China's Continued Deflationary Pressure Supports Case For Monetary Easing

| -0.3% YoY | China's September CPI inflation |

| Lower than expected |

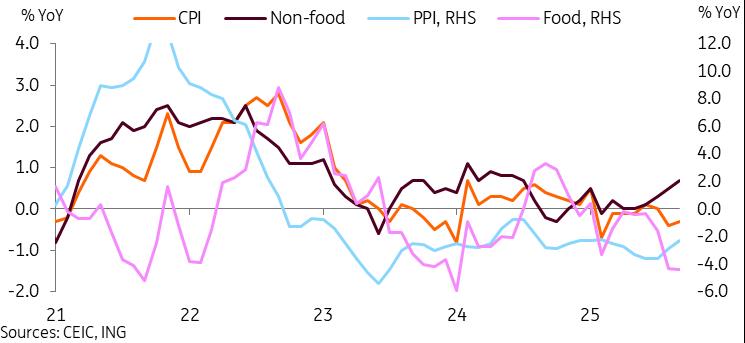

CPI inflation edged up but remained in deflation

China's CPI inflation edged up in September, but the economy remained in deflation. The main reason is a continued slide in food prices down to -4.4% YoY, a 20-month low. This is, in part, base effect-driven, as MoM prices actually picked up 0.7%. The primary culprit has been pork (-17%), which is currently in a downward trend and likely to continue dragging food inflation for several more months. On a YoY basis, we continued to see notable drags from vegetable (-13.7%), egg (-11.9%), and fruit (-4.2%) prices despite MoM gains for each of these categories. The drag from these categories may persist in October, but should ease from November onward, helping to support a turnaround of food inflation.

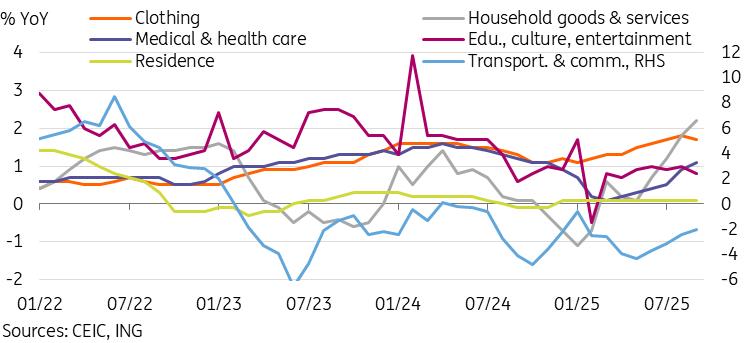

The silver lining in the data was that non-food inflation picked up to 0.7% YoY, up for a fourth consecutive month despite a -0.1% MoM dip. Household goods and services rose 2.2% YoY, driven by a 5.5% YoY uptick in household appliance prices. Sports & recreation (0.8%) and healthcare (1.1%) also contributed positively to non-food inflation. However, rent prices remained flat in YoY terms in September amid the property market slump. Transportation (-2.0%) continued to experience deflation due to falling auto and fuel prices.

If the recovery of non-food prices is sustained, it would go a long way toward pushing China out of deflationary territory. But the MoM decline suggests that, at this stage, this is still questionable. As food prices are often cyclical, this drag will fade. We should see China's CPI inflation data edge back into positive territory, potentially before year-end but more likely next year.

PPI inflation unsurprisingly remained in deflationary territory for the 36th consecutive month, at -2.3% YoY. However, this represented a second straight month of higher PPI inflation, as input prices edged up a little higher from -4.0% YoY to -3.1% YoY. Most industries continued to face falling ex-factory prices. Exceptions are non-ferrous metals mining (13.9%), non-ferrous metal smelting and processing (6.5%), as well as water production and supply (2.3%).

Lower-than-expected third-quarter inflation may translate to a more supportive GDP deflator in next week's GDP read, adding upside risk to our current 4.5% YoY forecast.

Considering the slowing momentum in 3Q, another month of deflation suggests that monetary policy easing remains on the table. The recent escalation of tensions between China and the US ahead of potential talks between Presidents Xi and Trump at the end of the month could keep the PBOC on hold for the rest of October. That would leave ammunition to support markets if talks do not go well. November, consequently, remains an interesting window to watch for potential easing.

Non-food prices continued to show signs of improvement

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Casper Network Advances Regulated Tokenization With ERC-3643 Standard

- Forex Expo Dubai Wins Guinness World Recordstm With 20,021 Visitors

- Superiorstar Prosperity Group Russell Hawthorne Highlights New Machine Learning Risk Framework

- Freedom Holding Corp. (FRHC) Shares Included In The Motley Fool's TMF Moneyball Portfolio

- Versus Trade Launches Master IB Program: Multi-Tier Commission Structure

- Ozzy Tyres Grows Their Monsta Terrain Gripper Tyres Performing In Australian Summers

Comments

No comment