated inventories and subdued demand; however, the threat of supply disruptions from Indonesia will limit the downside. We see prices averaging $15,250/t in 2026.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment