Doubleview Gold Corp Announces Increased Footprint And Potential Volume At Its Hat Polymetallic Deposit In Northwestern British Columbia

| DDH | | From (m) | To (m) | Length (m) | CuEq (%) Excl. Sc 2 O 3 | Ag (g/t) | Au (g/t) | Co (g/t) | Cu (%) | Sc (g/t) |

| H093 | | 16.3 | 657.0 | 640.7 | 0.34 | 0.31 | 0.15 | 59 | 0.19 | 25.9 |

| H093 | Including | 16.3 | 645.0 | 628.7 | 0.35 | 0.31 | 0.15 | 59 | 0.20 | 25.7 |

| H093 | Including | 30.0 | 69.0 | 39.0 | 0.52 | 0.63 | 0.39 | 100 | 0.14 | 24.6 |

| H093 | Including | 45.0 | 60.0 | 15.0 | 1.03 | 1.18 | 0.79 | 196 | 0.26 | 22.6 |

| H093 | Including | 501.0 | 634.0 | 133.0 | 1.03 | 0.83 | 0.40 | 63 | 0.65 | 28.7 |

| H093 | Including | 537.0 | 634.0 | 97.0 | 1.35 | 1.12 | 0.52 | 75 | 0.86 | 30.9 |

| H093 | Including | 564.0 | 627.0 | 63.0 | 1.88 | 1.58 | 0.72 | 90 | 1.20 | 29.1 |

| H093 | Including | 604.0 | 625.0 | 21.0 | 4.78 | 4.19 | 1.76 | 187 | 3.14 | 21.5 |

| H093 | Including | 614.0 | 623.0 | 9.0 | 9.88 | 9.01 | 3.46 | 358 | 6.66 | 12.6 |

| H094 | | 30.0 | 540.0 | 510.0 | 0.22 | 0.15 | 0.10 | 59 | 0.11 | 25.9 |

| H094 | Including | 42.0 | 164.0 | 122.0 | 0.26 | 0.24 | 0.17 | 66 | 0.09 | 26.5 |

| H094 | And | 138.4 | 246.0 | 107.6 | 0.30 | 0.17 | 0.16 | 87 | 0.12 | 27.8 |

| H094 | Including | 234.0 | 246.0 | 12.0 | 0.91 | 0.39 | 0.40 | 183 | 0.50 | 31.2 |

| H094 | And | 430.0 | 540.0 | 110.0 | 0.31 | 0.16 | 0.12 | 55 | 0.19 | 23.3 |

| H095 | | 9.0 | 224.0 | 215.0 | 0.19 | 0.18 | 0.11 | 63 | 0.07 | 22.6 |

| H095 | Including | 102.0 | 303.0 | 201.0 | 0.17 | 0.14 | 0.10 | 76 | 0.06 | 24.2 |

| H096 | | 38.6 | 720.0 | 681.4 | 0.37 | 0.22 | 0.18 | 63 | 0.19 | 28.0 |

| H096 | Including | 102.0 | 720.0 | 618.0 | 0.40 | 0.23 | 0.20 | 64 | 0.20 | 28.4 |

| H096 | Including | 349.0 | 738.0 | 389.0 | 0.50 | 0.3 | 0.23 | 57 | 0.28 | 29.3 |

| H096 | Including | 484.0 | 720.0 | 236.0 | 0.67 | 0.4 | 0.32 | 56 | 0.38 | 29.9 |

| H096 | Including | 556.0 | 679.0 | 123.0 | 0.83 | 0.49 | 0.40 | 49 | 0.46 | 27.6 |

| H096 | Including | 612.0 | 683.0 | 71.0 | 1.01 | 0.61 | 0.51 | 51 | 0.54 | 27.4 |

| H096 | Including | 641.0 | 679.0 | 38.0 | 1.44 | 0.85 | 0.76 | 57 | 0.75 | 25.3 |

Notes:

1 - Copper Equivalent (CuEq) currently does not include Scandium

2 - The intervals presented in this table are not true widths. The true width of mineralized sections has not been determined.

3 - Metal equivalents should not be relied upon for future evaluations. Drill hole intercepts included in this news release are core lengths that may or may not represent true widths of mineralization. It is not possible to determine true widths.

4 - Parameters used to calculate Copper Equivalent: Au price (US$/oz): 2365.09; Ag price (US$/oz): 27.43; Cu price (US$/lb): 4.17; Co price (US$/lb): 14.76. Au recovery: 89.0%; Ag recovery: 68.0%; Cu recovery: 84.0%; Co recovery: 78.0%. * Copper Equivalent Calculation CuEq in % = ([Ag grade in ppm] *27.43*0.68/31.1035 + [Au grade in ppm] *2365.09*.89/31.1035 + 0.0001* [Co grade in ppm] *14.76*0.78*22.0462 + 0.0001* [Cu grade in ppm] *4.17*0.84*22.0462)/(4.17*22.0462*0.84).

Details of the algorithm used to estimate %CuEq are presented in the notes above. The metal values used in our current algorithm are average trailing three years commodity prices, and do not reflect recent dramatic increases in prices of mineral commodities. Scandium, a potentially recoverable high value strategic alloy metal (customarily quoted as Sc2O3 ) that is present in small but possibly highly important amounts in Hat mineralization, is not assigned any value pending metallurgical investigations and recoverable results.

Core samples are delivered securely to a fully accredited commercial laboratory and processed by industry-standard methods. Assays are received at irregular intervals, verified by reference to notes provided by our field crew, added to our database, and disseminated publicly by News Release.

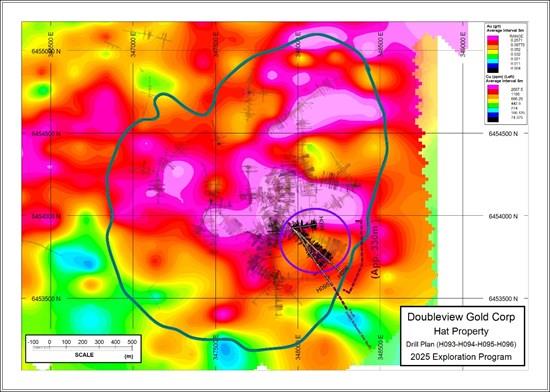

Drill holes H093, H094, H095 and H096, as shown in Figure 1, are located in proximity to hole H092 and further explore the area of high metal values (i.e. H092: 411.5m with 0.62% CuEq) in an easterly extension of the main Lisle Zone. The combination of drill hole data from H090 to H096 added an approximate domain of 330 m x 400 m to the Lisle deposit that has not been delimited in any direction. Numerous intervals from those holes are included in Table 1 of this News Release.

Figure 1: Drill Plan with the Induced Polarization Plan and 2024 Conceptual Pit Outline

To view an enhanced version of this graphic, please visit:

Figure 2: Section on H093 and H096 and 2024 Conceptual Pit Outline

To view an enhanced version of this graphic, please visit:

A composite of Hole H093 assays from16.3m to 693m comprises 676.7m (2220 feet) with 0.33% CuEq. Within that long mineralized section there are several higher-grade intervals, including 63.0m (206.7 ft) with 1.88 %CuEq and 21.0m (68.9 ft) with 4.78 %CuEq and 9.0m (29.5 ft) with 9.88% CuEq.

A composite of drill hole H094 assays included 107.6m (353 ft) with 0.30% CuEq, in an almost throughout mineralized hole from 30 m (98 ft) to 540 m (1772 ft ) with 0.22% CuEq.

Drill hole H095 is believed to have followed in an unmineralized fault that does not represent the limit of mineralization; the drill hole did not leave the fault.

Mr. Farshad Shirvani, President and CEO, comments that: We believe that the previously disclosed assays, combined with assays presented in this News Release and, speculatively, additional data from core samples that are being processed in the laboratory, will further reinforce our conceptual mineral deposit model, promote resources from Indicated and Inferred categories to higher confidence levels, including Measured, and require re-design of the current open pit layout. The new drill holes will be added in a revised MRE (Maiden Resource Estimate 2025) and the PEA (Preliminary Economic Assessment) that is on-going. Drill holes H093, H094 and H095 have contributed greatly to achieving new dimensions in the eastern part of the Hat deposit. This exciting new area necessitates a vigorous follow up that is currently on our agenda. Both the "footprint" and value of our project have been greatly increased, not only by the expansion but also by the recent dramatic increase in metal, mineral and commodity prices."

Initial scoping of the implications of this new assay information allowed our field crew to revise and re-direct our efforts to concentrate on better defining the deposit. We hope to release further drill hole assay data soon."

Table 2 summarizes coordinates of the recent drill holes.

