India Textile Dyes Market Size, Share, Trends, Growth, Top Companies And Report 20252033

Key Highlights:

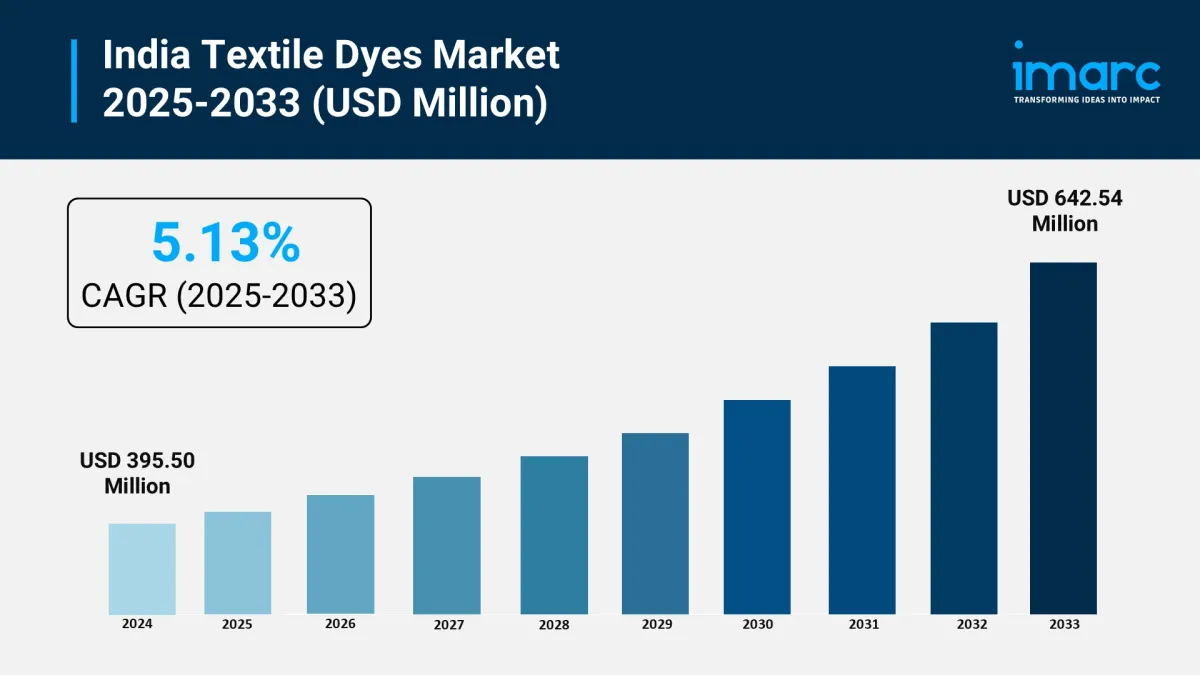

. 2024 Market Size: USD 395.50 Million

. 2033 Forecast Size: USD 642.54 Million

. CAGR (2025–2033): 5.13%

. Rising adoption of eco-friendly and sustainable dye formulations

. Growing textile exports boosting demand for high-quality dyes

. Expanding domestic apparel and home textile market

. Technological advancements in dyeing processes improving efficiency

Get Free Sample Report: https://www.imarcgroup.com/india-textile-dyes-market/requestsample

How Is AI Transforming the Market?

AI is transforming the textile dyes market by enabling automated color matching, reducing wastage, and improving production efficiency. AI-powered predictive analytics helps manufacturers anticipate demand trends and optimize dye formulation. Machine vision technology ensures color consistency in large-scale production, while AI-driven R&D accelerates the development of sustainable and non-toxic dyes.

Key Market Trends and Drivers:

. Shift toward natural and biodegradable dyes to meet sustainability goals

. Rising demand for functional dyes with UV protection and antibacterial properties

. Increasing investment in textile dyeing automation

. Expansion of export-oriented textile manufacturing in India

. Government initiatives supporting eco-friendly textile production

Explore the Full Report with Charts, Table of Contents, and List of Figures: https://www.imarcgroup.com/india-textile-dyes-market

Market Segmentation:

By Dye Type:

. Direct

. Reactive

. Vat

. Basic

. Acid

. Disperse

. Others

By Fiber Type:

. Wool

. Nylon

. Cotton

. Viscose

. Polyester

. Others

By Application:

. Clothing and Apparels

. Home Textiles

. Automotive Textiles

. Others

By Region:

. North India

. South India

. East India

. West India

Competitive Landscape:

The competitive landscape covers market structure, key player positioning, winning strategies, competitive dashboard, and company evaluation quadrant. Detailed profiles of all major companies are included in the report.

Latest Developments:

. February 12, 2025 – Union Minister of Textiles inaugurated the Garment Technology Expo, DyeChem World Bharat Tex 2025, and the Indian Handicrafts Pavilion, showcasing sustainable dyes and advanced apparel technologies.

. February 16, 2025 – India's Ministry of Textiles and the EU launched seven projects worth EUR 9.5 Million to promote natural dyes, bamboo crafts, and traditional textiles, benefiting 35,000 stakeholders across nine states.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment