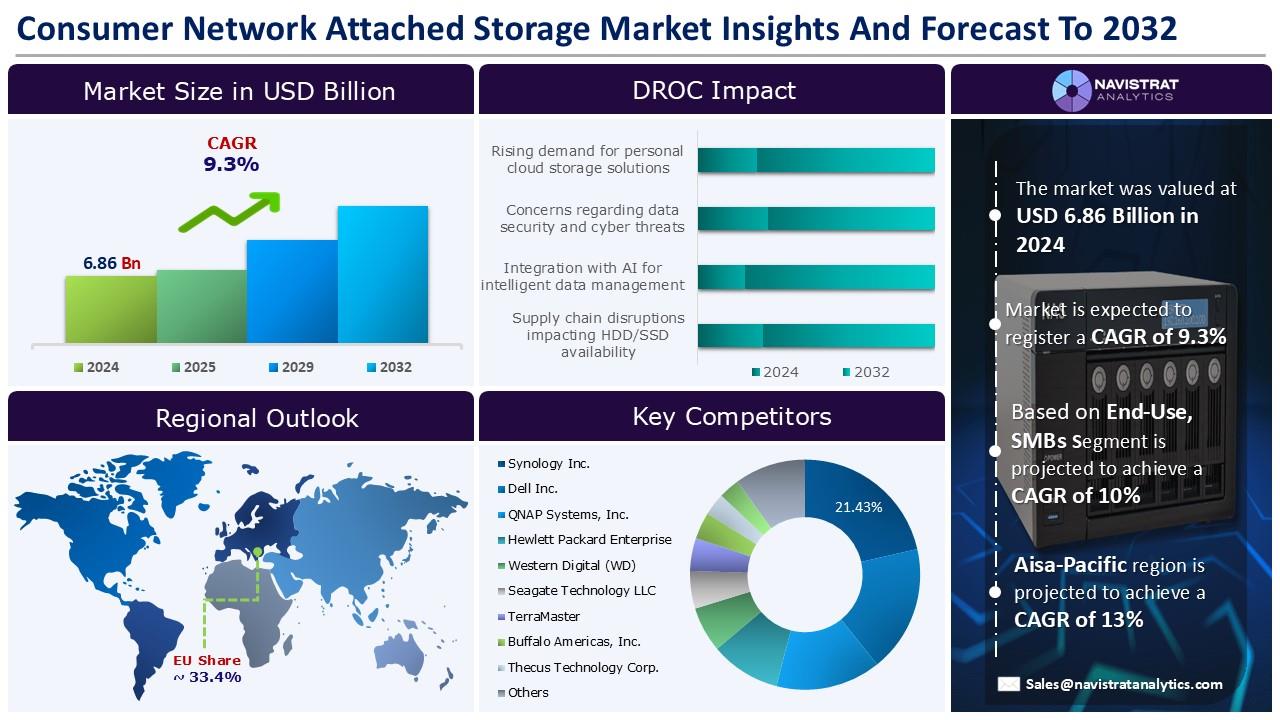

Consumer Network Attached Storage Market is 6.86 billion in 2024 and is projected to register a CAGR of 9.3%

(MENAFN- Navistrat Analytics) 18th September 2025 – Increasing deployment of CCTV monitoring equipment is projected to drive substantial demand for consumer NAS systems throughout the predicted period. Consumers are increasingly using security cameras capable of capturing high-resolution video footage. As a result, the need for storage will continue to grow rapidly.

Government investments are accelerating this trend. For example, the United States Department of Homeland Security (DHS) stated that on October 1, 2024, more than USD 454 million in NSGP funding was given to over 3,200 faith-based and charitable groups. This financing will assist the installation of new security cameras, which will increase the demand for consumer NAS.

Multimedia consumption is also changing storage requirements. Influencers demand cloud-based NAS to easily manage, store, and publish videos to social media platforms like YouTube, Facebook, Instagram, TikTok, and others. According to a study, 71% of marketers believe that short-form video provides the best ROI when compared to long-form or live forms. As a result, consumer demand for NAS as a personal cloud hub is expected to increase significantly.

However, supply chain dependence on crucial components, as well as cybersecurity issues, are projected to limit revenue growth in the consumer NAS market throughout the forecast period. NAS device production and assembly rely heavily on modern processors and storage controllers, which require key materials like gallium nitride (GaN) and silicon carbide (SiC). Disruptions in the sourcing of these components might slow down the production process, increasing production costs.

Get Exclusive Report Insights Here:

Segment market overview and growth Insights:

The small and medium-sized businesses (SMBs) segment is expected to register a 10% CAGR by 2032. SMBs' increasing usage of cloud-linked and hybrid NAS systems reinforces this trend. These solutions enable organizations to combine the dependability of local storage with the convenience of cloud platforms, providing seamless communication for scattered teams and remote personnel. Furthermore, the rising digitization of SMBs in industries such as retail, healthcare, education, and professional services is driving up the need for secure storage for managing customer information, financial data, multimedia material, and project files.

The hard disk drive (HDD) segment accounts for the highest revenue share in 2024. HDDs are becoming one of the most affordable methods to expand storage without drastically raising expenses. This makes HDDs the ideal option for users who value capacity above performance, especially for applications including personal cloud storage, data backup, and surveillance/ CCTV footage management. Furthermore, the rising use of smart homes and linked devices has increased demand for greater storage capacities, bolstering the market position of HDD-based NAS equipment.

Regional market overview and growth insights:

Asia Pacific region is expected to reach a CAGR of 13% by 2032. Consumer NAS solves issues by allowing smooth data access, storage, and device integration. The Asia-Pacific region features one of the world's most diversified connection environments, ranging from developing economies to highly advanced 5G nations such as Japan, South Korea, Singapore, and Australia. The GSMA research estimates that by 2030, 5G will account for 50% of mobile connections in the area.

Furthermore, increased urbanization and the necessity for monitoring are driving the development of consumer NAS. According to research, China alone has over 700 million CCTV cameras as of August 2023, accounting for more than half of the total number of CCTV cameras worldwide. This massive surveillance environment is driving demand for data backup and storage capacity, promoting consumer NAS as a crucial component of the Asia-Pacific digital economy.

Europe is expected to contribute a significant revenue share in 2024. The EU has supported USD 112.21 billion (EUR 95.5 billion) in the Horizon Europe initiative between 2021 and 2027. This will spur innovation in sophisticated technologies such as artificial intelligence, quantum computing, and data sovereignty. On July 16, 2025, the EU committed to investing USD 205.63 billion (EUR 175 billion) under the plan by 2028-2034.

Competitive Landscape and Key Competitors:

The Consumer Network Attached Storage Market is characterized by numerous players, with major players competing across segments and regions. The list of major players included in the Consumer Network Attached Storage Market report is:

• Synology Inc.

• Dell Inc.

• QNAP Systems, Inc.

• Hewlett Packard Enterprise Development LP

• Western Digital (WD) Corporation

• Seagate Technology LLC

• TerraMaster

• Buffalo Americas, Inc.

• Thecus Technology Corp.

• ASUSTOR Inc.

• Ugreen Group Limited

• NAS Station PC

Buy Your Exclusive Copy Now:

Major strategic developments by leading competitors

Minisforum : On 12th January 2025, MINISFORUM entered the network-attached storage (NAS) market with the release of the MINISFORUM N5 Pro. This powerful NAS solution can accommodate up to five hard drives and three PCIe NVMe SSDs, providing performance features often associated with higher-end systems. The N5 Pro has a semi-transparent, magnetically fastened front panel for easy access to drive bays, and its modular motherboard architecture allows for simple upgrades of memory, storage, and PCIe components.

Unlock the Key to Transforming Your Business Strategy with Our Consumer Network Attached Storage Market Insights –

• Download the report summary:

• Request Customization:

Navistrat Analytics has segmented the consumer network attached storage market by storage solution, design, deployment model, storage type, storage capacity, mount type, application, end-use and region:

• Storage Solution Outlook (Revenue, USD Billion; 2022-2032)

• Fixed-Capacity NAS

• Scale-Up NAS

• Scale-Out NAS

• Design Model Outlook (Revenue, USD Billion; 2022-2032)

• 1-Bay

• 2-Bays

• 4-Bays

• 5-8 bay

• >8 bay

• Deployment Model Outlook (Revenue, USD Billion; 2022-2032)

• On-Premises

• Cloud

• Hybrid

• Storage Type Outlook (Revenue, USD Billion; 2022-2032)

• Hard Disk Drive (HDD)

• Flash Storage (SSD)

• Hybrid

• Storage Capacity Outlook (Revenue, USD Billion; 2022-2032)

• Less than 1 TB

• 1 TB to 20 TB

• More than 20

• Mount Type Outlook (Revenue, USD Billion; 2022-2032)

• Standalone

• Rackmount

• Application Outlook (Revenue, USD Billion; 2022-2032)

• Data Backup and Recovery

• Media Streaming and Home Entertainment

• Personal Cloud and Remote Access

• Video Surveillance and Home Security

• IoT and Smart Home Integration

• Others

• End-Use Outlook (Revenue, USD Billion; 2022-2032)

• Residential

• Small and medium-sized businesses (SMBs)

• Regional Outlook (Revenue, USD Billion; 2022-2032)

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East & Africa

Get a preview of the detailed segmentation of market:

Government investments are accelerating this trend. For example, the United States Department of Homeland Security (DHS) stated that on October 1, 2024, more than USD 454 million in NSGP funding was given to over 3,200 faith-based and charitable groups. This financing will assist the installation of new security cameras, which will increase the demand for consumer NAS.

Multimedia consumption is also changing storage requirements. Influencers demand cloud-based NAS to easily manage, store, and publish videos to social media platforms like YouTube, Facebook, Instagram, TikTok, and others. According to a study, 71% of marketers believe that short-form video provides the best ROI when compared to long-form or live forms. As a result, consumer demand for NAS as a personal cloud hub is expected to increase significantly.

However, supply chain dependence on crucial components, as well as cybersecurity issues, are projected to limit revenue growth in the consumer NAS market throughout the forecast period. NAS device production and assembly rely heavily on modern processors and storage controllers, which require key materials like gallium nitride (GaN) and silicon carbide (SiC). Disruptions in the sourcing of these components might slow down the production process, increasing production costs.

Get Exclusive Report Insights Here:

Segment market overview and growth Insights:

The small and medium-sized businesses (SMBs) segment is expected to register a 10% CAGR by 2032. SMBs' increasing usage of cloud-linked and hybrid NAS systems reinforces this trend. These solutions enable organizations to combine the dependability of local storage with the convenience of cloud platforms, providing seamless communication for scattered teams and remote personnel. Furthermore, the rising digitization of SMBs in industries such as retail, healthcare, education, and professional services is driving up the need for secure storage for managing customer information, financial data, multimedia material, and project files.

The hard disk drive (HDD) segment accounts for the highest revenue share in 2024. HDDs are becoming one of the most affordable methods to expand storage without drastically raising expenses. This makes HDDs the ideal option for users who value capacity above performance, especially for applications including personal cloud storage, data backup, and surveillance/ CCTV footage management. Furthermore, the rising use of smart homes and linked devices has increased demand for greater storage capacities, bolstering the market position of HDD-based NAS equipment.

Regional market overview and growth insights:

Asia Pacific region is expected to reach a CAGR of 13% by 2032. Consumer NAS solves issues by allowing smooth data access, storage, and device integration. The Asia-Pacific region features one of the world's most diversified connection environments, ranging from developing economies to highly advanced 5G nations such as Japan, South Korea, Singapore, and Australia. The GSMA research estimates that by 2030, 5G will account for 50% of mobile connections in the area.

Furthermore, increased urbanization and the necessity for monitoring are driving the development of consumer NAS. According to research, China alone has over 700 million CCTV cameras as of August 2023, accounting for more than half of the total number of CCTV cameras worldwide. This massive surveillance environment is driving demand for data backup and storage capacity, promoting consumer NAS as a crucial component of the Asia-Pacific digital economy.

Europe is expected to contribute a significant revenue share in 2024. The EU has supported USD 112.21 billion (EUR 95.5 billion) in the Horizon Europe initiative between 2021 and 2027. This will spur innovation in sophisticated technologies such as artificial intelligence, quantum computing, and data sovereignty. On July 16, 2025, the EU committed to investing USD 205.63 billion (EUR 175 billion) under the plan by 2028-2034.

Competitive Landscape and Key Competitors:

The Consumer Network Attached Storage Market is characterized by numerous players, with major players competing across segments and regions. The list of major players included in the Consumer Network Attached Storage Market report is:

• Synology Inc.

• Dell Inc.

• QNAP Systems, Inc.

• Hewlett Packard Enterprise Development LP

• Western Digital (WD) Corporation

• Seagate Technology LLC

• TerraMaster

• Buffalo Americas, Inc.

• Thecus Technology Corp.

• ASUSTOR Inc.

• Ugreen Group Limited

• NAS Station PC

Buy Your Exclusive Copy Now:

Major strategic developments by leading competitors

Minisforum : On 12th January 2025, MINISFORUM entered the network-attached storage (NAS) market with the release of the MINISFORUM N5 Pro. This powerful NAS solution can accommodate up to five hard drives and three PCIe NVMe SSDs, providing performance features often associated with higher-end systems. The N5 Pro has a semi-transparent, magnetically fastened front panel for easy access to drive bays, and its modular motherboard architecture allows for simple upgrades of memory, storage, and PCIe components.

Unlock the Key to Transforming Your Business Strategy with Our Consumer Network Attached Storage Market Insights –

• Download the report summary:

• Request Customization:

Navistrat Analytics has segmented the consumer network attached storage market by storage solution, design, deployment model, storage type, storage capacity, mount type, application, end-use and region:

• Storage Solution Outlook (Revenue, USD Billion; 2022-2032)

• Fixed-Capacity NAS

• Scale-Up NAS

• Scale-Out NAS

• Design Model Outlook (Revenue, USD Billion; 2022-2032)

• 1-Bay

• 2-Bays

• 4-Bays

• 5-8 bay

• >8 bay

• Deployment Model Outlook (Revenue, USD Billion; 2022-2032)

• On-Premises

• Cloud

• Hybrid

• Storage Type Outlook (Revenue, USD Billion; 2022-2032)

• Hard Disk Drive (HDD)

• Flash Storage (SSD)

• Hybrid

• Storage Capacity Outlook (Revenue, USD Billion; 2022-2032)

• Less than 1 TB

• 1 TB to 20 TB

• More than 20

• Mount Type Outlook (Revenue, USD Billion; 2022-2032)

• Standalone

• Rackmount

• Application Outlook (Revenue, USD Billion; 2022-2032)

• Data Backup and Recovery

• Media Streaming and Home Entertainment

• Personal Cloud and Remote Access

• Video Surveillance and Home Security

• IoT and Smart Home Integration

• Others

• End-Use Outlook (Revenue, USD Billion; 2022-2032)

• Residential

• Small and medium-sized businesses (SMBs)

• Regional Outlook (Revenue, USD Billion; 2022-2032)

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East & Africa

Get a preview of the detailed segmentation of market:

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Chicago Clearing Corporation And Taxtec Announce Strategic Partnership

- Everstake Expands Institutional Solana Services With Shredstream, Swqos, And Validator-As-A-Service

- Japan Smart Cities Market Size Is Expected To Reach USD 286.6 Billion By 2033 CAGR: 14.6%

- Alchemy Markets Launches Tradingview Integration For Direct Chart-Based Trading

- Blackrock Becomes The Second-Largest Shareholder Of Freedom Holding Corp.

- Pluscapital Advisor Empowers Traders To Master Global Markets Around The Clock

Comments

No comment