Table 2. Details of Location and direction of drill holes:

| DDH ID | UTM-East (m) | UTM-North (m) | Elevation (m) | Azimuth (°) | Dip (°) | Max-Depth (m) | Year |

| H093 | 347963 | 6453927 | 966 | -72.19 | 127 | 693 | 2025 |

| H094 | 347963 | 6453927 | 966 | -74.89 | 77 | 597 | 2025 |

| H095 | 347963 | 6453927 | 966 | -57.33 | 137 | 762 | 2025 |

| H096 | 347963 | 6453927 | 966 | -65.00 | 132 | 922.5 | 2025 |

Quality Assurance and Quality Control:

Hat Project drill cores are processed at Doubleview's field camp where they are photographed, measured and logged by our technical staff and then divided using a diamond bladed saw. One half is placed in a stout bag to form the assay sample that is forwarded securely to the independent analytical lab. The remaining half core is stored on site where it is available for further examination and sampling. The assay cores are subject to a Chain of Custody routine as they are shipped from camp to a bonded carrier for delivery to the lab.

All core samples are prepared and analyzed at AGAT Laboratories in Calgary, an independent ISO 17025 and ISO 9001 certified facility. Samples are dried, crushed to 70% passing 2 mm, split to obtain a 250 g representative portion, and pulverized to 85% passing 75 μm. Gold, platinum, and palladium are assayed by 30-50 g fire assay with ICP-OES finish. Multi-element analyses (up to 48 elements) are performed by four-acid digestion with ICP-OES/MS, with ore-grade assays applied where required. Selected samples are further analyzed for whole-rock oxides using lithium borate fusion with ICP-OES, and Loss on Ignition is determined separately. Routine quality assurance protocols include insertion of blanks, duplicates, and certified reference materials, ensuring accuracy and reliability of results.

Doubleview maintains a website at .

Qualified Persons:

Erik Ostensoe, P. Geo., a consulting geologist, and Doubleview's Qualified Person with respect to the Hat Project as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed, and approved the technical contents of this news release. He is not independent of Doubleview as he is a shareholder in the company.

About Doubleview Gold Corp

Doubleview Gold Corp. is mineral resource exploration and development company headquartered in Vancouver, British Columbia, Canada. It is publicly traded on the TSX-Venture Exchange (TSXV: DBG), (OTCQB: DBLVF), (WKN: LA1W038) , and (FSE: 1D4). Doubleview focuses on identifying, acquiring, and financing precious and base metal exploration projects across North America, with a strong emphasis on British Columbia. The company enhances shareholder value through the acquisition and exploration of high-quality gold, copper, cobalt, scandium, and silver projects-collectively critical minerals utilizing cutting-edge exploration techniques.

Doubleview's success is deeply rooted in the unwavering support of its long-term shareholders, supporters, and institutional investors. Their ongoing commitment has been instrumental in advancing the company's strategic initiatives. Doubleview looks forward to further collaborative growth and development and continues to welcome active participation from its valued stakeholders as the company expands its portfolio and strengthens its position in the critical minerals sector.

About the Hat Polymetallic Deposit

The Hat Deposit, located in northwestern British Columbia, is a polymetallic porphyry project with major resources of copper, gold, cobalt, and the potential for scandium. As one of the region's significant sources of critical minerals, the Hat deposit has undergone targeted exploration and development. The 0.2% CuEq cut-off resource estimate, as of the recently completed Mineral Resource Estimate and the Company's July 25, 2024, news release, is summarized below:

| | | | Average Grade | Metal Content | ||||||||

| Open Pit Model Hat | Resource Category | Tonnage | CuEq | Cu | Co | Au | Ag | CuEq | Cu | Co | Au | Ag |

| Mt | % | % | % | g/t | g/t | million lb | million lb | million lb | thousand oz | thousand oz | ||

| In Pit | Indicated | 150 | 0.408 | 0.221 | 0.008 | 0.19 | 0.42 | 1,353 | 733 | 28 | 929 | 2,045 |

| Inferred | 477 | 0.344 | 0.185 | 0.009 | 0.15 | 0.49 | 3,619 | 1,945 | 91 | 2,328 | 7,575 |

Scandium potential for the Hat Deposit is estimated to be 300 to 500 million tonnes at an average grade of 40 ppm (0.004%) Sc2O3.

For further details of the MRE, please refer to the Company's July 25, 2024 news release.

On behalf of the Board of Directors,

Farshad Shirvani, President & Chief Executive Officer

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment