Crypto Sparks As Fed Interest Rate Cut Amid Trump's Central Bank Shake-Up

This anticipated policy adjustment occurs amid political tensions and a contested appointment process at the Fed. President Donald Trump 's administration has recently targeted Fed governor Lisa Cook, accusing her of mortgage fraud in an effort to remove her from her position. Meanwhile, the Senate has confirmed White House economic adviser Stephen Miran to the Federal Reserve's board of governors, creating concerns about increased political influence over monetary policy decisions-an evolution that could impact the regulatory landscape for cryptocurrencies , NFTs, and DeFi projects.

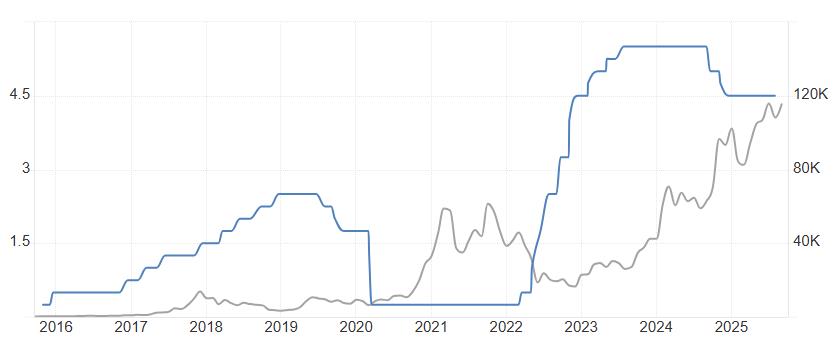

Bitcoin price spiked in 2021-2022 amid low US interest rates. Source: Trading Economics Implications for Crypto Policy and Markets

President Trump 's efforts to remove Cook-a Biden-era appointee-are part of a broader push by the administration to exert more political control over the Fed. In a recent public statement, Trump accused Cook of making false mortgage-related statements, which she denied, asserting that the charges were politically motivated. An appeals court in Washington temporarily blocked her removal, allowing her to carry out her duties while legal proceedings continue.

Meanwhile, Miran, an economist with previous pro-crypto comments, was confirmed as a temporary Fed board member, but questions remain about whether he will have to step down should his term extend beyond January 2026. Democratic lawmakers are concerned that such political influence could sway the Fed's monetary policy, with potential consequences for the crypto industry, especially regarding regulation and liquidity.

Crypto Markets Brace for Rate CutsCrypto traders are closely watching the Fed's decision, with many expecting a rate cut that could unlock trillions in liquidity, fueling growth in DeFi, NFTs, and Ethereum -based assets. Experts suggest that risk-on assets like Ether (ETH ) and Solana (SOL ) could see heightened interest, as lower interest rates typically boost liquidity and risk appetite.

Traditional assets like Bitcoin and gold are also seen as beneficiaries, with historical trends indicating that rate cuts often lead to positive gains for these assets. As market sentiment remains sensitive to policy shifts and liquidity flows, Bitcoin and other cryptocurrencies are positioning themselves for potential long-term gains amid ongoing macroeconomic uncertainty.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment