Trump Tariffs Threaten To Torpedo The Yuan

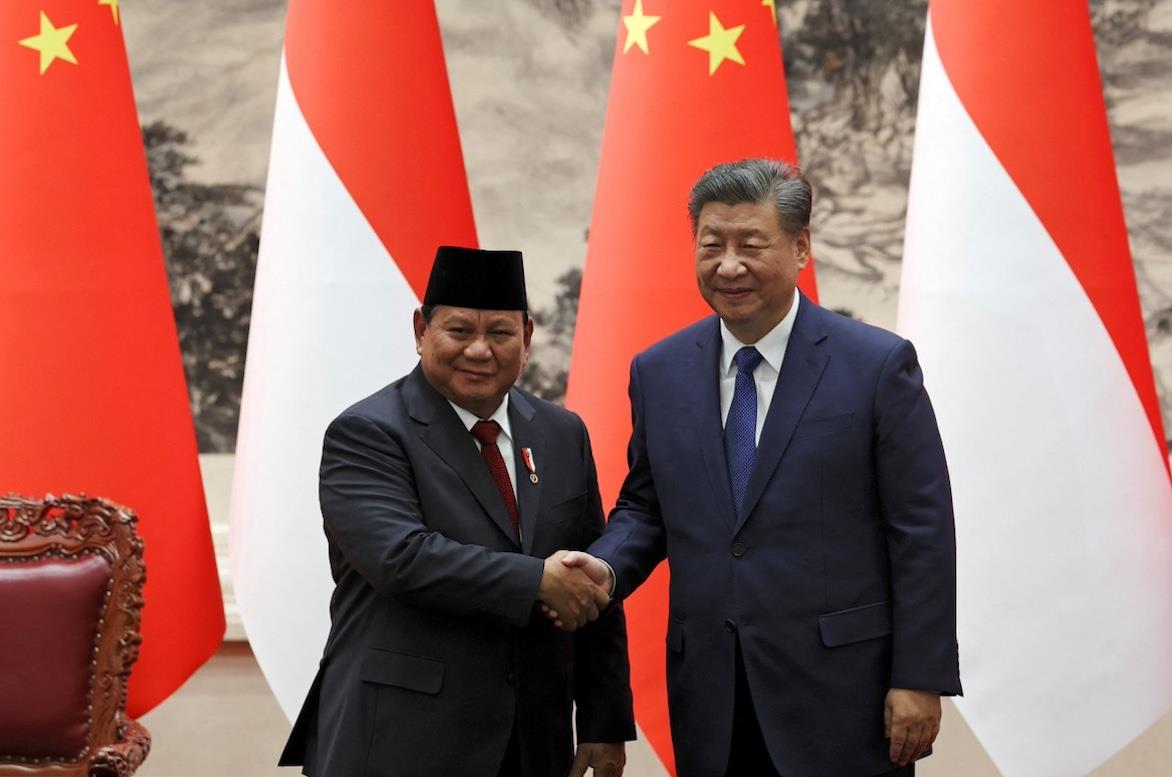

A reasonable assumption? Not if People's Bank of China Governor Gongsheng has anything to say about it. There are many reasons why Pan – and, for now, President Xi Jinping – want a stable exchange rate versus the dollar.

The dominant one is confidence. A big yuan decline might signal to global investors that there's an unseen major problem in Asia's biggest economy on top of a crippling property crisis, deepening deflation and massive capital flight.

The wildcard, though, is how Trump's coming trade wars might have Team Xi scrambling to make currency devaluation great again.

“Donald Trump's victory ... is ushering in a new phase of stress on the Chinese currency,” says Wei He, an analyst at Gavekal Research.

“The major question is what will happen if Trump starts to make good on his threats of new tariffs after taking office in January. In this scenario, it is highly unlikely that the renminbi will remain at its current level,” He said.

After Trump began imposing tariffs in 2018, the PBOC allowed a 13% depreciation of the yuan in order“to partially restore export competitiveness,” He says.“It's therefore well within the realm of possibility that it would allow depreciation again, especially given the renewed policy focus on supporting domestic demand.”

Again, this isn't the most likely scenario as yuan internationalization

has been a top Xi priority. A weaker exchange rate would set back Xi's plan to increase the yuan's global use in trade and finance.

In

2016, China

won a place for the yuan in the International Monetary Fund's“special

drawing

rights” basket joining the dollar, yen, euro and pound. In the years since, the currency's use has soared. Excessive exchange-rate meddling now might dent trust in the yuan, slowing its pivot toward reserve-currency status.

At the same time, a falling yuan might increase the odds highly indebted Chinese companies, including giant property developers, default on their foreign currency-denominated off-shore debts. That would increase the risk of more China Evergrande Group-like crises and new cause to dump Chinese assets.

It follows that the monetary easing needed to sustain the yuan's declines - particularly with the US Federal Reserve cutting rates, too - could damage Beijing's deleveraging efforts. Over the last few years, Xi's inner circle made big strides toward weeding out financial excesses.

That sheds light on why Xi and Premier Li Qiang have been reluctant to give the PBOC latitude to slash rates more assertively, even as deflationary pressures build.

Not surprisingly, the“PBOC already appears to be quietly renewing its defense of the currency through large state-owned commercial banks,” says Gavekal's He.

Yet if Xi switched course, it would unleash two unpredictable dynamics.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment