Hyperliquid Strategies Secures $1B To Expand HYPE Acquisitions

- Hyperliquid Strategies files with the SEC to raise $1 billion through an offering of 160 million shares, aimed at purchasing more HYPE tokens. The firm plans to leverage its merger with biotech company Sonnet BioTherapeutics and SPAC Rorschach I LLC, led by notable industry figures including David Schamis and Bob Diamond. Post-merger, Hyperliquid will hold over 12.6 million HYPE tokens, worth nearly $470 million, making it the largest corporate holder of the token. The move reflects a broader trend of companies diversifying into crypto treasuries beyond Bitcoin and Ethereum, although sustainability during market downturns remains uncertain. Decentralized derivatives trading volume hit $1 trillion in October, driven by the rising popularity of perpetual futures and innovative crypto trading strategies.

Hyperliquid Strategies is increasing its efforts to expand its crypto reserves through a significant capital raise, as detailed in its recent SEC filings. The company plans to issue up to 160 million shares of common stock, with proceeds allocated for further purchases of HYPE tokens, which power the decentralized derivatives platform. Serving as an advisor, Chardan Capital Markets is facilitating this offering.

Source: CointelegraphHyperliquid Strategies, a pending merger entity, is formed through the combination of Nasdaq -listed biotech firm Sonnet BioTherapeutics and the special purpose acquisition company Rorschach I LLC. The newly merged company will be led by CEO David Schamis, with Bob Diamond, former Barclays CEO, serving as chairman.

The strategic move appears to have spurred an almost 8% rally in the HYPE token, pushing its price to $37.73 over the past 24 hours, amid a broader market decline of 0.6%, according to data from CoinGecko.

Dominance in HYPE holdings signals strategic positioningFollowing the merger, Hyperliquid Strategies is projected to hold over 12.6 million HYPE tokens-valued at close to $470 million-complemented by an additional $305 million in cash reserves. The firm intends to use these funds to buy more tokens, potentially reinforcing its position as the largest corporate holder of HYPE, data from CoinGecko shows.

This approach exemplifies a broader trend where firms accumulate crypto assets beyond Bitcoin and Ether, often to build resilient and diversified crypto treasuries. While such strategies have often initially inflated share prices, questions remain on their long-term viability during market downturns, as analysts warn against overexposure during periods of volatility.

Nevertheless, demand for HYPE and similar assets may endure due to their increasing popularity in decentralized perpetual futures trading-a sector that has surged recently, driven by the need for 24/7 trading, high leverage, and opportunities to profit from both rising and falling markets.

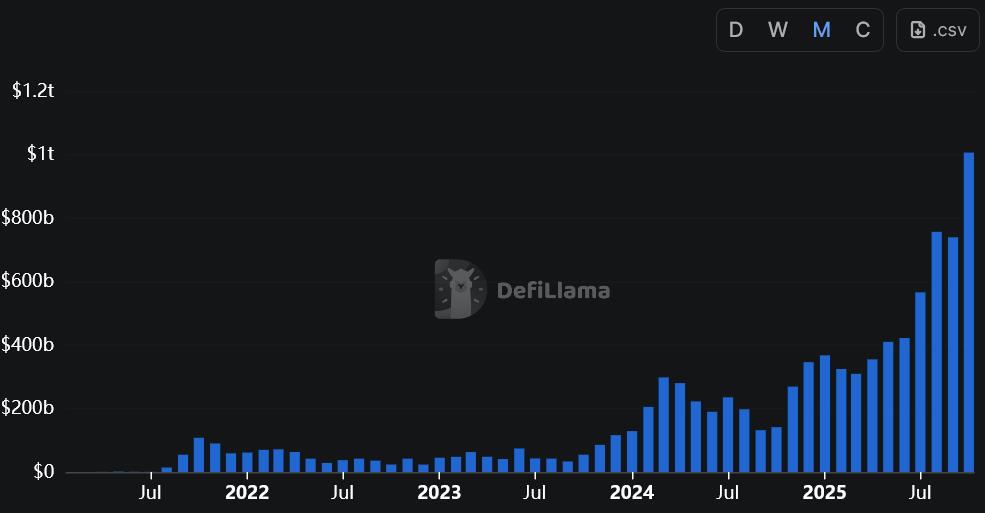

Decentralized perpetual futures trading hits new heightsThe volume of decentralized derivatives trading has reached unprecedented levels, surpassing $1 trillion in October alone, according to DeFiLlama. In just the first 23 days of the month, trading volume has already exceeded September's record of $772 billion. October 10 marked a daily trading record of $78 billion.

Change in monthly perps trading volume since February 2021. Source: DeFiLlama

Leading October's trading volume is Hyperliquid, which has executed $317.6 billion in transactions this month, followed by Lighter, Aster, and edgeX, with $255.4 billion, $177.6 billion, and $60.6 billion respectively. This growth underscores the rising importance of decentralized derivatives in modern crypto markets, attracting both institutional and retail traders seeking innovative trading opportunities.

As decentralized derivatives trading continues to grow, it consolidates its position as a vital component of the expanding blockchain ecosystem, particularly in the context of crypto regulation and market resilience.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment