403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

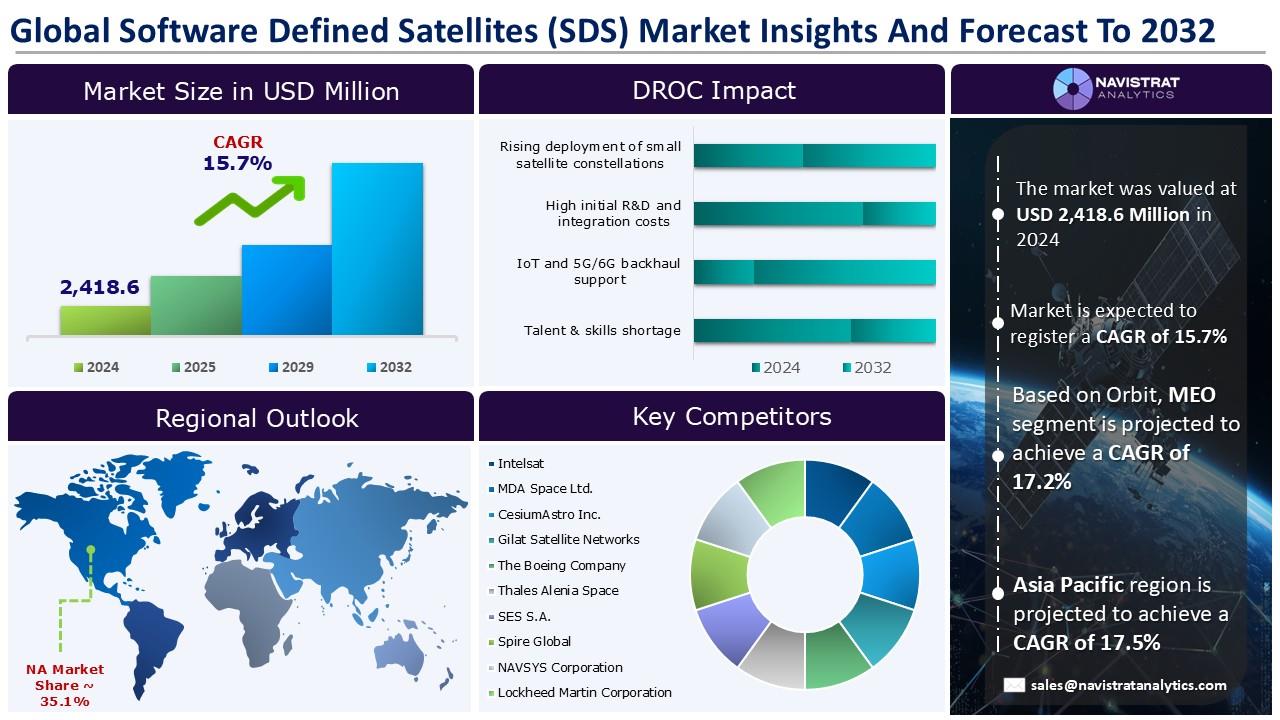

Software Defined Satellites (SDS) Market Size to Reach USD 7,802.3 million in 2032

(MENAFN- Navistrat Analytics) November 18, 2025- The rising deployment of small satellite constellations has emerged as a major driver of revenue growth in the Software Defined Satellites (SDS) market. These constellations are revolutionizing data collection by offering frequent revisit rates and continuous global coverage of key regions. Equipped with advanced imaging technologies, small satellites deliver high-resolution, near-real-time data, empowering both government and commercial organizations to make more informed decisions. The increasing popularity of small satellite constellations reflects a growing demand for cost-effective, scalable, and agile Earth observation solutions. For instance, in 2021, China unveiled its Guowang constellation, a large-scale initiative comprising 13,000 satellites overseen by the government to enhance national space capabilities and global connectivity.

In May 2024, SKY Perfect JSAT, Asia’s largest satellite operator, entered a partnership with Thales Alenia Space, a joint venture between Thales and Leonardo, to build JSAT-31—a new-generation software-defined satellite based on Thales Alenia Space’s Space INSPIRE (INstant SPace In-orbit REconfiguration) platform. This collaboration marks a step forward in flexible, reprogrammable satellite infrastructure that allows for rapid adaptation to evolving mission needs.

Unlike terrestrial networks, satellite networks face inherent challenges, including high latency, dynamic topologies, and limited bandwidth resources. Consequently, traditional terrestrial network technologies are often unsuitable for satellite systems. The evolution of satellite communications has accelerated alongside terrestrial networks, intensifying the need for seamless integration between the two domains.

Segments market overview and growth Insights

Based on software architecture segment, Software Defined Satellites (SDS) market is segmented into on-board virtualized platforms, Software-Defined Radios (SDR), Cloud-Native Ground Integration (SaaS and PaaS), middleware & bus abstraction layers, and others. Software-Defined Radios (SDR) segment contributed the largest share in 2024. Software-Defined Radios (SDRs) play a pivotal role in this transformation by enabling satellite systems to execute functions—such as modulation, demodulation, and signal processing—via software rather than fixed hardware. These SDRs are increasingly used in ground-space and inter-satellite communications, as well as in on-orbit servicing applications. With the growing demand for high processing power, both Earth Observation (EO) and communication satellites are rapidly adopting SDR technology.

Regional market overview and growth insights

North America held the largest market share in 2024. Market growth is primarily driven by demand for flexible, reconfigurable satellite architectures, advances in onboard computing and AI/ML integration, and increasing private investment in satellite communication and exploration missions. In April 2023, Kratos Defense & Security Solutions, Inc., a leading technology company focused on defense, national security, and advanced communications, announced a strategic partnership with ALL.SPACE, the world’s sole provider of multi-orbit smart terminals. This collaboration aims to jointly develop and deliver integrated solutions that enhance the performance and flexibility of software-defined satellite ground systems.

Competitive Landscape and Key Competitors

The Software Defined Satellites (SDS) market is characterized by a fragmented structure, with many competitors holding a significant share of the market. List of major players included in the Software Defined Satellites (SDS) market report are:

o Intelsat

o MDA Space Ltd.

o CesiumAstro Inc.

o Gilat Satellite Networks

o The Boeing Company

o Thales Alenia Space

o SES S.A.

o Spire Global

o NAVSYS Corporation

o Lockheed Martin Corporation

o L3Harris Technologies, Inc.

o Reorbit

o Hensoldt AG

o SpaceX

o Eutelsat Communications SA

Major strategic developments by leading competitors

Helsing: In February 2025, Helsing and Loft Orbital announced a partnership to develop a multi-sensor, AI-enabled satellite constellation to enhance real-time defense intelligence for Europe.

MDA Ltd.: In September 2023, MDA Ltd. introduced its software-defined digital satellite product line, marking a shift from analog to digital platforms in line with the global move toward reprogrammable satellite systems.

Navistrat Analytics has segmented the Software Defined Satellites (SDS) market based on software architecture, deployment, orbit, application, end-use, and region:

• Software Architecture Outlook (Revenue, USD Million; 2022-2032)

o On-board Virtualized Platforms

o Software-Defined Radios (SDR)

o Cloud-Native Ground Integration (SaaS and PaaS)

o Middleware & Bus Abstraction Layers

o Others

• Deployment Outlook (Revenue, USD Million; 2022-2032)

o CubeSats or NanoSats

o SmallSats or Microsats

o Medium and Large Satellites

• Orbit Outlook (Revenue, USD Million; 2022-2032)

o LEO

o MEO

o GEO

• Application Outlook (Revenue, USD Million; 2022-2032)

o Earth Observation (EO) and Remote Sensing

o Satellite Communications (Satcom)

o Navigation & PNT augmentation

o Scientific/Research Missions

o Others

• End-Use Outlook (Revenue, USD Million; 2022-2032)

o Commercial Service Providers

o Defence & National Security Agencies

o Government and Civil Agencies

o Enterprise and Vertical Customers

• Regional Outlook (Revenue, USD Million; 2022-2032)

o North America

a. U.S.

b. Canada

c. Mexico

o Europe

a. Germany

b. France

c. U.K.

d. Italy

e. Spain

f. Benelux

g. Nordic Countries

h. Rest of Europe

o Asia Pacific

a. China

b. India

c. Japan

d. South Korea

e. Oceania

f. ASEAN Countries

g. Rest of APAC

o Latin America

a. Brazil

b. Rest of LATAM

o Middle East & Africa

a. GCC Countries

b. South Africa

c. Israel

d. Turkey

e. Rest of MEA

In May 2024, SKY Perfect JSAT, Asia’s largest satellite operator, entered a partnership with Thales Alenia Space, a joint venture between Thales and Leonardo, to build JSAT-31—a new-generation software-defined satellite based on Thales Alenia Space’s Space INSPIRE (INstant SPace In-orbit REconfiguration) platform. This collaboration marks a step forward in flexible, reprogrammable satellite infrastructure that allows for rapid adaptation to evolving mission needs.

Unlike terrestrial networks, satellite networks face inherent challenges, including high latency, dynamic topologies, and limited bandwidth resources. Consequently, traditional terrestrial network technologies are often unsuitable for satellite systems. The evolution of satellite communications has accelerated alongside terrestrial networks, intensifying the need for seamless integration between the two domains.

Segments market overview and growth Insights

Based on software architecture segment, Software Defined Satellites (SDS) market is segmented into on-board virtualized platforms, Software-Defined Radios (SDR), Cloud-Native Ground Integration (SaaS and PaaS), middleware & bus abstraction layers, and others. Software-Defined Radios (SDR) segment contributed the largest share in 2024. Software-Defined Radios (SDRs) play a pivotal role in this transformation by enabling satellite systems to execute functions—such as modulation, demodulation, and signal processing—via software rather than fixed hardware. These SDRs are increasingly used in ground-space and inter-satellite communications, as well as in on-orbit servicing applications. With the growing demand for high processing power, both Earth Observation (EO) and communication satellites are rapidly adopting SDR technology.

Regional market overview and growth insights

North America held the largest market share in 2024. Market growth is primarily driven by demand for flexible, reconfigurable satellite architectures, advances in onboard computing and AI/ML integration, and increasing private investment in satellite communication and exploration missions. In April 2023, Kratos Defense & Security Solutions, Inc., a leading technology company focused on defense, national security, and advanced communications, announced a strategic partnership with ALL.SPACE, the world’s sole provider of multi-orbit smart terminals. This collaboration aims to jointly develop and deliver integrated solutions that enhance the performance and flexibility of software-defined satellite ground systems.

Competitive Landscape and Key Competitors

The Software Defined Satellites (SDS) market is characterized by a fragmented structure, with many competitors holding a significant share of the market. List of major players included in the Software Defined Satellites (SDS) market report are:

o Intelsat

o MDA Space Ltd.

o CesiumAstro Inc.

o Gilat Satellite Networks

o The Boeing Company

o Thales Alenia Space

o SES S.A.

o Spire Global

o NAVSYS Corporation

o Lockheed Martin Corporation

o L3Harris Technologies, Inc.

o Reorbit

o Hensoldt AG

o SpaceX

o Eutelsat Communications SA

Major strategic developments by leading competitors

Helsing: In February 2025, Helsing and Loft Orbital announced a partnership to develop a multi-sensor, AI-enabled satellite constellation to enhance real-time defense intelligence for Europe.

MDA Ltd.: In September 2023, MDA Ltd. introduced its software-defined digital satellite product line, marking a shift from analog to digital platforms in line with the global move toward reprogrammable satellite systems.

Navistrat Analytics has segmented the Software Defined Satellites (SDS) market based on software architecture, deployment, orbit, application, end-use, and region:

• Software Architecture Outlook (Revenue, USD Million; 2022-2032)

o On-board Virtualized Platforms

o Software-Defined Radios (SDR)

o Cloud-Native Ground Integration (SaaS and PaaS)

o Middleware & Bus Abstraction Layers

o Others

• Deployment Outlook (Revenue, USD Million; 2022-2032)

o CubeSats or NanoSats

o SmallSats or Microsats

o Medium and Large Satellites

• Orbit Outlook (Revenue, USD Million; 2022-2032)

o LEO

o MEO

o GEO

• Application Outlook (Revenue, USD Million; 2022-2032)

o Earth Observation (EO) and Remote Sensing

o Satellite Communications (Satcom)

o Navigation & PNT augmentation

o Scientific/Research Missions

o Others

• End-Use Outlook (Revenue, USD Million; 2022-2032)

o Commercial Service Providers

o Defence & National Security Agencies

o Government and Civil Agencies

o Enterprise and Vertical Customers

• Regional Outlook (Revenue, USD Million; 2022-2032)

o North America

a. U.S.

b. Canada

c. Mexico

o Europe

a. Germany

b. France

c. U.K.

d. Italy

e. Spain

f. Benelux

g. Nordic Countries

h. Rest of Europe

o Asia Pacific

a. China

b. India

c. Japan

d. South Korea

e. Oceania

f. ASEAN Countries

g. Rest of APAC

o Latin America

a. Brazil

b. Rest of LATAM

o Middle East & Africa

a. GCC Countries

b. South Africa

c. Israel

d. Turkey

e. Rest of MEA

Navistrat Analytics

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment