Tabaqchali: Corporate Earnings Growth Underpins Iraq Market Rally

Any opinions expressed are those of the author, and do not necessarily reflect the views of Iraq Business News .

Market Marks a Milestone, Closing at an All-time High

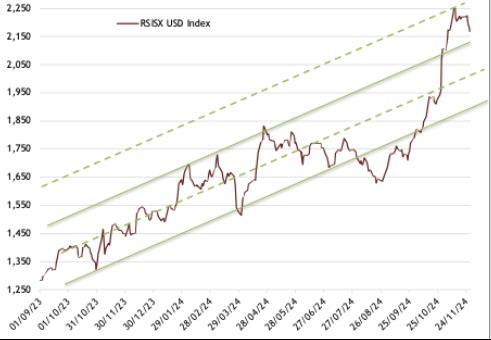

The market, as measured by the Rabee Securities U. S. Dollar Equity Index (RSISX USD Index), was 2.9%, in November and is up 41.7% for the year.

The market's powerful momentum over the last two months continued into the second week of the November when it was up 7.3%, before profit-taking cut that to an increase of 2.9%, suggesting that the market will likely consolidate these gains or pull-back somewhat.

However, its technical picture continues to be positive, and the likely consolidation or pullback, should be within its multi-month uptrend as much as they have done over the prior months (chart below).

Rabee Securities U.S. Dollar Equity Index

(Source: Iraq Stock Exchange, Rabee Securities, AFC Research, daily data as of November 30th)

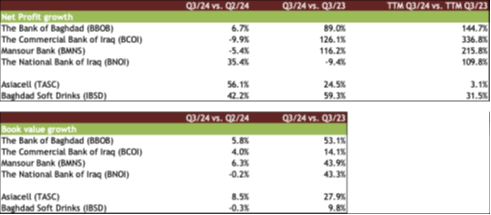

Underpinning the market's multi-month rally has been the strong net profit and shareholder equity growth of the top companies in the market, both quarter-over-quarter and year-over-year, which continued with the release of 3rd quarter of 2024 (Q3/24) results.

Given that these companies operate in different sectors, each with its own dynamics, and each company within the same sector with its own particular dynamics, the tables below aim to capture these differences by looking at both quarterly and yearly growth. They compare Q3/24 to Q2/24, Q3/24 to Q3/23 to capture quarterly growth both sequentially and year-over-year, as well as trailing 12 months (TTM) ending in Q3/24 to TTM ending in Q3/23 to capture full-year growth.

Earning and book value growth for selected companies

(Source: Rabee Securities, company reports, and AFC Research. Notes (*), data as of Q3/2024)

The background to the healthy growth enjoyed by these companies is the relative stability that the country has enjoyed over the last few years, which provided a stable and predictable macroeconomic framework for businesses and individuals to operate in and to plan for capital investments on a scale not seen in the last prior decades of conflict; that in turn, should be sustained by the population's pent-up demand for goods and services to catch up with the rest of the world.

Supporting this growth are the liquidity injections into the economy by the government's expansionary three-year budget for 2023-25 that resulted in an estimated real non-oil GDP growth in 2023 of 6.0%, followed by an estimated 3.5% in 2024, which is projected to grow further still by 3.3% in 2025 (IMF). For the banking sector, this has been further fuelled by the significant fundamental developments that promise to accelerate the adoption of banking and bring about a transformation of the sector and its role in the economy, which in turn should promote the growth of other companies.

The equity market, as measured by the Rabee Securities U. S. Dollar Equity Index (RSISX USD Index), having surpassed its 2014 peak by 4.6%, has the potential to rally further reflecting the powerful dynamics discussed here.

However, significant risks remain given Iraq's recent history of conflict, extreme leverage to volatile oil prices, as well as the risk that the widening of the current Middle East conflict will not be contained and evolve to destabilise the region -even though the temporary ceasefire in Lebanon lowered the likelihood of a widening, yet risks remain that this will not hold or that other negative developments take place.

Please click here to download Ahmed Tabaqchali's full report in pdf format .

Mr Tabaqchali (@AMTabaqchali ) is the Chief Strategist of the AFC Iraq Fund, and is an experienced capital markets professional with over 25 years' experience in US and MENA markets. He is a Visiting Fellow at the LSE Middle East Centre, Senior Fellow at the Institute of Regional and International Studies (IRIS), and a Senior Non-resident Fellow at the Atlantic Council.

His comments, opinions and analyses are personal views and are intended to be for informational purposes and general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any fund or security or to adopt any investment strategy. It does not constitute legal or tax or investment advice. The information provided in this material is compiled from sources that are believed to be reliable, but no guarantee is made of its correctness, is rendered as at publication date and may change without notice and it is not intended as a complete analysis of every material fact regarding Iraq, the region, market or investment.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Casper Network Advances Regulated Tokenization With ERC-3643 Standard

- Forex Expo Dubai Wins Guinness World Recordstm With 20,021 Visitors

- Superiorstar Prosperity Group Russell Hawthorne Highlights New Machine Learning Risk Framework

- Freedom Holding Corp. (FRHC) Shares Included In The Motley Fool's TMF Moneyball Portfolio

- Versus Trade Launches Master IB Program: Multi-Tier Commission Structure

- Ozzy Tyres Grows Their Monsta Terrain Gripper Tyres Performing In Australian Summers

Comments

No comment