Rates Spark: Dutch Pension Reforms May Be Pushing For Steeper 10S30s

Euro rates are pushing for new highs, but we don't think the front end can drive the bearish move much longer. Markets price in only a 30% chance of another cut next year, which seems to be pushing the limit given there are still pockets of weakness in the data and the balance of risks remains tilted towards the downside. From a (geo)political perspective, we can still think of plenty of scenarios that would challenge the growth outlook. Trump's trade deals don't seem set in stone, whilst US economic weakness, French politics and the Ukraine conflict also add to the uncertainty.

Meanwhile, the inflation outlook is also still tilted towards disinflation, in our view, which would make a cut more likely than a hike if anything. And if the ECB were to ease more, then moving in pairs of two cuts would make more sense than just tweaking the rate by a mere 25bp. Having said that, the 2Y inflation swap is at just 1.75% which suggests markets are already positioned for an undershoot of the target. Nevertheless, we will need more data to gain confidence that inflation won't fall too far.

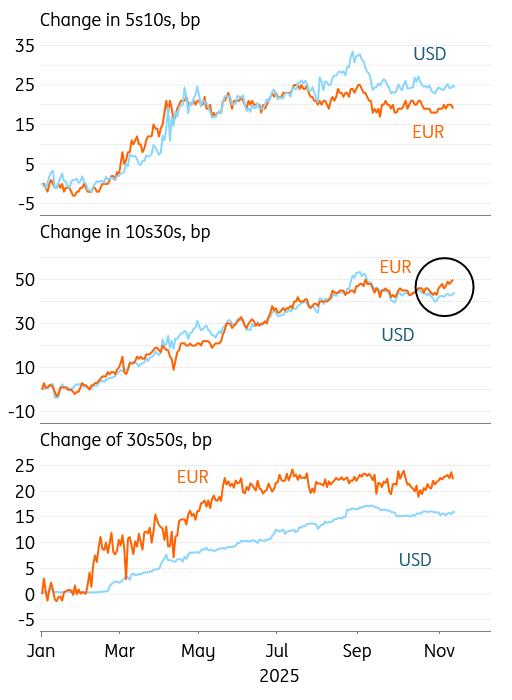

Dutch pensions fund transition at work in back end steepeningFurther out on the curve, the Dutch pension reforms could finally be pushing for a steepening of the 10s30s beyond the US curve. Many investors turned more cautious after the US flattening challenged this popular trade, but with 1 January approaching, we may see a comeback.

In our view, the steepening seen in the 30s50s is a good reason to think pension-related activity is at play here. Recent transition approvals from the Dutch central bank, including headlines this week, reduce the risk of delays. At the same time, the IT side remains complex and could still force delays even in December.

Dutch pension reforms may finally be pushing for a steeper 10s30s

Source: ING, Macrobond Friday's events and market view

It will be another quiet day in terms of data, as many official releases in the US still face delays despite the government having reopened – the originally scheduled retail sales and PPI for October should still be impacted. More focus will be on Fed speakers after the hawkish tones of late have also pressured front-end rates higher. Schmid and Logan, two hawkish-leaning Fed members, are scheduled to speak today alongside Bostic.

The eurozone will release final October CPI data for Spain and France, as well as the second estimate for third-quarter GDP growth. Among the ECB officials speaking today, chief economist Lane should be the most watched.

There is no government bond supply scheduled for the day. The European sovereign ratings scheduled for review and possible updates after markets close are Cyprus (S&P, A-/Stable), Greece (Fitch, BBB-/Positive) and Portugal (Moody's, A3/Stable).

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment