Agriforce Stock Soars As Company Moves To Build AVAX Treasury

According to a recent press release, AVAX One plans to accumulate over $700 million worth of AVAX tokens as part of its long-term strategy to integrate revenue-generating fintech businesses into the Avalanche ecosystem. The fundraising effort includes a $300 million private investment in public equity (PIPE), pending shareholder approval, alongside an additional $250 million through equity-linked instruments.

Leading the capital raise is Hivemind Capital, with participation from over 50 investors that include prominent institutional firms and crypto -native players like ParaFi, Galaxy Digital, Kraken , Big Brain Holdings, and FalconX.

The company's advisory board will be headed by Anthony Scaramucci, founder of SkyBridge Capital, and Brett Tejpaul, the head of Coinbase Institutional. Matt Zhang, founder of Hivemind Capital and the company's nominated chairman, explained that Avalanche was a deliberate choice for its focus on on-chain finance and strategic partnerships. Zhang emphasized that staking, the process of locking up crypto to secure a blockchain network and earn yields, played a pivotal role in the decision, as it provides immediate revenue streams that could make the treasury profitable from day one.

At the time of writing, AVAX was trading around $31.76, according to CoinGecko. Based on this price, the company's planned investment of $700 million would buy approximately 22 million AVAX tokens. Considering the current staking APY of roughly 6.7%, the position could generate approximately $46.9 million annually in staking rewards.

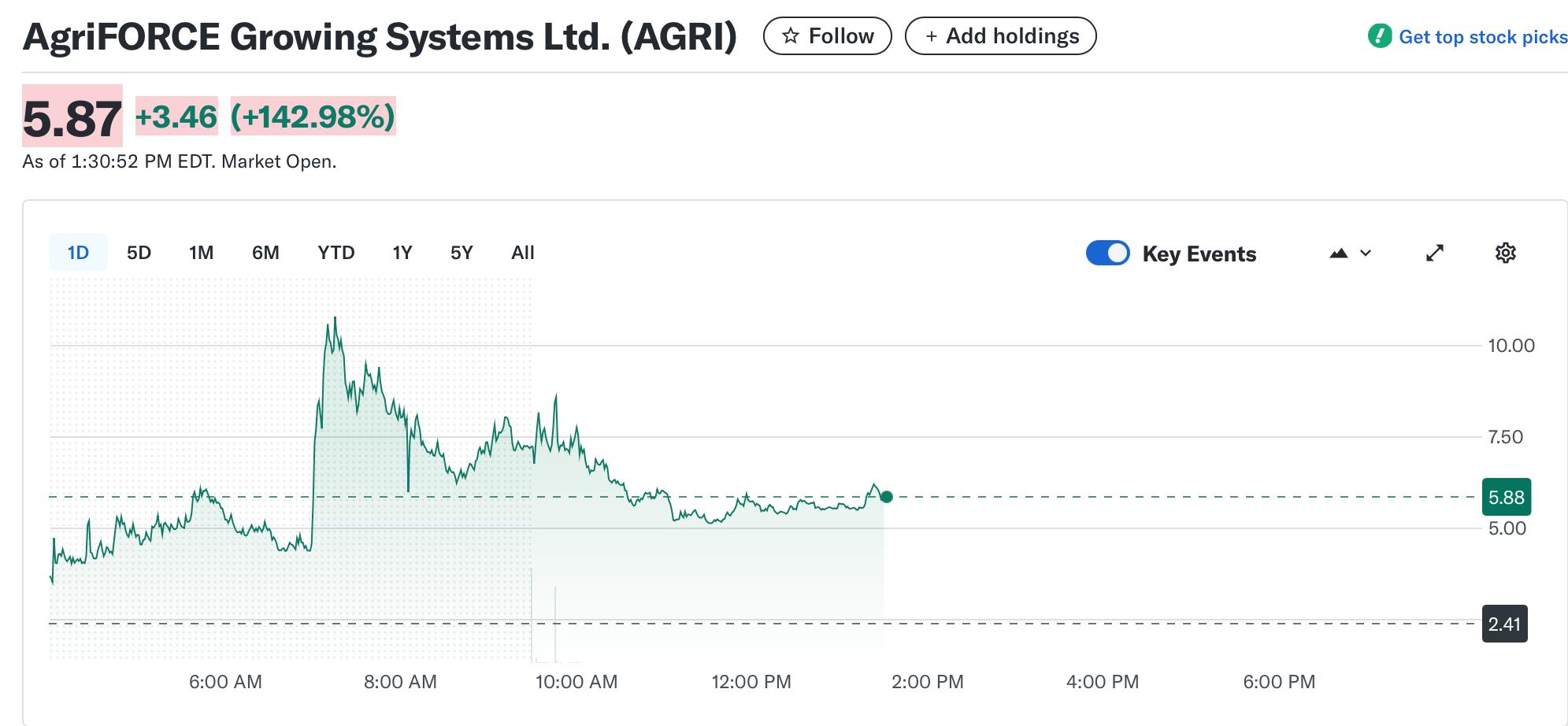

This move follows the Avalanche Foundation's recent efforts to raise $1 billion dedicated to digital asset treasury projects and AVAX accumulation initiatives. Meanwhile, AgriFORCE's stock experienced extreme volatility, opening at $7.30 after closing at $2.41 on Friday, before settling at $5.73 by day's end on Nasdaq , a 137% increase.

AgriFORCE intraday performance. Source: Yahoo Finance

Avalanche , an open-source blockchain launched in 2020 by Cornell University professor Emin Gün Sirer, continues to gain traction across various sectors. It supports smart contracts and decentralized applications (DApps), with particular strength in decentralized finance (DeFi). Notably, Avalanche has seen significant growth in Web3 gaming activity, surpassing 1 million daily transactions twice in one week, driven largely by projects like MapleStory Universe.

Investor interest remains high, with firms like Sweden's Vitune launching AVAX -based crypto ETFs, and major asset managers like VanEck and Grayscale filing to launch Avalanche -focused exchange-traded funds (ETFs). The network's transaction volume also surged over 66% in late August, reaching over 11.9 million transactions in a week. Meanwhile, AVAX 's price has appreciated roughly 24% over the past two weeks, signaling increasing confidence and activity within the broader crypto markets.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment