First Atlantic Nickel Intersects 0.23% Nickel And 0.31% Chromium Over 366 Meters In Third Drill Hole At RPM Zone, Confirming At Least 500-Meter Mineralized Width

| Hole ID | From (m) | To (m) | Interval (m) | Ni (%) | Cr (%) |

| AN-24-04 | 12 | 378 | 366 | 0.23 | 0.31 |

| Drill Hole Intersection Breakdown | |||||

| including | 12 | 135 | 123 | 0.23 | 0.32 |

| including | 135 | 240 | 105 | 0.23 | 0.33 |

| including | 240 | 378 | 138 | 0.24 | 0.29 |

| including "up to" | 0.28 | 0.86 |

Table 2: AN-24-04 Drill Hole Collar Location Information.

| Hole ID | Easting (UTM NAD 83) | Northing (UTM NAD 83) | Elevation (m) | Azimuth (deg) | Dip (deg) | Depth (m) |

| AN-24-004 | 567315 | 5357583 | 232 | 90 | -60 | 378 |

PHASE 2 DRILLING OBJECTIVES: RPM ZONE EXPANSION

The fully funded Phase 2 drilling program is set to start soon, with Phase 2 equipment now arriving following the successful completion of road access. This phase will employ a higher-powered drill rig equipped with NQ/HQ core capabilities and will focus on the following key objectives:

Expand the open 500-meter by 400-meter mineralized footprint through large-scale step-out drilling. Test deeper mineralization to better define the vertical extent of the RPM Zone. Investigate continuity between the RPM Zone and the nearby Chrome Pond area to determine whether they form a single, larger mineralized system. Explore additional targets along the 30-kilometer ultramafic ophiolite trend.Building on the success of the Phase 1 program, which delineated an open-ended mineralized area measuring approximately 500 meters in lateral width and 400 meters in length, Phase 2 is designed to significantly advance the geological understanding and resource potential of the RPM Zone. Awaruite (a natural nickel metal) mineralization has been confirmed in all four Phase 1 drill holes, with assays returning an average of approximately 0.24% nickel. Importantly, all holes began and ended in mineralization, underscoring the open nature of the system along strike, at depth, and laterally, offering strong potential for further expansion in Phase 2.

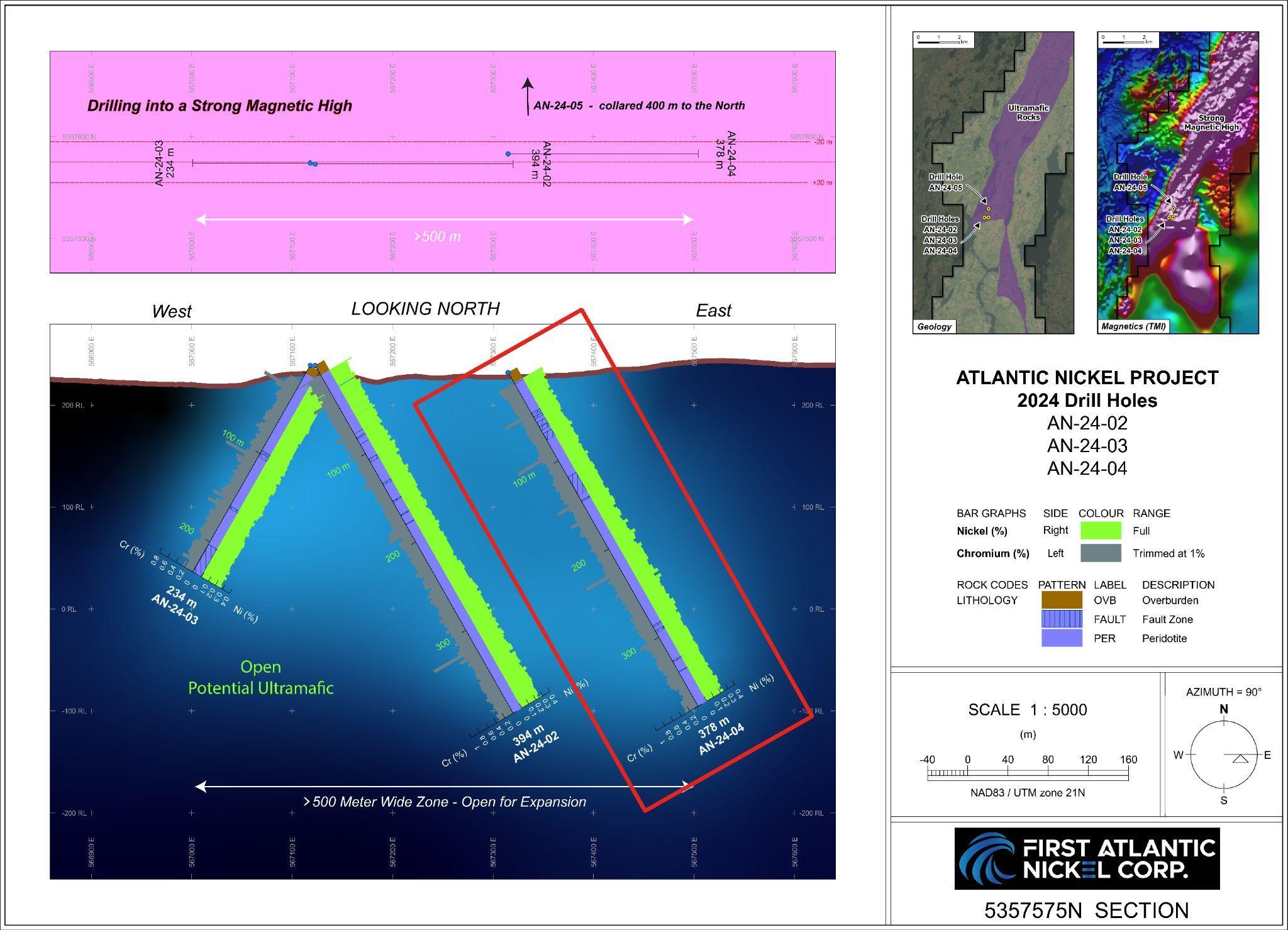

Figure 1: Cross-sectional view of RPM drill holes AN-24-02, AN-24-03, and AN-24-04, displaying downhole assay values for nickel and chromium. All reported holes terminate in mineralized rock, showing a mineralized width averaging 0.24% Nickel over 500m indicating potential for further expansion.

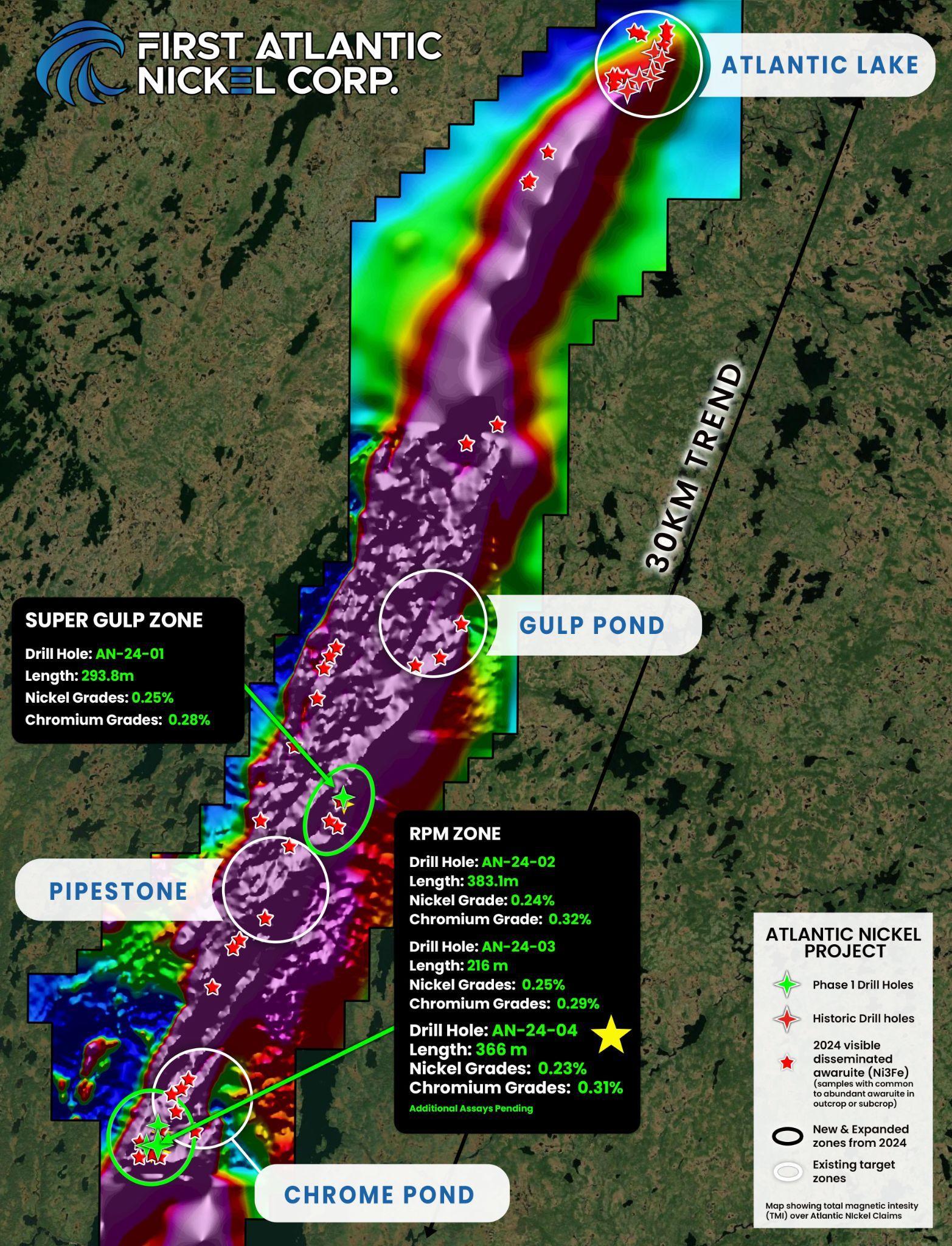

Figure 2: Map of the 30-kilometer-long nickel trend, showing the locations of Phase 1 drill holes and associated nickel and chromium assay results for AN-24-01, AN-24-02, AN-24-03, and AN-24-04.

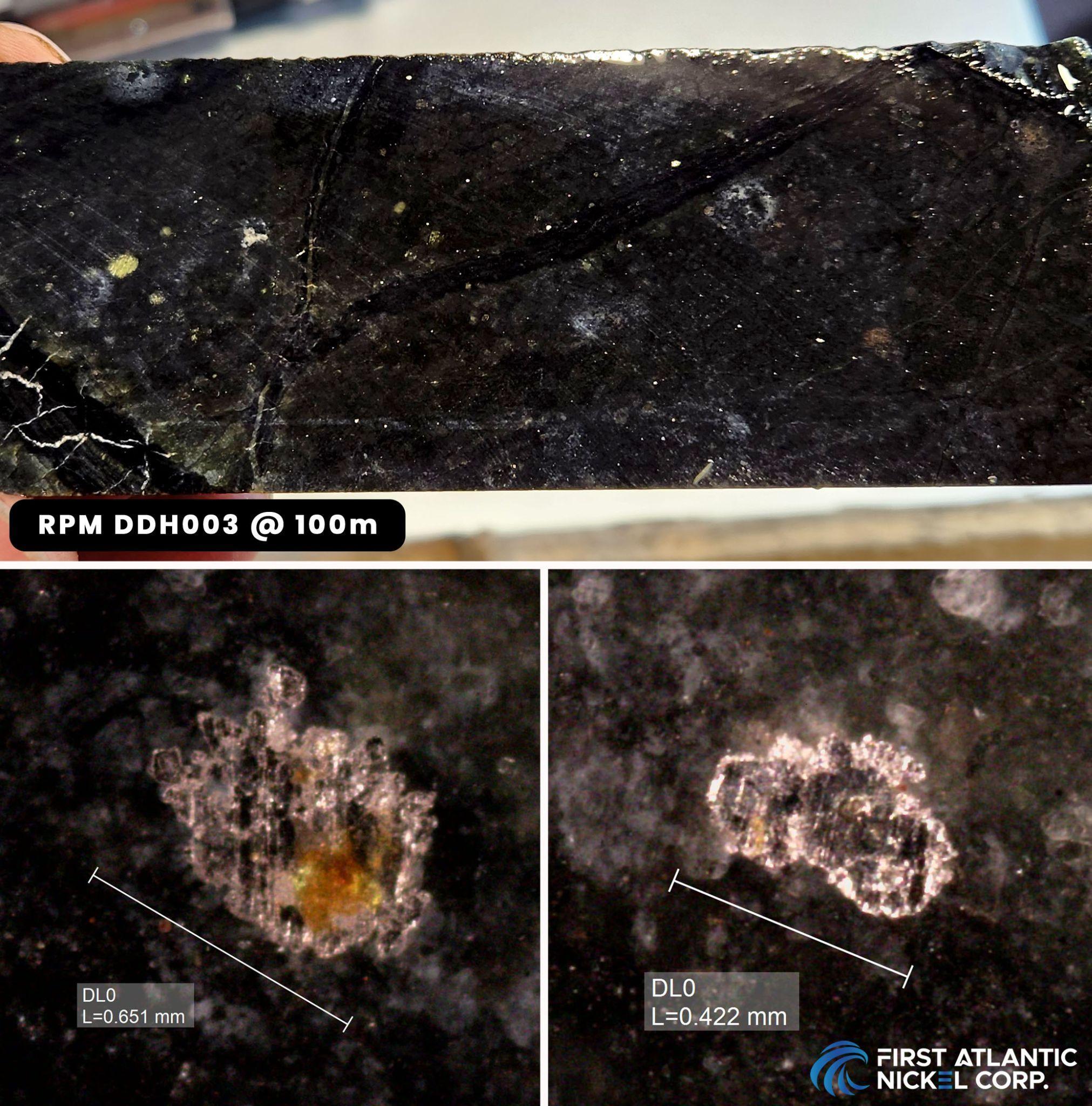

Figure 3: Core sample from drill hole RPM-DDH003 (AN-24-04) at a depth of 100 meters, showing visible awaruite mineralization. The lower images detail magnified views of awaruite grains, which exhibit both smooth and grooved surface textures, with grain sizes ranging from 422 to 651 microns.

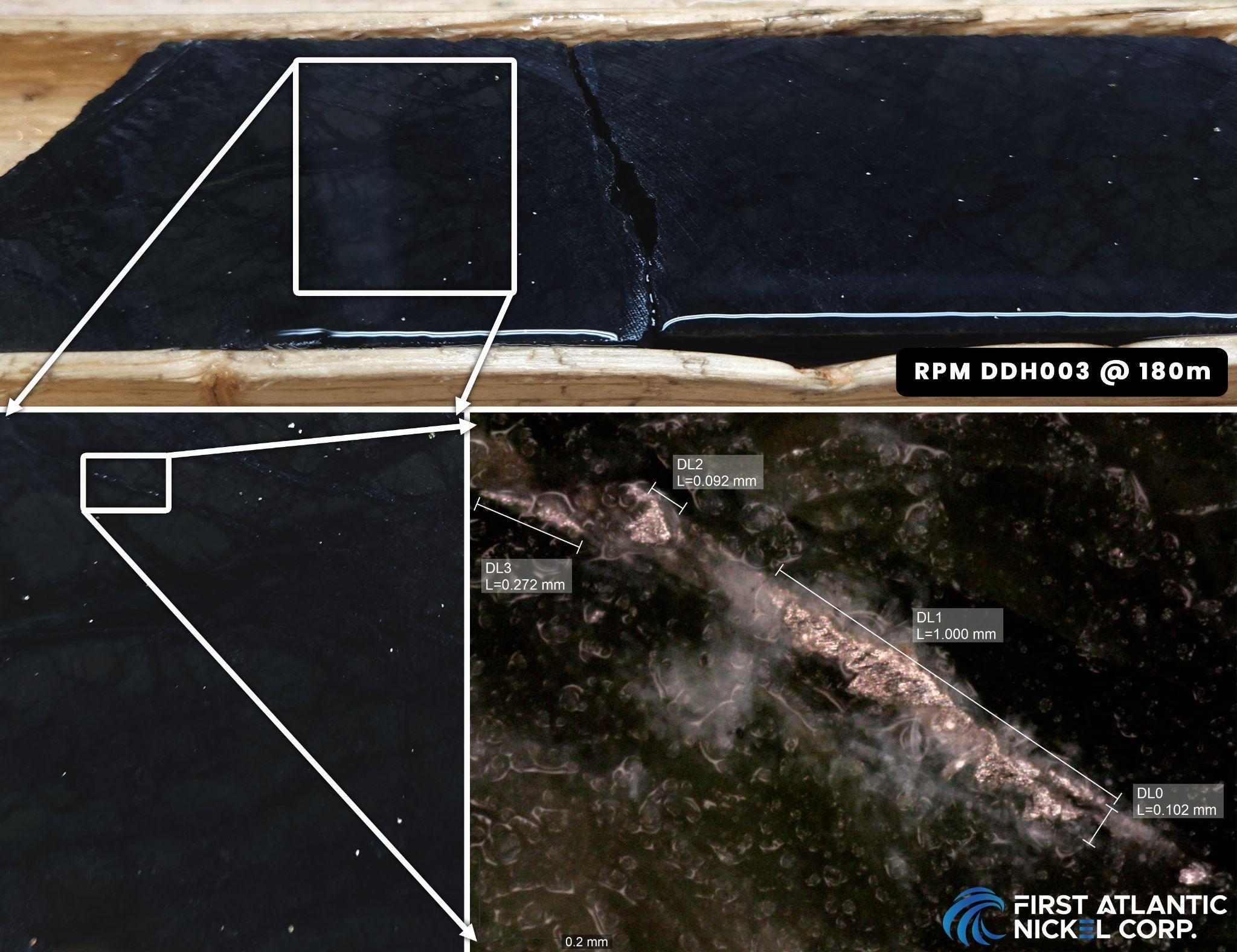

Figure 4: Core sample from drill hole RPM-DDH003 (AN-24-04) at a depth of 180 meters, featuring visible awaruite mineralization. The lower images showcase magnified views of the awaruite grains, displaying smooth and grooved surface textures. An elongated awaruite nickel-alloy grain, measuring up to 1,000 microns in size, is observed forming as a fracture filling, while average visible grain sizes range from 100 - 600 microns.

METALLURGICAL PROGRAM

Davis Tube Recovery (DTR) testing is underway for drill holes AN-24-04 and AN-24-05 to quantify the magnetically recoverable nickel content and assess the project's suitability for commercial-scale magnetic separation. These results will form the foundation of a broader metallurgical program aimed at developing a process flowsheet. The planned program will incorporate pilot-scale magnetic separation as the primary beneficiation method, followed by gravity separation or flotation to produce a saleable nickel concentrate. The presence of large-grain awaruite, frequently exceeding 500 microns, supports the potential for cost-effective, smelter-free processing. This approach aligns with the Company's strategy to advance environmentally responsible development while contributing to the strengthening of North America's critical minerals supply chain.

Awaruite (Nickel-iron alloy Ni2Fe, Ni3Fe)

Awaruite, a naturally occurring sulfur-free nickel-iron alloy composed of Ni3Fe or Ni2Fe with approximately ~75% nickel content, offers a proven and environmentally safe solution to enhance the resilience and security of North America's domestic critical minerals supply chain. Unlike conventional nickel sources, awaruite can be processed into high-grade concentrates exceeding 60% nickel content through magnetic processing and simple floatation without the need for smelting, roasting, or high-pressure acid leaching1. Beginning in 2025, the US Inflation Reduction Act's (IRA) $7,500 electric vehicle (EV) tax credit mandates that eligible clean vehicles must not contain any critical minerals processed by foreign entities of concern (FEOC)2. These entities include Russia and China, which currently dominate the global nickel smelting industry. Awaruite's smelter-free processing approach could potentially help North American electric vehicle manufacturers meet the IRA's stringent critical mineral requirements and reduce dependence on FEOCs for nickel processing.

The U.S. Geological Survey (USGS) highlighted awaruite's potential, stating, "The development of awaruite deposits in other parts of Canada may help alleviate any prolonged shortage of nickel concentrate. Awaruite, a natural iron-nickel alloy, is much easier to concentrate than pentlandite, the principal sulfide of nickel"3. Awaruite's unique properties enable cleaner and safer processing compared to conventional sulfide and laterite nickel sources, which often involve smelting, roasting, or high-pressure acid leaching that can release toxic sulfur dioxide, generate hazardous waste, and lead to acid mine drainage. Awaruite's simpler processing, facilitated by its amenability to magnetic processing and lack of sulfur, eliminates these harmful methods, reducing greenhouse gas emissions and risks associated with toxic chemical release, addressing concerns about the large carbon footprint and toxic emissions linked to nickel refining.

Figure 5: Quote from USGS on Awaruite Deposits in Canada.

The development of awaruite resources is crucial, given China's control in the global nickel market. Chinese companies refine and smelt 68% to 80% of the world's nickel4 and control an estimated 84% of Indonesia's nickel output, the largest worldwide supply5. Awaruite is a cleaner source of nickel that reduces dependence on foreign processing controlled by China, leading to a more secure and reliable supply for North America's stainless steel and electric vehicle industries.

Investor Information

The Company's common shares trade on the TSX Venture Exchange under the symbol " FAN ", the American OTCQB Exchange under the symbol“ FANCF ” and on several German exchanges, including Frankfurt and Tradegate, under the symbol " P21 ".

Investors can get updates about First Atlantic by signing up to receive news via email and SMS text at . Stay connected and learn more by following us on these social media platforms:

FOR MORE INFORMATION:

First Atlantic Investor Relations

Robert Guzman

Tel: +1 844 592 6337

...

Disclosure

Adrian Smith, P.Geo., is a qualified person as defined by NI 43-101. The qualified person is a member in good standing of the Professional Engineers and Geoscientists Newfoundland and Labrador (PEGNL) and is a registered professional geoscientist (P.Geo.). Mr. Smith has reviewed and approved the technical information disclosed herein.

Analytical Method & QAQC

Samples were split in half on site with one half remaining in the core box for future reference and one half packaged in secure bags. QAQC method included the use of blanks, duplicates and certified reference material (standards) with one being inserted once in every 20 samples in order to test the precision and accuracy of the lab. All results passed the QA/QC screening at the lab, and all company inserted standards and blanks returned results that were within acceptable limits.

Samples were sent to Activation Laboratories LTD (“Actlabs”) in Fredericton, NB. Actlabs is an ISO 17025 certified lab, accredited and acting independently from First Atlantic Nickel. Each sample was crushed, with a 250 g sub-sample pulverized to 95% - 200 mesh. A portion of the sample is fused with a lithium metaborate/tetraborate flux and analyzed by ICP-OES for major oxides and elements including cobalt, chromium and nickel.

True widths are currently unknown. However, the nickel bearing ultramafic ophiolite and peridotite rocks being targeted and sampled in the Phase 1 drilling program at the Atlantic Nickel Project are mapped as several hundred meters to over 1 kilometer wide and approximately 30 kilometers long.

About First Atlantic Nickel Corp.

First Atlantic Nickel Corp. (TSXV: FAN) (OTCQB: FANCF) (FSE: P21) is a Canadian mineral exploration company developing the 100%-owned Atlantic Nickel Project, a large-scale nickel project strategically located near existing infrastructure in Newfoundland, Canada. The Project's nickel occurs as awaruite, a natural nickel-iron alloy containing approximately 75% nickel with no-sulfur and no-sulfides. Awaruite's properties allow for smelter-free magnetic separation and concentration, which could strengthen North America's critical minerals supply chain by reducing foreign dependence on nickel smelting. This aligns with new US Electric Vehicle US IRA requirements, which stipulate that beginning in 2025, an eligible clean vehicle may not contain any critical minerals processed by a FEOC (Foreign Entities Of Concern)6.

First Atlantic aims to be a key input of a secure and reliable North American critical minerals supply chain for the stainless steel and electric vehicle industries in the USA and Canada. The company is positioned to meet the growing demand for responsibly sourced nickel that complies with the critical mineral requirements for eligible clean vehicles under the US IRA. With its commitment to responsible practices and experienced team, First Atlantic is poised to contribute significantly to the nickel industry's future, supporting the transition to a cleaner energy landscape. This mission gained importance when the US added nickel to its critical minerals list in 2022, recognizing it as a non-fuel mineral essential to economic and national security with a supply chain vulnerable to disruption.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements:

This news release may include "forward-looking information" under applicable Canadian securities legislation. Such forward-looking information reflects management's current beliefs and are based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, expectations regarding the timing, scope, and results from the Phase 1 work and drilling program; results from the Phase 2 work and drilling program, future project developments, the Company's objectives, goals or future plans, statements, and estimates of market conditions. Readers are cautioned that such forward-looking information are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry. Additional factors and risks including various risk factors discussed in the Company's disclosure documents which can be found under the Company's profile on Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

____________________________________________________

1

2

3

4

5

6

Photos accompanying this announcement are available at

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment