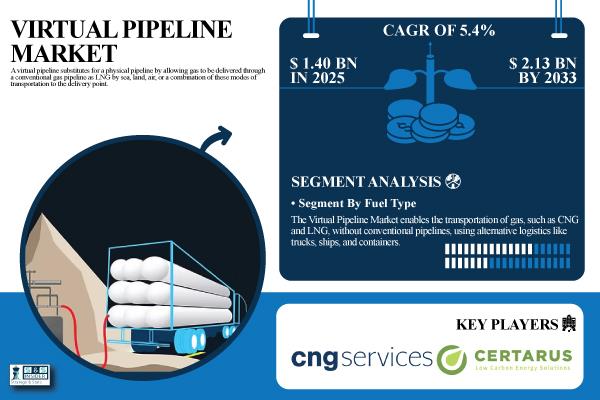

Virtual Pipeline Market Size To Worth USD 2.13 Billion By 2033 Report By SNS Insider

| Report Attributes | Details |

| Market Size in 2025E | USD 1.40 Billion |

| Market Size by 2033 | USD 2.13 Billion |

| CAGR | CAGR of 5.4% From 2026 to 2033 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | . By Fuel Type (CNG, LNG, Others) . By Application (Transportation, Industrial & Commercial) |

Purchase Single User PDF of Virtual Pipeline Market Report (20% Discount) @

Key Industry Segmentation

By Fuel Type

CNG currently leads the market, driven by its widespread availability, lower transportation cost, and strong adoption in regions lacking pipeline infrastructure. Industries and commercial users prefer CNG virtual pipelines due to easier handling, mature storage technology, and suitability for short- to mid-distance transport. LNG is the fastest-growing segment, supported by rising demand for high-energy-density fuels, increasing LNG adoption in heavy transportation and remote power generation, and expanding micro-liquefaction and small-scale LNG distribution networks that make LNG virtual pipelines more viable.

By Application

Transportation segment dominates the market, powered by the rapid adoption of natural gas–powered vehicles, emission-reduction initiatives, and the need to supply fuel where physical pipeline networks are absent. The segment benefits from the growth of fleet operators, mining trucks, buses, and long-haul transport shifting toward CNG and LNG. Industrial & Commercial is the fastest-growing application segment, driven by rising energy demand in remote manufacturing sites, oil & gas operations, brick kilns, food processing plants, and commercial establishments that rely on virtual pipelines for a stable, clean, and cost-effective fuel supply in areas without pipeline connectivity.

Regional Insights:

North America currently holds the top spot in the global market for virtual pipeline systems, due to the U.S.'s significant market share, convenient availability, and affordable prices. Due to the quick movement in consumer preference toward adopting cleaner alternatives to fossil fuels as well as the considerable investments in natural gas made by developing economies.

The Virtual Pipeline Market in Asia Pacific is expected to grow significantly between 2025 and 2033, driven by rising energy demand, infrastructure expansion, and a shift toward cleaner fuels like CNG and LNG.

Do y ou h ave a ny s pecific q ueries o r n eed a ny c ustomiz ed r esearch on Virtual Pipeline Market? Schedule a Call with Our Analyst Team @

Recent News:

- In August 2024, Kinder Morgan paid USD 135 million to acquire North American Natural Resources, Inc., as well as its subsidiary firms North American Biofuels LLC and North American-Central LLC. The transaction comprises seven amounts of landfill gas to power facilities in Michigan and Kentucky in the amalgamate purchase amount and accompanying contract fees. hrough this transaction, Kinder Morgan makes the Final Investment Decision (FID) to upgrade 4 of the 7 gas-to-power facilities to renewable natural gas facilities for an estimated USD 175 million in capital costs.

Exclusive Sections of the Virtual Pipeline Market Report (The USPs):

- FUEL TYPE ADOPTION & COST METRICS – helps you compare transported fuel volume shares, cost-per-MMBtu differences, and adoption growth rates of CNG vs. LNG, enabling optimized fuel strategy decisions. APPLICATION-LEVEL EFFICIENCY INSIGHTS – helps you assess deployment share across transportation and industrial/commercial uses, along with delivery turnaround times and fleet utilization for operational planning. MARKET REVENUE & COMPETITIVE POSITIONING INDEX – helps you understand annual market growth, company-wise market share, and contract value trends to identify high-value opportunities and leading logistics players. INFRASTRUCTURE & SAFETY PERFORMANCE METRICS – helps you evaluate the number of established virtual pipeline corridors, compliance with global safety standards, and readiness of transport fleets. DIGITAL MONITORING & FLEET TECHNOLOGY ADOPTION RATE – helps you track the share of fleets equipped with real-time monitoring and pressure management systems, revealing tech advancement and risk-mitigation levels. COST-TO-DELIVERY OPTIMIZATION BENCHMARKS – helps you analyze transportation cost structures, turnaround speeds, and utilization rates to support supply chain optimization and operational efficiency improvements.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment