403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

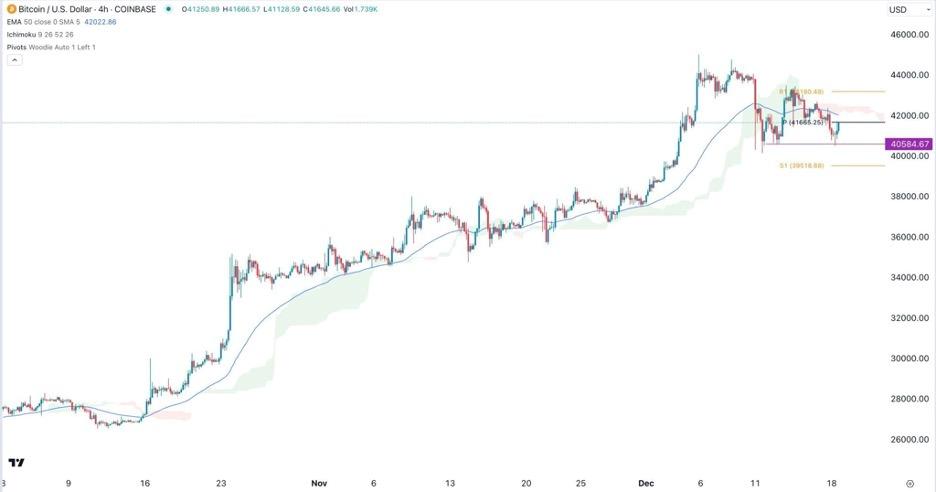

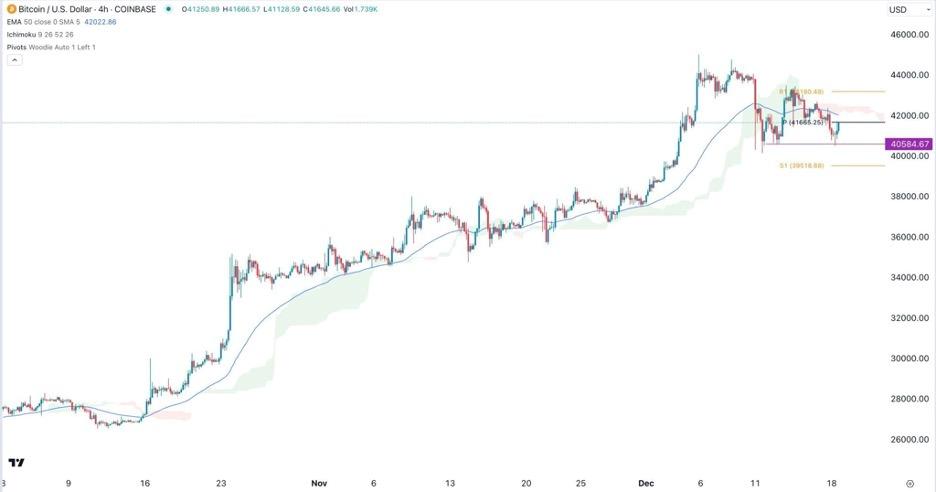

BTC/USD Forex Signal: Bitcoin Forms A Double Bottom At 40,58

(MENAFN- Daily Forex) Forex Brokers We Recommend in Your Region See full brokers list 1 Read full review Get Started

Bullish view

Ready to trade Bitcoin in USD ? We've shortlisted the best MT4 crypto brokers in the industry for you.

Bullish view

- Buy the BTC/USD pair and set a take-profit at 43,180. Add a stop-loss at 40,000. Timeline: 1-2 days.

- Sell the BTC/USD pair and set a take-profit at 40,000. Add a stop-loss at 43,000.

Ready to trade Bitcoin in USD ? We've shortlisted the best MT4 crypto brokers in the industry for you.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment