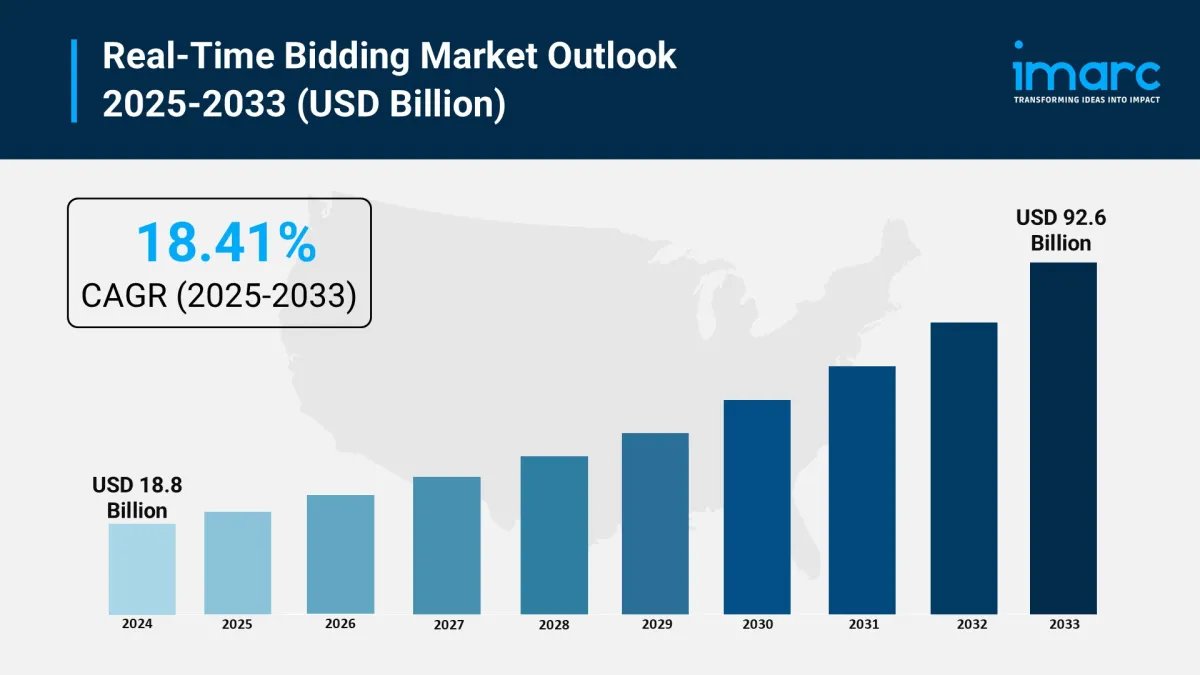

Real Time Bidding Market Size To Surpass USD 92.6 Billion By 2033, At A CAGR Of 18.41%

The real-time bidding market is experiencing rapid growth, driven by surge in programmatic advertising adoption, rise in mobile and video advertising, and advancements in ai and machine learning. According to IMARC Group's latest research publication,“ Real-Time Bidding Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033 “, The global real-time bidding market size reached USD 18.8 Billion in2024. Looking forward, IMARC Group expects the market to reach USD 92.6 Billion by 2033, exhibiting a growth rate (CAGR) of 18.41% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Get Your Free“Real Time Bidding Market” Sample PDF Report Now!

Our report includes:

-

Market Dynamics

Market Trends And Market Outlook

Competitive Analysis

Industry Segmentation

Strategic Recommendations

Growth of the Real Time Bidding Industry

-

Surge in Programmatic Advertising Adoption:

The Real Time Bidding (RTB) industry is booming because more businesses are jumping on the programmatic advertising bandwagon. This approach automates ad buying and selling, letting advertisers target specific audiences with precision in milliseconds. The shift from traditional ad methods to programmatic ones saves time and boosts efficiency. For example, Google's integration of AI-driven search ads with its Performance Campaign in May 2024 shows how companies are doubling down on automation to create dynamic, relatable ads. The global digital ad spend is soaring, with North America alone accounting for 42.5% of the RTB market share, driven by heavy investments in tech and data analytics. This demand for automated, data-driven ad placements is pushing RTB platforms to scale rapidly, making them a go-to for businesses aiming to maximize ad impact.

-

Rise in Mobile and Video Advertising:

The explosion of mobile and video content is fueling RTB growth like never before. With people spending hours on smartphones and streaming platforms, advertisers are pouring budgets into mobile and video ads for their high engagement rates. For instance, the retail and e-commerce sector is leaning heavily on RTB to target online shoppers, with mobile devices leading the charge due to their widespread use. Video ads, in particular, are dominating, as they draw larger audiences with vibrant visuals-outpacing static image ads in impact and cost. The media and entertainment segment holds the largest RTB market share, driven by the surge in connected TV (CTV) and over-the-top (OTT) platforms. This shift to mobile and video formats is making RTB a critical tool for reaching audiences where they're most active.

-

Advancements in AI and Machine Learning:

AI and machine learning are supercharging the RTB industry by making ad campaigns smarter and more effective. These technologies analyze vast amounts of user data to optimize bidding strategies, detect fraud, and personalize ads in real time. For example, companies like Criteo and Adobe are using AI to fine-tune ad targeting, ensuring ads hit the right audience at the right moment. This precision boosts return on investment, with businesses reporting higher engagement rates thanks to tailored ads. The open auction model, which commands 58.8% of the RTB market, thrives on AI-driven bidding for its cost efficiency and wide reach. As AI continues to evolve, it's helping RTB platforms tackle challenges like ad fraud while delivering more relevant, impactful ads, driving massive industry growth.

Trends in the Global Real Time Bidding Market

-

Growth in Connected TV and OTT Advertising:

Connected TV (CTV) and over-the-top (OTT) advertising are taking the RTB market by storm. With streaming platforms like Netflix and Hulu gaining millions of users, advertisers are using RTB to bid on ad slots in real time, targeting viewers with personalized video ads. The media and entertainment sector leads this trend, holding the largest RTB market share due to high engagement on CTV platforms. For example, Google's AdMob rolled out programmatic bidding for limited ads in December 2023, tapping into contextual demand from various sources. This shift allows brands to reach cord-cutters and streaming audiences with precision, boosting ad relevance. As CTV and OTT viewership skyrockets, RTB is becoming the backbone of digital video advertising, offering scalability and real-time optimization.

-

Focus on Privacy and Data Compliance:

Privacy concerns are reshaping the RTB market as regulations like GDPR and CCPA push for stricter data handling. Advertisers and platforms are prioritizing data anonymization and secure practices to comply with these laws while maintaining user trust. For instance, ad exchanges and demand-side platforms (DSPs) are investing in technologies to protect user data, with 58.8% of RTB transactions occurring in open auctions that now emphasize transparency. This trend is critical as RTB relies on user data for targeting, and non-compliance risks hefty fines-up to 4% of global revenue. Companies like Salesforce are adapting by integrating privacy-focused tools into their RTB solutions, ensuring ads remain effective without compromising user privacy. This focus is driving innovation in secure, ethical advertising practices.

-

Expansion of In-Game Advertising:

The gaming industry is a hotbed for RTB growth, with in-game advertising emerging as a major trend. As mobile, online, and console gaming explode, RTB enables advertisers to bid on ad spaces within games, targeting players based on behavior and demographics. The gaming sector's dynamic environment offers high engagement, with brands like AppNexus leveraging RTB to deliver ads in real time. For example, mobile apps and games are seeing rapid RTB adoption, with the mobile device segment projected to grow fastest due to widespread smartphone use. This trend is fueled by gamers spending hours in virtual worlds, creating prime ad opportunities. RTB's ability to deliver personalized, non-intrusive ads in gaming environments is making it a game-changer for advertisers chasing younger, tech-savvy audiences.

Leading Companies Operating in the Global Real Time Bidding Industry:

-

Adobe Inc.

AppNexus Inc.

Criteo SA

Facebook Inc.

Google LLC

Match2One AB

MediaMath, Inc.

MoPub/ Twitter Inc.

PubMatic, Inc.

Salesforce.com, inc.

Smaato, Inc.

The Rubicon Project, Inc.

Verizon Media

WPP plc

Yandex Europe AG.

Real Time Bidding Market Report Segmentation:

By Auction Type:

-

Open Auction

Invitation-Auction

Open Auction represents the largest segment as open auctions allow for broad participation and competition among a wide range of advertisers, leading to higher bid prices and greater inventory liquidity.

By Advertisement Format:

-

Video

Image

Video accounts for the majority of the market share. Video ads have higher engagement rates and effectiveness, making them highly sought after by advertisers looking to maximize their ROI.

By Application:

-

Media & Entertainment

Retail and E-commerce

Games

Travel & Luxury

Mobile Applications

Others

Retail and e-commerce exhibit a clear dominance in the market due to its reliance on targeted advertising to drive conversions and sales, making RTB an essential tool for their digital marketing strategies.

By Device:

-

Mobile

Desktop

Others

Mobile holds the biggest market share owing to the pervasive use of smartphones and the significant amount of time consumers spend on mobile devices.

Regional Insights:

-

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

North America's advanced digital advertising infrastructure, high internet penetration, and significant investment in programmatic advertising technologies place it at the forefront of the RTB market.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment