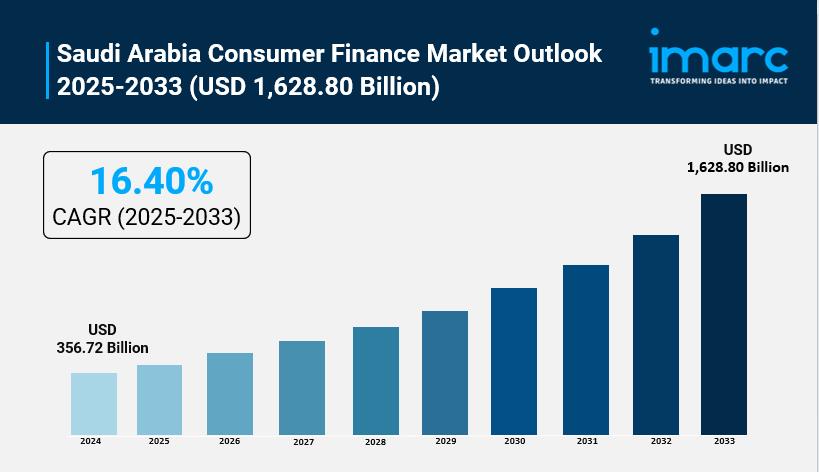

Saudi Arabia Consumer Finance Market To Reach USD 1,628.80 Billion By 2033, Growing At 16.40% CAGR

Key Highlights

-

Market size (2024): USD 356.72 Billion

Forecast (2033): USD 1,628.80 Billion

CAGR (2025–2033): 16.40%

Digital transformation and the rise of fintech, including Buy Now, Pay Later (BNPL) services and Sharia-compliant products, are key market trends.

A young, tech-savvy population, rising disposable incomes, government initiatives like Vision 2030, and increased home ownership rates are driving the market.

The consumer finance market is dominated by personal and home loans, driven by government housing initiatives and increasing demand for credit.

How Is AI Transforming the Consumer Finance Market in Saudi Arabia?

-

Personalized Banking : AI tailors financial services to individual needs, boosting customer satisfaction. A Finastra survey shows Saudi Arabia leads globally in AI adoption for financial services.

Fraud Detection : AI strengthens security by spotting fraud fast. Saudi banks using AI-driven systems cut fraud losses, enhancing trust and safety for consumers.

Government Support : Vision 2030 and SDAIA drive AI innovation. Regulatory sandboxes help fintechs test AI solutions, fostering a vibrant, tech-savvy financial ecosystem.

Fintech Growth : Over 200 fintech firms now operate in Saudi Arabia, up from 20, leveraging AI for digital payments and lending solutions.

Economic Impact : AI is set to add $135.2 billion to Saudi Arabia's economy, with finance leading investments at $28.3 million, transforming consumer experiences.

Grab a sample PDF of this report : https://www.imarcgroup.com/saudi-arabia-consumer-finance-market/requestsample

Saudi Arabia Consumer Finance Market Trends and Drivers

-

Digital Payment Adoption : Rising smartphone use and Vision 2030 drive digital payment and e-wallet popularity.

BNPL Popularity Surge : Buy Now, Pay Later services gain traction among youth for flexible payments.

Sharia-Compliant Financing Growth : Demand for Islamic finance products like Murabaha rises with cultural preferences.

Vision 2030 Initiatives : Economic diversification and financial inclusion boost consumer lending and fintech innovation.

Fintech and Regulatory Support : SAMA's reforms and Open Banking Framework enhance financial access and competition.

Saudi Arabia Consumer Finance Industry Segmentation:

The report has segmented the market into the following categories:

Product Type Insights:

-

Personal Loans

Credit Cards

Mortgages

Auto Loans

Home Equity Loans

Credit Score Insights:

-

Excellent (700-850)

Good (620-699)

Fair (580-619)

Poor (300-579)

Application Channel Insights:

-

Online

In-Store

Mobile App

Broker

Loan Purpose Insights:

-

Debt Consolidation

Home Renovations

Education

Car Purchase

Medical Expenses

Term Length Insights:

-

Short-Term (less than 1 year)

Medium-Term (1-5 years)

Long-Term (5+ years)

Regional Insights:

-

Northern and Central Region

Western Region

Eastern Region

Southern Region

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=29525&flag=E

Recent News and Developments in Saudi Arabia Consumer Finance Market

-

2025-07: Rapid digital transformation drives Saudi Arabia's consumer finance innovation, with widespread adoption of online banking, mobile payments, and digital lending platforms. AI enhances credit scoring, personalized financial advice, fraud detection, and customer service automation, improving accessibility and efficiency in the sector.

2025-04: Buy Now, Pay Later (BNPL) services gain popularity among Saudi consumers, particularly younger demographics, facilitating interest-free installment payments for large purchases across e-commerce and retail channels. Companies like Tamara and Tabby lead this revolution, offering flexible payment options that boost customer loyalty and sales.

2025-02: Fintech innovations such as mobile wallets (e.g., STC Pay, Apple Pay) become mainstream, reducing cash dependence and expanding financial inclusion. Peer-to-peer lending platforms and robo-advisors for wealth management also emerge, providing alternative funding sources and personalized investment advice via advanced algorithms.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment