Binance Launches $400M Support Program For Traders Affected By Friday's Market Drop

- Binance introduces a $400 million relief fund, including token vouchers and a low-interest loan pool, to aid affected traders and ecosystem players. Qualified users can receive vouchers ranging from $4 to $6,000, provided they experienced liquidations during a specific period. The exchange clarifies that it does not accept liability for user losses, framing the move as a confidence-restoring effort. This follows Binance's prior announcement of a $45 million“reload airdrop” to compensate memecoin traders facing losses. The crypto industry continues to grapple with repercussions from market disruptions caused by macroeconomic tensions and leverage liquidations.

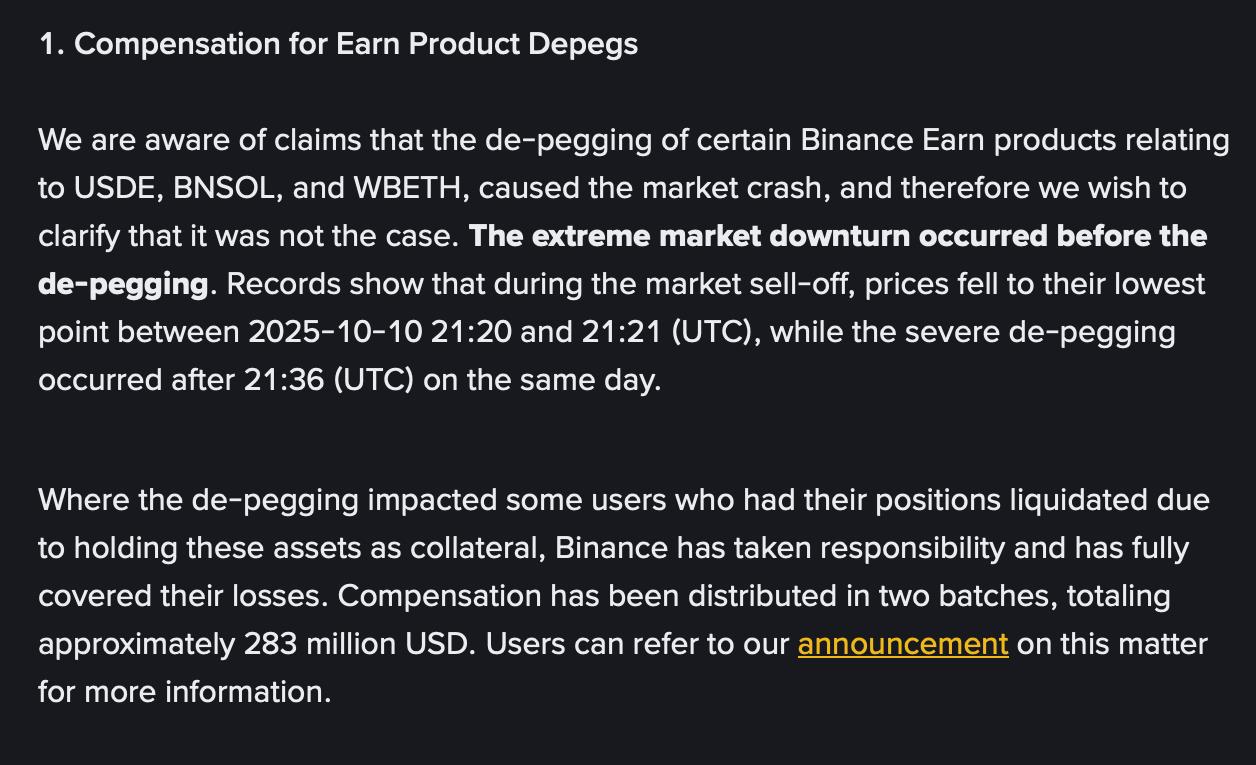

After a dramatic decline in cryptocurrency prices on Friday, triggered by geopolitical tensions and macroeconomic concerns, Binance announced a comprehensive $728 million recovery package. This encompasses recent measures like a $45 million airdrop targeting memecoin traders and $283 million in immediate post-crash compensation. The newest contribution, a $400 million industry fund, aims to stabilize the ecosystem and support key participants affected by the volatility.

Source: cz_binanceThe downturn resulted in over $19 billion in leveraged positions liquidated within 24 hours, marking one of the most significant single-volume liquidations in crypto history. Amid the chaos, Binance faced scrutiny over technical glitches that hindered some traders from closing their positions and discrepancies in stablecoin pricing caused by oracle malfunctions. Several altcoins, including Enjin (ENJ), Cosmos (ATOM), and IoTeX (IOTX), temporarily displayed inaccurate prices, further complicating the situation.

Binance responded swiftly with a statement asserting that its core futures systems remained operational throughout the event, even as users faced challenges and confusion. The exchange emphasized its ongoing commitment to industry stability, launching a combined relief effort that includes a $45 million airdrop, immediate compensation totaling $283 million, and the new $400 million fund.

Source: Binance Community reactions and industry concerns

The recent announcements have elicited mixed reactions within the crypto community. Some traders and analysts lauded Binance's efforts to support affected users and restore faith in the market recovery. Conversely, critics pointed out systemic issues, with one user arguing that internal oracle mispricing was a primary cause of the cascading liquidations and subsequent market crash. Others expressed skepticism about the adequacy of Binance's compensation, considering it insufficient to cover the full extent of traders' losses.

Source: SeedliCapital

As the crypto markets continue to face macroeconomic headwinds, regulatory scrutiny and technological vulnerabilities remain pressing concerns for industry stakeholders. Binance's proactive measures highlight a pivotal moment for risk management and industry resilience in the evolving landscape of cryptocurrency and blockchain trading.

Crypto Investing Risk Warning

Crypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Crypto Market Update: Pepeto Advances Presale With Staking Rewards And Live Exchange Demo

- Tria Raises $12M To Be The Leading Self-Custodial Neobank And Payments Infrastructure For Humans And AI.

- Simplefx Relaunches First Deposit Bonus

- Chartis Research And Metrika Release Comprehensive Framework For Managing Digital Asset Risk

- Whale.Io Launches Battlepass Season 3, Featuring $77,000 In Crypto Casino Rewards

- M2 Capital Announces $21 Million Investment In AVAX Digital Asset Treasury, AVAX One

Comments

No comment