The Reckoning: Chinese Car Wars

Blood on the dohyō. Photo: YouTube

It was a blood sport, piling up corpses all over the dohyō. All British makes were wiped out. Harley Davidson was the only American left standing. Italians were dismembered.

The Japanese also savaged each other, leaving only four surviving Samurai – Honda, Kawasaki, Suzuki and Yamaha. Those were glorious days for Japanese industry.

Japan's carmakers also had a storied rise but it was far more genteel. Theirs was a story of perseverance, incremental improvement (kaizen ), lean production with a laser focus on quality, lacking the kill-or-be-killed bet-the-farm reckless abandon of the motorcycle wars. Toyotas, Nissans and Hondas were exquisitely engineered but they didn't revolutionize the car. The survivors of Japan's motorcycle wars went on to develop the crotch-rocket – completely redefining what a motorcycle could be. And the world is a better place for it.

Han Feizi once had gasoline in his veins. He read

Iacocca

as an impressionable lad and, at one point, could identify every car on American roads just by their taillights (girls have their horse phase). A stint as an engineer at General Motors quickly drained the gasoline from Han Feizi's young veins.

Han Feizi, however, remained enough of a car guy that, fifteen minutes into the Auto China 2024 exhibition in Beijing, he understood that industrial blood-sport had returned – this time in a far larger arena and with much more at stake. China is repeating the Japanese motorcycle wars, except it's with cars. It will be bloody and it will revolutionize what a car can be.

It is still early in the ballgame but every facet of the auto industry is now being disrupted. China's car market is the largest in the world (twice the size of the US) and gladiators from all corners of the world have come to fight it out in an epic battle royale. It's a free for all and there are no loyalties. Alliances are being formed. Alliances are being severed. Fighters are selling each other weapons and inventing new ones. Everyone knows that this is a kill-or-be-killed blood sport and that only a handful of combatants can survive.

BYD bet the farm on unbridled expansion. It has more than tripled its workforce in three years to over 700,000 (with over 100,000 in R&D) – about five times that of Tesla. The company's model lineup of over a dozen EVs sold under four brands runs the gamut from $9,600 commuters to $140,000 luxury sedans to $240,000 supercars and everything in between. BYD has an EV bus division and a solar arm. BYD is vertically integrated – making parts in-house, with much of its battery output sold externally. Besides massive new factories in China, BYD is also building capacity in Europe, ASEAN, Central Asia and Latin America.

NIO bet the farm on battery swapping to solve the charging time problem. The luxury brand known for white glove customer service just survived its second near death experience. The company pulled through the first one with a strategic investment from the Hefei government. NIO's batteries-as-service model differentiates the company in a crowded field but profitability has been elusive and competition from fast charging technology is intense. Late last year, the company received a $2.2 billion capital injection from CYCN, an Abu Dhabi investment fund, buying valuable time. It would be a mistake to write NIO off. It would be a mistake to write anyone off in China's car wars when surviving to fight another day is already a victory.

Xiaomi bet the farm that a maker of phones can pack a car with all the bells and whistles and price it to sell. On paper, the SU7 has performance, styling and digital features superior to Teslas and Porsches three to six times its price. The company is betting that expertise manufacturing mobile phones can be carried over to EVs (built in conjunction with BAIC), allowing an upstart like Xiaomi to compete with established carmakers like Tesla and Porsche. Orders for its premier SU7 have exceeded 70,000 units. Time will tell if delivery, cost and quality meet expectations.

When will US come to the Philippines' defense?

What China seeks on the far side of the moon

Russia riding US right out of West Africa

Huawei bet the farm that the value of EVs is embedded in digital architecture. The tech giant has partnered with Seres, Chery, Changan and JAC to produce electric vehicles built around Huawei technology – infotainment, sensor suite, powertrain, self-driving system etc. Will this model work as seamlessly as Huawei expects across different partner companies? We will find out.

Geely bet the farm on an acquisition strategy, picking up troubled automakers and defunct brands from all over the world. Geely's stable of brands – Volvo, Polestar, Lotus, Smart, London Taxi, Proton, Aston Martin (17%) – gives the company international presence and local gravitas. Time will tell how successfully Geely leverages its international sprawl.

Tesla bet the farm that it needs to manufacture in China to economically export to the rest of the world. The company received a tremendous amount of grief for skipping the Auto China exhibition two years in a row. Tesla hit the ground running in 2019 when the Shanghai Giga Factory commenced production, making Tesla consistently profitable for the first time. Faced with China's Cambrian explosion of new EV launches, Tesla's excruciatingly long product cycle has, of late, kneecapped sales. Elon Musk was just in Beijing, securing a deal with Baidu to help bring full self driving to China, keeping Tesla in the game. To fight another day in China's car wars is a win.

These are just some of the plot lines clashing on the battlefield of China's car wars. Every company is swimming in violent waters roiled by technology's merciless march. Batteries are getting cheaper, safer, lighter and more energy dense. AI- and 5G-enabled automation is lowering manufacturing costs across the supply chain. Self-driving capabilities are continuously improving. Companies are field testing business models from battery-as-service to partnerships between carmakers, battery producers and digital architecture providers. A Foxconn style contract manufacturing model may be taking shape. China is transitioning to solar power at an exponential clip – this could potentially collapse electricity prices, further accelerating the EV transition. Everything is in flux. Nothing is certain.

Legacy carmakers are either getting their ducks in order, up a creek without a paddle or sticking their heads in the sand. Volkswagen bought a strategic 5% stake in Xpeng for $700 million and has formed a partnership to develop future models (getting ducks in order). BMW announced that it will invest $2.8B in its Shenyang factory to build EVs. Mercedes has partnered with BYD in the upscale Denza brand and made vague promises to continue its EV transition.

Nissan and Honda (up a creek) are exploring a partnership to co-develop EVs. The CEO of Toyota (head in sand) is insisting that pure EVs will top out at 30% of global car sales (it has already hit 50% in China) with the rest taken by hybrids, internal combustion engines and – Toyota's hobby horse – hydrogen fuel cell vehicles.

GM, Ford and half of Stallantis (Jeep and Dodge) have their work cut out for them. All three operate in a Galapagos market distorted by the“chicken tax” – a 25% tariff placed on light trucks in 1964 in retaliation for European tariffs on US chicken. While European tariffs on American chicken have long been abandoned, lobbying by carmakers has kept light trucks tariffs in place.

Ever since, passenger cars have been starved of engineering resources as the Big Three aggressively marketed pickup trucks – once a niche product for farmers and tradesmen – to suburban families. To further leverage the chicken tax, the Big Three invented the SUV – a passenger car pretending to be a truck.

In good times, selling +$60K pickup trucks and SUVs in a protected market is a highly lucrative business. Ford and GM generated $4B and $12B in profits last year. In bad times, the Big Three find their product lines wanting and uncompetitive. After oil price surges in the crisis of 1973 and the deposition of the Shah of Iran in 1979, Chrysler was bailed out by the Federal government for the first time. In the 1980s and 90s, the Big Three lobbied for and were granted“voluntary” export restrictions on Japanese cars. During the 2008 financial crisis, both GM and Chrysler (again) were bailed out with loans from the Federal government.

In the summer of 1991, matriculating students for MIT's class of 1995 were all sent a copy of

The Next Century, David Halberstam's treatise on American competitiveness. Discussion sessions on the book were held during freshman orientation. The treatise is an abridged version of

The Reckoning, Halberstam's 800 page tome published in 1986 on the parallel histories of the Ford Motor Company and the Nissan Motor Company. Halberstam's conclusion was bleak. America was being outworked, outengineered and outcompeted not just by Japan but also Korea, hot on Japan's heels.

The timing could not have been worse. MIT freshmen were asked to contemplate a world where America was number two right at the beginning of Japan's long stagnation. Over time, the call to arms fell on deaf ears. The fighting spirit MIT's leadership hoped to instill in America's best technical minds quickly dissipated as the threat from Japan and the Soviet Union both magically dematerialized.

The MIT class of 1995 went on to exciting companies like Microsoft, Goldman Sachs and dotcoms. The Big Three car companies, which David Halberstam fretted over, were so flyover country – c'mon man, they're for state school grads.

The Reckoning was published thirty years too soon and chose the wrong Asian boogeyman. Nissan would stagnate with Japan, easily neutered by Yen appreciation (thank you, Plaza Accord) and export restrictions. The US was the largest car market in the 90s and it ultimately called the shots, no matter how much better Japanese engineering was.

Today's reckoning is far more profound. This isn't half a dozen Japanese carmakers exporting cars to the US – that was easily swatted down. This is 100 Chinese carmakers revolutionizing the industry with reckless ambition in what is now the world's largest and most competitive car market. The Chinese car wars are in their early days but already threaten to unleash onto global markets a tsunami of EVs honed by intense competition. Nations with auto industries view this as an existential threat. Nations without auto industries are climbing all over each other trying to secure an offshore assembly plant from a Chinese carmaker.

Faced with imports of Chinese EVs, the once climate-obsessed EU is watering down its target of phasing out sales of cars with internal combustion engines by 2035. EU commissioners in Belgium are busily formulating tariff strategies for Chinese EVs. The US is expectedly unhinged, with Senators already calling for a straight-up ban on Chinese cars for, you guessed it, national security reasons.

As we saw from the unintended consequences of the chicken tax, protectionist policies often result in distorted markets with higher priced and inferior products – American pickup trucks and land-whale SUVs are overpriced abominations with no export appeal.

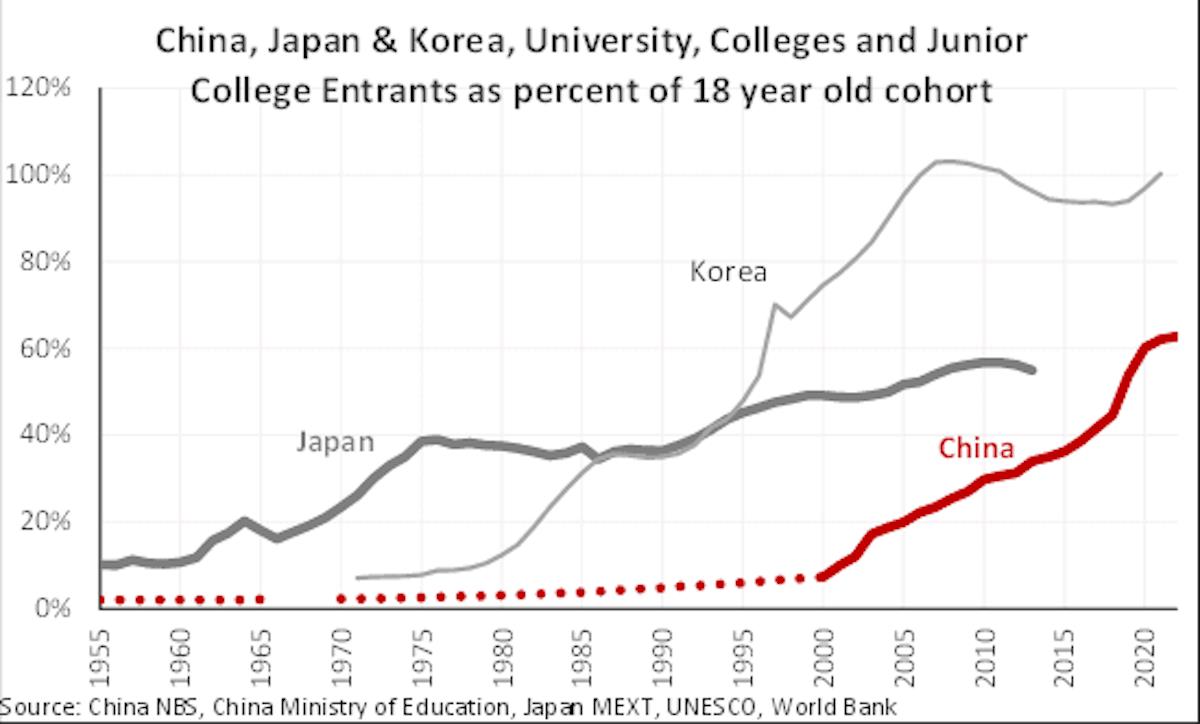

The dilemma for the US/EU/Japan and Korea, at its root, is one of human capital. Japan is the canary in the coal mine with its STEM workforce having peaked in the late 1990's. The country's three lost decades reflect the gradual decay of Japan's human capital. Europe is not far behind while the US and Korea are special cases.

Korea has so far managed to outrun demographics by grinding harder, educating every last person to the highest level possible. It's akin to conscripting children and old people off the streets during wartime. This is clearly not sustainable.

Sign up for one of our free newsletters

- The Daily ReportStart your day right with Asia Times' top stories AT Weekly ReportA weekly roundup of Asia Times' most-read stories

The US, the land of immigrants, should at least be able to tread water. Unfortunately, despite Asians rising from 1% of the population in 1980 to over 5% today, accounting for ~25% of the Ivy League (and 40% of MIT), there has been no measurable increase in innovation, scientific papers or company formation. The only conclusion we can draw is that this is a case of in-one-pocket out-the-other. As Asians piled into STEM fields, Jews and“heritage” white populations dropped out. Immigration has not proved additive to America's technological leadership.

Meanwhile, China is adding ~6 million technical grads (university and junior college) to its workforce every year. This will continue for thirty years, quadrupling China's STEM workforce. The Cambrian explosion of car companies and new model launches is the upshot of this phenomenon – China's real demographic story.

BYD and Huawei have 6 million college grads to choose from – and they are considered top employers to work for. General Motors and Ford have a couple hundred thousand to choose from after Tesla, Silicon Valley and Wall Street had their pick.

In February, Apple cancelled its car project ten years in the making after spending a reported $10B. C'mon Tim Cook, what are you thinking? Apple has more money than God – just do it, man! But we suspect we know what Tim Cook was thinking. The scuttlebutt is that the program was scotched after JV negotiation with Hyundai fell through. Apple just does not have, nor does it believe it can hire, the manpower to pull it off. TSMC, Boeing and American shipyards are facing similar crises.

Winston Churchill famously said,“Americans can always be trusted to do the right thing, once all other possibilities have been exhausted.” The right thing in this case is to engage with the changing world or be left behind. Retreating behind tariff walls or outright bans will further isolate America's auto industry into a Galapagos market of ridiculous trucks sold at nosebleed prices.

Without a surge in STEM grads, the right thing becomes a more bitter pill to swallow – it would require the US to allow Chinese EV makers to build factories and perhaps R&D centers in America. Requiring Chinese companies to form JVs with local partners might be a big ask given that the US only accounts for 13% of the global car market, but some technology transfer arrangement may be possible.

David Halberstam failed to see that the US – accounting for a third of the global car market in 1990 – could easily sidestep its Japan reckoning. This perhaps convinced a generation of policymakers that they can perform the same magic trick again on China. That would be a stupid move. China's car market is now twice that of the US and the Global South's is more than three times that of the US (up from two thirds of the US figure in 1990).

The US market simply does not matter as much as it used to. The Chinese car wars will play out like the Japanese motorcycle wars – full of blood, guts and spectacular innovation. The US will eventually do the right thing. But dawdling will result in more corpses than necessary.

Thank you for registering!

An account was already registered with this email. Please check your inbox for an authentication link.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment