Gold Surges Rs 3,040 To Rs 1.33 Lakh/10G

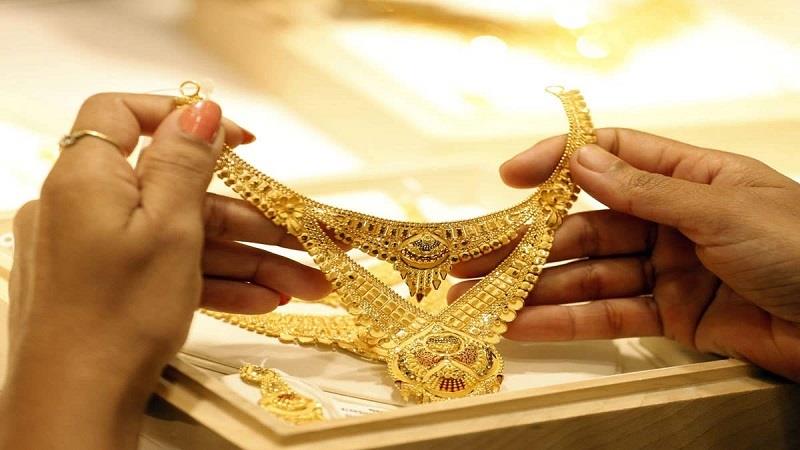

File photo

New Delhi- Gold prices surged by Rs 3,040 to Rs 1,33,200 per 10 grams in the national capital on Monday, tracking strong global trends and a weak US dollar, according to the All India Sarafa Association.

Analysts said sustained jewellery demand amid the ongoing wedding season supported the precious metal.

The precious metal of 99.5 per cent purity zoomed by Rs 3,040 to Rs 1,32,600 per 10 grams (inclusive of all taxes).

ADVERTISEMENTGold is now inching closer to its all-time high of Rs 1,34,800 per 10 grams (99.9 per cent purity) and Rs 1,34,200 per 10 grams (99.5 per cent), respectively, traders said.

“Gold extended last week's rally, supported by a softer US dollar, growing expectations of a Federal Reserve rate cut next week, upbeat forecasts from major banks, and continued robust central bank buying, all of which are helping drive the market higher,” Saumil Gandhi, Senior Analyst – Commodities at HDFC Securities, said.

Silver continued its upward march for the fifth straight day, surging by Rs 5,800 to Rs 1,77,000 per kilogram (inclusive of all taxes), as per the association.

In the international market, spot gold rose by USD 42.29, or 1 per cent, to USD 4,261.52 per ounce, as the dollar index was quoting 0.19 per cent lower at 99.27, lending support to bullion prices.

“Spot gold held its gains and trades above USD 4230 per ounce ahead of US manufacturing PMI, ADP employment, services PMI and the core PCE index, alongside speeches from Federal Reserve officials and the Fed Chair Jerome Powell's remarks later in the day,” Kaynat Chainwala, AVP Commodity Research, Kotak Securities, said.

She added that prospects of Kevin Hassett, who is widely viewed as favouring lower rates, emerging as a frontrunner to replace Fed Chair Powell may reinforce rate-cut bets if US economic indicators soften further.

Since the beginning of the year, the yellow metal has surged by USD 1,656.57, or 63.6 per cent, from USD 2,605.77 per ounce on December 31, 2024.

Rising for the sixth straight day, spot silver gained 2 per cent to hit a fresh record of USD 57.85 per ounce in the global markets. The metal jumped 15.7 per cent over the past week and has doubled so far in 2025, rallying 100 per cent from USD 28.97 per ounce on December 31, 2024.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment