Bitcoin's Future Looks Bright: Key Data Shows It's Here To Stay

- Friday's Bitcoin plunge underscores persistent volatility, fueled by leverage and liquidity challenges amid a volatile crypto market. Liquidations reached $5 billion, revealing vulnerabilities in collateral assets and the risks associated with derivatives trading. The market remains cautious, with low liquidity and insolvency rumors exacerbating concerns, especially ahead of Monday's U.S. holiday.

Bitcoin (BTC ) sharply declined by $16,700 on Friday, marking a 13.7% correction in less than eight hours. The price dropped to $105,000, wiping out roughly 13% of open futures positions in BTC terms. While dramatic, such steep intraday moves are not unprecedented in Bitcoin's history, even outside major crises.

Largest Bitcoin intraday crashes since May 2017. Source: TradingView / CointelegraphExcluding the“COVID crash” of March 12, 2020 - with a notable 41.1% intraday plunge that was partly driven by issues at BitMEX - there have been 48 other episodes of deeper corrections in Bitcoin's recent history. For instance, on Nov. 9, 2022, Bitcoin plummeted 16.1%, falling to $15,590 amid the fallout from the FTX collapse, which saw nearly 40% of Alameda Research's assets tied up in the native token FTT. This episode brought additional market chaos as Binance and other exchanges reported barriers to withdrawals and increased insolvency fears.

Bitcoin volatility remains high despite ETF market's maturingPost-ETF market dynamics have hinted at a possible reduction in daily volatility, with intraday crashes exceeding 10% becoming less frequent. Nevertheless, given Bitcoin's four-year cycle and evolving trading landscape, it may be premature to declare the end of significant swings. Recent notable declines include a 15.4% correction on August 5, 2024, and a 13.3% correction in March 2024, shortly after the U.S. spot ETF launch. These swings, coupled with Friday's $5 billion futures liquidations, suggest the market might still face prolonged stability issues.

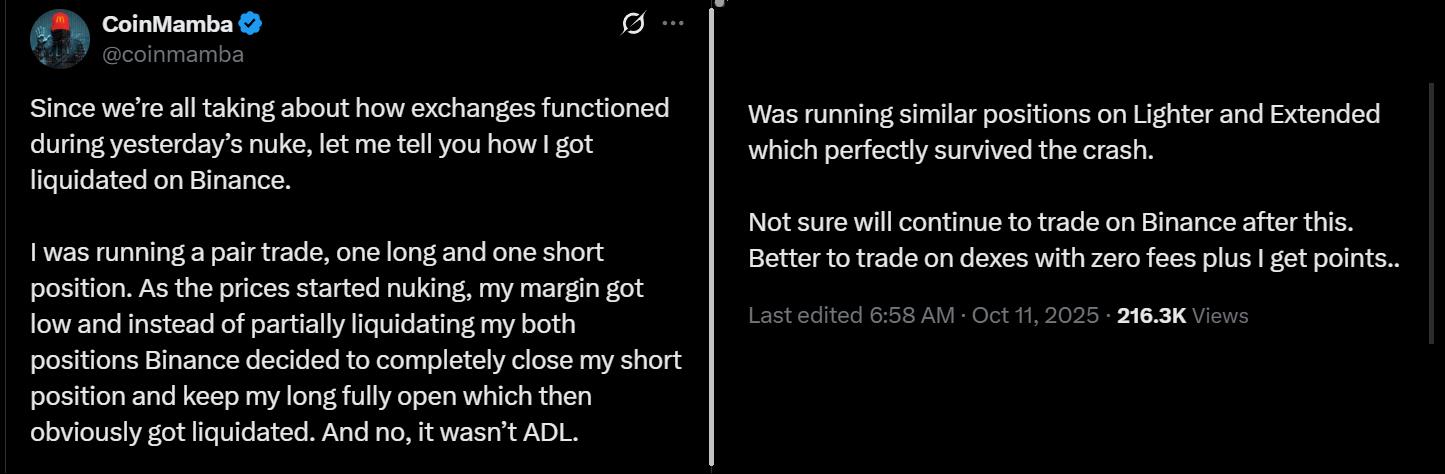

Liquidation data from Hyperliquid , a decentralized perpetual exchange, revealed that $2.6 billion of bullish positions were forcibly closed. Meanwhile, several platforms reported issues with portfolio margin calculations, and traders expressed concerns over auto-deleveraging - a process where positions are liquidated automatically when collateral levels fall below thresholds. This has caused some traders to see significant gains wiped out instantly, especially in less liquid assets and altcoins, which sometimes plunged over 40%.

BTC /USDT Perpetual futures vs. spot BTC/USD prices. Source: TradingView / Cointelegraph

Bitcoin perpetual futures, which typically traded about 5% below spot prices during the crash, have yet to return to pre-event levels. This persistent disparity complicates liquidity and market-making strategies, especially during periods of low trading volume and heightened risk perceptions.

While Friday's sharp correction has raised concerns, it is also likely influenced by reduced weekend liquidity and the closure of U.S. bond markets for the holiday. Rumors of insolvency and risk aversion among market makers contributed to the market's fragility. Traders and investors are now watching closely to see whether Bitcoin can establish support at the $105,000 level or if further corrections remain likely in the near term.

This turbulent episode underscores the ongoing need for caution and resilience within the rapidly evolving landscape of cryptocurrency trading, especially as authorities ponder future regulations and market participants adapt to a more mature yet still volatile crypto environment.

Crypto Investing Risk Warning

Crypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment