India Confectionery Market Share, Size, Analysis, Top Companies, Growth Drivers And Report 2025-2033

Key Highlights

-

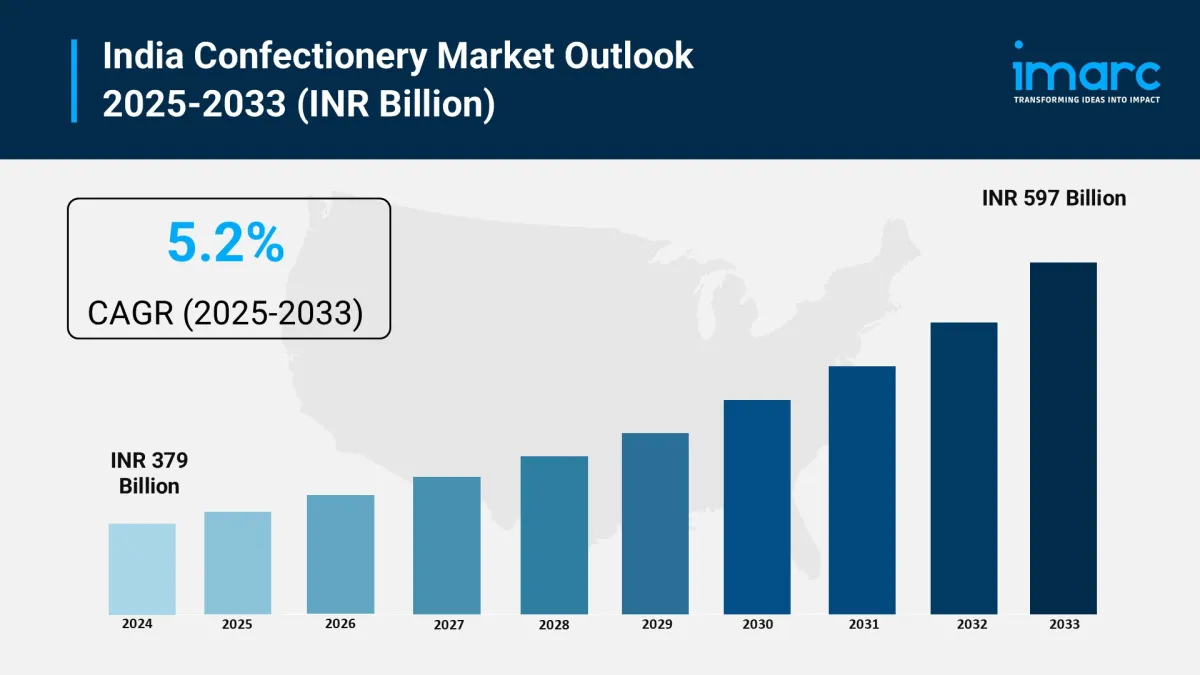

Market size (2024): INR 379 billion

Forecast (2033): INR 597 billion

CAGR (2025–2033): 5.2%

Fast urbanization, rising disposable incomes, and a developing culture of gifting confectionery are key drivers.

Growing consumer preference for luxury treats and a cultural shift towards gifting high-end chocolates on festive occasions.

Increasing retail penetration and internet access are making confectionery products widely available across urban and Tier-II cities.

Adults are the largest consumer group, driven by impulse snacking and a demand for sugar-free, low-calorie, and functional confectionery.

Key companies operating in the India confectionery market include Candico India Ltd, Parle Products Pvt. Ltd, Haldiram Foods International Pvt. Ltd, Lotte India Corporation Ltd, MTR Foods Pvt. Ltd, EVEREST Food Products Pvt. Ltd, Flury's Swiss Confectionery Pvt Ltd.

Request Free Sample Report: https://www.imarcgroup.com/india-confectionery-market/requestsample

How Is AI Transforming the Confectionery Market in India?

AI-enabled solutions are being integrated across the confectionery value chain to deliver:

-

Personalization and Generative AI: AI is driving personalized marketing campaigns and interactive experiences, allowing brands to engage with shoppers in novel ways. Generative AI helps create tailored content, reflecting changing brand narratives and resonating with diverse consumers.

Taste Innovation: AI is used to predict consumer and market preferences, streamlining flavor experimentation and reducing the risk of unsuccessful product launches. It helps identify upcoming trends by analyzing e-commerce data, online recipes, and restaurant menus.

Automation in Manufacturing: AI and automation streamline inventory management of raw materials like cocoa, sugar, and milk. They optimize production lines for efficiency, minimize waste, and ensure consistent product quality through automated inspection and predictive maintenance.

Supply Chain Optimization: AI enhances traceability from raw material sourcing to the final product, helping identify and manage recalls efficiently. It also optimizes logistics by evaluating factors like traffic and weather for efficient delivery routes.

Enhanced Customer Service: AI-powered chatbots and sentiment analysis tools personalize customer communication, improve engagement, and efficiently handle orders and inquiries.

Key Market Trends and Drivers

-

Rising Disposable Incomes & Urbanization: A growing middle class with higher disposable incomes is boosting confectionery consumption, particularly for premium and gourmet products. Urbanization exposes consumers to global brands and convenient formats.

Evolving Gifting Culture: The increasing trend of gifting confectionery during festivals, weddings, and celebrations, with premium and attractively packaged options, is a significant sales driver. Chocolates are increasingly chosen over traditional sweets for gifting.

Health and Wellness Consciousness: A growing demand for healthier alternatives, including sugar-free, low-calorie, organic, and functional confectionery items, driven by increased awareness of dietary choices and rising incidences of lifestyle diseases.

Product Innovation: Manufacturers are introducing new flavors, textures (e.g., liquid-filled candies, chewy gums), and fusion products blending traditional Indian flavors with modern confectionery to appeal to diverse tastes and maintain consumer interest.

Expansion of Retail and E-commerce: The proliferation of modern retail formats (supermarkets, hypermarkets) and the rapid growth of e-commerce platforms and quick commerce services are enhancing product accessibility and driving impulse purchases across urban and semi-urban areas.

Aggressive Marketing and Branding: Brands are employing emotional appeals, nostalgia marketing, and social media influence to connect with consumers, especially millennials and Gen Z.

Market Segmentation The report has segmented the market into the following categories:

Analysis by Product Type:

-

Hard-boiled Sweets

Mints

Gums and Jellies

Chocolate

Caramels and Toffees

Medicated Confectionery

Fine Bakery Wares

Others

Analysis by Age Group:

-

Children

Adult

Geriatric

Analysis by Price Point:

-

Economy

Mid-range

Luxury

Analysis by Distribution Channel:

-

Supermarkets and Hypermarkets

Convenience Stores

Pharmaceutical and Drug Stores

Online Stores

Others

Regional Analysis:

-

North India

West and Central India

South India

East India

Contact Our Analysts for Brochure Requests, Customization, and Inquiries Before Purchase : https://www.imarcgroup.com/request?type=report&id=6142&flag=C

Latest Development in the Industry

-

The market continues to see a strong focus on premiumization , with urban consumers willing to spend more on high-quality, artisanal, and aesthetically appealing sweets, especially for gifting. The premium chocolate segment is experiencing a higher CAGR than the generic market.

The health and wellness segment within confectionery is witnessing significant growth, driven by demand for sugar-free, organic, and functional treats (e.g., protein-rich bars, probiotic-infused chocolates).

Flavor fusion and regional innovation are key trends, with brands experimenting with combinations like Gulab Jamun-flavored chocolate or Paan toffees, and traditional mithai being blended with modern formats.

The expansion of e-commerce and quick delivery platforms is proving essential for brands to reach a wider consumer base, including semi-urban areas, and to capitalize on impulse purchases, with online chocolate sales growing significantly.

Manufacturers are actively working on reducing sugar content in products globally, a trend that is increasingly impacting the Indian confectionery market due to rising health consciousness and incidences of diabetes and obesity.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Over US$13 Billion Have Trusted Pendle, Becoming One Of The Largest Defi Protocols On Crypto

- Tapbit At TOKEN2049: Reshaping The Crypto Landscape Through Product Innovation

- Bydfi Joins Korea Blockchain Week 2025 (KBW2025): Deepening Web3 Engagement

- Dupoin Reports Global Growth, Regulatory Coverage, And User Experience Insights

- Superiorstar Prosperity Group Russell Hawthorne Highlights New Machine Learning Risk Framework

- WBTC Strengthens Its Role As Multichain Standard For Bitcoin In Defi

Comments

No comment