Shubh Labh Or Stock Loss? A Reality Check On Festive Picks

The annual rush of 'Diwali picks' is here, with brokerages promising to light up your portfolio like a firecracker. But before you load up on their“shubh labh" (auspicious profit) stocks, remember that the gains are not certain.

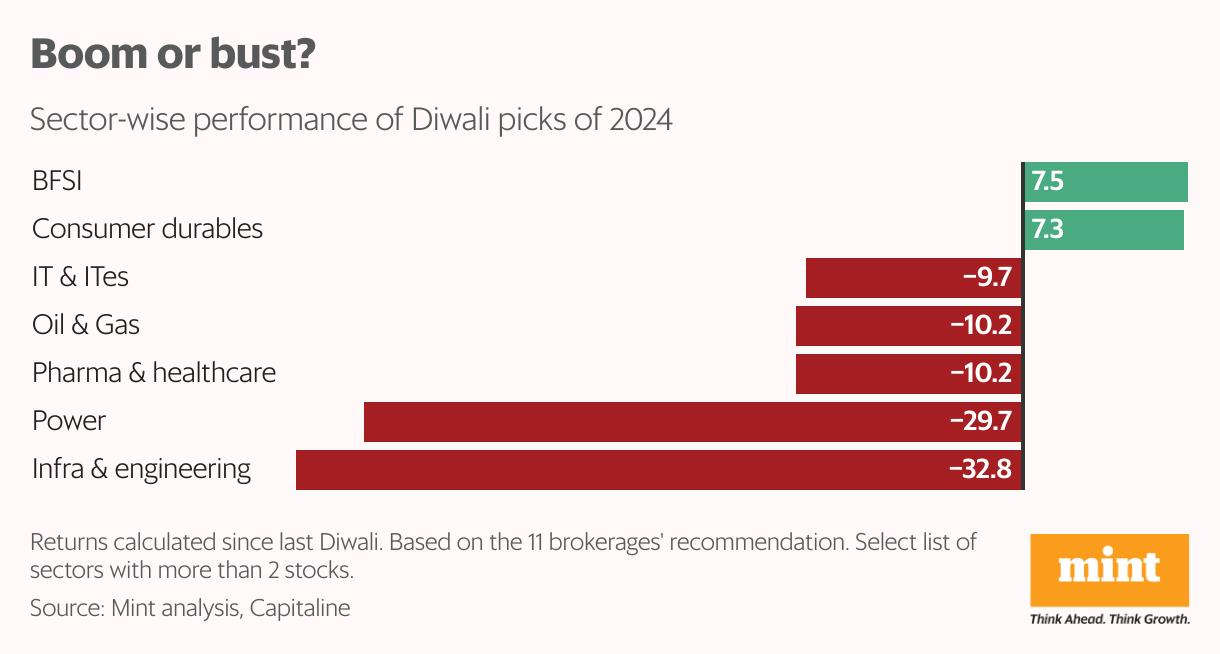

Mint collated and analyzed these much-hyped festive recommendations from the last two Smavats (Hindu calendar years starting Diwali)-focusing on this timeframe due to limitations in collecting older data. The results for Samvat 2081 (2024-25) tell a story of dashed hopes. Last year, nearly a dozen brokerages collectively recommended 58 diverse stocks-spanning banking, IT, and consumer goods-often with a 12-month holding period. The performance since last Diwali? Their shine has severely dulled. A staggering two-thirds (66%) of these festive picks actually declined, while only a third managed to outperform the Sensex's modest 3.2% return during the same period.

However, the tables turned with the Muhurat picks for Samvat 2080 (2023-24). Here, returns were stronger and genuinely impressive. Of the 45 stocks recommended by a few leading brokerages in Samvat 2080, nearly half (49%) gained over 23% in the year since Diwali, decisively outpacing the Sensex's 22% rise. Only nine stocks fell during this period. This upbeat performance was driven by optimism around India's growth momentum and expectations of political stability ahead of the 2024 Lok Sabha elections. In their recommendations notes, brokerages had highlighted that the return of a strong majority government could trigger a meaningful market re-rating, and most had assigned one-year targets to their festive recommendations.

Also read 1 trillion test: Will the next wave of IPOs lift the market or drown investors ?"> ₹1 trillion test: Will the next wave of IPOs lift the market or drown investors ?

The findings highlight a broader truth: even“auspicious" Diwali bets by leading analysts aren't immune to macro headwinds and shifting investor sentiment. Over the past year, markets have faced multiple crosswinds, volatile foreign flows, uneven earnings recovery, and global trade frictions, which have weighed on stock performance.

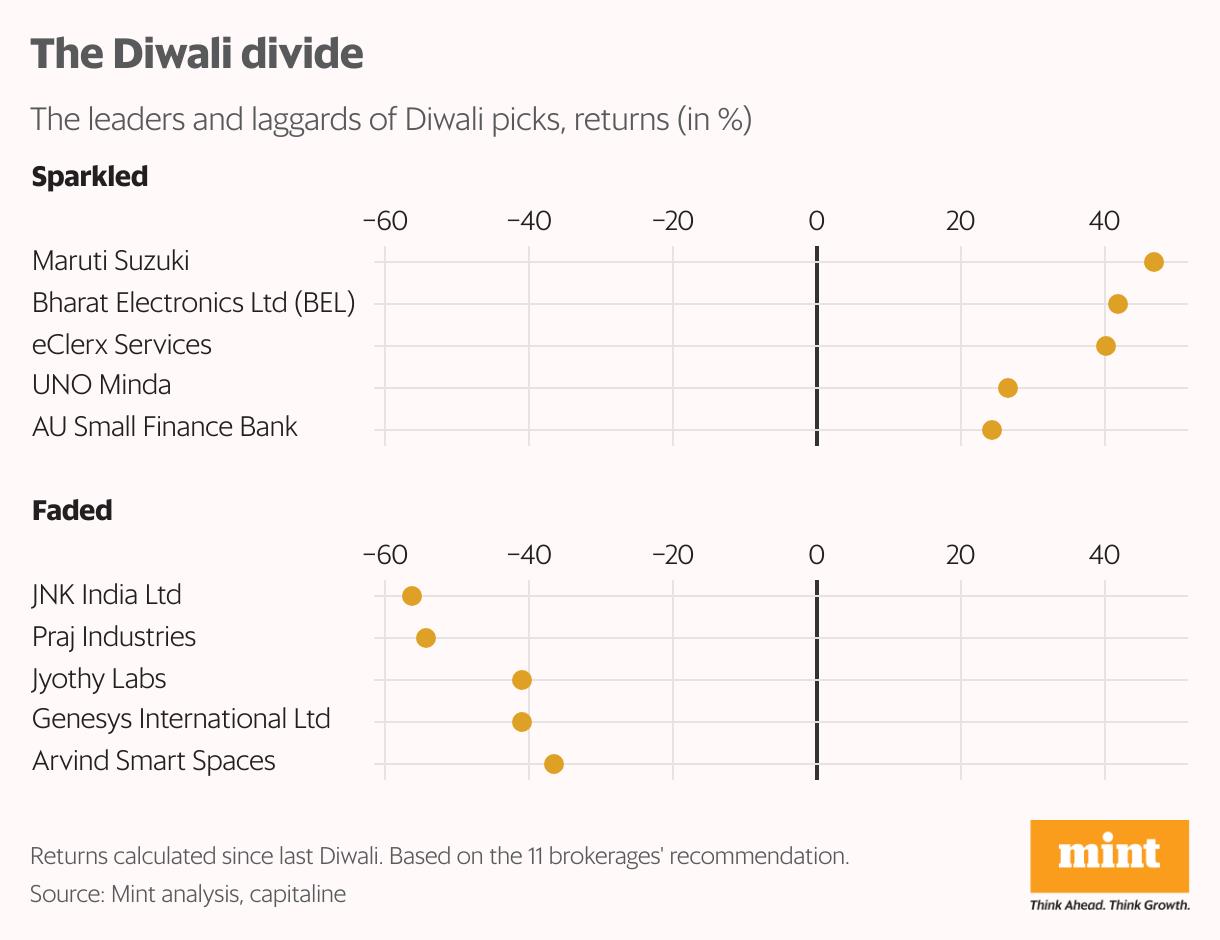

Who shone, who lostDespite the broader underperformance in Samvat 2081, a few sectors bucked the trend. Auto and auto-ancillary stocks delivered strong returns, powered by resilient demand and margin recovery. Maruti Suzuki surged 47%, while UNO Minda rose 27%, aided by festive-season tailwinds and an upturn in domestic volumes.

Among financial names, select banking, financial services, and insurance (BFSI) picks fared relatively well. AU Small Finance Bank gained 24.4%, Nippon Life India Asset Management rose 23.9%, and HDFC Bank jumped 12.6%, though state-run lenders such as SBI managed only a 7.5% rise.

Other names that held up were Dixon Technologies (up 22%) and Titan (up 7.3%), supported by resilient urban consumption and government incentives for local manufacturing.

But the worst damage was seen in power, infrastructure, and real-estate counters, where most picks suffered double-digit losses. Torrent Power (-30%), Inox Wind (-32%), and NTPC (-17%) were among the biggest losers as energy stocks corrected from elevated valuations.

Infrastructure firms such as NCC and HG Infra were down 33% each after last year's rally, weighed down by muted order execution and profit-booking. Real-estate and allied plays also wilted - Arvind Smart Spaces (-37%) and Gravita India (-28%) fell on demand moderation and stretched valuations.

What went wrong?“The picks from brokerages are all just views. Anyone who gives a very short-term view is bound to be making errors because things are very dynamic," said Anand K Rathi, co-founder, MIRA Money.“I don't think last year, brokerages would have calculated any impact of Trump on the Indian market. That's one reason why many got it wrong. But this isn't a trend-it's a one-off. Given where India stands today and the improving ties with the US, I believe there are good times ahead," he added.

Interestingly, several 2023 picks reappeared on the 2024 Diwali lists. Long-term market favourites like ICICI Bank, Axis Bank, Maruti Suzuki, Titan Company, Torrent Power, and Max Healthcare have been repeated, signalling broker confidence that these stocks will deliver, even after a mixed year for the broader Diwali Picks basket.

Also read Tata Capital IPO: Safe bet on Tata name or risky play on NBFC margins ?

Cautionary optimismWhile Diwali often marks the start of a new investing cycle for many retail participants, analysts say the lessons from last year's underperformance should prompt investors to be more discerning.

“Retail investors should continue to consider brokerage recommendations but not follow them blindly," said G. Chokkalingam, founder and MD of Equinomics Research.“Before investing, they should check if the stock has already rallied, whether valuations are reasonable, and if the company's balance sheet is strong with low debt. Businesses with sound working capital management and credible promoters should always be preferred."

Chokkalingam added that retail investors without the time or ability to assess these parameters should consider mutual funds instead of direct stock investing.

Tempered expectations for 2025As markets usher in Samvat 2082, several brokerage houses have unveiled their fresh Diwali 2025 stock recommendations - with a clear tilt towards the banking and financial services (BFSI) space. The sector features in every list, led by State Bank of India (with an estimated 25% upside from current levels), Aditya Birla Capital (44%), HDFC Bank (19%), and Bajaj Finance (11%).

Beyond BFSI, brokerages are also betting on industrials and pharmaceuticals. Among pharma names, Laurus Labs stands out with a projected 47% upside, followed by Mankind Pharma (38%), Senores Pharmaceuticals (16%) and Lupin (21%). In the FMCG basket, ITC is seen offering a potential 35% gain, alongside Hindustan Unilever and Tata Consumer Products. Auto counters such as Hero MotoCorp (43% upside) and Maruti Suzuki also feature prominently in the festive picks.

Also Read | Wary of price rise during festivals, Centre starts onion sales at ₹24/kHowever, analysts caution that these recommendations may not deliver quick returns in the near term as the market continues to remain in a consolidation phase, balancing strong domestic fundamentals with global uncertainties.

“With two-thirds of last year's Diwali picks underperforming the Sensex, investors should approach this season's recommendations with tempered expectations," said Harshal Dasani, business head, INVasset PMS.“The market currently sits in a consolidation band, reflecting a tug-of-war between strong domestic macros and global uncertainties. In such an environment, many thematic Diwali bets are sentiment-driven rather than conviction-based."

Dasani believes investors should focus on selective, dat -backed opportunities instead of festive hype.“The metals and mining space continues to show long-term strength supported by infrastructure spending and a global commodity upcycle. Auto ancillaries with strong balance sheets and export linkages, electronic manufacturing firms benefiting from the China+1 shift, and hospital chains with steady earnings visibility stand out as quality plays," he said.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment