(MENAFN- Asia Times)

A growing number of macroeconomists and financial analysts are sounding the alarm about the exploding US national debt, now approaching US$35 trillion or 120% of GDP. Interest payments on the debt have become the largest item in the US national budget, ahead of defense spending and entitlements.

In early June, former US House Speaker Paul Ryan proposed that the US government should accept stablecoins, asset-backed cryptocurrencies, as payment for US Treasuries. Ryan argued that the measure would create an“immediate, durable increase in demand for US debt, which would reduce the risk of a failed debt auction and an attendant financial and economic crisis.”

Ryan's proposal can be seen as a sign of how serious the US debt problem has become. Cryptos were conceived as anti-fiat currencies. They are privately issued digital currencies that can be used anonymously throughout the world. Bitcoin, the first cryptocurrency, was meant to be a platform for a new financial system that could start with a clean slate.

Fast forward to 2024 and crypto advocates in the US are calling for asset-backed cryptos (stablecoins) to be regulated so they can be used to purchase US Treasuries and to pay taxes. Cryptos may come to the rescue of the flawed financial system they were supposed to replace.

Two weeks after Ryan made his proposal, US Congressman Matt Gaetz introduced a bill that would allow Americans to pay their federal income tax in Bitcoin. Gaetz said the radical move would promote innovation, increase efficiency and offer more flexibility to American citizens.

Gaetz said in a statement:“This is a bold step toward a future where digital currencies play a vital role in our financial system, ensuring that the US remains at the forefront of technological advancement.”

The question is whether a fiat currency can coexist with privately issued currencies. The dollar lost 90% of its value in the last 50 years and it continues to lose purchasing power at a rate of about 10% per year.

Cryptos vary widely in value, but nearly all of them are priced in dollars. That means they are not immune to a possible (some economists say inevitable) devaluation of the dollar.

Bitcoin Pizza Day

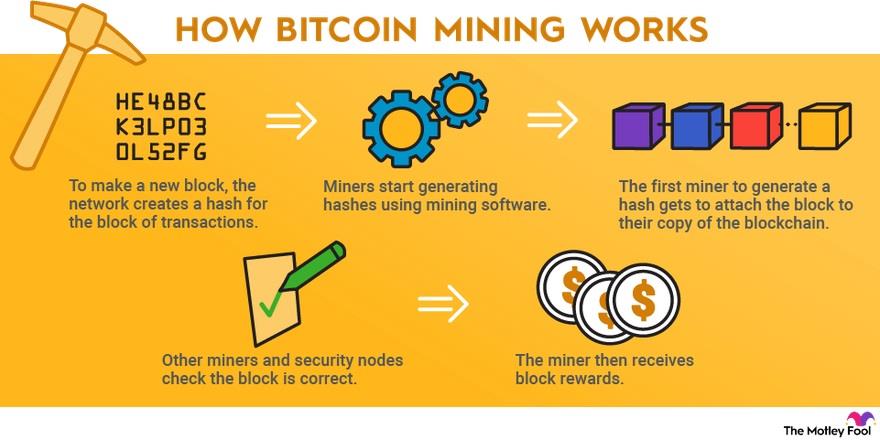

A bit of crypto history. On October 31, 2008, a computer programmer using the pseudonym Satoshi Nakamoto posted a paper on a cryptography bulletin board to announce Bitcoin, the first peer-to-peer cryptocurrency. Users could“mine” Bitcoins by solving complex mathematical problems and be rewarded with the newly minted Bitcoins.

Nakamura pointed at the 2008 bailout of Wall Street with taxpayer money to argue that the financial system was corrupt and benefitted a small elite. Bitcoin would be the people's money, beyond the control of governments. It would enable people to make payments to anyone in the world anonymously and nearly free of charge.

Only 21 million Bitcoins could be mined, making the digital currency immune to inflation caused by excessive money printing, a typical feature of fiat currencies.

Bitcoin is based on technologies that existed, among them digital signatures.

In 2010, Bitcoin recorded its first commercial transaction. A Bitcoin miner named Laszlo Hanyecz offered 10,000 BTC to whoever delivered two pizzas to his home in Florida.

British programmer Jeremy Sturdivant accepted the offer. He had two pizzas delivered to Hanyecz's home at a cost of $25, and Hanyecz transferred 10.000 bitcoins to Studivant's Bitcoin wallet. The transaction valued Bitcoin at $0.0041.

MENAFN03072024000159011032ID1108403509

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.