Hedge Funds On Course For Best Year Of The Decade - Citco

-

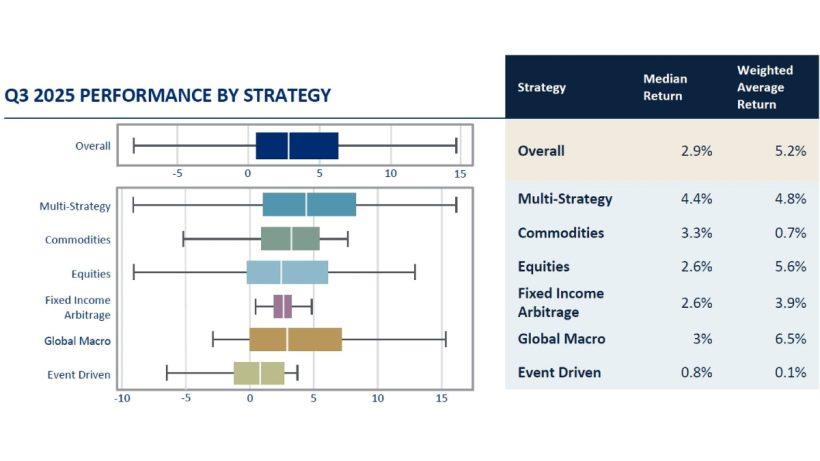

Hedge funds saw a return of 5.2% in Q3 led by Global Macro strategies

All strategy types positive in Q3

Inflows continue, with Multi-Strategy funds taking lion's share

New York/London, 29th October 2025: Hedge funds delivered their twelfth consecutive quarter of positive returns in Q3 to leave them on track for their best calendar year of the decade, with all strategy types in the green over the latest three-month period.

Building on gains made earlier in the year, funds administered by the Citco group of companies (Citco) achieved a weighted average return of 5.2% in Q3, with 80% of funds seeing positive returns.

The latest quarterly gains mean hedge funds have achieved a weighted average return of 16.6% year-to-date (YTD). A positive final quarter could see the average fund surpass 2020's annual return of 18.3%.

Throughout the year the trio of Multi-Strategy, Equity and Global Macro funds have topped the performance charts, and it was a repeat of that story in Q3. Global Macro funds took top spot in Q3, with a weighted average return of 6.5%, with Equity strategies a close second at 5.6%, and Multi-Strategy funds returning 4.8%. Year-to-date, Multi-Strategy funds have a weighted average return of 19.3%, with Equities at 17.1% and Global Macro at 15.8%.

On an Assets under Administration (AUA) basis, the largest funds had the highest weighted average returns, with funds with more than $3bn of AUA and those with between $1bn-$3bn of AUA both returning 5.5%.

Going hand-in-hand with positive performance, hedge funds saw net inflows every month in Q3. Driven by demand for Multi-Strategy funds, total net inflows came in at $23.5bn in Q3, with subscriptions of $60.1bn well ahead of redemptions of $36.5bn. Combined with inflows in Q1 and Q2, total net inflows YTD to hedge funds administered by Citco stand at $41.3bn.

The third quarter also broke new ground for trading activity across Citco's clients in terms of monthly and quarterly figures, with multiple asset classes seeing record volumes.

Meanwhile, treasury payment volumes continued to soar, with another milestone achieved in terms of volumes in Q3 after the number of payments processed in a single quarter set a new record.

Declan Quilligan, Head of Hedge Fund Services, Citco Fund Services (Ireland) Limited, said:

“Hedge funds are very much back in vogue, and this latest quarter of positive performance cements their return to the mainstream.

“Reaching 12 consecutive quarters of positive returns is a milestone in itself and while we will no doubt see more twists and turns over the final few months of the year, 2025 could well be a banner year for hedge funds.

“Investors are taking advantage of this consistent run of performance, with inflows every month in Q3, as the combination of diversification and returns continues to prove enticing.”

About the Citco group of companies (Citco)

The Citco group of companies (Citco) is a network of independent companies worldwide. These companies are leading providers of asset-servicing solutions to the global alternative investment industry. With over $2 trillion in assets under administration and operations spanning across 36 countries, Citco's unique culture of innovation and client-driven solutions have provided Citco's clients with a trusted partner for more than four decades. Having grown organically into one of the largest asset servicers in the industry, Citco's Fund Services companies offer a full suite of middle office and back office services including treasury and loan handling, daily NAV calculations and investor services, corporate and legal services, regulatory and risk reporting as well as tax and financial reporting services. Investing heavily in innovation and technology whilst further developing its current suite of client-friendly solutions, Citco will continue into the future as a flagbearer for the asset-servicing industry.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment