How Do Current Trends Impact The Latin America Video Game Development Market Outlook For 2025 And Beyond?

Download a sample copy of the report: https://www.imarcgroup.com/latin-america-video-game-development-market/requestsample

Key Highlights

-

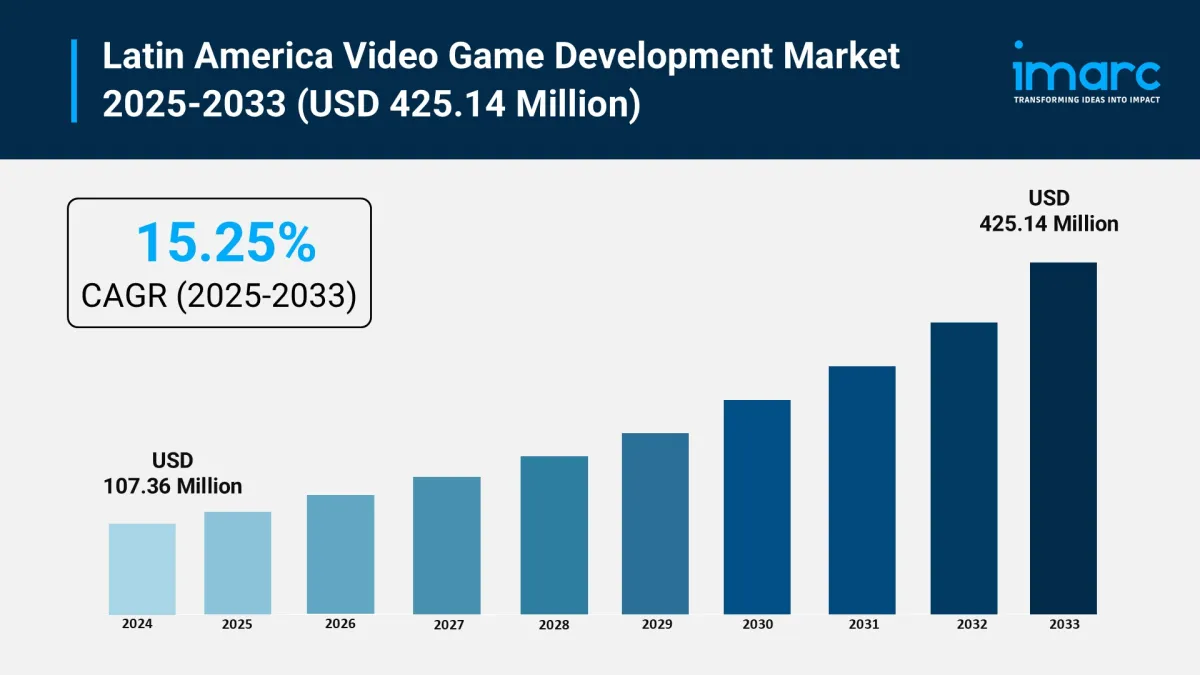

Market size (2024): USD 107.36 million

Forecast (2033): USD 425.14 million

CAGR (2025–2033): 15.25%

Smartphone penetration >80 % and 5G roll-outs in Brazil, Mexico, Argentina, boosting mobile gaming reach.

International publishers (Tencent, Riot, Ubisoft) expanding studios & accelerator programs across São Paulo, Mexico City, Buenos Aires.

E-sports prize pools and live-streaming audiences growing 30 % YoY, creating downstream demand for original LatAm titles.

How Is AI Transforming the Video Game Development Market in Latin America?

AI-powered toolchains are being embedded across the dev pipeline to deliver:

-

Procedural content generation for expansive open-world environments inspired by Amazonian and Andean landscapes

AI-driven play-testing bots that slash QA cycles by 40 % for indie studios with limited budgets

Real-time Spanish & Portuguese NLP voice synthesis, enabling dynamic character dialogue without costly VO sessions

Personalized in-game offers and adaptive difficulty tuned to player behavior analytics

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=33828&flag=C

Key Market Trends and Drivers

-

Mobile-First Explosion: Free-to-play hyper-casual and mid-core titles capturing micro-transaction revenue across Tier-2 cities

Government XP: Brazil's Lei do Bem tax credits, Mexico's Prosoft 4.0 grants, and Chile's CORFO seed funds are reducing burn rates for start-ups

Talent 2.0: Regional universities launching specialized game-design degrees; remote-work visas luring diaspora developers back home

Cultural Soft Power: Studios like Wildlife, Etermax, and Bromio are creating folklore-infused IPs (Aztec, Incan, Afro-Brazilian themes) that travel globally

Cloud Publishing: AWS, Google Cloud, and Azure opening LatAm data-center regions, lowering latency and server costs for multiplayer titles

Latin America Video Game Development Market Segmentation:

Platform Insights:

-

Console

Mobile

PC

Cloud Gaming

Genre Insights:

-

Action

Adventure

Shooter

Role-Playing

Simulation

Strategy

Sports

Casual

Others

Deployment Insights:

-

On-Premises

Cloud-Based

Revenue Model Insights:

-

Pay-to-Play

Free-to-Play

Subscriptions

In-App Purchases

Game Type Insights:

-

Single-Player

Multi-Player

Massively Multiplayer Online (MMO)

End User Insights:

-

Individual

Institutional

Country Insights:

-

Brazil

Mexico

Argentina

Colombia

Chile

Peru

Others

Latin America Video Game Development Market News:

-

In May 2025, Argentina's Nimble Giant Entertainment (part of Embracer) unveiled“Project Orion”- an AI-assisted co-op shooter backed by a USD 50 million investment, set in a dystopian Buenos Aires skyline

At Brasil Game Show 2025 (October, São Paulo), 180+ indie studios showcased prototypes leveraging generative-AI art pipelines; the event closed with six signed publishing deals totaling USD 22 million

Colombia's Ministry of ICT announced a USD 30 million game-dev seed fund (July 2025) targeting women-led studios and AI-driven educational games, aiming to triple the national studio count by 2028

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment