Bearish Oil Outlook, But Upside Risks Abound

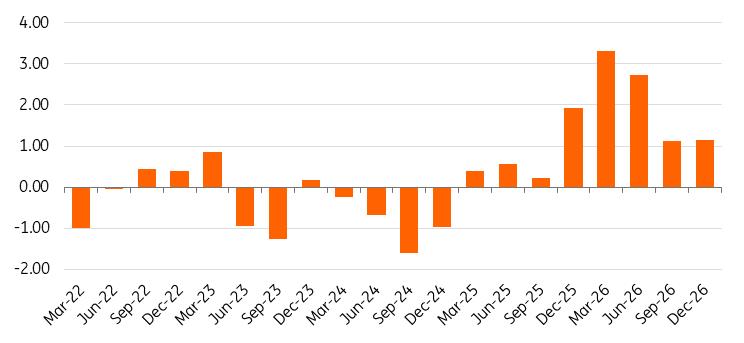

Our balance sheet shows that the surplus in the oil market is set to grow in 2026, following OPEC+'s decision to unwind supply cuts at a quicker-than-expected pace. Non-OPEC supply is also expected to grow at a healthy clip despite this year's price weakness.

According to our balance, we will see a surplus of more than 2m b/d in 2026. Global supply is set to grow by 2.1m b/d next year, while demand looks to be more modest at around 800k b/d.

The peak of this surplus is expected in the first half of 2026. However, with our balance sheet showing a surplus in every quarter next year, global oil stocks should continue to build through the year, keeping downward pressure on prices. We forecast that ICE Brent will average US$57/bbl over the year, with the key assumption being that Russian oil flows continue unabated despite US sanctions on Rosneft and Lukoil.

The scale of the surplus and the expected build in inventory should put the forward curve under additional pressure, pushing it deeper into contango. The front end of the curve has held up better than expected as supply risks provide support. In addition, the growing amount of Russian oil at sea not making its way to the destination suggests the spot market may be tighter than what the oil balance suggests at the moment.

This is a key risk to our bearish view. Clearly, if sanctions prove more effective than we and the market expect, this leaves upside for oil prices. However, Russia has managed to keep oil flowing since 2022 despite sanctions and embargoes. We suspect the use of intermediaries and the larger discounts available to buyers of Russian crude oil should see flows continue.

Downside risks include ongoing peace talks. If they lead to the lifting of certain sanctions on Russia, much of the supply risk hanging over the oil market will ease. While we don't believe such a scenario would dramatically increase Russian oil supply, given that it's held up well despite sanctions, removing this risk could push Brent down to the low $50s.

The oil market faces a large surplus in 2026 (m b/d)

Source: ING Research, IEA, EIA, OPEC Will volatility return to oil markets?

What's really stood out in oil markets this year is the lack of volatility, particularly given the myriad geopolitical events and supply risks. There's the ever-lurking uncertainty over sanctions on Russian oil supply, but also US and Israeli strikes on Iran. After such an event, one would've expected violent spikes in the oil market, given the fears over the loss of Iranian supply, and the potential spillover into the broader region. Instead, Brent had a brief rally to just over $80/bbl.

So, why is there a lack of volatility in markets this year?

First, we have been living in a world with heightened geopolitical risks since Russia's invasion of Ukraine. So, there will be an element of fatigue when it comes to geopolitical developments, particularly when events in recent years have had little to no impact on oil supply.

Second, there have been growing expectations of a surplus environment, particularly towards the end of this year and into 2026, which would have comforted the market. Perhaps the biggest factor blunting volatility is the large amount of spare capacity that OPEC has been sitting on. It was a little more than 5m b/d earlier in the year, easing concerns over potential supply disruptions. But obviously, OPEC has been tapping into this spare capacity aggressively this year. As such, this buffer is much smaller moving forward. It means the market in the future may be more sensitive to developments, which could mean increased volatility.

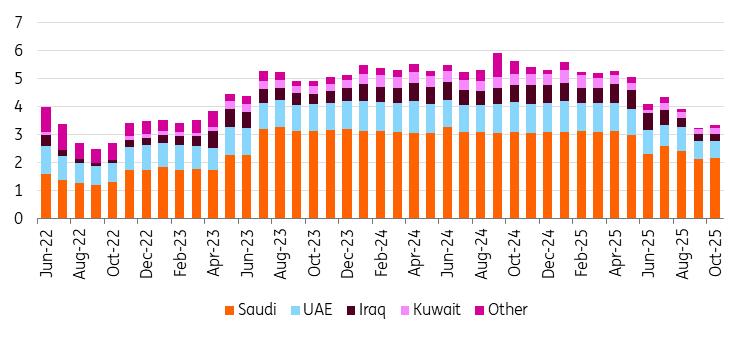

OPEC's spare production capacity provided comfort to the market in recent years but is now falling (m b/d)

Source: IEA, ING Research OPEC+ policy shift and its next moves

OPEC+ chose an interesting time this year to shift policy from defending prices to defending market share. It coincided with tariff and trade uncertainty. The group surprised the market by bringing supply back onto the market at a much faster-than-expected pace. Initially, the alliance was set to bring 2.2m b/d of supply back over an 18-month period. Instead, OPEC+ returned the supply to the market within six months. It went further by starting to unwind the next tranche of 1.65m b/d of voluntary cuts. However, further supply increases will be paused over the first quarter of next year. So far, OPEC has brought back 411k b/d of this second tranche. The surplus in the oil market next year suggests the group shouldn't bring the remaining 1.24m b/d from this tranche back onto the market next year. This will depend on how Russian supplies hold up.

One of the key questions this year has been why there was a shift in production policy by OPEC+. Some of the reasons include the group, specifically Saudi Arabia, getting increasingly frustrated that efforts to defend prices failed. We were seeing supply from the group falling along with oil prices, as non-OPEC+ producers increased output.

There's also growing frustration over some members producing well above their production targets. Iraq had consistently produced above its target in 2024 but has since complied much better with the deal. It's now Kazakhstan that is producing well above target, with output ramping up following the expansion of the Tengiz field. In late 2024, there were already warnings of growing frustration in the group due to overproduction by some members. Saudi Arabia reportedly warned members of the risk of significantly lower oil prices if production targets aren't respected. This warning was seen as a veiled threat.

Another possible reason behind the increases was to test the production capabilities of members. There's been a lot of debate and contention over where maximum sustained capacity is for members, given that it sets the baseline for production targets. Naturally, countries would want to inflate capacity numbers so that the baseline for production cuts/targets is higher. The rapid supply increase over the last several months should give a good indication of which producers may need to see adjustments to their assumed maximum sustained capacity and baselines.

How long OPEC+ continues with this new policy really depends on what you think is the key driver behind the supply increases. If it's about testing baselines used for production targets, the shift in policy could be relatively short-lived. It also has the potential to lead to disagreement within the group, particularly among members seeing their baselines lowered.

If recent increases are more about frustration over the lack of success with output cuts, cuts could linger a while longer, potentially during all of 2026. The question then becomes how much pain OPEC+ members can endure in the form of lower oil prices and how much this impacts the public finances of member countries. For example, our forecast for Brent to average $57/bbl through 2026 is significantly below the Saudi fiscal break-even oil price of around $90/bbl.

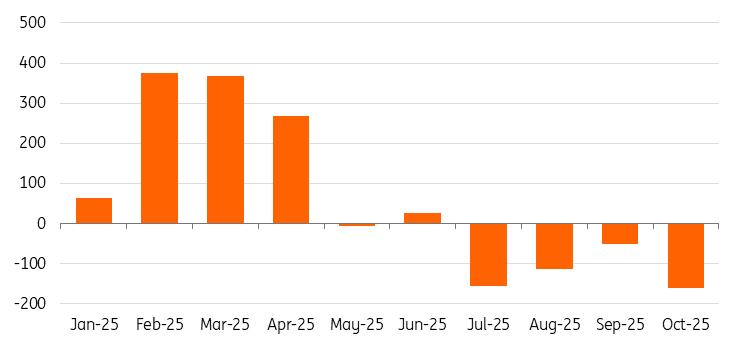

OPEC+ 8 output goes from overproduction to underproduction as production targets are raised (k b/d)

Note: This compares OPEC+ 8 actual production vs. production targets. A positive number means producing above target, while a negative number is producing below target. Source: OPEC, ING Research US crude supply set to fall in 2026

US oil production has held up well this year despite the weakness seen in WTI and the fall in drilling activity. Baker Hughes data shows that the oil rig count in the US has fallen more than 15% so far this year, and to its lowest levels since September 2021, when the industry was still recovering from the impact of Covid.

Despite this fall in drilling activity, US crude oil production has continued to hit record highs, breaking above 13.8m b/d in September 2025. It's on course to average around 13.6m b/d in 2025, growing 360k b/d year-on-year.

However, given the current low prices and the outlook under pressure, we expect US crude oil production will start to soften. For now, we are assuming a marginal decline in output, but sub-$60/bbl WTI leaves room for larger declines in 2027 production. According to the Dallas Fed Energy Survey, producers need, on average, $65/bbl to profitably drill a new well. This is above where the entire WTI forward curve is trading.

US oil output hits record highs despite drilling decline, but this won't last

Source: Baker Hughes, EIA, ING Research Another modest year of oil demand growth

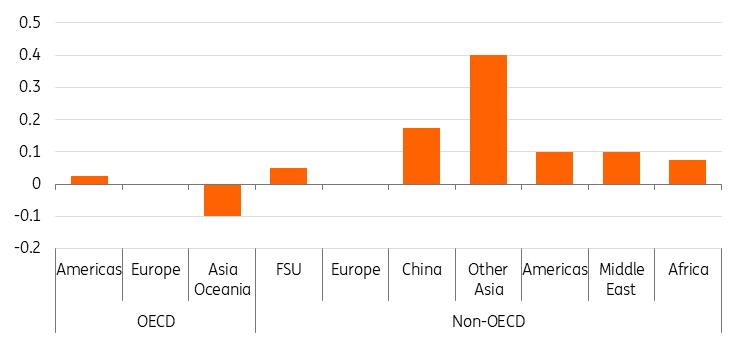

Our numbers show that oil demand is estimated to grow by around 700k b/d in 2025 and by a further 800k b/d in 2026. For 2026, demand is expected to be driven by non-OECD countries and specifically Asia (excluding China), which will make up around 50% of global demand growth. Meanwhile, Chinese demand is expected to be modest at less than 200k b/d.

While there have been some headwinds amid trade tensions, there are clear structural changes occurring, particularly to road fuel demand. Strong sales of new energy vehicles continue to displace oil demand. There are also some interesting regional trends. It's been well telegraphed, for example, that road diesel demand in Europe has peaked and is trending lower. Yet petrol demand in some key markets within Europe is seeing strength from the growing share of hybrid vehicle sales.

Global oil demand set for modest growth in 2026 (m b/d)

Source: IEA, ING Research Lingering uncertainty over Russian supply

The biggest risk to our bearish view on the market is centred around Russian oil supply. The latest US sanctions on Rosneft and Lukoil have led to lots of uncertainty over what will happen to supply. Buyers, at least for now, seem hesitant to continue with purchases. And while Russian seaborne export volumes appear to be holding up well, this crude is taking much longer to get to its destination, and so we are seeing a growing amount of Russian oil at sea. If this continues, eventually we'll need to see Russian oil production starting to decline. However, we believe that Russian oil will continue to flow once trade adjusts to the sanctions. Increased use of intermediaries, so that buyers are not facing sanctioned entities, would likely satisfy buyers, while a growing discount for Russian crude will make it even more appealing.

Possibly, a bigger risk for the market is the increased attacks we have seen by Ukraine on Russian energy infrastructure. While these attacks have been largely focused on refinery assets, we have also seen an increasing number of attacks on ports, which could impact both crude oil and refined product exports.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment