Copper Upside Building On Tight Supply

Copper supply has seen a wave of disruptions this year, tightening the 2025 and 2026 balance, most recently Freeport's declaration of force majeure at its giant Grasberg mine in Indonesia. Grasberg is the world's second-largest copper mine, contributing around 4% of global production. Two minor mining areas recovered production as planned in November, while the main area, which is responsible for 70% of output, is expected to slowly resume operations next year. A full recovery is expected in 2027.

The disruption at Grasberg has added to the already high number of supply disruptions this year, including the flooding of the Kamoa-Kakula mine in the DRC in May and an accident hitting the El Teniente mine in Chile in July.

Chile, the world's largest copper producer, continues to struggle with falling ore grades and operational setbacks. Meanwhile, Ivanhoe Mines trimmed the outlook for production from its Kamoa-Kakula mine as it continues to recover from the flooding earlier this year.

The copper supply chain is under strain, tight from mining to concentrate production. Meanwhile, the refined metal flows are being disrupted by tariff risks and unusually high US stockpiles.

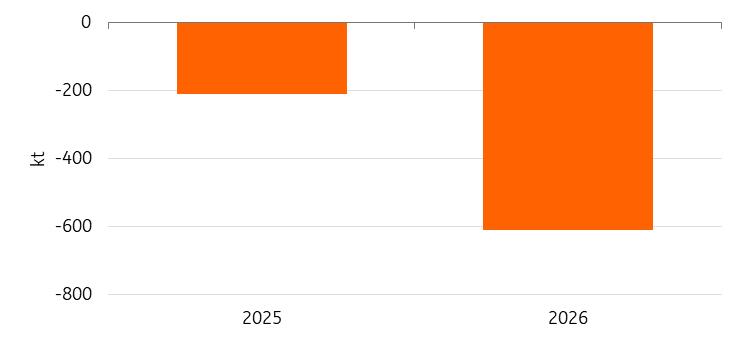

Our refined copper balance for 2026 is now showing a deficit of around 600kt for 2026, following a deficit of around 200kt in 2025.

Refined copper surplus is widening

Source: WBMS, ICSG, ING Research Tariff arbitrage drives distortions

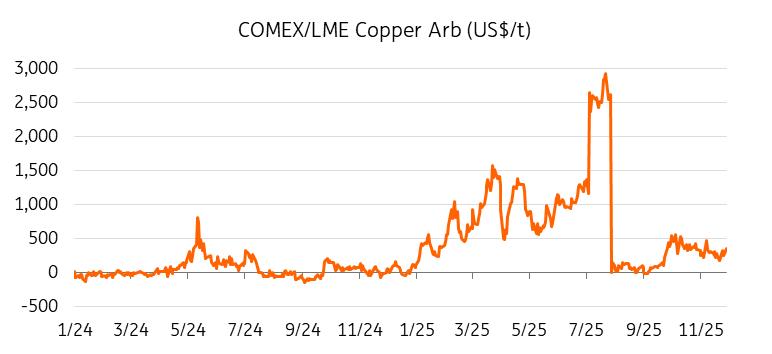

Donald Trump's tariff policies have caused extreme price distortions between the US and the LME benchmark. Traders pulled large quantities of copper into the US earlier this year to front-run potential tariffs, pushing COMEX prices sharply above LME.

US refined copper imports were up more than 50% YTD in August

Source: TradeMap, ING Research

Although refined copper was ultimately exempted, the risk of reinstated tariffs, with a potential 15% tariff hike under review in June 2026, continues to support the COMEX/LME arb.

Traders keep paying extra for US copper

Source: COMEX, LME, ING Research

This has also led to high premiums across the rest of the world. Producers plan to impose record premiums on European and Asian customers next year, effectively compensating for profits they could earn selling to the US.

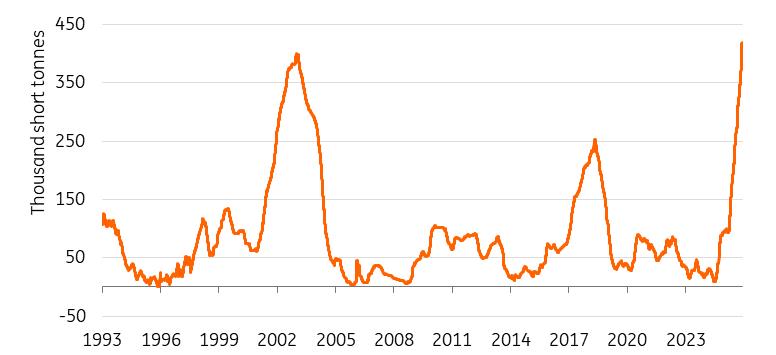

Meanwhile, COMEX inventories have soared more than 300% this year to more than 400kt, an all-time high.

Comex copper inventories surge to all-time high

Source: COMEX, ING Research

The recent update by the US Geological Survey to its list of critical minerals, which has added 10, including copper, lead, metallurgical coal, and silver, is a strategic move to strengthen US mineral supply chains and national security. This development, which expanded the list to 60 minerals, may reinforce speculation about a potential increase in US import tariffs in 2027. If implemented, tariffs could widen the price difference between COMEX and LME markets, mirroring trends seen in July 2025.

But if Trump decides against tariffs on refined copper once again, significant volumes of US copper stockpiles could flow back to the global market. This would lead to a collapse of the COMEX premium, pushing US prices lower, and moving the global refined balance into a surplus.

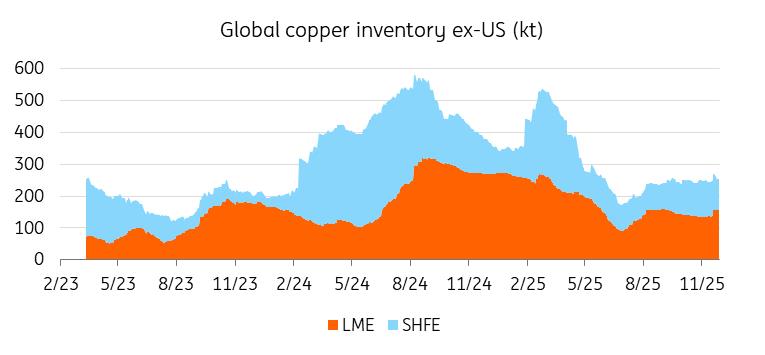

But until there is any clarity on the tariff front, the tariff risk will keep ex-US supply tight and global prices elevated.

Ex-US inventories are low

Source: LME, SHFE, ING Research Demand outlook mixed but long-term drivers solid

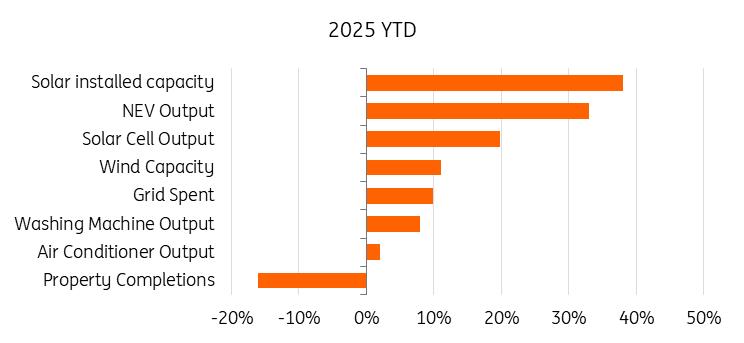

Demand for copper remains mixed, particularly in China. Property completions are still lagging, keeping construction-related copper use depressed, likely to remain a drag on copper. But non-property demand indicators have been positive, including strong grid investment, electrification, renewable build-out and EV and battery materials growth.

Non-property demand trends have been positive

Source: NBS, ING Research

The risk of demand destruction also shouldn't be overlooked. Chinese buyers are showing some signs of price sensitivity, with mainland smelters planning to step up shipments abroad, as higher prices deter domestic buyers.

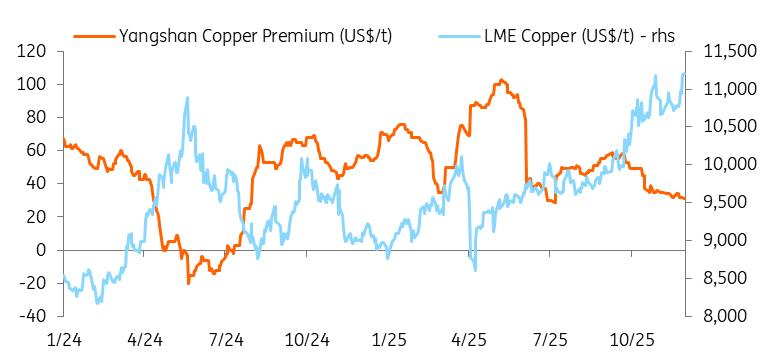

The Yangshan premium has recently slumped to its lowest since July. The premium is paid on top of global exchange prices and is usually a good measure of Chinese buying appetite. Its peak was just above $150/t. This could put a ceiling on copper's upside.

Yangshan premium slumps

Source: LME, SMM, ING Research

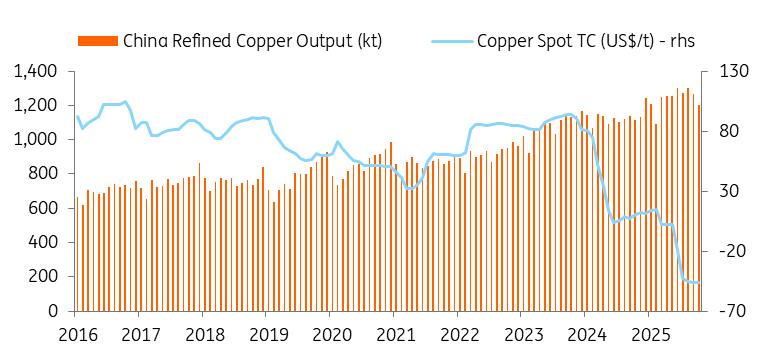

China is usually a major net importer of refined copper; however, it still exports some volumes when it turns profitable to do so. The reversal in these flows has been partially due to surging domestic supply. China's refined copper output has been strong despite low treatment and refining charges (TC/RC). TC/RCs – the fees earned by smelters for processing ore into metal – have plunged to record lows this year due to a shortage of raw materials amid rapid growth in China's smelting capacity. Spot charges have fallen as low as minus $60/t this year.

China 2025 copper output set to hit record high

Source: NBS, Asian Metal, ING Research China's refined output keeps hitting records

China's copper smelters posted a succession of record production figures this year despite a tightening feedstock market and despite the government's campaign against industrial overcapacity and excessive competition. The copper industry has been granted more leniency due to its strategic role in high-tech and clean energy manufacturing. Chinese smelters' advantage also comes from higher prices of sulfuric acid, a byproduct of copper smelting, as well as ownership stakes in mines.

Meanwhile, smelters abroad are struggling to keep their operations running amid rising cost pressures and aggressive Chinese competition. Earlier this year, Glencore received a government bailout to keep its Mount Isa smelter and refinery in Australia running for another three years.

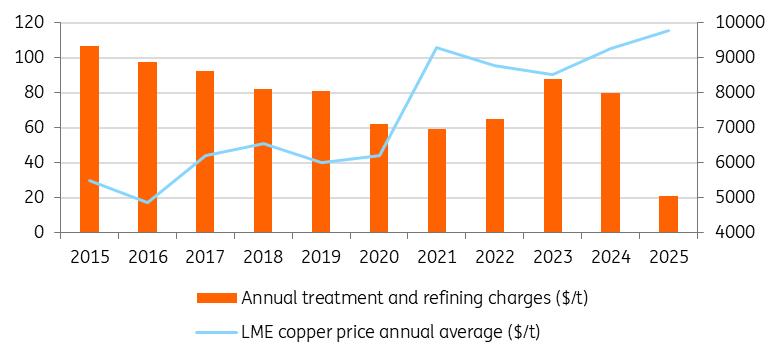

TC/RCs are likely to remain under pressure next year as concentrate supply growth lags expanding smelter capacity. Unless new mine projects ramp up quicker than expected, smelters will continue to face margin compression and may curtail output.

Smelting fees fell to a record low this year

Source: LME, ING Research

Major copper smelters in China recently pledged to jointly cut intake of copper concentrate as falling processing fees squeezed margins. The China Copper Smelters Purchasing Team (CSPT), a group of 13 major smelters, said it will cut concentrate processing rates by more than 10% next year. Still, while CSPT's proposed 10% smelter cut reflects tight concentrate availability, it does not necessarily imply a meaningful change in the global refined copper balance, with the concentrate that China does not process simply reallocated to other smelters globally.

In addition, although similar pledges were made last year, they didn't result in significant reductions in refined copper output. This year, China has produced almost 10% more refined copper through October.

Upside risks risingIn the near term, supply disruptions should keep a floor under prices around the $11,000/t level. However, for the rally to extend, stronger demand – particularly from China, the largest consumer – will be crucial. For now, prices will remain rangebound.

We see prices peaking in Q2 at $12,000/t as copper stockpiles keep building in the US, tightening ex-US markets before losing a bit of momentum in H2 as tariff policy should become clearer. The downside risk here is the reversal of these flows if the refined metal is exempt from tariffs once again.

We see prices averaging $11,500/t in 2026.

Upside risks include potential cuts to Chinese domestic output, additional supply disruptions and stronger investment momentum in energy transition sectors and AI.

On the downside, risks include further weakening in demand, a potential US tariff change that could push inventory onto global markets, and wider macro headwinds.

The long-term bullish narrative remains intact for copper, supported by structural demand from the grid, electrification and renewable infrastructure and, increasingly, from data centres and AI infrastructure.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment