China E-Learning Market Overview, Key Players And Future Outlook 2025-2033

Key Highlights

-

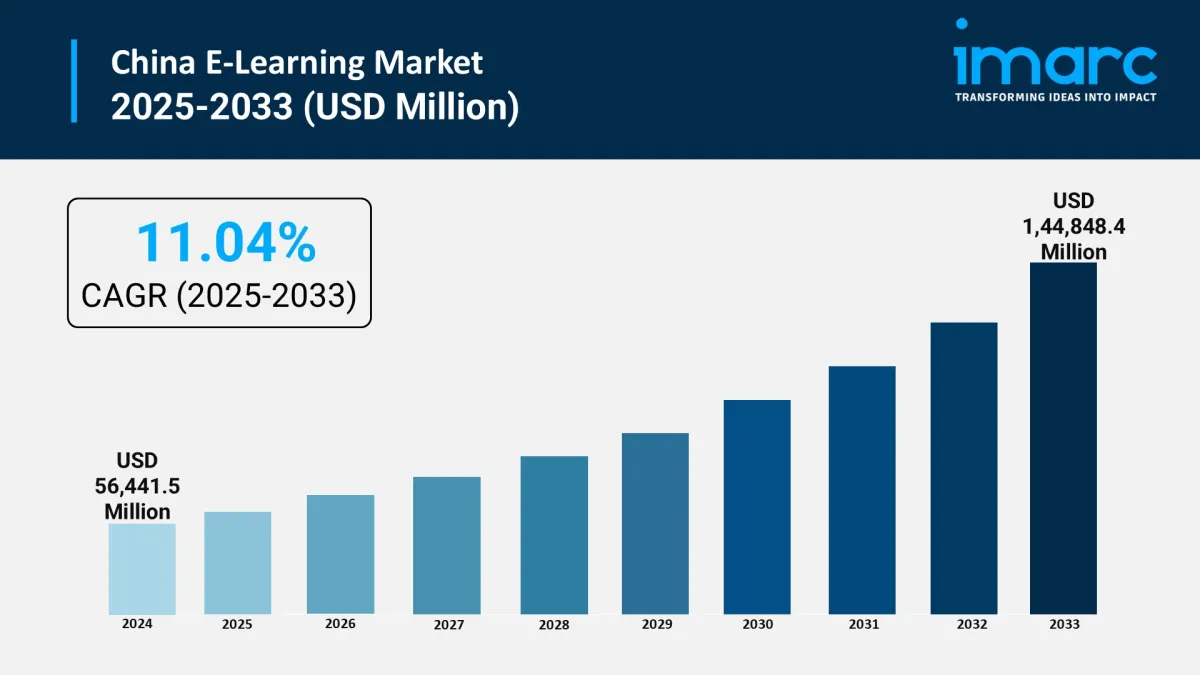

Market size (2024): USD 56,441.5 Million

Forecast (2033): USD 144,848.4 Million

CAGR 2025–2033: 11.04%

Core growth drivers: broadband & mobile expansion, government digital-education policy, AI and adaptive learning adoption, demand for upskilling/reskilling and lifelong learning.

Regulatory backdrop: lingering effects of the 2021“Double Reduction” crackdown on K-12 for-profit tutoring have reshaped the market; 2024–25 regulatory clarifications and gradual easing/allowed non-core tutoring activities are enabling new business models (after-school non-core, vocational, adult and senior learning).

Recent policy & product trends: Beijing rolling out mandatory AI education hours; platforms leaning into AI, micro-learning, blended models, and lifelong learning for seniors/workforce.

Market Trends and Drivers

-

With China pushing reskilling and workforce development, B2B L&D platforms and micro-credential providers can capture corporate budgets and public-sector tenders.

Products that use AI for personalized pathways, automated assessment, and teacher support will be prioritized by schools and platforms as Beijing mandates AI literacy

Demographic shifts create a“silver economy” for leisure, digital literacy, and vocational courses targeted at older adults.

Tier-2/3 cities and rural provinces are still underpenetrated; hybrid (online + local learning centers) models reduce friction and boost retention.

Request Sample For PDF Report: https://www.imarcgroup.com/china-e-learning-market/requestsample

Industry Segmentation

Technology Insights:

-

Online E-Learning

Learning Management System

Mobile E-Learning

Rapid E-Learning

Virtual Classroom

Others

Provider Insights:

-

Services

Content

Application Insights:

-

Academic

-

K-12

Higher Education

Vocational Training

-

Small and Medium Enterprises

Large Enterprises

Regional Insights:

-

North China

East China

South Central China

Southwest China

Northwest China

Northeast China

Latest industry developments

-

After the 2021 overhaul that curtailed for-profit K-12 core subject tutoring, regulators in 2024–25 issued clarifications and draft rules that open room for permitted tutoring categories (non-core subjects, vocational, adult learning), prompting firms to pivot offerings. This regulatory evolution is unlocking measured recovery and investment.

Reports in late 2024 noted tutoring firms cautiously returning with new models (non-profit labels, vocational/skill courses, franchise/light-asset models). Market actors are shifting from pure K-12 test prep to lifelong and workforce learning.

Cities such as Beijing are rolling out mandatory AI education hours for students - a signal that AI-enabled learning products (curriculum, tools, teacher assistants) will see institutional demand. Platforms are embedding AI for personalization, automated grading, and predictive learning paths.

Senior learning, vocational reskilling, and corporate L&D are expanding fast-driven by ageing demographics, employment shifts, and government support for lifelong learning.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Solo Leveling Levels Up: Korean Billion-Dollar Megafranchise Goes Onchain With Story

- Freedom Holding Corp. (FRHC) Shares Included In The Motley Fool's TMF Moneyball Portfolio

- From Tracking To Thinking: Edgen's“Smart Portfolio” Brings Portfolio-Native Multi-Agent Reasoning To Asset Portfolios

- Cregis At FOREX Expo 2025: Connecting Forex With Crypto Payment

- Currency Relaunches Under New Leadership, Highlights 2025 Achievements

- Cregis At TOKEN2049 Singapore 2025: Unlocking The Next Frontier Of Adoption

Comments

No comment