Tabaqchali: Iraqi Banks End The Year With A Bang

Any opinions expressed are those of the author, and do not necessarily reflect the views of Iraq Business News .

Banks End the Year with a Bang

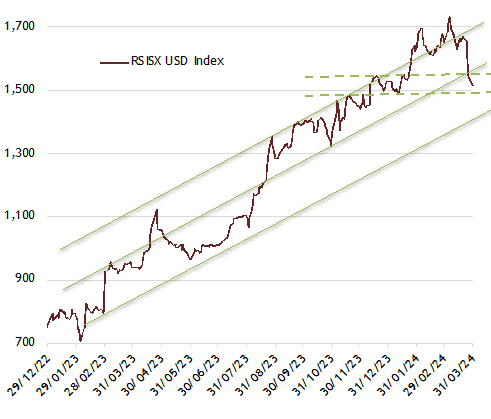

The market, as measured by the Rabee Securities U. S. Dollar Equity Index (RSISX USD Index), was down 8.4% for the month, and down 1.0% for the year. The onset of the fasting month of Ramadan at the end of the second week provided the market, and its participants, with a much-needed respite from the powerful momentum of the last few months, and an opportunity to consolidate the solid gains of this momentum (chart below) - with the extent of the consolidation influenced by the fundamentals that drove these gains.

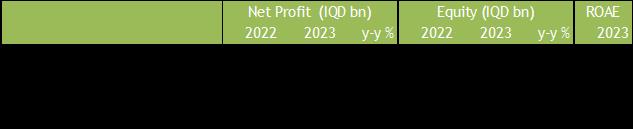

Key among them were the significant developments discussed a few months ago in "Banks to Fuel the Market's Next Phase ", that would lead to an acceleration in the growth of net profit and equity values for the top quality banks. The extent of this acceleration can be seen from the stellar year-over-year growth in 2023 for country's top-four banks (table below)- which are among the RSISX USD Index's major constituents.

Rabee Securities U.S. Dollar Equity Index

(Source: Iraq Stock Exchange, Rabee Securities, AFC Research, daily data as of March 31st)

Year-over-Year Comparisons

(Source: Rabee Securities , AFC Research, data as of Q4/2023)

(Note: All numbers rounded up for ease of display, while percentage changes are of actual numbers)

The catalyst for this spectacular growth was the Central Bank of Iraq's (CBI) new procedural requirements for its provisioning of U.S. dollars for cross-border transfers in mid-November 2022, and the subsequent series of measures throughout 2023, which promise to accelerate the adoption of banking and bring about a transformation of the sector and its role in the economy. All of which disproportionally benefited the top-quality banks, whose net profit and equity values accelerated quarter on quarter from the 4th quarter of 2022 (Q4/2022), and throughout 2023 as the CBI's measures came into effect as discussed in the market outlook for 2024 in "What Next After a Gangbuster Year ??? ".

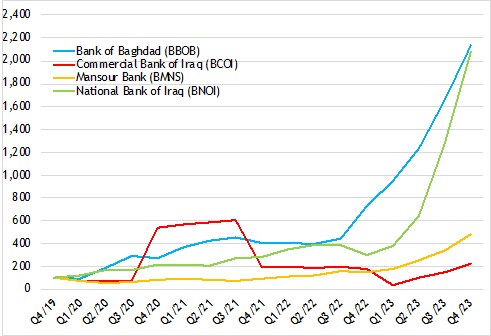

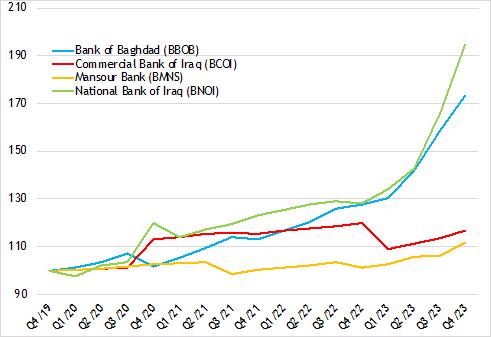

This acceleration can be appreciated by considering it in the context of the growth of each of these banks over the last four years as in the two graphs below. The first is that of trailing 12-month net profit, while the second is of trailing equity values, for Q4/19 - Q4/23. Both have been normalised, with Q4/19 figures set at 100 to allow for a review of the growth of these two key measures during this period, and for an easy comparison between the four banks - with the areas in pink background showing the effects of the acceleration that began in Q4/2022.

Normalised Trailing 12-months Net Profit

Normalised Trailing 12-months Equity Values

(Sources: Rabee Securities, AFC Research, data as of Q4/2023. Note: The graphs based on this data, are for net profit and equity value of the company and not per-share data.)

The National Bank of Iraq (BNOI), and the Bank of Baghdad (BBOB) both had a sharp acceleration in net profit and equity value quarter-on-quarter (above two charts), and both finished with stellar year-over-year growth for 2023 (above table). For the two banks, this growth builds upon the successful strategies pursued by each over the course of the prior few years as reviewed in "The Opportunity in Retail Banking " and in "Banks and the Predictability of Earnings ".

Following these two, but with a distance, was Mansour Bank (BMNS), which still experienced strong growth, while the Commercial Bank of Iraq (BCOI) lagged the three, but nevertheless had a solid year-over-year growth in 2023 (*). For all of these banks, the accelerations in net profit and equity values builds upon the gradual multi-year recovery in the banking sector following the 2014-2017 economic crisis that devastated the sector, as reviewed in "Private Sector Deposit & Loan Growth Continues "; and in which each of the four bank pursued different strategies for recovery that drove each banks' growth trajectory.

The intensity of such an acceleration should moderate meaningfully over the course of the next few quarters, and the quarterly progression will likely be uneven, leading to a new normal for the net profit and equity value growth profile for each of the four banks. However, five strong quarters, i.e., Q4/22-Q4/23, are not enough to arrive at a picture of what this new normal is, as the CBI's measures would unfold over a long time - more likely measured in years than months - and importantly as the banks need to adapt their strategies and infrastructures to normalize these changes, and accommodate the higher growth levels.

Nevertheless, it's clear that the future growth trajectories of the four banks will be from a much higher base, and from a significantly improved financial position. Moreover, this new normal will be marked by an increased adoption of banking and of formality, coupled with a move away from the dominance of cash and informality - developments that the investment thesis for the banking sector contends would come with growth in bank lending, resulting in an expansion of the money circulating in the economy and consequently to an increase in non-oil GDP. Over time, the banks' net profit should grow substantially, and ultimately feed into higher stock market valuations driven by both earning momentums, and by increases in market multiples placed upon these net profits.

However, risks remain given Iraq's recent history of conflict, extreme leverage to volatile oil prices, as well as the risks of a potential widening of the current Middle East conflict that could destabilise the region - as reviewed recently in "Markets Continue to Look Through Tensions ".

Notes

(*) The currency's official devaluation in December 2020, and subsequent revaluation in February 2023, had an over-sized effect on BCOI's net profit and equity values relative to the other three banks' net profit and equity values given the nature and size of its holdings of Iraq's sovereign Eurobonds - which has the effect of distorting the growth experienced in the period.

Please click here to download Ahmed Tabaqchali's full report in pdf format .

Mr Tabaqchali (@AMTabaqchali ) is the Chief Strategist of the AFC Iraq Fund, and is an experienced capital markets professional with over 25 years' experience in US and MENA markets. He is a Visiting Fellow at the LSE Middle East Centre, Senior Fellow at the Institute of Regional and International Studies (IRIS), and a Senior Non-resident Fellow at the Atlantic Council. He is also a board member of Capital Investments, the investment banking arm of Capital Bank in Jordan.

His comments, opinions and analyses are personal views and are intended to be for informational purposes and general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any fund or security or to adopt any investment strategy. It does not constitute legal or tax or investment advice. The information provided in this material is compiled from sources that are believed to be reliable, but no guarantee is made of its correctness, is rendered as at publication date and may change without notice and it is not intended as a complete analysis of every material fact regarding Iraq, the region, market or investment.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment